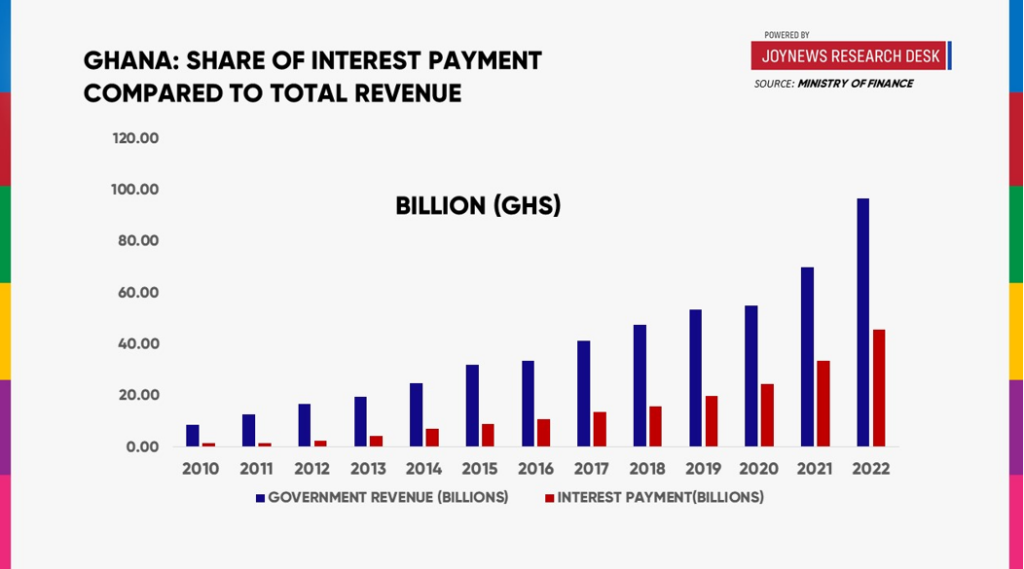

Ghana spent 42% of its revenue to servicing debt between 2017 and 2022, according to the 2024 United Nations report on Unpacking Africa’s Debt.

This marks a significant increase compared to the 2010–2016 period, during which 27% of Ghana’s revenue was used to service debt.

The 15-percentage-point rise in debt servicing from the 2010 – 2016 to the 2017 – 2022 period underscored the increased fiscal pressures the country faced.

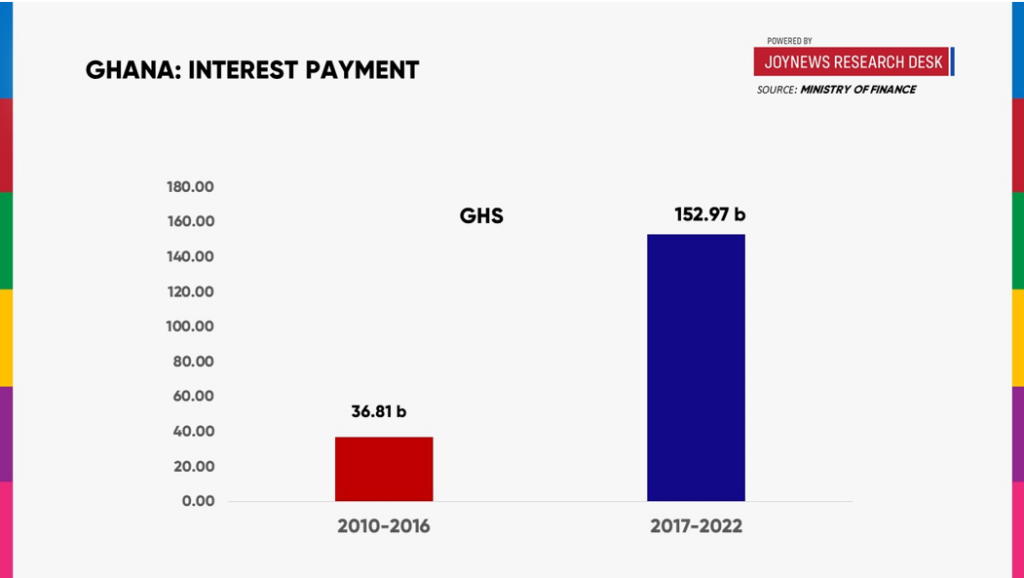

Data from the Ministry of Finance reveals a sharp escalation in interest payments over the years. While GH¢36 billion was spent on debt servicing between 2010 and 2016, the amount soared to GH¢152 billion during the 2017–2022 period.

