In a significant stride forward, Ghana's economy has achieved a significant milestone by crossing the GHȼ1 trillion Gross Domestic Product (GDP) threshold, a projection initially articulated by former Finance Minister Ken Ofori Atta, during the presentation of the 2024 budget.

Ken Ofori Atta's pronouncement, delivered amidst the budgetary discourse, heralded this attainment as a historic juncture in the nation's economic trajectory, forecasting a substantial growth from GHȼ219.5 billion in 2016 to surpassing GHȼ1 trillion in 2024 under President Akufo-Addo’s administration.

“Mr. Speaker, the 2024 Budget is even more significant because we will cross the GH¢1 trillion Gross Domestic Product (GDP) mark for the first time in our economic history. Let me repeat, Mr. Speaker, Ghana’s economy under President Akufo-Addo’ s final year in office is projected to be valued at over GH¢1 trillion in 2024 from GH¢219.5 billion in 2016", he stated.

This achievement was revealed in the Bank of Ghana's May 2024 Summary of Economic and Financial data report, indicating a sense of progress within the country's economy.

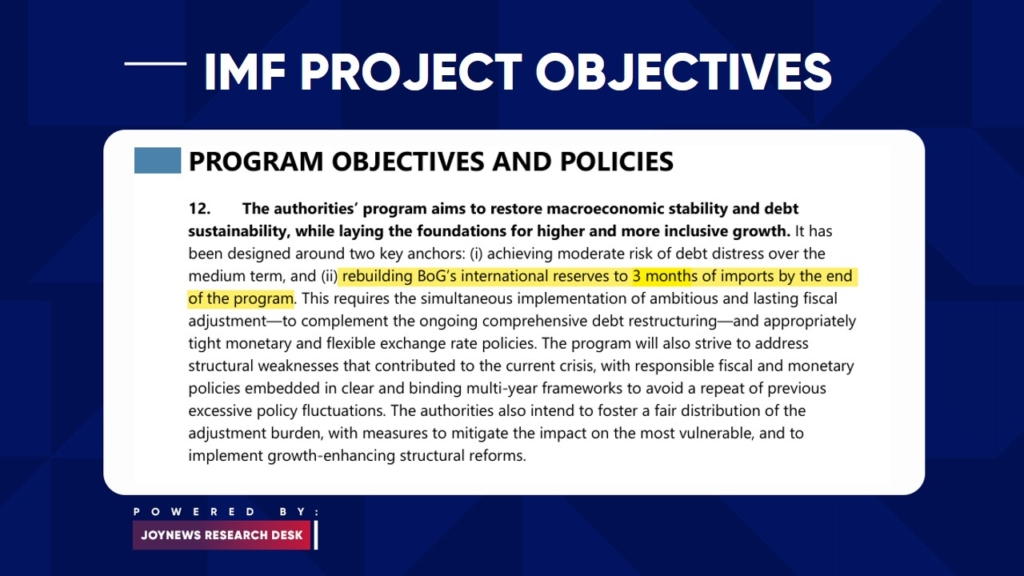

Notably, Ghana's import cover has also reached three months, a pivotal target set under the IMF programme, with a Gross International Reserves (GIR) standing at USD 6.59 billion.

However, amid the celebratory air, questions arise regarding the true health of Ghana's economy. Despite the monumental GDP milestone, there are underlying challenges that demand attention and scrutiny.

One glaring concern is the escalating public debt, which has surged to GHȼ658.6 billion as of February 2024. This translates to a burden of GHȼ21,383 per Ghanaian, based on the 2021 Population and Housing Census data. The increment marks a substantial increase by GHȼ77.5 billion post the IMF programme. The surge primarily stems from domestic debt, overshadowing the stability exhibited in external debt. Experts attribute this surge to the depreciation of the Ghanaian cedi, which has witnessed a 14.6% decline against the dollar in the current year, trading at GHȼ13.9 on the interbank rate and GHȼ14.56 on the FX rates.

Ghana's monetary policy rate which has also been pegged at 29% for four consecutive months from January to April in 2024 has raised concerns, contributing to dwindling consumer and business confidence. Reports from Bloomberg indicate that the cedi's depreciation has outpaced all major currencies globally since the MPC's decision to leave borrowing costs unchanged in March, resulting in an average inflation rate of 25%.

Adding to the economic intricacies, Ghana's trade balance has witnessed a significant downturn compared to the same period last year. The Bank of Ghana's May 2024 Summary sheet highlights a staggering 46.5% decrease, amounting to USD 648.2 million, attributed partly to a slump in cocoa earnings. Revenue from cocoa exports, crucial for currency defense, plummeted by 49% to $599 million in the first four months of the year.

In essence, while Ghana celebrates its monumental GDP milestone, the economic landscape paints a gloomy picture of success intertwined with challenges. Keeping a close eye on borrowing, stabilizing the currency, and boosting exports will be crucial for ensuring continued economic progress. The path ahead necessitates vigilant economic management to navigate through the difficulties and ensure sustainable growth for the nation.

Latest Stories

-

Ghana’s Prof. Alexander Debrah wins €50K EDCTP Dr. Pascoal Mocumbi Prize for global health contributions

42 minutes -

Fuel prices to fall from June 16 due to postponement of GH¢1.0 levy

2 hours -

PassionAir assures passengers after Kumasi–Accra flight encounters turbulence

3 hours -

Fatherhood Beyond Finances: Two drivers inspire a rethink on presence, bonding and recognition

3 hours -

President Mahama urges protection of fuel price gains amid Middle East tensions

4 hours -

Republic of Rogues: Where Thieves Have Heads and the System Has None

4 hours -

Musah Mohammed donates jerseys and footballs to youth teams in Nkawkaw

5 hours -

Omane Boamah urges youth to persevere, recounts dramatic admission struggle at POJOSS

5 hours -

Minority unhappy over suspension of fuel levy, demands full repeal

5 hours -

Helicopter carrying Hindu pilgrims crashes in India, killing seven people

6 hours -

Council of State member urges Ghana to localise global solutions for youth employment

6 hours -

CAS overturns FIFA ruling and awards Right to Dream development fees from Ernest Nuamah’s transfer

6 hours -

Hitz Praise Zone: Nii Noi launches new gospel show on Hitz FM

7 hours -

BOAD reaffirms commitment to energy transition and sustainable agriculture in West Africa

8 hours -

10 kinds of women who have denied men the joy of fatherhood

8 hours