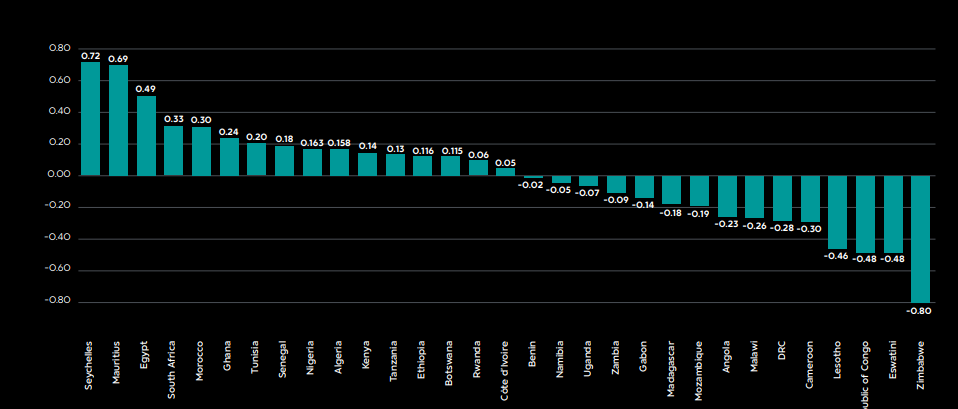

Ghana is ranked 6th in Africa as the most attractive investment country in Africa in 2024, Rand Merchant Bank (RMB) ‘Where to Invest in Africa 2024’ report has revealed.

The nation had an overall score of 0.24.

For Innovation, it scored 0.549, placing 9th whilst it had 0.935, placing 5th in the Growth Structure.

It also placed 6th in Economic Stability and Investment Climate (0.27)

The country however placed 10th in Urbanisation (0.553) and 6th in Connectedness (0.850), whereas it placed 26th in Complexity.

The report stated that “Ghana represents a substantial market. Further, it is among the top ten for urbanisation, connectedness, innovation, political stability, personal freedom and employment. It also ranks favourably on corruption and tops the list on import concentration”.

The reported noted that there are positive signs on the fiscal front.

“Fiscal consolidation is broadly on track, with an estimated deficit of 4.6% of GDP [Gross Domestic Product] at the end of 2023, significantly lower than the 10.7% deficit in 2022. At 15.7% of GDP in 2023, revenues and grants reached the same level as 2022 despite lower oil revenues”, it stressed.

By 2027, growth is forecast to benefit from increased gold and oil exports as new projects come online.

Seychelles came first with a score of 0.72%. It was followed by Mauritius (0.69) in 2nd position and Egypt (0.49) in 3rd.

In 4th and 5th positions were South Africa (0.33) and Morocco (0.30).

In the current edition of the RMB Where to Invest in Africa report, it maintained that the investment decision needs to be viewed through both an economic performance lens and an operating environment lens.

Thus, building on the previous work, it packaged this data as:

1. Economic performance and potential

2. Market accessibility and innovation

3. Economic stability and investment climate

4. Social and human development

The four pillars are constructed from a total of 20 metrics, each comprising a multi-year database of robust figures drawn from pre-eminent institutions.

The 2024 RMB Where to Invest in Africa report is based on the input of experienced professionals and, in part, on work published in peer-reviewed journals to expand on our earlier model. The quantitative model underlying this report stands on the shoulders of the work done on prior editions.

Latest Stories

-

SAFA President Danny Jordaan arrested for alleged $71k fraud and embezzlement case

9 mins -

Bagbin risks 10-year jail for defying Supreme Court – Justice Atuguba

32 mins -

The Exploratory partners HPW Ghana to expand practical STEM education in rural Ghana

34 mins -

Path to economic recovery challenging but overarching trend remains positive – GIPC

46 mins -

Mobile Money fraud: Deloitte to hold training on Fundamentals of Digital Forensics and e-Discovery

49 mins -

Ghana bagged $179.07m from FDIs in first-half of 2024

53 mins -

MobileMoney rewards loyalty, excellence at its 15th anniversary celebration

1 hour -

2024 Election: Predictions of NDC victory cannot hold – Yendi MP

2 hours -

Ghana’s Petroleum Hub Project to transform petroleum downstream sector

2 hours -

Mohammed Kudus will come back from red card suspension stronger – Michail Antonio

3 hours -

AFCON 2025Q: Ghana’s chances of qualifying are ‘low to impossible’ – Angola coach

3 hours -

Sammi Awuku leads NPP youth to rally support in Odododiodio and Korle Klottey constituencies

3 hours -

AFCON 2025Q: Stars to fly with 22 players for Angola test, Ebenezer Annan to join in Luanda

3 hours -

Historic coronation of Torgbi Mileba III: A celebration of heritage with support from Vanuatu’s Trade Commissioner to Ghana

3 hours -

Bawah Fuseini aims to transform National Sports College into international standard facility

4 hours