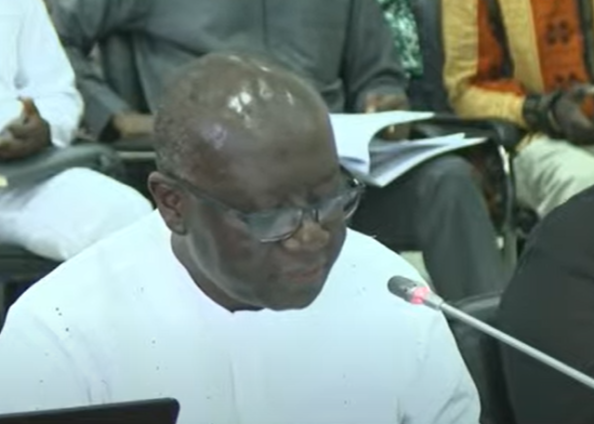

Finance Minister Ken Ofori-Atta was in Parliament on Friday to answer questions from the Minority Caucus calling for his head as the keeper of the country's purse.

Mr Ofori-Atta when he appeared before Parliament’s Ad-hoc Committee apologised to Ghanaians for the economic hardship, which he said has nothing to do with him being incompetent.

Below is the full text of his responses to the committee.

Introduction

Hon. Co-Chairs and members of this Adhoc Committee, good morning and through you, good morning to the Ghanaian people. I believe this process we are engaged in here is a useful opportunity to strengthen our democratic processes.

- Hon. Co-Chairs, during the course of my remarks this morning, you can expect forthrightness. The Proponents’ motion of censure has accused me of many things and includes some very disparaging remarks and attacks on my person and integrity. I am certain that Ghanaians will have a more balanced view of the events “that led us here’ as I take the opportunity to speak to the matters raised.

- My principal reflections today are to ensure that by the end of these proceedings, the “truth” will have taken centre stage and, in the process, any unfounded doubts about my motives, my competence, and my character would have been dispelled.

- Before I proceed with my detailed responses, I would like to make a personal comment to the Ghanaian people:

- Since, the Akufo-Addo government came into office in 2017, everything we have sought to do was aimed at making the lives of the people better.

- We have been focused on this vision to improve lives and in the first 4 years, our efforts were leading to a realisation of the vision.

- Today, I acknowledge our economy is facing difficulties and the people of Ghana are enduring hardships. As the person, President Akufo-Addo has put in charge of the economy, I feel the pain personally, professionally and in my soul. I see and feel the terrible impact of rising prices of goods and services on the lives and livelihoods of ordinary Ghanaians. I feel the stress of running a business. But, it is the strength and perseverance of the Ghanaian people that inspire me and my colleagues in Government every morning, to press on. That is what gives me the strength to press on to find solutions and relief for Ghanaians to the myriad of problems that our country and the rest of the world are facing, especially, since March 2020.

- Co-chairs, let me use this opportunity to say to the Ghanaian people what I believe, with courage, every Finance Minister around the world may wish to say to his people now: I am truly sorry. When we set out so purposefully between 2017 and the early parts of 2020, we never imagined that a global pandemic such as Covid, with its prolonged economic fallout, would inflict such pain and suffering upon the Ghanaian people. The shock to our system has been hard and the impact on our livelihoods severe. But, we have not been resting on our oars. We continue to work to keep the lights on, to avoid the queues at our filling stations, our classrooms full, our hospitals and dispensaries mostly stocked with medicines, continue to pay salaries and our roads being built and fixed.

- Now, let me get into the details:

The ground of the Proponents claiming that there has been “Unconstitutional withdrawals from the Consolidated Fund in blatant contravention of Article 178 of the 1992 Constitution supposedly for the construction of the President’s Cathedral”, I submit as follows:

- Hon. Co-Chairs, let me first submit, that I am uncomfortable about the formulation of this ground. It presupposes that Parliament is assuming the jurisdiction to enforce and/interpret a provision of the Constitution, against the combined effect of articles 2(1) and 130(1), which grants the sole and exclusive power to the Supreme Court. Nonetheless, I say with both humility and confidence that I have not breached the Constitution in making payments to support the construction of the National Cathedral of Ghana.