In total, Ghana’s debt servicing between 2010 and 2022 amounted to GH¢189 billion, with a staggering 81% of that paid in the latter five years.

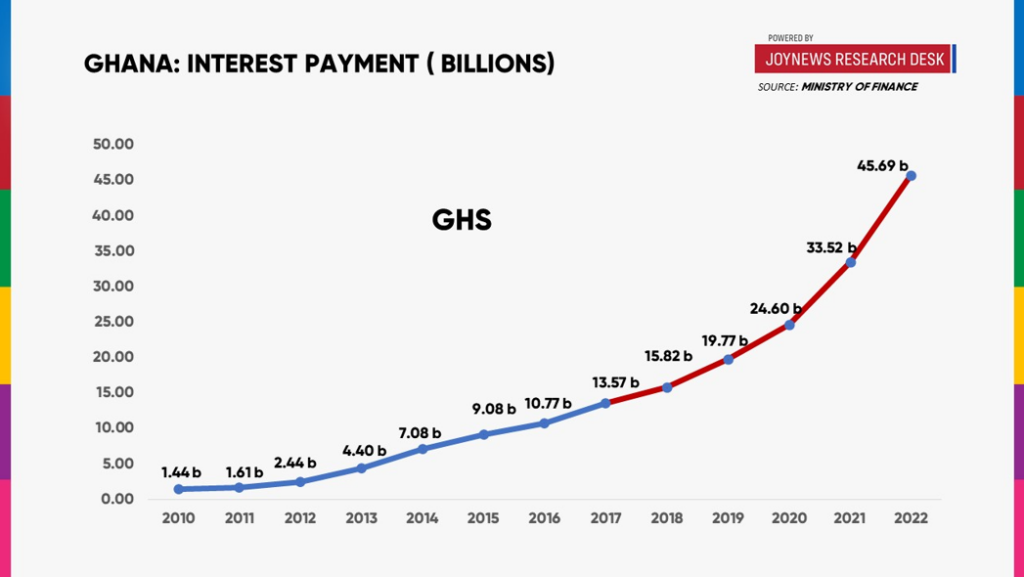

Also, within 2010 and 2022, the nation’s lowest interest payment was recorded in 2010 which is GH¢1.44 billion and recorded its highest interest payment in 2022 which is GH¢45.69 billion as per the data from the Ministry of Finance.

The 2024 United Nations report on Unpacking Africa’s Debt also identified that the steep increase in debt servicing constrained government spending on public services and eventually led to Ghana’s being classified as one of the world’s 10 most debt-distressed nations.

The IMF revealed that, in 2020, Ghana’s debt to revenue ratio reached an all-time high of 127%, the highest in Sub-Saharan Africa at the time.

Despite the debt to revenue ratio dropping to 117% in 2022, Ghana had to default on its external debts in 2022 with the subsequent restructuring of domestic and foreign debt.

Latest Stories

-

Pyramids beat Sundowns to win first-ever CAF Champions League title

15 minutes -

Pyramids FC win CAF Champions League following 2nd leg victory over Sundowns

18 minutes -

Pyramids FC clinch first CAF Champions League title with victory over Mamelodi Sundowns

46 minutes -

Nations FC cite “poor officiating” and “security lapses” as reasons for abandoning Basake Holy Stars match

54 minutes -

Breaking the cycle: School girls in Techiman unite against child marriage, demand menstrual dignity

1 hour -

2024/25 GPL: Hearts dispatch relegated Legon Cities

2 hours -

2024/25 GPL: Samartex edge Aduana Stars 2-1 in final home game

2 hours -

GPL 2024/25: Karela United thump Accra Lions at home

2 hours -

Prof. Kwaku Asare shoots down Fiscal Council proposals

2 hours -

2024/2025 GPL: Holy Stars, Nations FC game abandoned after violence

2 hours -

GPL 2024/25: Heart of Lions keep slim title hopes alive with win over Bechem

2 hours -

2024/25 GPL: GoldStars beat Berekum Chelsea to enhance title hopes

3 hours -

From superstars to synergy: What PSG teaches us about success, ego, and building systems that work

3 hours -

2024/25 GPL: Accra Lions relegated following defeat to Dreams FC

3 hours -

GPL 2024/25: Albert Amoah hits hat-trick as Asante Kotoko beat Medeama

3 hours