The Bank of Ghana has revealed a rapid emergence of SIM swap fraud targeting individuals with access to mobile banking channels. According to the apex bank, about GHȼ4.6 million was lost to this fraud in 2023, attributed to 15 recorded cases.

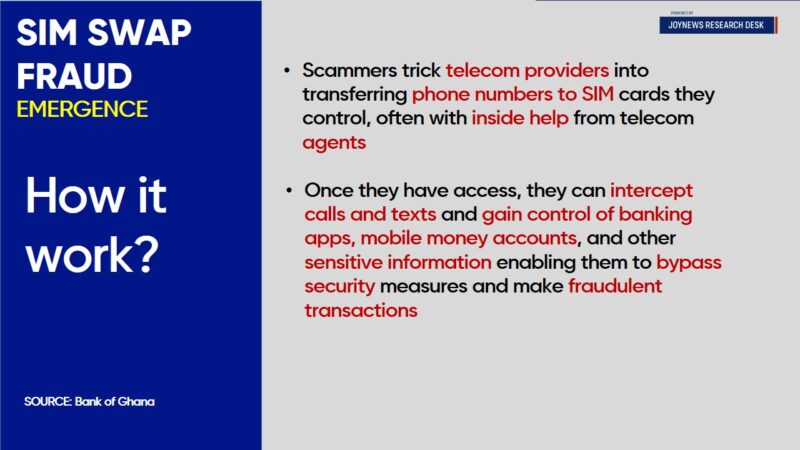

This type of fraud targets individuals with mobile banking access, including banking apps, WhatsApp banking, or any account linked to their mobile number. Scammers trick telecom providers into transferring victims' phone numbers to SIM cards they control, often with inside help from telecom agents.

Once they have access, they can intercept calls and texts and even gain control of banking apps, mobile money accounts, and other sensitive information, enabling them to bypass security measures and make fraudulent transactions.

Even in the event of cheque clearing, fraudsters can intercept mobile phone confirmations.

The threat extends beyond individuals to corporate institutions, where large sums of money can be stolen.

Ransford Nana Addo Junior, a Certified Fraud Examiner and Financial Crime & Fraud Lecturer at the National Banking College, says "It is not only individual accounts. When a SIM swap happens on corporate accounts, it's more dangerous. For instance, if the CFO of a hotel has his number swapped and a fraudulent transaction is initiated, the fraudsters will be the ones receiving the confirmation."

He also noted that SIM swap fraud extends beyond banking:

"It goes beyond just the mobile channels and even beyond banking. For instance, if somebody wants to intercept your medication information sent through SMS or your SSNIT records, it can be intercepted through SIM swap as well."

To protect yourself, be cautious in sharing personal information and regularly monitor your accounts for suspicious activities. If you suspect fraud, act quickly by contacting your service provider and bank to secure your accounts and prevent further damage.

For payment service providers, the Bank of Ghana has directed compliance with section 34(3)(a) and (b) of the Payment Systems and Services Act 2019 (Act 987). This requires the deactivation of a customer's electronic money account for two days when they swap or replace their SIM card. The account can be reactivated once the customer presents valid identification, mitigating SIM swap-related fraud.

Details of the report showed a 5% rise in the number of overall fraud cases reported leading to a loss of GHS 88 million in 2023.

Latest Stories

-

Goldbod is already doing wonders – Mahama praises CEO Sammy Gyamfi

31 minutes -

Mahama promises attractive cocoa price in August, pledges 200,000 hectare bost to sector

32 minutes -

UHAS Council Chairman Prof. Kodzo Gavua urges graduates to serve with passion, integrity, and innovation

2 hours -

Dr. Charisa Ogbogbo becomes first female professor in Mathematical Sciences at UG

2 hours -

Communication Ministry assures data price cuts as TELCOS prepare to reduce costs soon

2 hours -

Fans battle it out in FIFA, Basketball, and Gala at Hitz FM’s ‘Rep Ur Jersey’

2 hours -

Suspended CJ’s affidavit facetious and unnecessary – Dafeamekpor

3 hours -

Dafeamekpor, Kabila clash over past comments on Woyome case and Wontumi arrest

4 hours -

Give schools power to dismiss violent students – EduWatch urges as indiscipline rises

4 hours -

Excitement peaks at Hitz FM’s ‘Rep Ur Jersey’ ahead of UCL final at Aviation Social Centre

4 hours -

2025 Unity Cup: Black Stars hammer Trinidad and Tobago to finish third

4 hours -

Mid-air turnaround of OP122 flight was due to technical issue, not fuel shortage – PassionAir clarifies

4 hours -

Support children battling cancer -Lifeline for Childhood Cancer appeals

5 hours -

Mz Nana shines bright with triple nomination at 2025 Ghana Music Awards USA

5 hours -

What do we lose if suspended CJ hearing is publicised? – Bomfeh questions closed proceedings

5 hours