- Hon. Co-Chairs, three days ago, when the Proponents were here, they alleged that I had made payments from the Contingency Fund to support the National Cathedral. I want to state that this is just not true. Let me be categorical. I have taken no money from the Contingency Fund to make payments for the National Cathedral.

- It appears the proponents have confused the Contingency Fund with the Contingency Vote. Let me explain. There is a difference between Contingency Fund and Contingency Vote.

The Contingency Fund, the Proponents refer to, is what is covered under the Constitution, specifically under article 177. This constitutes money voted by Parliament and advances from this must be authorised by the Parliamentary Finance Committee. The Contingency Vote, on the other hand, is a line under the “Other Government Obligations” vote which is approved by the Finance Committee and passed as part of the annual Appropriation Acts passed by Parliament.

- Hon. Co-Chairs, in preparing the Annual Budgets, the practice is that provision is made for indicative expenditures that have not been fully costed at the time of the Budget presentation. Provisions are made in the Contingency Vote to cater for such expenditures. For example, in 2014, there was no specific allocation in the 2014 budget for Ghana’s participation in the FIFA World Cup in Brazil. The Cabinet of President John Mahama, in March 2014, at the time, approved some $9.622 million for that tournament, including that amount which was flown to Brazil in a private jet for the players. A more current example is Ghana’s participation in Qatar. The Black Stars qualified for the 2022 FIFA World Cup, way after the 2022 budget, presented on 16 November 2021, was approved by Parliament. No specific amount was budgeted for it but through the Contingency Vote, we have been able to provide funds legitimately for the team to participate in the competition.

- Expenditures in respect of the National Cathedral were made from the Contingency Vote under the “Other Government Obligations” vote as has been the practice before my tenure (I have copies of several payments from the Contingency Vote dating back to 2015 to share). Hon. Co-Chairs, as Finance Minister, I am fully aware of the approval procedures for use of the Contingency Fund and have not breached its requirement.

- The National Cathedral is 100% owned by the State and is not the President’s Cathedral as described by the Proponents. Indeed, the Attorney General issued an opinion on 6th January 2022, that the National Cathedral is a state-owned company limited by guarantee, under the Ghana Museums and Monuments Board.

- Hon. Co-Chairs, the policy direction and updates on the National Cathedral have been publicly presented over the years through the National Budget Statement and Economic Policy presented to Parliament.

- In paragraph 156 of my Budget Speech on the 2019 Budget Statement and Economic Policy, I announced on the floor of Parliament, Government’s vision for the National Cathedral as well as the commitment to facilitate the construction by providing the land, the Secretariat, and seed money. This subject was part of the policy approval of the Budget after extensive debate.

- Subsequently, regular updates on the progress of the construction of the National Cathedral have been provided to Parliament and the nation. These include:

- 2020 Budget Statement and Economic Policy – Paragraph 385: which announced the establishment of the Board of Trustees and Secretariat for the Cathedral.

- Mid-Year Review of the 2020 Budget Statement – Paragraph 279: which provided an update on the ground-breaking ceremony held on 5th March 2020 to mark the formal commencement of the construction phase of the project.

- 2021 Budget Statement and Economic Policy – Paragraphs 1132 and 1134: which informed the House of the Letter of Intent (LoI) signed on 25th November 2020 between NCG Trustees and RIBADE JV (led by Rizzanni de Eccher with M Barbisotti & Sons and Desimone. And, the Appointment of Apostle Prof. Opoku-Onyinah as the new Chairman of the Board of Trustees on 8th February 2021.

- Mid-Year Review of the 2021 Budget Statement – Paragraphs 354 and 355: which announced the expansion of the Cathedral project to include a Bible Museum (Bible Museum of Africa - BMOA) and Biblical Garden; as well as

the establishment of the 100-Cedis-a-Month “Ketewa Biara Nsua” Club, in line with the original plan to encourage as many donors as possible to contribute towards the establishment of this national monument.

In conclusion, Co-Chairs, all the payments made for the National Cathedral were lawfully done and from the Contingency Vote under the “Other Government Obligations” vote and not from the Contingency Fund as alleged by the Proponents.

I now focus on the grounds claiming “Deliberate and dishonest misreporting of economic data to Parliament”.

