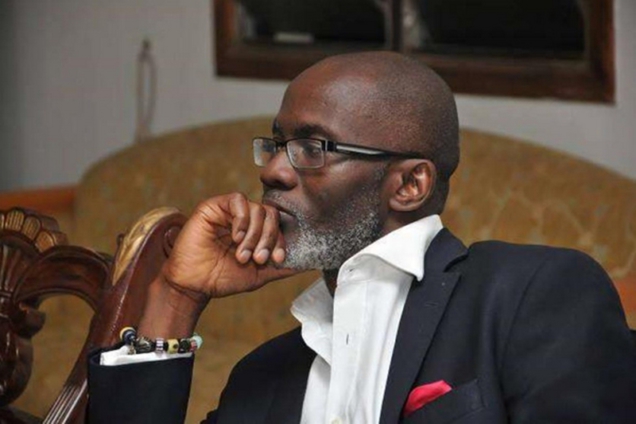

Founder and Executive Director of the Daquah Institute, Gabby Asare Okyere-Darko has threatened to sue Bia East Constituency MP for falsely linking him to the Agyapa Royalties deal.

This comes after Richard Acheampong accused Okyere-Darko of being a beneficiary of the deal.

But reacting to the claim, the close confidant of the President denied having any hand in the deal and, therefore, said he will sue the legislator for defamation.

"An MP has falsely accused me of being a beneficial owner of Agyapa Royalties, formerly Asaase Royalties, an entity registered both here in Ghana and Jersey, a British dependent, for the purposes of an anticipated listing on the London Stock Exchange.

"I am serving notice that I have instructed my lawyers to sue the MP for Bia East, Richard Acheampong for defamation," he said in a statement.

The Agyapa Royalties deal

Parliament August 14th approved the controversial Agyapa Mineral Royalty Limited agreement with the government of Ghana despite a walkout by the Minority.

Two years ago, the house passed the Minerals Income Investment Fund Act 2018 which establishes the Fund to manage the equity interests of Ghana in mining companies, and receive royalties on behalf of government.

The fund is supposed to manage and invest these royalties and revenue from equities for higher returns for the benefit of the country.

The law allows the fund to establish Special Purpose Vehicles (SPVs) to use for the appropriate investments. Last month, government introduced an amendment to the act to ensure that the SPVs have unfettered independence.

Reactions by Minority

However, Minority in Parliament have raised concerns over the deal.

The main concern being raised is that creating the SVP as an offshore company in a tax haven will make it difficult to oversight the firm and properly identify who future shareholders of Asaase Royalties will be when the shares get floated.

The minority claims the agreement makes it impossible for a future government to replace managers of Asaase Royalties Limited although the Minerals Income Investment Fund will remain the majority shareholder.

Subsequently, Former President John Mahama questioned the motive behind the Akufo-Addo government’s decision to pass the “controversial agreement” with Agyapa Mineral Royalty Limited.

Addressing supporters of the NDC at Dzodze as part of his four-day tour of the Volta Region, Mr Mahama saluted the Minority in Parliament for drawing attention to the elevated risk in placing an ostensible second Sovereign Wealth Fund in a haven.

According to him, the deal is shrouded in secrecy, as individuals and shareholders behind the company are still unknown to Ghanaians.

Commenting on the deal, the Bia East MP alleged that Mr Okyere-Darko is a major beneficiary of the deal.

But Mr Okyere-Darko denied the the claim saying it is falsehood peddled to defame him.

In a stetement, he indicated that he has been dragged into the matter because of his role as a shareholder in Asaase radio.

"Yes, I am a shareholder in Asaase Radio, a completely separate business with absolutely no link to that state-owned company. But should my ownership of a radio station with the name Asaase mean that I am a shareholder in Asaase Royalties, as well?

"Stretching that illogic should also make me a shareholder in AsaaseGPS, Asaase Farms, Asaase Construction and the over 20 companies bearing the name Asaase!," he added.

Below is the statement by Gabby Otchere-Darko

STATEMENT

An MP has falsely accused me of being a beneficial owner of Agyapa Royalties, formerly Asaase Royalties, an entity registered both here in Ghana and Jersey, a British dependent, for the purposes of an anticipated listing on the London Stock Exchange.

I am serving notice that I have instructed my lawyers to sue the MP for Bia East, Richard Acheampong for defamation.

Not to be outdone, the leader of the main opposition party, John Mahama, reportedly said on his campaign tour that Jersey is known as a haven for corrupt deals and he wanted to know who the owners of Agyapa were.

Jersey, like Guernsey, is a British dependent country, an established offshore jurisdiction which offers 0% income tax for listed companies, where several non-UK companies seeking to list on the London Stock Exchange (LSE) choose to register. It would have made no sense for Agyapa to be registered in the UK proper to pay corporate taxes in the UK when its only purpose there is to raise money from the London bourse.

Agyapa Royalties is 100% owned by a body set up by an Act of Parliament, where the MP earns his income. That body is the Minerals Income Investment Fund set up in 2018, (Act 978), which is 100% state-owned. Agyapa Royalties shall remain 100% owned by the Ghana Government on behalf of the people of Ghana until it does its planned initial public offering on the London Stock Market or wherever, for investors to buy shares in it. Even then the Ghana Government intends to hold on to 51%.

