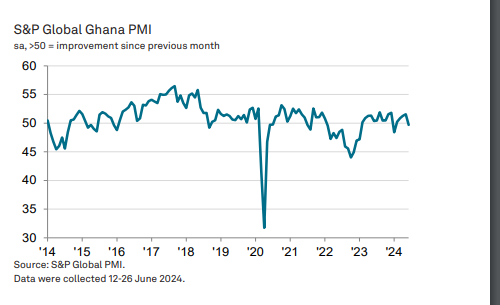

Ghana Purchasing Managers’ Index (PMI) dipped to 49.7 in June 2024 from 51.6 in May, according to S&P Global.

The index signalled a marginal monthly deterioration in business conditions, ending a four-month sequence of improvement.

According to the report, the strong inflation was a key issue for the private sector in June 2024 and was largely responsible for the renewed downturn at the end of the second quarter.

Similarly, the rate of purchase price inflation hit a 19-month high, having quickened for the fifth consecutive month. A depreciation of the cedi against the US dollar was the main cause of the rise in purchase costs, according to respondents.

Staff expenses also increased again in June 2024 as firms acted to support their workers at a time of rising living costs.

In response to the rapid increase in input prices, S&P Global said companies raised their own selling prices substantially. The pace of output price inflation was the fastest since November 2022 as 34% of respondents increased their charges.

Inflationary pressures dampened demand in June 2024 as new orders were unchanged following four consecutive months of expansion. That said, some firms indicated that their customers had accepted price rises and continued to make new orders.

The impact of price rises on client demand, S&P said fed through to business activity which decreased for the first time in four months, albeit only slightly. Inflationary pressures also impacted private sector firms' own purchasing decisions.

Andrew Harker, Economics Director at S&P Global Market Intelligence, said: "The spurt of inflation in Ghana's private sector is having an increasingly concerning impact on business conditions, and in June caused a stagnation of new orders and outright reductions in output and purchasing activity. While employment continued to rise, providing the main bright spot in the month, job creation will likely prove unsustainable should price rises continue to bear down on demand.”

"Looking at the second quarter of the year as whole, solid output growth in the opening two months of the quarter should mean that GDP [Gross Domestic Product] numbers remain solid. The worry is that the second half of the year will be more of a struggle”, said Mr. Harker.

Business confidence strong

Meanwhile, business confidence strengthened in June 2024 amid hopes of an improvement in economic conditions over the coming year.

Optimism in the outlook for output was predicated on stability of both the exchange rate and prices, however.

Latest Stories

-

Government suspends GH₵1 fuel levy indefinitely, new date to be announced later

9 minutes -

Democratic state politician and husband shot dead in targeted attack

22 minutes -

15 killed by Israeli fire near Gaza aid site, hospitals say

27 minutes -

Ashaiman NDC in shock as chairman Shaddad Jallo dies

1 hour -

Mahama converts Daboya College into public Teacher Training Institution, revives Doli project

1 hour -

Prioritise prudence, not foreign debt – Deputy Ahafo Regional Imam implores African leaders

1 hour -

Mahama promises STEM School and TVET Centre for Savannah Region

1 hour -

Mahama announces new public university for Savannah Region

1 hour -

Ahiagbah demands Health Minister’s dismissal over handling of nurses’ strike

1 hour -

Mahama’s clemency for radio stations was pure gimmick – Egyapa Mercer

1 hour -

GRA postpones implementation of Energy Sector Levy

2 hours -

GES urges supervisors and invigilators to uphold integrity and honesty

4 hours -

Don’t let your parents down – Omane Boamah to Pope John SHS students

4 hours -

Prof Sharif Khalid defends gov’t’s record on health workers, questions comparisons with UK

4 hours -

Razak Opoku: KGL-NLA contract the best since establishment of NLA in 1958

5 hours