INTRODUCTION

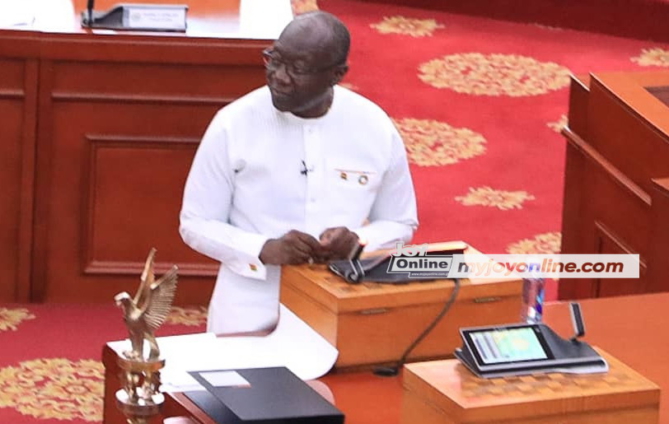

1. Right Honourable Speaker, Honourable Members of Parliament, I stand before you, on the authority of His Excellency, President Nana Addo Dankwa Akufo-Addo, to present the Mid-Year Fiscal Policy Review of the Budget Statement and Economic Policy of the Government of Ghana for the 2023 Financial Year.

2. Today's presentation is in fulfilment of Section 28 of the Public Financial Management Act, 2016 (Act 921) and Regulation 24 of the Public Financial Management Regulations (L.I. 2378).

3. I respectfully request that the entire 2023 Mid-Year Fiscal Policy Review document is captured in the Hansard. United for Progress

4. Mr. Speaker, eight months ago, I presented the 2023 Budget Statement and Economic Policy of the Government- ‘NKABOM’ Budget. At the time, the economy was going through a very difficult period amidst unprecedented global turbulence.

5. Mr. Speaker, eight months ago, I presented the 2023 Budget Statement and Economic Policy of the Government- ‘NKABOM’ Budget. At the time, the economy was going through a very difficult period amidst unprecedented global turbulence. This was within the context of major external shocks coupled with domestic vulnerabilities triggered by credit rating downgrades, tightened domestic financing conditions and increased cost of borrowing. With the cost of shipping a container increasing seven-fold in the 18 months following March 2020, just about every country in the world grappled with soaring prices from 2021.

6. Our country, like many others globally, experienced unusually sharp increases in food, fertiliser and fuel prices, rising inflation and exchange rate depreciation, leading to severe economic challenges and hardships for the people. A headline in the December 2022 edition of The Economist captured the global situation in these words: “2022 has been a year of brutal inflation”.

7. Mr. Speaker, it is no exaggeration to say we cannot find another period in our history where so many different headwinds hit our economy at the same time with unrelenting speed and scale. Thankfully, as the numbers are beginning to show and as many Hon. Members of the House have indicated to me in our engagements, we have, together as a nation, turned the corner.

8. Mr. Speaker, we have avoided the unimaginable, but what could have been so easily possible under different leadership circumstances. With a lot of effort, we have managed to avoid empty shop shelves for medicines and other essentials; we have 3 seen no shortages of food; we have been spared the frustrating spectre of long queues for fuel at our filling stations; and, we have managed, in spite of all the challenges, to keep the lights on. Indeed, as the Psalmist said (in Psalm 118:23) this is the LORD’s doing; and it is marvellous in our eyes.

9. This ‘turning the corner’ is underpinned by the investments and sacrifices we have collectively made during this difficult period since March, 2020.

10. Mr. Speaker, it is important that we acknowledge some of the major milestones that this country has experienced in the last 3 years. We should be still and appreciate that despite our challenges as a country, we have been saved from many extreme conditions that others have suffered, including peace, health, security, continuous supply of power, and life itself, amongst others.

11. Over that period, the country has gone through extremely difficult situations, and the gratitude of His Excellency the President and his government goes to the good people of Ghana for their patience, understanding and positive contributions to Government’s efforts to weather the storm:

i. During the CoVID-19 period, we indeed lost family members and friends. But, it is also true that Ghana recorded some of the lowest cases of mortality and infections worldwide. This was due to the implementation of a swift and robust COVID response programme led by H.E the President. We recorded 171,653 CoVID-19 cases and 1,462 deaths as against 10.8 million recorded cases and 228,738 deaths on the African continent alone, and 249 million recorded cases and 2 million deaths in Europe. May the souls of the faithfully departed, rest in peace.

ii. We invested immensely in education to ensure that school years were not disrupted, and we did so because we knew the alternative would be significantly costlier to society. That was why the President ensured that our children returned to school earlier to write their examinations to enable us to build the requisite human capital for the future;

iii. We ensured consistent power supply and kept the lights on to enable businesses and households function, despite the increasing cost of legacy energy agreements; iv. We continued paying salaries and wages of all public sector employees and factored in a 30% increment of base pay for workers on single spine salary structure this year;

v. We invested in the security of the nation and protected our citizens, including the lives of the 1.1 million visitors who responded to our “Beyond 4 the Year of Return” programme, thus boosting tourism even in the middle of the crises; and vi. We cleaned up and strengthened the Financial Sector to promote entrepreneurship and private sector businesses, including agriculture, tourism, hotels, manufacturing, etc.

12. Mr. Speaker, 2022 was the most difficult year for me as Ghana’s Finance Minister. On July 1st 2022, we took what was then a very difficult but necessary decision to request support from the IMF to implement our Post-COVID-19 Programme of Economic Growth (PC-PEG). The country was going through a dire period of economic uncertainties and despondency.

13. A year on, our steps are more grounded, the vision is clearer, the path to recovery is better set, and confidence in our economy is back, growing gradually.

14. Mr. Speaker, we have turned the corner and, more importantly, we are determined to continue down that path. Soon, we expect the measures taken resulting in economic activity greater than anything experienced in the history of the Fourth Republic. Our plans and programmes should soon lead to a sustained increase in domestic production, including manufacturing and farming, replacing many of the products that we are used to importing.

15. Mr. Speaker, when I presented the 2023 Budget in November last year, I indicated that we would pursue major fiscal and monetary policy measures within the framework of the PC-PEG – our coordinated response to the macro-fiscal challenges, which H.E the President charged us to develop in March, 2022, before going to the IMF – thus the PC-PEG.

16. As a first step towards fulfilling this objective, Parliament passed the revenue, and expenditure measures as well several other macro-critical economic policies we presented in the 2023 Budget, and we are grateful for that. Along these lines, we also needed to create additional fiscal space by:

i. negotiating an International Monetary Fund (IMF) Programme;

ii. concluding a debt operations programme; and

iii. attracting significant investments (especially green investments) for a vibrant growth strategy.

17. Mr. Speaker, I can now report that we have been diligent and resolute in implementing these measures and successfully:

i. Negotiated the US$3 billion 3-year IMF-ECF Programme, which was approved on 17th May, 2023 to support the implementation of our PC-PEG 5

ii. Concluded on February 14th the initial part of the Debt Operations, of which the Domestic Debt Exchange Programme (DDEP);

iii. Developed a framework for the V20 Climate Prosperity Plan to attract climate investments from the private sector; and

iv. Initiated the Mutual Prosperity Dialogue to crowd in domestic and external private investment to underpin our growth strategy.

18. These achievements have been with the support and commitment of this august House and the Ghanaian people. It demonstrates that when we speak with one voice, we can achieve what we set our minds to do- Genesis 11:6- “if as one people speaking the same language, they have begun to do this, then nothing they plan to do will be impossible for them”

19. Right Honourable Speaker, accordingly, H.E. President Akufo-Addo has asked that I convey his profound gratitude to this House for passing all the revenue Bills as well as the expenditure measures.

20. Indeed, our sincere gratitude also goes to all investors, financial institutions and bondholders for the sacrifice, support and forbearance in this difficult period of our country’s economic history. We appreciate your contribution towards “turning the corner’’ and commitment to partner us in transforming the economy.

