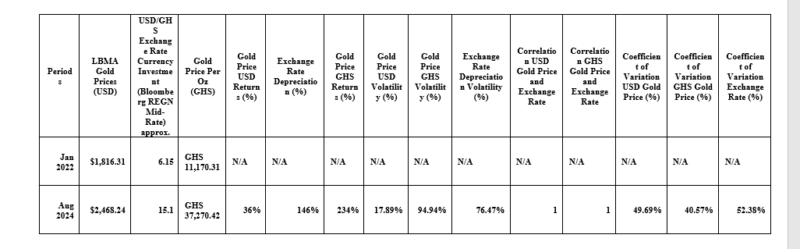

I have gathered the following historical data to provide education on the Ghana Gold Coin investment. For this case study analysis, I assumed that you invested in the Ghana Gold Coin in January 2022 and held onto it until August 2024.

The table provides a detailed analysis of the Ghana Gold Coin (GGC) investment from January 2022 to August 2024. Key metrics such as gold price returns in USD and Ghanaian Cedi (GHS), exchange rate depreciation, volatility, and the coefficient of variation offer a clear picture of the investment's performance and associated risks.

Key Findings

- Gold Price Returns

- The US dollar price of gold increased by 36% during this period, demonstrating a solid appreciation in value.

- For investors in Ghana holding gold in GHS, the returns were even more substantial at 234% due to the significant depreciation of the cedi.

- Exchange Rate Depreciation

- The exchange rate from USD to GHS depreciated by 146%, reflecting the sharp weakening of the Ghanaian cedi against the US dollar. This depreciation led to an increase in the GHS value of gold for local investors, greatly enhancing their returns.

- Volatility

- The volatility of gold prices in USD was 17.89%, indicating moderate fluctuations in international gold prices.

- The volatility in GHS gold prices was much higher, at 94.94%, driven by the significant fluctuations in the exchange rate.

- Exchange rate depreciation also exhibited high volatility at 76.47%, signaling an unstable local currency.

- Correlations

- Both the USD gold price and the GHS gold price showed a perfect correlation (1) with the exchange rate. This indicates that the changes in the exchange rate directly impacted the price of gold in local currency, making exchange rate fluctuations a key factor for local investors.

- Coefficient of Variation

- The coefficient of variation for the USD gold price was 49.69%, indicating that the risk relative to return was moderate for USD investors.

- The coefficient of variation for the GHS gold price was 40.57%, suggesting a better risk-adjusted return for GHS investors despite the higher volatility.

- The coefficient of variation for the exchange rate was 52.38%, highlighting the substantial instability in the exchange rate and the associated risks.

Investment Decision Based on Coefficient of Variation

The coefficient of variation (CV) is a crucial metric for assessing the level of risk compared to the return on investment. A lower CV indicates a better risk-adjusted return, meaning the investor is receiving a relatively higher return for the amount of risk undertaken.

- For USD investors, the CV of 49.69% indicates moderate risk relative to the returns. This suggests that while investing in gold in USD was somewhat volatile, the returns were reasonably in line with the risk.

- For GHS investors, the CV of 40.57% indicates a more favorable risk-return balance compared to USD. Despite the higher volatility in GHS prices, the substantial returns made the risk more worthwhile for GHS investors.

- The CV of 52.38% for the exchange rate signals that currency fluctuations posed a significant risk. The high coefficient of variation for the exchange rate implies that investors relying heavily on exchange rate movements should be cautious, as currency instability could drastically impact their returns.

Final Investment Decision

Given the high returns but also the high volatility and exchange rate risk, investing in the Ghana Gold Coin (GGC) would have been beneficial for investors with a high-risk tolerance, especially those investing in GHS. The coefficient of variation for GHS gold prices suggests that the returns justified the risks, especially compared to holding USD. However, conservative investors might view the high volatility and the unstable exchange rate as reasons to approach the GGC investment with caution.

