Ghana was ranked as the second most attractive country in terms of power supply or electricity among 18 countries in Sub Saharan Africa, Fitch Solutions has revealed.

The country followed South Africa in SSA whereas Botswana placed 3rd.

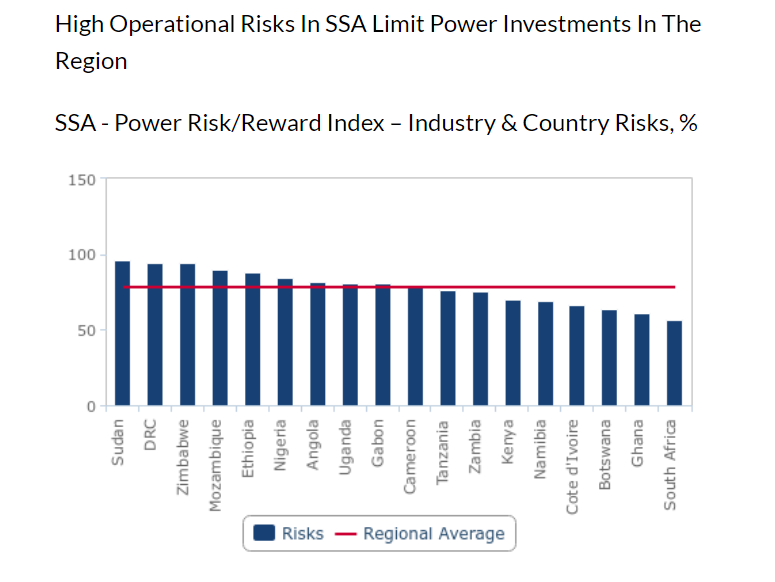

According to the report, the country had one of the least Power Risk/Reward Index in the SSA region.

Ghana’s risk/reward index was slightly above 50%, whereas South Africa was nearly 50%.

Among the 18 countries, Sudan (18th), DRC (17th), Zimbabwe, Mozambique (16%) were ranked bottom. Their risk/reward index were very high.

“We expect political and economic risks to limit power sector growth in Sub-Saharan Africa over the next decade. Political instability and economic challenges in Sub-Saharan Africa will continue to pose major hurdles for power sector development.”

“Countries within the region, such as Ethiopia, Kenya, Nigeria, and South Africa are grappling with issues such as corruption, social unrest, and economic inequality, which deter foreign investment and complicate infrastructure project developments”, it added.

Furthermore, the UK-based firm said despite efforts by governments for power market reforms and private sector participation, the volatile political climate and weak governance structures undermine the effectiveness of these initiatives.

For instance, it said “in Nigeria, the ongoing conflict in the Northern regions and pervasive corruption issues have hindered the liberalisation of the power sector, limited the effectiveness of reforms, and deterred potential investors”.

Moreover, the economic outlook for SSA is clouded by high debt levels and limited fiscal space.

“An increase in public debt consumes a share of the national savings and this decrease in savings leads to higher interest rates, diminishing the incentives for investment. The International Monetary Fund (IMF) expects that the average debt ratio for SSA will remain elevated at around 60%, thus constraining public spending on infrastructure projects, including in the power sector”, it mentioned.

Latest Stories

-

Samer Chedid succeeds Mauricio Alarcón as CEO of Nestlé Central and West Africa

18 minutes -

Stephen Ntim takes temporal break as NPP Chairman due to health concerns

41 minutes -

Abolish ‘Additional Judge’ practice in lower courts – Justice Dennis Adjei urges

1 hour -

District assembly elections are already partisan – Sir Dennis Adjei urges reform

1 hour -

Africa World Airlines reschedules Accra–Ouagadougou route launch to 1st July

2 hours -

Mahama vows to reignite dream of Bukom Boxing Academy

2 hours -

Once I put on my judicial cap, my faith has nothing to do with judgement – Supreme Court nominee

2 hours -

LGBTQ: Judges must uphold the law, not personal faith – Justice Dennis Adjei

2 hours -

“If you cannot marry at 16, why sex at 16?” – Justice Adjei punches holes in Ghana’s laws

2 hours -

Criminalise falsehoods online just like offline offences – Sir Dennis Adjei backs misinformation law

2 hours -

Rain‑soaked Accra turned electric as ‘3 Faces of Jeffrey Nortey’ sold out National Theatre

2 hours -

Justice Dzamefe backs AI, virtual courts to tackle delays in justice delivery

2 hours -

First National Bank Ghana receives $35m capital injection to accelerate growth, lending capacity

2 hours -

2025 NCAA Champs: Rose Yeboah wins silver with season’s best jump

3 hours -

AI alone cannot fix judicial system without integrity – Ansa-Asare

3 hours