20. Indeed, our sincere gratitude also goes to all investors, financial institutions and bondholders for the sacrifice, support and forbearance in this difficult period of our country’s economic history. We appreciate your contribution towards “turning the corner’’ and commitment to partner us in transforming the economy.

21. We must also extend our appreciation to the IMF, the World Bank and other Development Partners as well as the G7 and G20 members who stood so strongly with us.

22. Mr. Speaker, for the first six months of the year, we continue making progress to exceed our non-oil revenue targets for the year. We have seen improvements in nonoil tax revenue collection despite some noticeable shortfalls in VAT. However, oil revenues have fallen short of expectations due to changes in global prices. We will, therefore, undertake a downward review of the oil-related revenue as well as the corresponding expenditures to align with the underperformance of some of our revenue handles. Specifically, this will impact the Annual Budget Funding Amount (ABFA).

23. Mr. Speaker, in view of the reason outlined above, as well as the lower domestic interest payment and amortization, following the completion of a part of the DDEP, and the reduction in the foreign financed CAPEX, the Appropriation has been revised from GHS227.7 billion as presented and approved in November 2022 to GHS206.0 billion. This is in line with Regulations 24 sub-regulation (3) of Public Financial Management Act Regulations 2019 (L.I. 2378). 6

24. Mr. Speaker, we will, therefore, not require a Supplementary Budget.

25. Mr. Speaker, Government is, however, committed to pursuing a robust growth strategy within the limited fiscal space and our fiscal consolidation programme. This will be done by attracting domestic and foreign private sector investments and expanding production, which will be encouraged and stimulated by Government policies and agencies.

26. Government’s Mutual Prosperity Dialogue with the private sector, will seek to facilitate the ease of doing business in order to crowd-in private domestic and foreign investments.

27. Mr. Speaker, security continues to be a priority of Government. The United Nations recently reported that over 1,800 terrorist attacks, resulting in nearly 4,600 deaths, were recorded in our region - West Africa in the first six months of this year. Due to this instability among others, increasing numbers of West African nationals are seeking refuge in our country. This has required a review of our security expenditures within our limited fiscal space.

28. Mr. Speaker, this 2023 Mid-Year Fiscal Policy Review will:

i. provide an update on economic performance for the first–half year of 2023 and outlook for the rest of the year;

ii. provide an update on the implementation of the IMF-supported PC-PEG including update on structural reforms and the progress towards achieving the quantitative performance criteria and indicative targets;

iii. provide an update on the Debt Restructuring Programme;

iv. present a revised 2023 fiscal framework which aligns with the IMFsupported PC-PEG; and v. outline government’s Growth Strategy to drive the recovery process.

29. I will now proceed to update the House on the macro-fiscal performance of the economy since December, 2022.

30. Mr. Speaker, as we usually do, the 2023 Budget was presented in November 2022 using end-September 2022 data. We now have end-December 2022 data, which indicate that:

i. Overall Real GDP growth was 3.1 percent compared to the revised target of 3.7 percent;

ii. Non-Oil Real GDP growth was 3.8 percent compared to the revised target of 4.3 percent;

iii. End-December inflation rate was 54.1 percent compared to the projected 28.5 percent; iv. Total Revenue and Grants for the period amounted to GH¢96.7 billion (15.8 % of GDP) compared with the revised target of GH¢96.84 billion (16.4 percent of GDP).

v. Total Expenditure on commitment basis amounted to GH¢165.1 billion (27.0% of GDP) against the revised target of GH¢133.8 billion (22.6% of GDP);

vi. Overall Budget deficit on commitment basis was 11.8 percent of GDP against the revised target of a deficit of 6.3 percent of GDP;

vii. Primary Balance on commitment basis was a deficit of 4.3 percent of GDP against a revised target of a deficit of 0.7 percent of GDP

viii. On cash basis, the Overall Budget deficit was 10.7 percent of GDP against the revised target of a deficit of 6.6 percent of GDP;

ix. The corresponding Primary Balance on cash basis was a deficit of 3.2 percent of GDP against a revised target of a surplus of 0.4 percent of GDP; and

x. Gross International Reserves was equivalent to 2.7 months of import cover.

31. Mr. Speaker, with the approval of Parliament, Government set out to achieve the following key macroeconomic targets for 2023:

i. Overall Real GDP growth of 2.8 percent;

ii. Non-Oil Real GDP growth of 3.0 percent;

iii. End-December inflation rate of 18.9 percent;

iv. Overall budget deficit of 5.9 percent of GDP (on commitment) and 7.7 percent on cash basis;

v. Primary Balance (Commitment basis) of a surplus of 0.7 percent of GDP and deficit of 1.1 percent of GDP on cash basis; and

vi. Gross International Reserves to cover not less than 3.3 months of imports.

32. As I have indicated, we have made significant progress on restoring macroeconomic stability and the narrative is changing. The economy is showing signs of recovery. The exchange rate has stabilised, inflation has softened, and interest rates have declined since December, 2022.

33. Mr. Speaker, these outturns are the result of focused implementation of all the measures we presented in the 2023 Budget and the positive sentiments arising from the progress with the IMF Programme, which I will now discuss. 8 IMF-SUPPORTED PC-PEG

34. Mr. Speaker, towards addressing the macro-fiscal challenges the economy faced in 2022, Government engaged the IMF to support the implementation of our PC-PEG.

35. On 17th May, 2023, the Executive Board of the IMF approved a 36-month Extended Credit Facility (ECF) in an amount equivalent to SDR 2.242 billion (approximately US$3 billion). The Programme is anchored on Government’s PC-PEG and designed to restore macroeconomic stability and debt sustainability. It includes extensive reforms to strengthen resilience and lay the foundation for stronger and more inclusive growth.

36. Mr. Speaker, the Programme has been designed to address the key issues facing the economy through the following key priority targeted interventions:

i. large and frontloaded fiscal consolidation to bring public finances back on a sustainable path. The programme envisages a cumulative fiscal adjustment of 5.1 percentage points (ppt) of GDP over the programme period (2023-2026) with a fiscal effort of 3.8 percentage points (ppt) in 2023 alone. The primary deficit on commitment basis will be reduced from 4.3 percent of GDP in 2022 to 0.5 percent in 2023. The fiscal consolidation will be executed by both mobilising more domestic revenue, and improving the efficiency of spending;

ii. protect the vulnerable through enhancement of existing social protection programmes, including the Livelihood Empowerment Against Poverty (LEAP), National Health Insurance Scheme (NHIS), the Capitation Grant, and the School Feeding Programme. The 2023 Budget, for example, doubled the benefits under the LEAP Programme as well as boosted the allocations to the School Feeding Programme;

iii. strong and ambitious structural reforms in tax policy, revenue administration, public financial management, financial sector, as well as strong measures to enhance revenue mobilisation and address weaknesses in the energy and cocoa sectors – both are critical to bring public finances back on sustainable path while creating fiscal space for critical development spending;

iv. bring inflation under control through prudent monetary policy including appropriate monetary policy tightening and the elimination of monetary financing of the budget. Containing inflation pressures requires coordination between fiscal policy and monetary policy.

v. rebuild international reserve buffer to 3 months of imports by the end of the Programme. The Bank of Ghana is pursuing enhanced flexible exchange rate policies to help rebuild international reserves;

vi. restore debt sustainability and preserve financial stability following the Domestic Debt Exchange Programme (DDEP) to support private investment and growth; and

vii. pursue reforms to encourage private investment, strengthen growth, and create more jobs.

37. Mr. Speaker, it is instructive to note that our path towards securing an approved IMF-supported Programme has been characterised by speed and resoluteness. More specifically, the following key and significant milestones were accomplished. We, among others,:

i. achieved Staff Level Agreement (SLA) in December 2022, 6 months after we formally requested for the IMF’s support to back our PC-PEG;

ii. were supported by China’s agreement to co-chair the Ghana’s Paris Club Official Creditor Committee (OCC);

iii. secured financing assurances from the OCC, co-chaired by China and France, on 12th May, 2023, 5 months after our formal request in December 2022;

iv. secured an IMF Board approval on 17th May 2023, 5 months after the SLA and 10 months after our formal request for a Fund Programme;

v. secured US$3bn IMF financing equivalent to three times Ghana’s quota;

vi. front-loaded disbursement of IMF resources with 40 percent in 2023 and the rest spread between 2024-2026; and

vii. successfully concluded a domestic debt exchange programme.

viii. The results are clear. We are witnessing the catalytic impact of crowding in other resources- · we are in discussions with the World Bank for a $900 million Development Policy Operation; the United States, through the International Development Finance Corporation, has announced a programme to invest US$300 million towards the construction of a Data Centre under the G7 Partnership for Global Infrastructure and Investment (PGII).