- The issue of deliberate misreporting of economic data to Parliament is not just unfortunate but simply untrue.

- I and, for that matter, the Ministry of Finance (MoF) have never misreported data to Parliament as has been alleged.

- On Tuesday 13th November 2022, the Proponents clarified their concerns relating to the reporting of fiscal data.

- In their submission, they alleged that different sets of data were presented to the IMF and the people of Ghana. That is untrue. The 2019 Article IV, which they cited, actually clearly demonstrates that the computing and Reporting of the deficit is

consistent between the Government and the IMF as shown on the Table labelled - Ghana: Selected Economic and Financial Indicators, 2017–24 on Page 4 of the IMF Article IV and appendix 3A of the 2019 budget. More importantly, we were under a Fund programme and could not have been able to exit if there were inaccuracies with the data we reported and the methodology used for computing the deficit.

- In actual fact, in the most recent IMF Article IV Report from 2021, one sees clearly demonstrated that the methodology utilized in computing the deficit is and has been consistent as shown in the Table labelled - Ghana: Selected Economic and Financial Indicators, 2019–22 on Page 3 of the Press Release numbered PR21/221.

- According to Hon. Ato Forson ---“Mr Chairman, paragraph 16, page 11 of the Staff Report – article 4 says, fiscal rules under Ghana; Public Financial Management Act. Fiscal rules could be strengthened – Box one – it goes on to say that about 2.8 percentage point of GDP in financial and energy sector payment were recorded below the line in the year 2019 Budget because the Government considers the financial sector cost as a one off and energy cost, as debt amortisation. Best international practices would include these transactions above the line as they reflect either direct Government obligation or Government transactions, transfers to State-owned Enterprises.”

- Because of the exceptional nature of the expenditure – financial sector cleanup and energy sector IPP payment, we agreed with The Fund that it could be treated below the line as shown in the Table earlier referred to. (Turning to the Presentation on the Board: In fact, as can be seen in the presentation, the style is consistent. We both report with Finsec and without Finsec. All information is reported and none hidden).

- Co-Chairs, it is also alleged that I have breached the second fiscal rule under the Fiscal Responsibility Act, 2018, (Act 982) namely the primary balance, in 2018 and 2019.

- Firstly, I maintain the legal position that Act 982 was not passed to take a retrospective effect. It is equally instructive to note that the fiscal and primary balance targets presented to Parliament for those two years did not have any estimate on the finsec clean-up cost above-the-line. Consequently, the primary balance target that we were targeting were, actually, surpluses of 1.6% of GDP in the main budget for 2018 and 1.1% in 2019. This, per our definition, excluded the finsec clean-up cost. Thus, if applicable, could not be said to have breached the law. To reiterate, the agreed style of reporting with the IMF was to show both a deficit including finsec clean-up and one excluding it.

I wish to state that:

- The allegation of deliberate misreporting of economic data to Parliament is completely not true. Since I took office in 2017, I have served the country with integrity and honesty.

- Under my leadership at the Ministry of Finance, there have been significant improvements in the accurate reporting of public finances. Today, under President Nana Akufo-Addo, Ghanaians are enjoying greater accountability and transparency in the management of the public purse than any other period under the Fourth Republic.

- Since 2017, Government has complied with the reporting provisions in the Public Financial Management Act 2016 (Act 921), including Budget Implementation report, Fiscal Reports, Public Debt Report, Petroleum Revenue Management Reports, ESLA report, etc.

- The Proponents have raised the issue of treatment of energy sector IPP payments and financial sector clean-up payments in the fiscal tables. The Ministry of Finance has explained its position on the treatment of these two items to the relevant Committees of Parliament during their scrutiny of the annual budget from 2018 to 2021. The Ministry of Finance actually

issued a Press Release on the subject on 10th May 2020, which we had hoped should have put this matter to rest.

- The Ministry included the energy sector IPP payments in the “amortisation” line in the Fiscal Framework during the 2018-2021. Financial sector clean-up costs were included in the fiscal framework annually for the period 2018 to 2021 to reflect the issuance of bonds to cover the non-cash costs.

