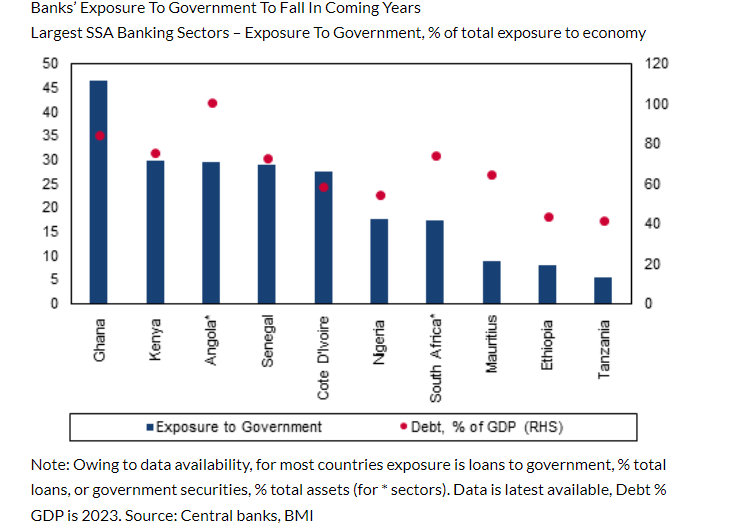

Ghana recorded the highest banks’ holdings of government debt in Sub Saharan Africa in 2023, Fitch Solutions has revealed.

In terms of government debt to Gross Domestic Product (GDP), the country came second behind Angola.

Kenya, South Africa and Senegal came 3rd, 4th and 5th respectively.

The report said banks in Sub-Saharan Africa including Ghana will continue to face risks associated with sovereign exposure throughout the forecast period. Nonetheless, these risks are expected to diminish over time.

During the Covid-19 pandemic, banks’ holdings of government debt and claims to the public sector surged as governments increased borrowing to fund additional expenditures.

With limited access to international markets owing to prohibitive costs, the report, said domestic banks became the main financiers. This dependence, it added, poses significant risks to banks, particularly when government finances are strained.

“This dependence poses significant risks to banks, particularly when government finances are strained. For instance, Ghana's default on its domestic and external debt in December 2022 led to considerable losses for banks participating in its domestic debt exchange programme”.

“As can be seen in the chart below, banking sectors in markets with elevated levels of government debt typically have the highest exposure to the government through loans or government securities holdings. We expect that the average debt-to-GDP ratio for the region will fall in the coming years, after peaking in 2023, boding well for our view that banks will reduce exposure to the sovereign”, it stressed.

Reopening of Africa’s Eurobond market in 2024 marks positive shift

The report continued that the reopening of Africa's Eurobond market in 2024, following a hiatus of more than a year, marks a positive shift, with successful, oversubscribed bond issuances from countries such as Côte d'Ivoire, Benin, and Kenya.

This resurgence, it said, provides government with a source of financing other than banks, offering banks the opportunity to lessen their exposure to sovereign debt, potentially liberating resources for increased lending to the private sector. However, this transition is expected to be gradual, as loan quality continues to be a concern and private sectors present higher risk profiles than sovereigns.

Latest Stories

-

The Self-Defeating spiral of regulatory technology?

12 minutes -

Police launch investigation into fatal shooting of Kusasi Chief in Asawase

16 minutes -

WAFCON 2024: ‘This one really hurt’– Jennifer Cudjoe reacts to semifinal loss

20 minutes -

Former Black Queens coach Nora Häuptle was overhyped – Former GFA EXCO Member

28 minutes -

WAFCON 2024: ‘Build on this and you’ll be champions’ – Kurt tells Black Queens

56 minutes -

Kelvin Taylor deserved fair hearing before arrest warrant – UGBS Lecturer

1 hour -

NRSA orders immediate removal of billboards in road medians over safety concerns

1 hour -

Duffuor Case: Accepting 60% recovery undermines justice and accountability – Sulemana Braimah

1 hour -

WAFCON 2024: Sports Minister lauds ‘courageous’ Black Queens performance against Morocco

1 hour -

Prices of some imported goods could be reduced in coming weeks – GIFF assures

2 hours -

Attorney-General to address uniBank case, asset recovery updates on Monday – Kwakye Ofosu

2 hours -

Duffuor Case: Manhyia South MP questions why State settled for only 60% recovery

2 hours -

Venus Williams, 45, becomes second oldest winner

2 hours -

WAFCON 2024: Ghana to face South Africa in third place play-off

2 hours -

Kusasi Chief in Ashanti region shot dead at home in Asawase

2 hours