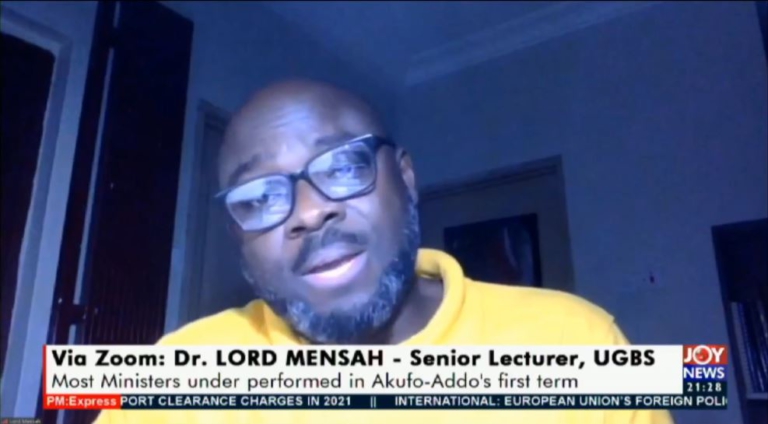

A Finance Lecturer at the University of Ghana Business School (UGBS), Prof. Lord Mensah says the country’s economy is not insolvent contrary to suggestions by some financial analysts that the economy is broke.

According to him, the government is not prioritising its expenditure which is creating a scenario of an insolvent economy.

Speaking on the AM show on Monday, January 17, 2022, Prof. Lord Mensah noted that a country like Ghana with the ability to generate revenue of about 70 billion Ghana cedis cannot be described as broke.

“Ghana is never broke, a country that is broke has no ability to generate revenue. Now if you look at Ghana as a country, I would say that we are not broke but we are not able to prioritise our spending that is what is making it look as if the country is broke. We are not broke because a country that would be able to generate revenue of about 70 billion Ghana cedis, what makes it a broke country?” he asked.

Prof. Lord Mensah said that over the past years, the government has instituted measures to generate revenue without managing its expenditure.

He explained that the government’s expenditure has not been efficient stressing that the country spends money in sectors that do not generate revenue.

“Government tries to put in measures that enhance revenue but then the only difficult thing is that government has not got the political will to look at the expenditure side. If you look at the expenditure side carefully, you will realize that there are some key areas that you may not want to touch and at the end of the day if you relate that to our revenue you may realize that more or less what we generate is not what we can spend, we are not doing that.”

“What we are doing in this country is that we are spending more than is necessary. All our expenditure is going into areas which are not necessarily generating revenue back into the system,” he stated.

This, he said is what has accounted for the increase in the country’s debt burden; adding that the downgrading of Ghana’s Long-Term Foreign-Currency Issuer Default Rating (IDR) from ‘B’ to ‘B-’ is not surprising.

“If you take the last budget that we read, it looks like all the revenue-enhanced policies that the government tends to roll out are falling on rocks because if you take the e-levy, the plan was that it had to kick off in January 2022 but look at where we are now; and also if you take the benchmark value reduction, it also has a problem.”

“Clearly, it tells you that the government is struggling when it comes to the ability to implement its revenue-enhanced policies. So if you are to create an economy of this nature, you’re going to downgrade it because if you’d be able to pay your debts, it has to do with your ability to raise money,” he said.

Fitch pointed out in its ratings that Ghana’s effective loss of market access to international bond markets increases risks to its ability to meet medium-term financing needs.

The downgrade of Ghana’s IDRs and Negative Outlook reflect the country’s loss of access to international capital markets in the second half of 2021, following a pandemic-related [COVID-19] surge in government debt.

“In our view, Ghana has sufficient liquidity and other available external financing options to cover near-term debt servicing without Eurobond issuance.”

“However, there is a risk that non-resident investors in the local bond market could sell their holdings, particularly if confidence in the government’s fiscal consolidation strategy further weakens, placing downward pressure on its reserves,” Fitch said.

Latest Stories

-

Franklin Cudjoe defends importance of National Economic Dialogue

7 minutes -

Sustainable solutions needed for energy sector woes – Prof Asuming

12 minutes -

National Economic Dialogue tackled key issues – Prof. Khalid

14 minutes -

NSA scandal: NIB detains Gifty Oware-Mensah

17 minutes -

Energy Minister must prioritise private sector involvement – Franklin Cudjoe

26 minutes -

International Women’s Day: Jean Mensa advocates for intensified efforts to bridge gender gap

28 minutes -

Support OSP with relevant laws to do its work – Kofi Bentil

33 minutes -

2025 Budget: We expect Finance Minister to outline strategies in securing digital money eco-system – Digital financial stakeholders

7 hours -

Pre-budget survey reveals big confidence in 2025 Budget – KPMG

7 hours -

MP for Sekyere Afram Plains inspires Ghanaian Youth on International Women’s Day

7 hours -

Ashaiman residents protest land dispute, demand justice

8 hours -

Mahama visits Mali on ‘Good Neighbourliness’ mission

8 hours -

GPL 2024/25: Berekum Chelsea host Accra Lions on league return

8 hours -

Former Black Stars boss Hughton ready for new challenge

8 hours -

Sudan FA dismisses salary row with Coach Kwasi Appiah

9 hours