38. Mr. Speaker, several key stakeholders played diverse roles in Ghana’s successful journey towards the approval of the IMF-Supported Programme. On behalf of His Excellency, President Akufo-Addo, I would like to express our sincere gratitude to Rt. Hon Speaker and Members of Parliament, our participating bondholders, retirees, financial institutions and other stakeholders, who played critical roles.

39. Permit me to express our sincere gratitude to the Managing Director of the IMF, her team led by Stephan Roudet and the Executive Board for providing the unfathomable cooperation throughout the whole process. We are also grateful to the World Bank Group, the US Treasury and US Development Finance Corporation. Government appreciates our other Development Partners, both multilateral (such as AfDB and Afreximbank) and bilateral, for their support under the programme.

40. Mr. Speaker, as a nation, we must and will prevail. Indeed, our only recourse is to be successful at the upcoming First Review of the Programme in September, 2023 and all other subsequent reviews. We are, therefore, respectfully calling on every member of this august House and “Fellow Ghanaians” to support these reforms.

41. Mr. Speaker to support the effective implementation of the IMF-supported PC-PEG, Government has put in place an implementation strategy.

STATUS OF PROGRESS TOWARDS ACHIEVING IMF PROGRAMME OBJECTIVES

42. Mr. Speaker, the IMF-Supported Programme will be monitored and reviewed semiannually, based on agreed targets to be met by end-June and end-December each year. We will prepare for a comprehensive assessment of the targets by the IMF during the First Review in September 2023, which will assess:

i. 9 Structural Benchmarks (SBs);

ii. 6 Quantitative Performance Criteria (QPCs); and

iii. 3 Indicative Targets (ITs).

43. Mr. Speaker, the IMF-supported PC-PEG has also prioritized social protection reforms to ensure that the vulnerable are protected from the impact of the ongoing fiscal adjustment.

44. Social spending on health, social protection, and education will be closely monitored to ensure timely disbursement of funds to beneficiaries. In addition, an indexation mechanism for benefits under the LEAP programme will be put in place by end-September 2023. Furthermore, the coverage of LEAP will be expanded, and its targeting improved to cover the extreme poor by 2024.

45. Mr. Speaker, Cabinet also approved a turn-around strategy for COCOBOD as part of measures to improve financial viability of the institution and to position it to deliver increased value for the people of Ghana. 46. I take this opportunity to assure all our key stakeholders of Government’s commitment to the unwavering implementation of our very own PC-PEG (Growth Programme) which undergirds the IMF- approved programme. DEBT OPERATIONS

47. Mr. Speaker, we announced in the 2023 Budget Statement that we will embark on a debt restructuring programme to alleviate fiscal pressures by: · reducing debt servicing costs; · improving debt sustainability; and ensuring macroeconomic stability and economic growth.

48. The restructuring is critical to the implementation of the IMF supported PC-PEG Programme. To ensure a return to the path of debt sustainability, a comprehensive debt strategy, centred on a restructuring programme was pursued.

49. Mr. Speaker, the perimeter for the restructuring includes both domestic (central government debt and some parastatals) and external.

50. The main aim of the operations is to reduce debt servicing costs and restore our debt sustainability. The debt operation focuses on achieving by 2028:

i. the present value of overall debt and external debt to GDP to below 55 percent and 40 percent thresholds, respectively; and

ii. external debt service to revenues and exports below the 18 percent and 15 percent thresholds, respectively. Domestic Debt Exchange Programme (DDEP)

51. Mr. Speaker, on 5th December 2022, Government launched the DDEP in a transparent manner while seeking to minimise its impact on bondholders.

52. After three (3) months of negotiations with the different bondholder groups and amendments to the original terms, Government successfully completed the DDEP on 14th February. Total bonds outstanding at the settlement date amounted to GH¢126,978.5 million, of which GH¢29,286.2 million were held by Pension Funds, bringing the total eligible bonds to GH¢97,749.6 million. The Ministry received final participation of GH¢82,994.5 million, representing 84.9 percent of total eligible bonds.

53. The DDEP has provided the Government with increased fiscal flexibility and addressed cash and other liquidity constraints. Once again, we are grateful to all investors who participated in this exchange.

54. Mr. Speaker, to complete the domestic debt operations, Government announced in April 2023 its intention to further pursue the discussions around the following domestic debt instruments which were excluded from the DDEP perimeter:

i. Energy sector Independent Power Producers (IPPs);

ii. Cocobills; iii. Local US dollar denominated bond; and iv. Bank of Ghana non-tradable debt.

55. Out of these remaining Debt instruments, Government launched debt operations for the Cocobills and local US dollar-denominated bonds on 14th July, 2023. The settlement date is today 31st July, 2023. We look forward to a successful operation.

56. Mr. Speaker, although Pension Funds were exempted from the main DDEP, we continue to engage them.

57. We are also engaging with the IPPs on debt relief and financing arrangements to achieve both debt sustainability for Ghana and financial sustainability for the energy sector.

58. Mr. Speaker, as part of the restructuring process for external Debt, Government requested the treatment of the bilateral debt under the G20 Common Framework beyond the Debt Service Suspension Initiative. Government also held a series of engagements with its bilateral creditors via the Paris Club to provide financing assurances to support Ghana’s IMF-ECF request.

59. The Official Creditor Committee for bilateral creditors was established and cochaired by China and France. The Committee provided financing assurances on 12th May 2023, to support the IMF’s Board approval of Ghana’s IMF-ECF request on 17th May 2023.

60. Mr. Speaker, Government has also begun the process of negotiating with its commercial creditors (our Eurobond investors). Two bondholder groups have been formed, comprising domestic and regional bondholders as well as international bondholders. Government has already shared a set of data and scenarios to commence discussions.

61. On the restructuring of Eurobonds, we expect to receive counteroffers from the bondholders in the short-term and envisages an agreement by year end.

Impact of the Debt Restructuring

62. Mr. Speaker, the Financial Sector, comprising Commercial Banks, Specialised Deposit Taking Institutions, Insurance Sector, and Fund Managers, participated significantly in the DDEP. The effects of the debt operations on the financial sector is elevated liquidity and solvency risks from impairment losses.

63. Regulators, including the Bank of Ghana, provided temporary regulatory forbearance to mitigate the liquidity impact of the DDEP. Importantly, Government is working with key partners to establish a Ghana Financial Stability Fund to provide liquidity and solvency support to the financial institutions. The eligibility criteria agreed with regulators and international partners will be published soon.

64. Mr. Speaker, these macro-prudential interventions and operations were also to address the impact of the large external shocks within a wider global economic context, which I now proceed to discuss.

65. Mr. Speaker, we are also mindful of the impact of the debt exchange programme on individuals and Government is working hard to stabilise the economy and towards a faster economic recovery to ameliorate impact on the welfare of the individuals.

OVERVIEW OF RECENT MACRO ECONOMIC DEVELOPMENTS Global Developments

66. Mr. Speaker, the global economy continues to struggle through a patchy recovery phase, following the shocks (including those from the CoVID-19 pandemic and the Russia-Ukraine war). It is within such context that the IMF, in its April 2023 World Economic Outlook update, projects global output growth to decline significantly to 2.8 percent in 2023, from 3.4 percent in 2022, before rising slightly to 3.0 percent in 2024.