- Contrary to the position of others that the MOF did not reflect the Finsec Payments and the energy sector IPP payments in the fiscal framework, I want to emphasize, with the Budget document as evidence, that these payments were reflected in the fiscal framework. Energy sector IPP payments were treated as “amortisation” and the non-cash financial sector clean-up payments were reflected in the “memo item” (Refer to Appendix 2A of the Fiscal Tables in the relevant Annual Budget).

- The MoF reflected Finsec clean-up payments in the memo item called “fiscal deficit (including finsec payments)” for the following reasons:

- They are extra-ordinary payment items which need not be mixed-up with traditional fiscal operations; and

- They are largely bonds and capturing them above the line will imply recognizing their payments now and recognizing their payments again when the payments fall

due in the future – a possible double counting. A method that the proponent is or ought to have been very much familiar with from his years as Deputy Minister of Finance.

- Likewise, the Energy sector IPP payments were reflected in the fiscal framework as part of the Amortisation line under the Financing part of the fiscal table for the following reasons:

- They are debts of SOEs that have been assumed by Government and are largely contingent liabilities that have crystalised for payments; and

- They are extraordinary, one-off payments which need not be mixed up with traditional expenditure items. Something, again, which the proponent should be very familiar with.

- However, the MoF agreed with the Finance Committee of Parliament in 2021 that going forward from 2022 onwards, both the Energy IPP payments and the Finsec Payments will be treated “above the line” in the fiscal framework for the following reasons:

- the Finsec bailout exercise is largely completed and, therefore, ceases to be an extraordinary budget item; and

- IPPs payments are expected to be made over the medium-term. Given that they have become explicit contingent liabilities, appropriately budgeting for them “above the line” ensures that resources are duly allocated for their settlement.

- The 2022 Budget, therefore, reflects this decision. Neither the Ministry, nor I have deliberately or dishonestly misreported economic data to Parliament.

- This is buttressed by the submissions made in May 2020 by the IMF Country Director, Dr Albert Touna Mama: “Our number includes these two elements (financial sector payments and energy sector payment) and we know why the Governor of Bank of Ghana made the decision not to have these two elements in the fiscal deficits."

There is also a claim on “Fiscal recklessness leading to the crash of the Ghana Cedi which is currently the worst performing currency in the world”, I will respond as follows:

- Hon. Co-Chairs, the grounds of recklessness presuppose that I have not been guided by the laid-down regulations. I want to state that I have not been reckless in the management of the FISCAL Operations of Government. Rather, our strenuous efforts to protect the public purse is what has helped this government to have achieved much, much more than any government over a similar period in virtually all sectors, including education, health, social welfare, policing, security in general, roads, railways, agriculture, industrialisation, tourism, digitization, and funding for anti-corruption institutions.

- Hon. Co-Chairs, I have come to Parliament House ten (10) times (eleven times since this Government) in the last 6 years to present the Annual and Mid-Year Budgets. On all occasions, I have discussed all proposed fiscal operations of Government (revenues, expenditures and financing).

- On all those occasions, I received approval as Parliament subsequently passed Appropriations Bills for all those Budgets. Every key expenditure made has been supported by this House. Indeed, we all saw the dire consequences when the House, for months, refused to pass a major revenue generation item introduced by this Government to support the fiscal stability of the economy. Sadly, the Minority Leader, when this government was compelled to approach the Fund this year, triumphantly took credit for frustrating government’s efforts to meet its half-year revenue targets.

“He told the Parliamentary Press Corps last June that, “Thanks to the opposition Government has already lost half-year revenue. That can only be attributed to the purpose and tenacity of the Minority Group in Parliament.”

- The consequences of this intentional stance have been dire. It precipitated a lack of confidence in the international market and closed access to Ghana’s traditional Eurobond issuance.

- Hon. Co-Chairs, it is worthwhile to note that indeed, the Proponents offered only one item as not having been approved

by Parliament for Payment –The National Cathedral of Ghana, and I have shown that to be untrue.

- I would hope we can take it that by extension of their proposition, they accept that all other expenditures have been approved by Parliament.

- We must all boldly share in the positive achievements regularly reported by the Bank of Ghana in its quarterly ‘Fiscal Development Reports’ for the years 2017-2021.

- Hon. Co-Chairs, it cannot be sustained that I have been reckless in supporting the implementation of the decisions of Parliament.

