Audio By Carbonatix

The International Monetary Fund has stated that Ghana breached the Debt Sustainability Analysis (DSA) thresholds, a situation that led the country into debt distress.

In a statement titled “Request for an arrangement under the Extended Credit Facility Programme”, the Fund said Ghana is in debt distress. It added that the country's debt level is also unsustainable.

“Given the ongoing debt restructuring and large and protracted breaches to the Debt Sustainability Analysis (DSA) thresholds, Ghana is in debt distress, and debt is assessed as unsustainable”.

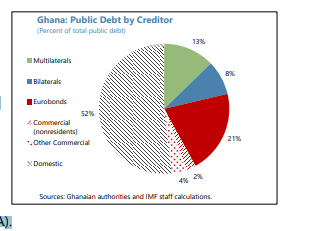

It pointed out that public debt increased to 88.1% of Gross Domestic Product by end-2022, almost evenly split between external (42.4% of GDP) and domestic (45.7% of GDP).

Again, the Fund mentioned that gross financing needs have reached about 19% of GDP.

“Under the proposed programmes baseline projections, which do not consider the possible outcome of the ongoing debt restructuring, the ratios of present value of public and external debt to GDP, and the ratios of external debt service to revenues and exports are and would remain above their LIC-DSF thresholds over the medium and long term”, it added.

Outlook subject to significant downside risks

The Fund further said that the outlook is subject to significant downside risks.

It explained that the baseline projections are predicated on successful programme execution and swift progress in implementing the authorities’ comprehensive debt restructuring and plans to address the large stock of domestic arrears, including to independent power producers (IPPs).

Notwithstanding mitigation strategies, it said that the domestic debt exchange presents significant risks to domestic financial sector stability, adding “exchange rate, credit, and liquidity risks further add to the vulnerabilities”.

“The authorities’ debt restructuring plans still leave a substantial need for T-bill [Treasury bills] issuance in the near term and expose Ghana to the uncertainty in domestic market conditions, though programme implementation and outreach may help mitigate financing risks. Domestic policy slippages represent a significant downside risk to the projections, further compounded by risks associated to the end-2024 general elections.”

Latest Stories

-

Adom FM’s ‘Strictly Highlife’ lights up La Palm with rhythm and nostalgia in unforgettable experience

2 hours -

Ghana is rising again – Mahama declares

5 hours -

Firefighters subdue blaze at Accra’s Tudu, officials warn of busy fire season ahead

6 hours -

Luv FM’s Family Party In The Park ends in grand style at Rattray park

6 hours -

Mahama targets digital schools, universal healthcare, and food self-sufficiency in 2026

6 hours -

Ghana’s global image boosted by our world-acclaimed reset agenda – Mahama

6 hours -

Full text: Mahama’s New Year message to the nation

6 hours -

The foundation is laid; now we accelerate and expand in 2026 – Mahama

7 hours -

There is no NPP, CPP nor NDC Ghana, only one Ghana – Mahama

7 hours -

Eduwatch praises education financing gains but warns delays, teacher gaps could derail reforms

7 hours -

Kusaal Wikimedians take local language online in 14-day digital campaign

8 hours -

Stop interfering in each other’s roles – Bole-Bamboi MP appeals to traditional rulers for peace

8 hours -

Playback: President Mahama addresses the nation in New Year message

9 hours -

Industrial and Commercial Workers’ Union call for strong work ethics, economic participation in 2026 new year message

10 hours -

Crossover Joy: Churches in Ghana welcome 2026 with fire and faith

11 hours