67. The projected slowdown reflects synchronous policy tightening around the globe, especially in the United States, the Euro area, the United Kingdom, and China, to contain the surge in inflation and worsening financial conditions. Despite signs of modest growth in early 2023, persistent high inflation and the global financial market turmoil have proven too strong and dampened hopes of a robust recovery. Commodity Prices in World Markets

68. Mr. Speaker, the price of crude oil declined by 15.7 percent between August 2022 and February 2023. This was due to a weakened demand, largely attributed to a huge decline in oil consumption in China. According to IMF’s World Economic 14 Outlook update, July 2023, crude oil prices are projected to fall from an average of US$96.4 a barrel in 2022 to US$73.1 a barrel in 2023. However, gold and cocoa prices have performed better than anticipated. Domestic Developments

69. Mr. Speaker, global developments, severely impacted the domestic economy. The performance of key indicators in 2022 are as follows:

i. Overall real GDP growth declined from 5.1 percent in 2021 to 3.1 percent in 2022. This was lower than the 3.5 percent projected for the year;

ii. Non-oil GDP growth declined over the period, recording a growth of 3.8 percent compared to 6.6 percent recorded in 2021;

iii. Headline inflation accelerated consecutively from 13.9 percent in January to 29.8 percent in June 2022 and to a peak at 54.1 percent in December 2022 following the sharp currency depreciation and surge in commodity prices;

iv. Interest rates broadly trended upward across the spectrum of the yield curve, consistent with the tightening policy stance. The 91-day and 182-day Treasury bill rates increased to 35.48 percent and 36.23 percent respectively, in December 2022, from 12.49 percent and 13.19 percent respectively, in the same period of 2021;

v. Cumulatively, the Ghana Cedi depreciated by 30.0 percent, 21.2 percent and 25.3 percent against the US dollar, the Pound Sterling and the Euro, respectively. This compared with an appreciation of 3.5 percent against the euro and a depreciation of 4.1 percent, and 3.1 percent against the US dollar and the pound respectively, in 2021; and

vi. Gross International Reserves declined by US$3,457.03 million to US$6,238.19 million equivalent to 2.7 months of import cover.

70. Mr. Speaker, on the fiscal front, there were several key developments in 2022.

71. Government, sought to, among others, strengthen its fiscal consolidation programme which commenced in 2021. The objective was to gradually return to the Fiscal Responsibility Act thresholds of a fiscal deficit of no more than 5 percent of GDP and an annual positive Primary Balance at the close of 2024. The strategy included pursuing a strong revenue-led consolidation to complement expenditure rationalisation measures. However, owing to several factors, Government’s fiscal policy suffered major setbacks from both external and domestic shocks.

72. Mr. Speaker, before discussing the 2022 fiscal outturns, we would like to note that the fiscal anchor in the context of the IMF-supported PC-PEG, is the Primary Balance on commitment basis. To align with this requirement, Government, therefore, had indicated in paragraph 210 of the 2023 Budget Statement, that the 15 fiscal accounts would henceforth be reported on commitment basis, thereby, taking into account outstanding unpaid commitments of Government.

73. Mr. Speaker, the assessment on commitment basis promotes transparency, enables a real-time monitoring of Government’s fiscal performance, and provides a realtime view on the payables, thus helping to prevent while reducing the accumulation of arrears. This information is also essential for the public to get a comprehensive view of the bold fiscal policies to restore fiscal and debt sustainability in Ghana.

74. Mr. Speaker, with this context, the provisional data on Government’s fiscal operations for 2022, indicate that: i. Total Revenue and Grants for the period amounted to GH¢96.65 billion (15.8% of GDP) compared with the Mid-Year Review target of GH¢96.84 billion (16.4% of GDP) and the projected outturn of GH¢98.08 billion (15.9% of GDP); and ii. on the other hand, Total Expenditure (on commitment basis) amounted to GH¢165.06 billion (27.0% of GDP) compared to the Mid-Year Review target of GH¢133.84 billion (22.6% of GDP) and the projected outturn of GH¢159.01 billion (25.8% of GDP).

75. Mr. Speaker, the higher expenditure, together with the lower revenue outturn, resulted in an overall budget deficit on commitment basis of GH¢72.19 billion (11.8% of GDP), compared to the 2022 Mid-Year Review target of GH¢37.00 billion (6.3% of GDP) and the projected outturn of GH¢60.93 billion (9.9% of GDP).

76. Mr. Speaker, the corresponding Primary Balance (on commitment basis) for the period was a deficit of GH¢26.51 billion (4.3% of GDP) compared to the 2022 MidYear Review target of a deficit of GH¢4.36 billion (0.7% of GDP) and the projected outturn of a deficit of GH¢16.92 billion (2.7% of GDP). Petroleum Revenue and Utilisation for 2022

77. Mr. Speaker, total petroleum receipts (i.e. proceeds from liftings and other petroleum receipts) as of December 2022, amounted to US$1.43 billion. This amount comprises receipts from: the 63rd to the 68th liftings from the Jubilee field; the 20th and 21st liftings from the Tweneboa Enyenra Ntomme (TEN) field; and the 9th, 10th and 11th liftings from the Sankofa-Gye Nyame (SGN) field.

78. In addition to the total receipts for the year under review, petroleum receipts that spilled over from 2021 to 2022 was US$14.82 million bringing the total amount distributed to US$1.44 billion. This compares with the amount distributed of US$808.61 million for the same period in 2021.

79. A total of US$581.52 million was transferred into the Ghana Petroleum Funds (GPFs) in 2022, compared to US$227.49 million in 2021. Out of the amount transferred, the Ghana Heritage Fund (GHF) received US$174.46 million, against US$68.25 million in 2021, while the Ghana Stabilisation Fund (GSF) received US$407.06 million, compared to US$159.24 million in 2021.

80. The total amount transferred in 2022 from petroleum liftings and related proceeds to the Annual Budget Funding Amount (ABFA) was US$526.31 million compared to US$352.79 million in 2021. Update on Public Debt Developments for 2022

81. Mr. Speaker, as at end-December 2022, Ghana’s central government debt and guaranteed debt in nominal terms stood provisionally at GH¢435,306.45 million, up from GH¢351,787.00 million at end-December 2021, representing an increase of 23.7 percent.

82. Using the revised GDP released by the Ghana Statistical Service in April 2023, the debt-to-GDP ratio as at end-December 2022 stood at 71.3 percent.

83. Mr. Speaker, the composition of the total debt stock was made up of a provisional amount of GH¢240,919.57 million, equivalent to 39.5 percent of GDP and GH¢194,386.89 million, equivalent to 31.8 percent of GDP for external and domestic debt, respectively. Update on Domestic Macroeconomic Developments in 2023

84. Mr. Speaker, I now proceed to update the House on the performance of the economy since January 2023 and the reason why there is a consensus that we are turning the corner. Available data indicates that:

i. Overall first quarter growth for 2023 was 4.2 percent, up from 3.0 percent recorded for the same period in 2022. This growth largely reflected an increase in the Services Sector which recorded a growth of 10.1 percent;

ii. Headline inflation eased in the first half of 2023. From the peak at 54.1 percent in December 2022, headline inflation gradually trended downwards from 53.6 percent in January 2023 to 42.5 percent in June 2023. The moderation in inflation was largely supported by monetary policy tightening, relative stability in the exchange rate and lower and stable ex-pump petroleum prices;

iii. Cumulatively, the Ghana cedi depreciated by 22.1 percent against the US Dollar in the year to July 17, 2023, compared to 21.1 percent in the same period in 2022. The Cedi, excluding the January, 2023 depreciation of 20%, has depreciated by an impressive 1.84% between February and July 17, 2023; 17

iv. Total export receipts fell by 7.9 percent to US$8,178.56 million on the back of lower crude oil exports receipts. Crude oil exports declined by 41.3 percent yearon-year due to a 21.4 percent decline in volumes and 25.3 percent fall in prices;

v. Current account recorded a provisional surplus of US$849.16 million (1.1% of GDP) compared with a deficit of US$1,111.87 million (1.5% of GDP) for the same period in 2022; and

vi. Gross International Reserves dropped from US$6.2 billion at the end of December 2023 to US$5.3 billion (2.5 months of import cover) in June 2023, reflecting BOG’s objectives of reducing their foreign liabilities in line with the IMF programme. Net International Reserves received a boost from gold reserves and improved to US$2,353.95 million equivalent to 1.1 months of import cover, compared with US$1,440.00 million (0.6 months of import cover) recorded at the end of December 2022. Banking Sector Developments and Outlook

85. Mr. Speaker, the banking sector posted unexpected, relatively strong performance during the first half of the year, despite the lingering effects of the DDEP. The Banks have reported increased deposits and investments, higher profitability and a return on equity of over 35 percent. The impact of the DDEP, such as the increase in nonperforming loans (NPLs), was partly moderated by the timely introduction of temporary regulatory reliefs. In the outlook, the operationalisation of the US$750 million Ghana Financial Stability Fund and the planned recapitalisation of banks would ensure stability as well as strengthen financial intermediation to support the private sector.