Funding economic growth and transformation

- Hon Co-Chairs, with the approval of funds by Parliament in the last 6 years, we have undertaken major transformative investments to improve the quality of life of Ghanaians:

- We have mobilised and invested in excess of GH¢28.3 billion (as at Sept, 2022) to Implement transformative Flagship Programs that improve social mobility and the quality of life of Ghanaians; (most of these did not exist prior to 2017); this include:

- Supporting 1,765,977 Ghanaian students under Free SHS/TVET to promote human Capital Development and social mobility.

- Enrolling 15,656,160 Ghanaians aged 15years and above on the National Identification Programme by Sept, 2021 to enhance security and economic efficiency.

- support about 100,000 Young graduates to enter the job market.

- Providing needed infrastructure to support decentralization and local governance to expand access to public services under the Regional Re- organisation programme.

- Promoting the development of railway network to advance national and regional connectivity

- Supporting the on-going construction of fishing harbours to service key coastal communities including Axim, Dixcove, Moree, Mumford, Winneba, Senya Bereku, Gomoa Feteh,Teshie and James Town.

- Increasing School Feeding beneficiaries from 1,677,322 in 2016 to 3,300,000 pupils in 2021.

- Increasing LEAP beneficiaries from 195,860 households in 2017 to 344,023 in 2021 to improve the livelihoods of for the underprivileged in our society.

- Increasing food production and security through Planting for Food and Jobs. It has led to a 71% increase in the national production of maize and 34% in paddy rice.

- We have invested significantly in retooling the security sector to maintain territorial integrity and improve internal security (CCTV, motor bicycles, vehicles, Forward Operating Bases, recruitment of security personnel etc);

- We have recruited over 200,000 Ghanaians into crucial service areas such as Education, Health, Security and Local Government; and

- Established a Tree Crop Development Authority with a focus on mango, cashew, rubber, oil palm, shea and coconut, in order to diversify our economy and provide raw materials for industrialisation.

- These and many more we have done.

On the issue of fiscal recklessness and depreciating cedi

- Hon. Co-Chairs, the idea that the depreciation of the Cedi is the result of fiscal recklessness is not supported by the available facts.

- The Ghana Cedi consistently performed very well throughout my tenure as Finance Minister, up until March 2022. The records show that between 2012 and 2016, the Cedi depreciated by an average of 17% whilst between 2017 and 2021, the average rate of depreciation was 7%.

- The major contributors to the currency problem are not necessarily fiscal factors Hon. Co-Chairs, unlike July 2014 when the Cedi was last rated as the world’s worst performing currency, the 2022 depreciation is largely attributed to extraordinary global factors including the strengthening of the US Dollar (even against major international currencies like the UK Pound and the Euro); and speculation due to economic uncertainties. For example, in this year, 2022, the Euro is worth less than the dollar for the first time in 20 years.

- As stipulated in Article 183 of the Constitution, Section 2(a). The Bank of Ghana shall promote and maintain the stability of the currency of Ghana and direct and regulate the currency system in the interest of the economic progress of Ghana. As such, the Bank of Ghana, which manages our reserves is leading the interventions to contain the depreciation of the Cedi.

- Government, on its part, is undertaking real sector interventions through initiatives such as 1D1F and the Ghana

CARES programme, to accelerate the import substitution of products such as poultry and rice, and promote an export led economy thereby reducing foreign exchange pressures from the imports of those products.

- We intend to announce additional measures to promote the consumption of local produce. Furthermore, the implementation of the AfCFTA positions Ghana as a continental trade hub, and we shall take advantage and boost the export orientation of our industries.

- The Ministry of Finance has also arranged significant financing including the US$750 million from Afrexim Bank to support the 2022 Budget and boost our foreign exchange reserves. This forex inflow has improved the supply of foreign currency and boosted the stability of the local currency. We continue to explore avenues to secure additional financing to boost the reserve position.

On the issue of “Alarming incompetence and frightening ineptitude resulting in the collapse of the Ghanaian economy and an excruciating cost of living crisis” I state as follows:

- Hon Co-Chairs, these are very strong language. The choice of words for this part of the motion is worrying, especially as it relates to the functioning of the whole national economy. The truth is, considerable progress has been made under my tenure

as Minister for Finance. Since 2017, we have competently managed the economy.