In conclusion, GGC offers a strong opportunity for returns but comes with substantial risks, particularly for those exposed to exchange rate fluctuations. Investors should assess their risk tolerance and market expectations before deciding to invest.

Is it Safe?

While gold has historically been a safe-haven asset, especially during economic instability or currency depreciation, the high volatility seen in both gold prices and exchange rates suggests that investing in gold carries significant risks in Ghana during the examined period. Although the returns were impressive, the extreme fluctuations and the dependence on exchange rate movements introduce substantial uncertainty. Thus, Ghanaian investors in the Ghana Gold Coin (GGC) should be prepared for high risk and volatility. While the investment offers protection against local currency depreciation and has delivered substantial returns, it is not free from significant short-term risks.

Another important concern for this investment is whether the Bank of Ghana will provide liquidity for trading the Gold Coin. This raises questions about the ease of buying and selling the Gold Coin when needed. Additionally, if you plan to hold onto the Gold Coin, consider where you will store it, as storage solutions like a bank safe deposit box also come with additional costs. Unless, you plan to do have this investment as “paper” or certificate investment. From the case study presented above, if an individual had invested in the Gold Coin from January 2022 to August 2024, their returns in Cedi would have been 234%. In comparison, investing solely in USD currency during the same period would have yielded a return of 146%. This shows that while the Gold Coin offers higher returns, it also comes with greater risk and volatility compared to simply holding dollars in Ghana as an investment option. Ultimately, the decision depends on your risk tolerance.

An important question to think about is whether the Bank of Ghana will provide the necessary support to make sure the Gold Coin (GGC) can be easily bought and sold. The Bank of Ghana has stated that the GGC is issued and backed by them, but does this mean that they will act as the clearinghouse for all buyers and sellers to guarantee that there’s always someone to trade with? This is critical for ensuring liquidity, meaning how quickly and easily you can sell your Gold Coin when needed. Understanding if the Bank of Ghana will take on this role is key to knowing how safe and reliable this investment is. This question is as important as in the case of Menzgold Ghana Limited unlicensed gold dealership and investment, this was the problem that made it like a Ponzi-scheme.

The issuance of the GGC allows the Bank of Ghana to manage excess cedi liquidity in the economy, complementing other financial tools. It provides Ghanaian savers with a new investment option and a natural hedge during economic uncertainty. By offering access to gold, the GGC helps residents diversify their portfolios and benefit from the Bank of Ghana's domestic gold purchase program.

Latest Stories

-

Employee fraud is everywhere, be intentional about stopping it – Expert counsels

15 minutes -

We have a very good chance of making it to the World Cup – Jordan Ayew

31 minutes -

Innovation Hubs as Engines of Sustainability: Charting Ghana’s path with lessons from the Hamburg Sustainability Conference 2025

33 minutes -

UHAS makes history with publication of landmark study in Nature Human Behaviour

60 minutes -

Asante Gold Corporation commended for community development projects in W/N region

1 hour -

World Environment Day: Stakeholders urge collaborative effort for sustainable ecosystem restoration

1 hour -

Photos: Thousands of Muslims observe Eid al-Adha 2025 at Independence Square

1 hour -

Russia launches ‘massive’ strikes days after Ukrainian drone attack

1 hour -

Ghana, Morocco agree to Visa-free travel for Ghanaians, says Foreign Affairs Minister

1 hour -

Samson Anyenini and OneGhana Movement renew calls for compensation for June 3 victims

2 hours -

California-based VIMA delivers lifesaving borehole to forgotten Ghanaian village

2 hours -

Health Minister calls for independent mediation to end nurses’ strike

2 hours -

Office of the Special Prosecutor remains Ghana’s most promising anti-corruption tool

3 hours -

Mahama promises significant drop in Hajj fares next year if…

3 hours -

Special Prosecutor reiterates calls for lifestyle audits, asset seizures without conviction

4 hours