2023 Half Year Fiscal and Debt Developments Summary of Fiscal Performance for Half Year 2023

86. Mr. Speaker, the provisional data on Government fiscal operations for the first half of 2023 indicate:

i. a slower pace in expenditure execution relative to revenue shortfall, resulting in an overall budget deficit on commitment basis of GH¢6.3 billion (0.8% of GDP), compared to the 2023 H1 Budget deficit target of GH¢28.3 billion (3.5% of GDP);

ii. a corresponding Primary balance (on commitment basis) of a surplus of GH¢8.8 billion (1.1% of GDP), compared to the target of a surplus of GH¢310 million;

iii. overall cash deficit of GH¢10.3 billion (1.3% of GDP), against the 2023 H1 Budget target of GH¢35,494 million (4.4% of GDP); and

iv. a corresponding primary balance (on cash basis) of a surplus of GH¢4,804 million (0.6% of GDP), against the 2023 H1 deficit target of GH¢6,908 million (0.9% of GDP). We are back on track to a positive Primary Balance.

87. Mr. Speaker, the fiscal balances, are driven by: i. Total Revenue and Grants for the first half of 2023 of GH¢59.3 billion (7.4% of GDP), 8.4 percent below the target of GH¢64.7 billion (8.1% of GDP). Despite the shortfall, the outturn shows a nominal y/y growth of 41.8 percent. The key driver of the revenue deviation is the lower-than-programmed oil receipts; and ii. Total Expenditure of GH¢68.5 billion (8.6% of GDP), 26.3 percent below the programmed expenditure of GH¢92.9 billion (11.6% of GDP). All other expenditure lines were contained within their respective targets for the period except for Compensation of Employees and Expenditure on Goods and Services. The higher-than-programmed Compensation of Employees outturn stems from higher payments for wage and salaries from the implementation of the 30 percent Base Pay increase for Public Sector Workers which was agreed to after the 2023 Budget was presented and approved by this august House last year. We need to protect our workers.

Update on 2023 Revenue Measures

88. Mr. Speaker, Government introduced several revenue measures to support the fiscal consolidation and growth agenda. The policy interventions were specifically targeted at growing the revenue base to yield an estimated 1.35 percent of GDP. The MoF and GRA are working together to ensure the realization of the full yield in the near future, through enhanced collection efforts, governance, and E-VAT implementation. Public Debt Developments for January -June 2023

89. Mr. Speaker, arising from the DDEP, several structural changes have commenced in the reporting of Ghana’s debt data. The debt from the Special Purpose Vehicles, which previously was not part of the Central Government debt, has now been included. Furthermore, we would be including the long term debt of selected SOEs such as COCOBOD and contingent liabilities arising from IPPs-PPAs and financial sector recapitalisation.

MACRO-FISCAL OUTLOOK FOR SECOND HALF OF THE YEAR

90. Mr. Speaker, the macroeconomic environment has changed significantly since the 2023 Budget was presented to this august House in November 2022.

91. Mr. Speaker, although pressures still exist, and there are formidable risks in the horizon, our economy is in a better position than it was seven months ago as the macroeconomic environment has seen relative stability since the beginning of the year.

92. This is largely explained by factors, including the positive sentiments following the Staff Level Agreement reached in December 2022 and the subsequent approval of the 3-year US$3.0 billion IMF-ECF; the eventual passage of all fiscal measures in the 2023 Budget; the completion of the DDEP; and China’s agreement to co-chair the OCC.

93. Mr. Speaker, I have also discussed the significant improvements in the key macroeconomic indicators, including inflation, exchange rate, interest rates, reserve position, growth rate and the performance of the Banks since December 2022.

Revision to 2023 Macroeconomic Framework

94. Mr. Speaker, all these developments, together with the need to align with the targets of the IMF-supported PC-PEG, warrant a revision to the macroeconomic framework. This was necessary because the framework was guided by the September, 2022 data, that underpinned the 2023 Budget in November, 2022. The revisions to the macro-fiscal framework generally seek to align the 2023 Mid-Year Fiscal Policy Review with the IMF-ECF supported PC-PEG.

95. Mr. Speaker, key revisions to the macro-fiscal targets for 2023 year include:

i. Overall Real GDP Growth rate of 1.5 percent down from 2.8 percent;

ii. Non-Oil Real GDP Growth rate of 1.5 percent down from 3.0 percent;

iii. End-period headline inflation of 31.3 percent, from 18.9 percent;

iv. Primary Balance on Commitment basis of a deficit of 0.5 percent of GDP compared to a surplus of 0.7 percent of GDP, aligning with IMF-supported PC-PEG target Primary balance;

v. Gross International Reserves (programme definition) sufficient to cover at least 0.8 months of imports of goods and services by 2023. 20 Revisions to GDP Projections

96. Mr. Speaker, the overall Real GDP growth for 2023 has been revised to 1.5 percent from 2.8 percent, and non-oil Real GDP growth has also been revised to 1.5 percent from 3.0 percent. The downward revision in projected growth for 2023 is an indication of a broad slowdown in the three sectors of the economy as a result of factors such as the fiscal consolidation plan and difficult global conditions.

97. Mr. Speaker, overall GDP Growth is, however, projected to rebound to 2.8 percent, 4.7 percent, and 4.9 percent in 2024, 2025 and 2026, respectively. This is a result of implementation of growth-oriented and structural transformation strategies in the PC-PEG. We have, however, been charged in the PC-PEG to develop an enhanced Growth Strategy supported by crowding in of private domestic and foreign investments to further boost growth. We are confident of a private sector outlook to boost growth and jobs.

Revisions to the 2023 Fiscal Framework

98. Mr. Speaker, the 2023 revised fiscal framework is now fully aligned with the IMF programme fiscal objectives in terms of primary balance (cash and commitment), revenue path, and trajectory of primary expenditures. The drivers of the revisions to 2023 Fiscal Framework includes:

i. Fiscal developments for Jan-June 2023 reflecting shortfalls in revenues and lower spending;

ii. Increase in base pay on Single Spine Salary Structure of 30 percent compared to the assumed 20 percent for the 2023 Budget;

iii. Partial restoration of capped transfers to the NHIS and GETFund;

iv. The impact of the completed Domestic Debt Exchange Program (DDEP) on debt service cost as well as on revenue mobilisation; v. IMF ECF Programme disbursements for 2023 of US$1.2 billion and reflection of other catalytic financing including the World Bank US$530 million (DPO - US$300 million and Emergency Projects - US$230 million) and expected disbursements of US$103mn from the AFDB;

vi. Revision in exchange rates, interest rates, crude oil prices, crude oil volumes, and GDP projections; and

vii. The need to align 2023 Mid-Year Review to the approved IMF-supported PC-PEG.

99. These realignments in the 2023 fiscal framework results in a revised primary balance on commitment basis of a deficit of 0.5 percent of the revised GDP. This is an adjustment of 3.2 percent from 3.7 percent of GDP, lower than the initial target of a 21 surplus of 0.7 percent of GDP set in the 2023 Budget. This aligns with the IMFsupported PC-PEG fiscal consolidation path. Revisions to Petroleum Revenues

100. Mr. Speaker, at the time of presenting the 2023 Budget, a Benchmark Revenue crude oil price of US$88.55 per barrel was used to project petroleum revenues for 2023, in line with provisions of the Petroleum Revenue Management Act (PRMA) 2011, (Act 815) as amended. Recent global economic developments have led to a decreased demand for crude oil.