- Hon. Co-Chairs, we have competently managed the economy since 2017. Indeed, to appreciate where we are now, we need to look back at where we came from. At the close of 2016, an assessment of the Economy revealed:

- limited fiscal space (fiscal deficit 6.5%);

- a distressed financial sector (NPL ratio-17.3%);

- an asset quality review document which had not been released;

- a derailed IMF-ECF programme and reduced economic output (GDP growth-3.4%);

- Inflation was 15.4% at the end of 2016;

- Monetary Policy rate (interest rate) was 25.5% at the end of December 2016;

- Limited CAPEX to MDAs; and

- ‘Dumsor’ which had decimated local industry and strongly impeded national productivity.

- Hon. Co-Chairs, it is important to note that through our leadership and commitment to turn around the economy from its state in 2016, we made great strides and remarkable progress in the years before the pandemic and the records attest to this.

- The headline facts are:

- We doubled economic growth in our first three years, and Ghana’s growth in 2019 was touted as one of the highest globally;

- Inflation came down significantly from 15.4% to 7.9% at the end of 2019 and remained in single digits till the pandemic hit in March 2020;

- The fiscal deficit which was about 6.5% was brought down to under 5 percent by the end of 2019;

- Exchange rate depreciation reduced significantly to under [5 percent] in 2017 and averaging [8.7 percent} between 2017 and 2019;

- We reduced interest rates in line with declining inflation expectations. Monetary Policy Rate declined from 25.5% at the end of December 2016 to 16% at the end of 2019 while the average lending rate for the same period declined from 31.70% to 23.7%;

- The government directly spent GH¢25 billion to save the banking and SDI sector, protecting the near collapse of the financial sector; saving close to 5,400 direct jobs and 12,000 indirect jobs; making sure 4.6 million depositors were protected; and

- Government also implemented comprehensive reforms across the energy sector and kept the lights on to-date.

- On the back of good economic management, in April 2019, Ghana successfully completed and exited the IMF-ECF programme that we inherited. To ensure irreversibility of the macroeconomic gains, Government introduced a number of measures including:

- passage of the Fiscal Responsibility Act, 2018 (Act 982) to cap the fiscal deficit at 5% of GDP and ensure maintenance of positive primary balance;

- passage of the Public Financial Management Regulations, 2019 (LI 2378) to strengthen regulation of the Public Financial Management System; and

- establishment of the two Social Partnership Programmes with Labour and Faith-Based Organisations.

- Clearly, there was strong momentum and optimism towards Ghana Beyond Aid agenda at the end of 2019.

- However, with the onset of the pandemic, the gains from over three years of fiscal rectitude were reversed as result of efforts to ensure lives and livelihoods were protected.

- Ultimately, these considerations informed the raft of revenue and expenditure measures outlined in the 2022 Budget Statement.

- We laid out the 2022 Budget to achieve Fiscal Consolidation anchored on debt sustainability. It is important at this point, to also highlight that a key component of the national debt stock related to three (3) exceptional expenditure items that are neither external nor a creation of this Government:

- Energy Sector Excess Capacity payments (GHC 17 billion), which relate to a legacy of take or pay contracts that saddled the country’s economy with annual excess capacity charges of close to US$1 billion;

- Direct COVID-19 expenditure amounted to GHC 12.0 billion; and

- the Banking Sector Clean up (GHC 25 billion).

- These three items alone, contribute to about 23% of our annual debt servicing cost. These three items were not created through the recklessness of the New Patriotic Party. The long dumsor that Ghanaians endured under the NDC administration between 2012 and 2016 was more to do with the NDC government’s inability to pay for power. So, Co-Chairs, I find it curious that Hon. Ato Forson will choose to cite energy bills as an example of the recklessness that the Minority charges me with and seek my removal by censure. Especially when we have had to pay around

$500 million dollars a year in excess capacity charges, for power the previous administration negotiated that we do not need and we do not use.

- Hon Co-Chairs, in actual fact, we have been able to renegotiate some of these power purchase agreements and the new agreements with the Priority IPPs, once finalized and executed will offer estimated nominal savings of more than USD 4 billion over the next 5 years.

