Senior Investment Executive at Dalex Finance and Leasing Company Ltd, Agnes Serwaa Abankwa says it will take at least a decade for Ghana to recover from the effects of the domestic debt exchange programme.

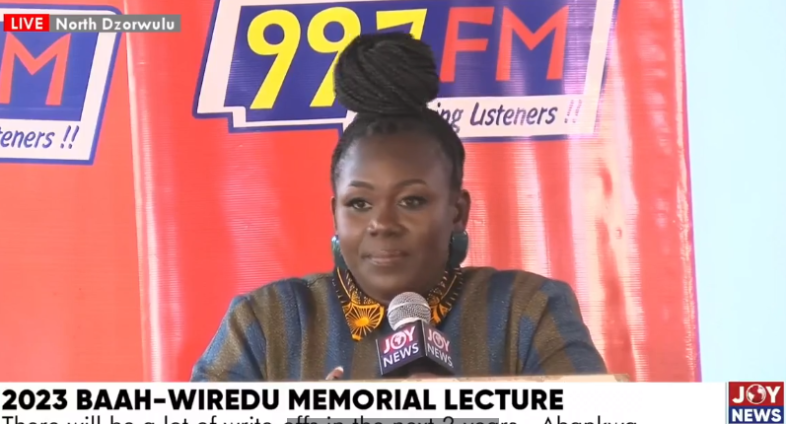

Speaking at this years annual Baah Wiredu Memorial Lecture held in Accra on Thursday, September 21, she stated that Ghana’s recovery will be very slow and painful and there will be the need for a lot of write-offs to help provide liquidity to banks.

“In the next two years, there’s going to be a lot of write offs. In 2023 when you look at most or all of the bank statements, you’ll realise that they recorded huge, huge losses and it is as a result of the DDEP. So if we want to move forward we’ll need to look at write-offs,” she said.

She explained that write-offs are essential for the financial sector to gain some form of stability to get back on its feet, augment capital and support the growth of the private sector.

According to her, now more than ever does the government need to fully rollout its much talked about stabilization fund to prevent a total collapse of Ghana’s fiscal space.

“I heard about the stabilization fund in 2022 and yet still nothing has been done. The money should be up and running now and support these struggling institutions. We don’t have to do it the Ghanaian way where we are going for committee meetings, we’re doing this, no! The money should be there so that distressed institutions can have access to that money and give out more loans because for financial sectors that is how we thrive, that is how we make money,” she said.

Ms. Abankwa predicted that during these hard times, badly hit banks may face consolidation and takeovers.

“And when I look at the survival stage, I compare it to a wounded lion. When a lion is wounded and its able to get back on its feet, it becomes very aggressive. And so in the next four years we need to be aggressive. Institutions that are struggling probably might experience takeovers, there will be some consolidation of some banks.”

She stated that there will be the need for bank recapitalisation as part of the stabilization efforts.

According to her, the halving of bank capitals by the steep depreciation of the cedi has left many banks vulnerable and at risk of collapse.

“Bank of Ghana gave a minimum capital requirement for every financial institution. Last year, the cedi to the dollar was six cedis to the dollar, this year it’s almost double. And so what it means is that your minimum capital requirement whatever money you have as your working capital has been halved so the value is low so we need to look at recpaitalisation.

“Once we are able to do this hopefully in the other four years we’ll be looking at recovery and mind you this recovery is going to be a painful process. It’s going to be slow and it’s going to be painful,” she said.

Latest Stories

-

2025 Mid-Year Budget: Economy is on steady course – Trade Expert

6 minutes -

Stanbic Investment Management Services Ltd announces strong 2024 performance

7 minutes -

Banking is necessary, but banks are not: Ghana’s digital finance disruption story

14 minutes -

Ghana set to sign bilateral debt agreements today under G-20 framework

21 minutes -

Gov’t narrows fiscal deficit target after better-than-expected first half

22 minutes -

Small Ivory Coast cocoa firms say EU deforestation rules might bankrupt them

29 minutes -

Finance Minister Ato Forson projects single-digit inflation for Ghana by December

36 minutes -

Heath Goldfields pays GH₵80m to settle legacy salary arrears left by former leaseholder

36 minutes -

2026 budget to be presented by end of October – Finance Minister Ato Forson

43 minutes -

Today’s Front pages : Friday, July 25, 2025

1 hour -

NPP govt was living ‘champagne lifestyle on Akepeteshie budget’ – Finance Minister Ato Forson rebukes

2 hours -

Rwanda’s Kagame appoints central banker as new prime minister

2 hours -

Mahama running an optics and settings government – Sammi Awuku

2 hours -

Parliament approves bill to scrap marine gas oil subsidy

2 hours -

Discipline, not rhetoric stabilised the cedi – Ato Forson jabs Bawumia

2 hours