101. Therefore, consistent with Section 7 of the Petroleum Revenue Management (Amendment) Act 2015, (Act 893), the average crude oil price has been revised to US$74.0 per barrel down from the price of US$88.55 per barrel used in the 2023 Budget. Accordingly, the total petroleum receipts have been revised downwards from US$1,484.47 million to US$1,008.65 million, representing a 32 percent decline.

PERFORMANCE OF GOVERNMENT INITIATIVES IN THE 2023 BUDGET

102. Mr. Speaker, in the 2023 Budget, Government outlined a series of measures to mitigate the impact of the severe economic challenges and also to preserve growth.

103. These include the implementation of flagship programmes, such as One District One Factory, Planting for Food and Jobs (PfJ) - Phase II, Strategic Anchor Industries, Infrastructure for Poverty Eradication Programme (IPEP), GhanaCARES, YouStart, Agenda 111, among others.

104. Mr. Speaker, within the context of our IMF-backed PC-PEG, these interventions assume greater significance in promoting growth and medium-term fiscal consolidation. In addition, as stated earlier, we are pursuing a social protection agenda to mitigate the impact of adjustment on the vulnerable.

One District One Factory

105. Mr. Speaker, in line with Government's unwavering commitment to industrialisation, the implementation of the flagship One District One Factory (1D1F) Initiative is on course. As of June, 2023, 126 factories were operational nationwide. Over 160,000 direct and indirect jobs have been created, especially for the youth who have been mobilised to establish agro-processing factories in 58 districts. 22 Ghana Priority Health Infrastructure Projects - Agenda 111

106. Mr. Speaker, Government initiated the Agenda 111 to address infrastructure deficit in the health sector and improve healthcare outcomes in the country. As at May 2023, total payments under the programme stood at US$189.34 million, with 83 active project sites in all 16 regions of the country. Agriculture and Food Security

107. Mr. Speaker, Planting for Food and Jobs has brought substantial improvements in Ghana’s agriculture sector. This has resulted in increased food security, employment along agricultural value chains, and accessibility of raw materials for developing industries. The programme has directly contributed to increased crop yields for major food staples such as maize, rice, and soya by 135 percent, 67 percent and 18 percent respectively within the period.

108. After a comprehensive review, Government is finalising PfJ Phase II to ensure a more efficient and targeted support for the agricultural sector. The key elements of Phase II are Inputs Credit System, Storage and Distribution Infrastructure, Commodity Trading and Digitised Platform.

The GhanaCARES “OBAATAN PA” programme

109. Mr. Speaker, I can report that efforts toward promoting commercial agriculture, building technological capability, and advancing digitalisation under the GhanaCARES programme are on track.

110. Last year, I indicated that Government is spearheading the Economic Enclaves Project (EEP) to establish ‘growth poles’ in key locations including Kasunya (Greater Accra), Kumawu (Ashanti) and Banda (Oti Region). The approach under the EEP is to provide agriculture infrastructure and land development support to our entrepreneurial youth and the formal private sector.

111. Mr. Speaker, to enhance production and value-addition in the enclaves, the provision of ancillary services such as housing, training facilities, irrigation canals, farm roads, and electricity have also commenced.

112. Mr. Speaker, it is gratifying to note that the domestic private sector has responded positively to the provision of these services. About ten (10) medium and large-scale enterprises with experience in the commercial agriculture space have applied to play diverse roles, ranging from anchor farmers to machine and equipment services, in the EEP site in Kasunya.

113. Mr. Speaker, in partnership with the National Service Scheme, about 20,000 acres of land in Sekyere Kumawu in the Ashanti region, is being developed to accelerate maize, tomato, groundnuts and animal production.

114. Mr. Speaker, Government expects that by end-2023, the EEP will have:

i. Fully seeded 7,500-acres of rice, on-boarded qualified private sector entrepreneurs as anchor farmers, embarked on value chain activities such as rice milling and packaging in Kasunya; and

ii. Developed and seeded 1,500 acres of lands in Kumawu and Banda (Oti Region) respectively and also engaged private sector partners in these Enclaves.

115. With these efforts, Mr. Speaker, we expect to gradually drive down the food component of inflation, create jobs for our youth, improve food security and reduce the volatility on the forex market. YouStart

116. Mr. Speaker, to equip participants with entrepreneurial skills, investment readiness tools as well as coaching and mentoring services under the YouStart initiative, 26,626 persons nationwide have received business advisory support services since its launch last year.

117. We will continue to work with Participating Financial Institutions, National Entrepreneurship and Innovation Programme (NEIP) and Ghana Enterprises Agency (GEA) to provide soft loans and managerial skills for the setting-up of youth-led enterprises. National Entrepreneurship and Innovation Programme

118. Mr. Speaker, the National Entrepreneurship and Innovation Programme, with support from the Ghana Economic Transformation Project (GETP), launched the Hubs Acceleration Grant Programme in April 2023.

119. The programme has supported 30 Business and Innovation Hubs with grants to resource start-ups in communities nationwide. Each Hub has received up to USD$180,000 and is required to resource 20 start-ups. In the second half of the year, 15 new Hubs will be supported to set up across the Country. Tourism and Creative Arts

120. Mr. Speaker, to make Ghana the Tourism Hub for the West Africa, the Domestic & Regional Tourism Campaign, dubbed “Experience Ghana, Share Ghana” was intensified across the country by Government.

121. Our goal is to complement this campaign, the Kwame Nkrumah Memorial Park, which was redeveloped and modernised with support from the World Bank and other development partners, was commissioned by President Akufo-Addo on 4th July, 2023. The redeveloped park will boost domestic and heritage tourism and is expected to attract over 1 million tourists annually.

122. Government will continue with the redevelopment of Aburi Botanical Gardens, Salaga and Pikworo Slavery Camps and Yaa Asantewaa Mausoleum to boost domestic tourism. Furthermore, in partnership with the Ghana Museums and Monuments Board (GMMB) efforts will continue to renovate selected Forts, Castles and Museums across the country.

123. Mr. Speaker, Government will work closely with the private sector to improve key tourist sites and events as part of the Beyond the Year of Return initiative. We have made considerable progress towards achieving 1.2 million visitors for 2023 with 150,000 jobs along the value chain, and 2 million foreign visitors and 1.5 million in domestic tourism by 2025. Road, Interchange and Bridge Infrastructure

124. Mr. Speaker, to improve mobility and accessibility, as well as safety along major trunk roads, the following projects are at various stages of completion:

i. Works on the 31.2km Assin Fosu-Assin Praso portion of the National Trunk Road N8 (Phase 2) - was completed and commissioned in June 2023;

ii. Accra-Tema Beach Road (Lot 1 and Lot 2) - 79 percent and 89 percent complete respectively;

iii. Construction of a 3-tier interchange at Nungua Barrier - is ongoing;

iv. Development works on the Kumasi Lake Road and Drainage Extension project - is 98 percent complete;

v. Selected Roads in Sekondi and Takoradi Phase 1 - is 21 percent complete;

vi. Tema-Aflao road - is 30 percent complete; vii. Nsawam-Ofankor road - is 26 percent complete;

viii. Reconstruction of Bechem-Techimantia-Akomadan road - is 64 percent complete;

ix. Reconstruction of Agona Nkwanta-Tarkwa road - is 34 percent complete;

x. Phase 2 of the Obetsebi Lamptey Circle Interchange and other ancillary works - is 86 percent complete as at June 2023;

xi. Construction of a 4-tier interchange at Suame in the Ashanti Region - has commenced;

xii. Construction of 50 prefabricated bridges in all sixteen regions continued in 2023 and are 86 percent complete as at end June;

xiii. Design, fabrication and delivery of 87 No. steel panel bridges - is ongoing, with 45 bridges delivered; and xiv. New bridge under construction at Twifo Praso to separate vehicular traffic from the railway line - is 93 percent complete.

