The Government of Ghana has formalized a crucial debt treatment agreement with its Official Creditors Committee (OCC) by signing a Memorandum of Understanding (MoU), a significant step towards restoring long-term debt sustainability.

The agreement, co-chaired by China and France, was disclosed in a statement from the Ministry of Finance dated January 29, 2025.

This milestone comes after Ghana, in December 2022, suspended portions of its external debt servicing to commercial and bilateral lenders amid a deep economic crisis.

At the time, inflation had soared to a staggering 54%, while international reserves had plunged to less than two months of import cover. The nation embarked on a comprehensive debt restructuring journey, including the successful completion of its Domestic Debt Exchange Programme (DDEP) in 2023.

A year ago, on January 12, 2024, Ghana reached an agreement with its Official Creditors under the G20 Common Framework for Debt Treatments, going beyond the Debt Service Suspension Initiative (DSSI).

However, it has taken another year to finalize and formalize the terms through the MoU.

“With the MoU now signed, the agreed terms will be implemented through bilateral agreements with each OCC member,” the Finance Ministry’s statement confirmed.

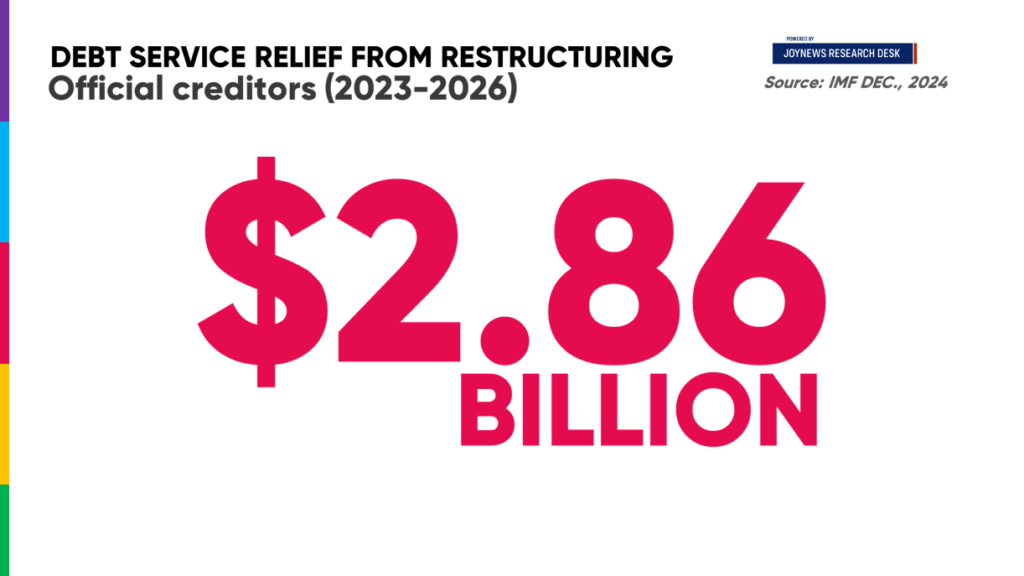

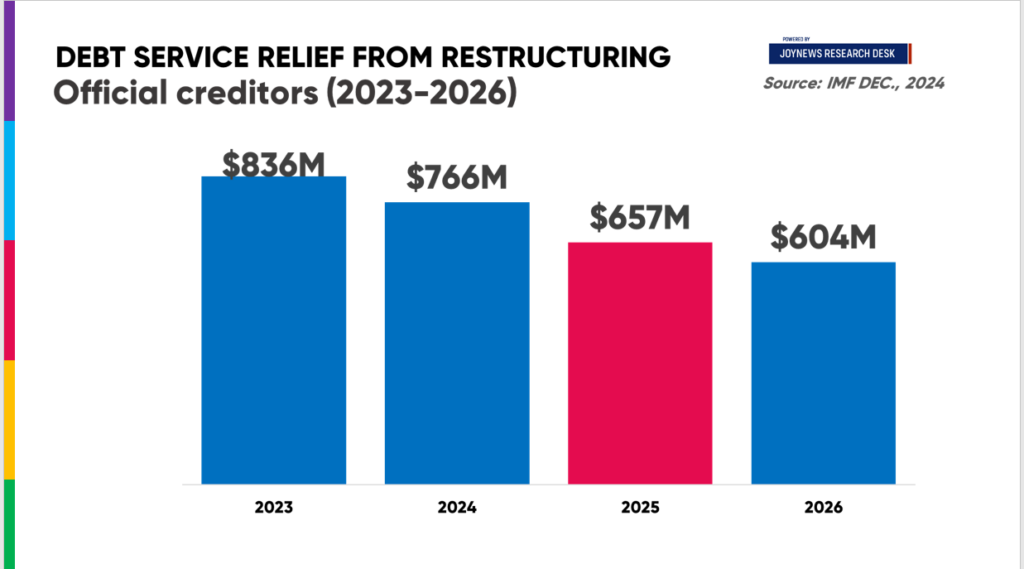

According to the International Monetary Fund’s December 2024 report, Ghana is set to benefit from a substantial debt servicing relief of approximately $2.86 billion.

Of this amount, an estimated $657 million is expected to be realized within 2025, providing much-needed fiscal space for economic recovery.

A breakdown of the debt relief figures shows that Ghana has already benefited from $1.6 billion (2023 and 2024) and is set to receive an additional $1.26 billion. Of this amount, $657 million is expected to be disbursed this year, while the remaining $604 million will be released in 2026 when the bilateral moratorium expires.

About the writer:

Isaac Kofi Agyei is the Lead Data & Research Analyst/Journalist at JoyNews based in Accra, where he covers mostly finance, economics, banking, and politics across Ghana and West Africa, from detailed analytical reports on all key issues to debt crises to IMF programmes. He also serves as the data and research correspondent for SBM Intelligence, an Africa-focused market/security leader in strategic research, providing actionable analyses of West Africa’s socio-political and economic landscape. With his solid academic background in economics and statistics and additional training from credible institutions such as the UNDP, Afrobarometr, Ghana Statistical Service, and a host of others, Isaac has honed his skills in effective data storytelling, reporting, and analysis.

Latest Stories

-

Rehoboth Properties responds to allegations of power theft at Kweiman Estate

3 minutes -

Your social media activity can affect your student visa application – U.S. Consul General

10 minutes -

GJA elections committee chairman reaffirms commitment to credible polls

51 minutes -

Visa denial is not deliberate; adhere to the rules – U.S Consul General

1 hour -

Part of Accra Sports Stadium still closed as NSA lacks funds for repairs

1 hour -

Haruna Mohammed calls for amendment of political parties act to enable financial independence

1 hour -

Stakeholders advocate professional development for teachers in the standards-based curriculum

1 hour -

Sheffield United invited entire Shooting Stars team for trials because of me – Rashid Fuseini

1 hour -

Do not apply for visa through agents; they are liars – U.S. Consul General

1 hour -

Quash order to restore Nii Adama Latse II – Nii Tackie Tsuru urges Supreme Court

2 hours -

Ghana Maritime Authority executes second successful offshore medical evacuation in months

2 hours -

Bond market: Turnover increased by 13.17% to GH¢1.33bn

2 hours -

Israel says Iran violates ceasefire, orders strikes on Tehran

2 hours -

Hearts of Oak reassign Ouattara as Special Advisor after hiring Didi Dramani Head Coach

2 hours -

Fix the cracks first – Patrick Boamah advises NPP ahead of flagbearer race

2 hours