- We have also used a significant part of the borrowing to undertake key transformative investments such as:

- The fixing constructing of over eleven thousand, five hundred (11,500) kilometres of new roads between 2017 and 2021;

- The construction of 12 major interchanges since 2017 as compared to 5 interchanges in the previous 8 years.

- the construction of the Eastern Regional and Central Gonja Hospitals;

- Commencing work on eighty-seven (87) of the Agenda 111 projects;

- funding on-going airport projects, including the Kumasi International Airport; and

- promoting the establishment of the Development Bank Ghana to provide competitive finance for Ghanaian Entrepreneurs.

- Indeed, the E-Levy was borne out of this heightened need to mobilize resources sufficient for managing the pre-eminent

challenges of our time: fiscal consolidation, debt sustainability, and reducing youth unemployment.

- Unfortunately, the delay in the passage of the E-levy adversely impacted market confidence and largely contributed to the downgrade in Ghana’s sovereign credit ratings in January 2022 and these resulted to a whole deterioration of the financial conditions for Ghana and closed Ghana’s access to the international capital markets (ICM) due to Deteriorated perception and loss of confidence by investors.

- For this reason, access to ICM funds was no longer available which resulted in a severe BOP problem that needs to be addressed.

- The Government thus resorted to the IMF as a lender of last resort to not only address the immediate and active BOP need but also to protect all the macro and social policy gains made in the last 5 years.

- Undoubtedly, the last few months have seen considerable economic uncertainty and challenges. These have been characterized by high of inflation levels and rapid depreciation of the cedi. Indeed, the economic challenges we are facing require deliberate but urgent, well thought out, strategic steps as well as the support of the Ghanaian people.

- The above notwithstanding, there are still some bright spots.

- Overall, our growth outturn of 3.4% and 4.8% in Q1 and Q2 2022 respectively, coupled with modest improvements in our fiscal position suggests our economy is gradually on the upswing despite the numerous shocks we have faced over the past two years.

- This progress gives us a solid foundation to confront the challenges in front of us.

- Undoubtedly, risks remain that we are highly attuned to; however, the Ministry of Finance is committed to working alongside all stakeholders, including the members of Parliament to ensure we can reposition our economy back on a path of growth and prosperity.

There is a claim of “Gross mismanagement of the Ghanaian economy, which has occasioned untold and unprecedented hardship”. I want to re-state that:

- Hon Co-Chairs, the current economic challenges we are experiencing in Ghana is not the outcome of mismanagement. But we acknowledge the hardships our people are going through in these difficult times.

- This assessment is wholly shared by objective observers. In the recent words of the Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva and I quote: “to the people of Ghana, like everybody else on this planet, you have been hurt by exogenous shocks. First the Pandemic, then Russia’s War in Ukraine and what we need to realise is not because of bad policies in the country but because of these combination of shocks...”

- I have already discussed the domestic triggers behind the depreciating Cedi. We simply cannot overlook the significant impact of the delayed passage of the revenue measures outlined in the 2022 Budget, which resulted in negative market reactions, credit rating downgrades, the narrowing of financing sources, and the eventual depreciation of the cedi. The timelines are obvious and cannot be ignored.

Going forward

- Hon. Co-Chairs, it is time to have an honest national conversation on the patterns of expenditure as a people. Our preference for imported goods, which requires foreign exchange that we do not earn enough of, implies that our cedi will continue to be under pressure

- It has become clear that we cannot continue in a business-as-usual mode. We have to significantly change our consumption

patterns and support investments in local capacity for production and export.

- Hon. Co-Chairs, even in these challenging times, we have not been rudderless. We have prepared the Post-COVID-19 Programme for Economic Growth (PC-PEG) as the domestic blueprint, which has benefitted from input from all key stakeholders including Civil Society Organizations (CSOs), social partners (labour unions, employers, and FBOs), academia, industry professionals, and the leadership of Parliament.

- This document contains a set of time-bound structural reforms and fiscal consolidation measures to place our debt levels and fiscal accounts on a sustainable path over the medium term and has underpinned Government’s engagement with the IMF.