125. Government will embark on a community roads improvement programme to increase productivity and facilitate the transportation of food crops. Districts Assemblies will be given complementary equipment to ensure that their local roads are motorable through-out the year.

126. Mr. Speaker, these notwithstanding, Government remains committed to improving road infrastructure in line with the fiscal consolidation plan in the IMF-backed PCPEG and in partnership with the private sector.

127. Mr. Speaker, the Road Sector’s Public Private Partnerships (PPP) programme for the financing, construction and management of road infrastructure has two projects at different stages of preparation:

i. Phase 1 of the Accra-Tema Motorway Extension Project (31.7km) involves the reconstruction of the Motorway. The Concession Agreement and draft Engineering Procurement and Construction (EPC) agreement have been finalised and will be laid in this House.

ii. The Development of Tema Arterial Roads will be structured on a PPP basis using the Build Operate and Transfer (BOT) model. The appraisal of the project is ongoing. Fisheries Resource Management Programme

128. Mr. Speaker, civil works on Phase 1 of the Anomabo Fisheries College project is complete and enrolment and training of students will commence by the end of the year.

129. As part of efforts to prevent diversion and hoarding of premix fuel which results in acute shortages, 37 out of a target of 50 premix automated vending machines 26 were installed in various landing beaches at Elmina, Chorkor and Nungua among others. Government will install the remaining 13 automated vending machines by end of the year at various landing beaches across the country.

130. Government has also piloted the use of electronic monitoring systems on trawlers to help check illegal, unreported and unregulated fishing practices.

Infrastructure for Poverty Eradication Programme

131. Mr. Speaker, under the Infrastructure for Poverty Eradication Programme, Government continues to embark on strategic investments across our communities nationwide in line with the fiscal consolidation plan. Through the Development Authorities, approximately 340 projects have been completed and accordingly handed over to the beneficiary communities. The remaining 297 projects are at different stages of completion.

Export Promotion and AfCFTA

132. Mr. Speaker, as part of our effort to take full advantage of AfCFTA, Government has established an Export Trade House in Nairobi, Kenya to promote made-inGhana products and services. We have also undertaken a marketing expansion expedition to Kenya with 63 Ghanaian companies to introduce them to the East African market.

133. Government has also facilitated the issuance of AfCFTA Certificates of Origin to 51 Ghanaian companies and businesses covering 300 product lines, indicating eligibility to be traded under AfCFTA. Private Sector Interventions Financial Intermediation for Entrepreneurship

134. Mr. Speaker, Government remains committed to promoting access to competitive financing for the private sector. Over the course of the past five years Government has established and recapitalised critical institutions that are able to provide financial intermediation to the private sector.

135. These institutions include Ghana Incentive-based and Risk-Sharing Scheme for Agricultural Lending (GIRSAL); Development Bank, Ghana (DBG); the Consolidated Bank Ghana (CBG), the Ghana Commodity Exchange (GCX); the Ghana Infrastructure Investment Fund (GIIF); and the Venture Capital Trust-Fund (VCTF), 27

136. Mr. Speaker, as the economy recovers, we need to support these critical institutions to deepen their interaction with private sector to spur growth and create more jobs. Government will place emphasis on:

i. Supporting DBG capital raising to the US$1 billion mark in the medium term and disbursing about GHC 1 billion in loans, from the current GHS450 million, by the end of the year;

ii. DBG and GIRSAL providing Partial Credit Guarantees that will reduce risk and attract more private sectors actors to expand agricultural operations;

iii. Operationalising an equity fund in partnership with other private sector investors to augment existing capital for SMEs; and

iv. Supporting GIIF to execute commercially sustainable infrastructure construction solutions, including the Agenda 111 Hospitals, Accra-Tema Expressway project, and affordable University Hostel accommodation Energy Security Renewable and Alternative Energy Development Programme

137. Mr. Speaker, the Ghana Nuclear Power Programme has made significant policy progress towards the development of Ghana’s first nuclear power plant. Government has shortlisted vendor companies and countries to identify the economical and resilient nuclear power technology for Ghana, as a source of clean and sustainable energy and other peaceful purposes only.

Petroleum Sector Development and Management Programme

138. Mr. Speaker, total oil production from all the producing assets within Ghana was approximately 18.5 million barrels from January to May 2023. This translates to an average production of 122,000 barrels per day. Total gas export to the Gas Processing Plant (GPP) at Atuabo and the Onshore Receiving Facility (ORF) at Sanzule within the same time was approximately 44.7 billion standard cubic feet with a corresponding average export rate of 296 million standard cubic feet per day.

139. The Cash Waterfall Mechanism (CWM) and the Natural Gas Clearing (NGC) have been used to equitably distribute revenues in the sector. Under the updated ESRP, the CWM is being reformed to ensure mandatory compliance to provide cash flow predictability to key players (IPPs and State Energy entities) within the energy sector.

140. Mr. Speaker, to address the impact of excess capacity payments on the economy, Government has sustained collaborative engagements with IPPs. Currently IPPs are 28 being engaged to restructure the accrued outstanding balances and eliminate payment shortfalls and arrears accrual in the sector.

141. The Gas Sales Agreement between VRA and N-Gas has been renegotiated to reduce the take or pay commitment and other financial obligations to the State.

Climate Change and Financing

142. Mr. Speaker, the World Bank estimates that climate change could cost Ghana approximately 1.7 percent of GDP annually by 2030 if left unaddressed.

143. Cognisant of this assessment, Government is working to secure carbon financing to support its Nationally Determined Contributions (NDCs) and meet its commitments under the Paris Agreement. This will drive foreign direct green investment to benefit local businesses.

144. Mr. Speaker, as part of our efforts to address loss and damage from climate change, Ghana, as one of the first pathfinder countries, launched the in-country process for Ghana’s participation in the Global Shield against Climate Risk and the Global Risk Modelling Alliance. These initiatives will enable us to assess quantitatively our climate risk, design solutions informed by the data and facilitate access to resources from the Global Shield.

145. Mr. Speaker, Government in partnership with the Green Climate Fund has established the Ghana Shea Landscape Emission Reduction Project (GSLERP) at an estimated cost of US$54.5 million. The GSLERP will focus on the Shea Landscape and will address the country’s efforts to reduce emissions from deforestation and forest degradation (REDD+).

146. Additionally, Government is implementing the Ghana Cocoa Forest REDD+ Programme (GCFRP), which covers 5.9 million ha (79% off-reserve, 21% on reserve) in seven regions. The programme will benefit 12 million urban and rural residents. Ghana became the second African country after Mozambique to receive FCPF REDD+ payments in January 2023.

147. Mr. Speaker, Ghana continues to have an impressive record in the climate space. The President currently chairs the Climate Vulnerable Forum while the Finance Minister chairs the V20 Group of Finance Ministers. This is an organisation of 58 countries with a population of 1.5 billion people in the most affected regions of the world.

148. Under the leadership of the President, we are transforming the Climate Vulnerable Forum and V20 into a permanent Inter-Governmental Organisation. The aim is to champion, principally, a ‘Fair Share’ Agenda to ensure appropriate financing for 29 adaptation, mitigation, and loss and damage; whilst leveraging our natural resources to raise carbon financing for accelerated climate action and to ensure that the 1.5-degree Celsius temperature threshold is not breached. Social Protection

149. Mr. Speaker, Government continues to sustain social protection programmes to protect the poor and the vulnerable. The half-year performance of the identified programmes are provided below:

i. Under the LEAP programme, Government disbursed a total of GH¢169.95 million as at June 2023 to 346,019 households comprising 1,533,748 individuals. This includes the increase of the monthly grant to beneficiary households from GH¢32.00 to GH¢64.00 for one-member household and GH¢38.00 to GH¢76.00 for two-member households. Our target under this programme period is to reach about 8 percent of the population, that is 2.5million people.

ii. Under the Ghana School Feeding Programme, coverage increased considerably from 1,671,777 beneficiaries in 2016 to 3,801,491 beneficiaries by June 2023. The feeding grants cost per meal, per child, per day increased from GH¢1.00 to GH¢1.20 for the 2023 academic year. We have also settled all arrears owed to caterers under the programme for the second and third terms of the 2022 academic year; and the first term of 2023.

iii. The Capitation Grant contributed to increased enrolment in public basic schools from 6,048,897 pupils for the 2021/2022 academic year to 6,114,302 pupils for the 2022/2023 academic year.

iv. Under the Free Senior High School (Free SHS)/Technical and Vocational Education and Training (Free TVET) programmes, a total of 447,396 first-year students enrolled during the 2022/2023 academic year to bring the total number of Free SHS/TVET beneficiaries to 1,318,035 students. Government continued with the construction of 9 state-of-the-art TVET centres to offer modern facilities and equipment, enable effective skills training and empower young people with the relevant skills required for employment and entrepreneurship.

v. Under our Complementary Education for underprivileged groups, including outof-school children, Government commenced the implementation of Cycle 8 of the Complementary Basic Education Programme (CBEP) in February 2023, with a total enrolment of 5,000 learners as at end June 2023.