The London Stock Market is the most transparent and regulated stock market in the world, with some 80% (in terms of value) of its non-UK listed companies registered in Jersey, where listed companies pay no income tax or capital gains tax. Other companies listed there and operating (or with subsidiaries) from jurisdictions like Jersey include, Tullow Oil, Vodafone Group, Anglo American, Barclays, Stanchart, BP, Diageo, BHP Billiton, Glencore, Rio Tinto and Tesco.

Until its listing is done, no individual can be claimed to have even 0.0001% of equity in Agyapa. If you are interested in owning shares in Agyapa, please wait until it gets on the stock market either here or elsewhere. Until then, don’t feel that any individual has gotten ahead of yourself.

Yes, I am a shareholder in Asaase Radio, a completely separate business with absolutely no link to that state-owned company. But should my ownership of a radio station with the name Asaase mean that I am a shareholder in Asaase Royalties, as well?

Stretching that illogic should also make me a shareholder in AsaaseGPS, Asaase Farms, Asaase Construction and the over 20 companies bearing the name Asaase!

The name change of Asaase Royalties, in my view, was a good move, and not because of Asaase Radio, per se, but because of the number of companies with similar names in the mining sector specifically and the confusion or potential passing off that could have caused.

According to a statement issued by MIIF yesterday, “The purpose of MIIF is to hold and manage the equity interests of the Government of Ghana (“GoG”) in mining companies, receive mineral royalties due to the GoG from mining operations, provide for the management and investment of the assets of the Fund, finance further development of the mining sector, and monitor and improve flows into the mining sector. Regardless of who is in power, the MIIF is the custodian of Ghana’s future mineral revenues. In terms of the MIIF Act, the powers of MIIF include the creation of a Special Purpose Vehicle (“SPV”) in any jurisdiction in furtherance of its objectives, and the listing of the SPV on any reputable stock exchange that MIIF considers appropriate, and assignment of all or any of its rights to mineral income to a SPV in furtherance of the objects of MIIF.”

It is common for non-UK companies seeking to list on the London Stock Exchange to register in an offshore jurisdiction like Jersey. According to a 2016 data released by the London Stock Exchange, 93 Jersey-domiciled companies were listed on the London bourse, with a market capitalization of £115.7bn. Again, a 2015 report, “Using a Jersey Company for a Stock Market Listing”, reads, “Jersey companies have established a strong reputation with investors — with approximately 80% of the non-UK holding companies in the current FTSE 100 index being Jersey companies.”

For Agyapa to list on the LSE it needs to operate from a jurisdiction acceptable to the LSE which is also tax efficient. A listed Jersey company pays no capital gains, capital transfer or corporation taxes and a shareholder of such a listed company who is not resident in Jersey is not liable to Jersey income tax on dividends or interest paid by the company. No stamp duty or other similar taxes is payable in Jersey on the issue or transfer of shares in a listed Jersey company.

Former President John Mahama has also questioned Agyapa Royalties as dubious and for the fact that it is registered in Jersey. Really?

One cannot form an offshore company in Jersey for a dubious enterprise and then list it on the London Stock Exchange!

Before forming a company in Jersey, the Jersey Financial Services Commission ("JFSC") requires the details of proposed directors of the company and details of any material ultimate beneficial owners of the company (i.e. the shareholders of the existing holding company of the group to be floated). In this case, Agyapa was first registered in Ghana, with MIIF being 100% owner and same applying in Jersey.

I repeat, if you are interested in holding shares in Agyapa, please hold on until the IPO. Until then it is all owned by the Ghana Government and the transparent nature of the LSE, regarding shareholders of listed companies offers the greatest assurance Ghanaians can get anywhere.

I’ve taken pains to search and attach a list of some of the companies registered and operating in Ghana using the name Asaase. Typical examples are Asaase Metals, Asaase Gold Trading, Asaase Mining Services, Asaase Resources, AsaaseAse Mining, and Asaasenu Mining

Latest Stories

-

WAFU B U-17 Girls’ Cup: Black Maidens beat Nigeria on penalties to win inaugral tournament

21 minutes -

Real Madrid beat Sevilla to keep pressure on leaders Atletico

1 hour -

Liverpool put six past Spurs to go four points clear

1 hour -

Manchester United lose 3-0 at home to Bournemouth yet again

1 hour -

CHAN 2024Q: ‘It’s still an open game’ – Didi on Ghana’s draw with Nigeria

2 hours -

CHAN 2024Q: Ghana’s Black Galaxies held by Nigeria in first-leg tie

3 hours -

Dr Nduom hopeful defunct GN bank will be restored under Mahama administration

3 hours -

Bridget Bonnie celebrates NDC Victory, champions hope for women and youth

3 hours -

Shamima Muslim urges youth to lead Ghana’s renewal at 18Plus4NDC anniversary

4 hours -

Akufo-Addo condemns post-election violence, blames NDC

4 hours -

DAMC, Free Food Company, to distribute 10,000 packs of food to street kids

6 hours -

Kwame Boafo Akuffo: Court ruling on re-collation flawed

6 hours -

Samuel Yaw Adusei: The strategist behind NDC’s electoral security in Ashanti region

6 hours -

I’m confident posterity will judge my performance well – Akufo-Addo

6 hours -

Syria’s minorities seek security as country charts new future

7 hours