- The negotiation with the IMF is progressing steadily and well and we are working assiduously to achieve a Staff-Level Agreement (SLA) by end of December 2022.

- As the President announced recently, Government is aggressively pursuing initiatives that will structurally boost the export orientation of this economy. In the coming 2023 Budget, and following consultations with key stakeholders, including AGI, Labour and the trading community, we expect to announce critical measures in this regard. This will complement that on-

going private sector-led interventions being promoted under the 1D1F and the GhanaCARES programme.

- However, the world had no playbook to help us tackle the Covid-19 pandemic. Parts of the Ghanaian economy were shut- down, including hotels, restaurants, and events. Our efforts were further destabilised by the disturbances in the global supply chain. But even in those times, we provided electricity and water-free, grants and loans to businesses in the formal and in formal sectors. We also paid our workers even when some were home for 9 months and did not lay off anyone.

- No country has been saved from the disruptions in supply chains, and record hikes in prices of energy, food and commodities. Every economy is facing macro-fiscal challenges, rises in public debt levels and narrowing fiscal space. Our situation was not helped by a combination of historic weaknesses in the structure of our import-dependent economy and our low capacity, even as compared to our neighbours, in raising domestic revenues. The 2023 Budget will contain policies directly aimed at tackling these vulnerabilities.

- Hon. Co-Chairs, I am aware of the enormity of the challenges we face. I am aware that lives and livelihoods needs to be protected. We have a well-consulted plan and the commitment to address this economic challenge. The Ministry of Finance and I

have been working so hard 24/7 to quickly restore market confidence and ensure economic growth. We are nearly through with the IMF negotiations. I am confident that once we conclude our debt sustainability programme and secure a Fund programme, the nation will next year see the stability and fiscal space that can spur us back on to a sustainable economic recovery and growth, which should endure considering on the investments we have made in all sectors.

Concluding remarks

- Co-Chairs, as a child, I was taught a hymn that has guided me throughout my life:

Land of our birth, we pledge to thee our love and toil in the years to be,

when we are grown and take our place as men and women with our race.

Land of our birth, our faith, our pride, for whose dear sake our fathers died;

O Motherland, we pledge to thee head, heart and hand through the years to be.

- Inspired by the words of this hymn, Hon. Co-Chairs, when I assumed the position of Minister of Finance, I resolved to serve the people of Ghana with my all.

- Under my tenure as Minister of Finance, I have overseen some great strides in the development of Ghana and the improvement of the lives of the Ghanaian people.

- As a nation, we are being tested. Our circumstances require a united and concerted response to the crisis. I implore our chiefs, elders and churches to take the mantle and speak a common language. Let us all work as one country to support labour negotiations, find a solution to the impasse in Parliament and rise above witch-hunting and entrapment. These are not ennobling and progressive for a society seeking transformation.

- Hon Co-Chairs, Ghana is a resilient country. Ghana has faced economic challenges since independence. Ghana has always come through each of them stronger and better than before. God willing, we shall come out of these difficult times too. Ghana, will, and must rise again!!

Thank you, co-chairs. God bless

Latest Stories

-

Kinshasa to host first World Music and Tourism Festival, celebrating rumba

1 hour -

Today’s Front pages: Friday, June 27, 2025

2 hours -

Kamal Deen Sulemana agrees deal with Atalanta

2 hours -

COVID-19 remains a threat – GHS cautions public

2 hours -

Renewed clashes in Nkwanta South leave one dead, several injured

2 hours -

Delay not intentional, let’s maintain good faith – Ayew Afriyie appeals to GRNMA

3 hours -

Ghana makes significant improvement in the 2025 World Competitiveness Report

3 hours -

Local Government Ministry to pilot 24-Hour Economy market

3 hours -

Parliament restores July 1 as Republic Day holiday

3 hours -

Global Summit: World leaders recommit to immunisation amid global funding shortfalls

3 hours -

No further postponements after July 10 – GRNMA warns

3 hours -

US-based Ghanaian petitions Acting CJ over alleged judicial misconduct in land dispute

3 hours -

Farmer punished for stealing assorted items from students

3 hours -

Telecel Ghana expands community footprint in Kumasi with 3 new shops

3 hours -

Decomposing body of 71-year-old retired teacher found in well

3 hours