Audio By Carbonatix

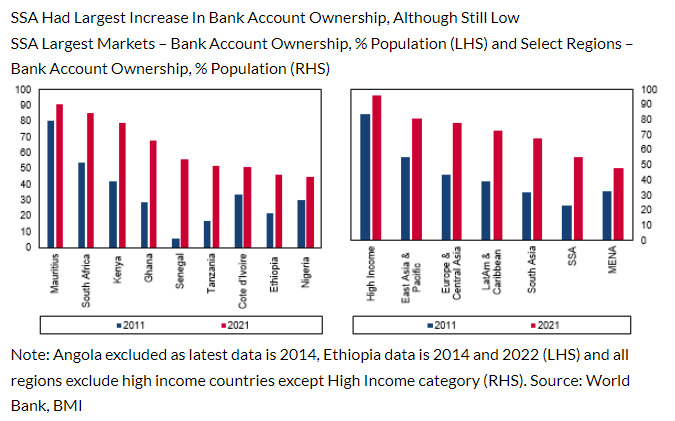

Ghana placed 4th in Sub-Saharan Africa with the largest growth in digital bank account ownership, Fitch Solutions, has revealed.

However, it described the increase as still low, compared to peers globally.

The country saw a growth of more than 40% in the digital bank account (including mobile money) between 2011 and 2022 to a little over 60%.

Mauritius placed 1st with more than 90% growth, followed by South Africa (82%) and Kenya (74%).

In 5th to 9th were Senegal (54%), Tanzania (50%), Ivory Coast (49%), Ethiopia (47%) and Nigeria (44%).

In the article “Navigating The Digital Banking Landscape In Sub-Saharan Africa”, the UK-based firm said Sub-Saharan Africa (SSA) has lagged behind other regions in banking sector development but leads in digital banking progress.

“We estimate that SSA banking assets will represent 53.0% of Gross Domestic Product in 2024, compared to the emerging markets average of 84.8%. Limited access to traditional banking has hindered broader economic participation and growth”.

Digital banking offers unprecedented opportunities for financial inclusion, fostering economic development and accelerating technology adoption. The proliferation of mobile phones, improved internet connectivity, and increasing regulatory support are key drivers of this shift.

Fitch Solutions added “We anticipate that SSA will continue to develop its digital banking capabilities, benefiting households, businesses, traditional and challenger banks, and the broader economy. This article investigates key themes and challenges associated with digital banking in SSA, a topic we previously highlighted as influential in the region’s banking development”.

It pointed out that Nigeria and Kenya stand out as the main hubs for digital banking in SSA, each showcasing unique ecosystems driven by traditional banks and innovative fintech companies. In Nigeria, key players like Kuda Bank and GTBank leverage robust mobile platforms to offer a range of financial services, targeting the unbanked and underbanked populations.

Other notable countries, it said, include South Africa with its advanced financial infrastructure, Ghana with surging mobile money usage, and Tanzania experiencing rapid mobile banking growth.

Latest Stories

-

Adom FM’s ‘Strictly Highlife’ lights up La Palm with rhythm and nostalgia in unforgettable experience

2 hours -

Ghana is rising again – Mahama declares

6 hours -

Firefighters subdue blaze at Accra’s Tudu, officials warn of busy fire season ahead

6 hours -

Luv FM’s Family Party In The Park ends in grand style at Rattray park

6 hours -

Mahama targets digital schools, universal healthcare, and food self-sufficiency in 2026

6 hours -

Ghana’s global image boosted by our world-acclaimed reset agenda – Mahama

7 hours -

Full text: Mahama’s New Year message to the nation

7 hours -

The foundation is laid; now we accelerate and expand in 2026 – Mahama

7 hours -

There is no NPP, CPP nor NDC Ghana, only one Ghana – Mahama

7 hours -

Eduwatch praises education financing gains but warns delays, teacher gaps could derail reforms

7 hours -

Kusaal Wikimedians take local language online in 14-day digital campaign

8 hours -

Stop interfering in each other’s roles – Bole-Bamboi MP appeals to traditional rulers for peace

8 hours -

Playback: President Mahama addresses the nation in New Year message

9 hours -

Industrial and Commercial Workers’ Union call for strong work ethics, economic participation in 2026 new year message

11 hours -

Crossover Joy: Churches in Ghana welcome 2026 with fire and faith

11 hours