GROWING THE ECONOMY

150. Mr. Speaker, the PC-PEG Government is implementing with the support of the IMFECF facility requires strong fiscal consolidation. This will enable us quickly reestablish macroeconomic stability and debt sustainability. These are necessary preconditions for high long-term economic growth, job creation and rapid transformation.

151. A key pillar of the PC-PEG is the focus on inclusive growth. Our renewed push for growth is informed by the usual experience that fiscal consolidation tends to have negative impact on growth. For the medium term, we are targeting revised economic growth rates of 1.5% for 2023; 2.8% (2024); and 4.7% (2025).

152. Mr. Speaker, we need to be deliberate and strategic in our actions if we are to exceed our pre-CoVID-19 strong economic growth which averaged 7%, compared to 4.5% and 2.6% in Lower Middle-Income Countries (LMIC) and Sub-Saharan Africa (SSA), respectively.

153. With the economy showing signs of stabilisation, Government intends to pursue a Growth Agenda that is fully aligned with the 2028 timeline for returning to a path to debt sustainability. Funding the Growth Agenda

154. Mr. Speaker, given the limited fiscal space as well as our determination not to accumulate new arrears, our growth agenda will be mainly financed from domestic and external private sector investments as well as a rationalisation of ongoing programmes. The approach is to prioritise existing programme that are critical for growth and can be implemented to deliver quick results without huge demands on the available budgetary resources.

Objective of the Growth Strategy

155. Ultimately, we will aggressively encourage the private sector, under the ‘Ghana Mutual Prosperity Dialogue Framework’ to promote shared growth anchored on job creation, food security, exports and import substitution.

156. Towards this objective, Government expects to finalise a Growth Strategy in August, 2023.

157. Mr. Speaker, the key elements of the Growth Strategy include:

i. accelerating scaling-up and aggregation in Agriculture and value-addition for key staples such as rice, poultry, maize, soya, tomatoes;

ii. supporting Industrial Parks and Economic zones that promote innovation and positive spillovers, and efficiency for key sectors such as the automotive, pharmaceutical, technology, textile and garment industries;

iii. promoting tourism to attract international and domestic tourist to boost incomes and create jobs; iv. deepening the digitalisation of Public Services to promote efficiency in service delivery and protecting the public purse; v. expanding housing delivery programmes to improve access to jobs and accommodation; and vi. deepening financial intermediation programmes to enhance inclusion and entrepreneurship.

CONCLUSION

158. Mr. Speaker, in preparing this 2023 Mid-Year Budget, we have held extensive engagements with Cabinet and also with diverse stakeholders including; Organised Labour, Employer Associations, Association of Ghana Industries, Ghana Union of Traders Association, Peasant Farmers Association, Civil Society Organisations, Chamber of Mines, Think-Tanks, African Leadership Institute for West Africa, the Academia, Faith Based Organisations, the investor community, the Council of State, National Development Planning Commission, Chief Directors and PPME Directorates of MDAs, and Chief Executives of all Metropolitan, Municipal and District Assemblies, and many others.

159. In all these meetings, stakeholders provided insights into issues such as widening the tax net, SOE Governance, expenditure controls, optimising extractive industry contributions, providing increased and targeted support to agriculture and industry, revamping ports operations and duties, as well as growing and changing the structure of the economy.

160. Mr. Speaker, the feedback has been illuminating and well received. The Faith-Based Organisation, for example, agreed to form a Committee to educate their congregation on their responsibility to pay taxes. We will continue to engage to find mutually acceptable solutions as we prepare the 2024 Budget Statement in November, 2023.

161. Mr. Speaker, last Friday, I had the singular privilege to be invited to participate in the Joint Caucus Meeting of Parliament. Indeed, the meeting effectively reflected the theme of the 2023 ‘Nkabom’ Budget. It was a pleasant and intimate experience. I appreciated the opportunity to engage and receive valuable feedback from the Hon. Members. I want to thank the leadership of the House for the opportunity and the shared urgency to transform our economy.

162. Mr. Speaker, I will be the first to admit that it has been an extremely difficult year for our country and our citizens.

163. Whilst most countries are still going through difficulties due to what is happening globally, our economic crisis also emanates from fundamental and systemic weaknesses that we must boldly confront.

164. These include:

i. Our low revenue to GDP ratio;

ii. Our high demand and dependence on imports, including food products that can easily be produced here;

iii. Our inefficient power management;

iv. Lack of robust expenditure and commitment control systems to secure us efficient public service delivery;

v. The numerous statutory funds with expenditure and economic governance issues; and vi. Weak SOE governance.

165. Mr. Speaker, what I have outlined today begins a strong effort on the part of Government to address these issues. Most of the structural reforms we proposed in the PC-PEG, with which we secured an IMF programme, are geared towards addressing these fundamental issues.

166. In the next 15-months, there will be renewed efforts to undertake the necessary reforms and implement very critical measures.

167. Mr. Speaker, I want to, once again, acknowledge the sacrifices that our people have made, especially in the roll-out of the DDEP. Government sincerely appreciates all these sacrifices. We are a resilient people but we must be resolute if we are to get our Community across the Jordan.

168. On our part, we will ensure that we implement:

i. Systems to enhance revenue collection through compliance measures to bring public finances back to a sustainable path while growing the real sector of the economy, especially agriculture;

ii. Implement the necessary structural reforms to strengthen expenditure commitment control, avoid arrears accumulation and protect the public purse; iii. Strengthen SOE governance;

iv. Review Statutory Funds and ensure improved alignment with key priorities;

v. Address the energy sector challenges; and vi. Implement the Accelerated Community Roads Improvement Phase II to expand motorability and improved roads nationwide.

169. Mr. Speaker, while concluding the 2023 Budget Statement in November, 2022 in this House, I emphasised that our unity – “Nkabom” - will be vital in confronting the daunting challenges facing our economy.

170. Mr. Speaker, today, I have provided updates to demonstrate that we have delivered on these critical areas. We thank “fellow Ghanaians” and partners for their invaluable support and sacrifices. Our economy is showing signs of stabilisation. And we are deeply grateful for the abiding grace of God, which has been more than sufficient to enable us turn the corner.

171. By being hopeful, speaking the same language of productivity, growth and working closely together, we are securing our own collective success.

172. Mr. Speaker, the implementation of on-going fiscal adjustments and sustained investments in our people have contributed immensely to the stabilisation we are seeing in the economy. Exchange rate has stabilized, inflation has softened, and interest rates have declined since December, 2022, and private investments have been announced due to increased investor confidence in our economy.

173. Ordinarily, Mr. Speaker, these positive trends should ease the burden on our pockets. As a Finance Minister and a family man myself, I will continue to work hard to build and sustain a favourable macroeconomic environment, and remain confident that the prices of goods and services would reflect the trend for all of us - for our families and enterprises.

174. Mr. Speaker, we must all work together – Regulators, Market Federations and Unions and the individual citizen – and play our part to ensure consumers are treated fairly to complete the turnaround.

175. This Mid-Year Fiscal Policy Review has outlined the strategy for re-aligning our Programme to sustain our progress to stability. We have not asked for additional funding. We have not asked for new tax measures. We have committed to stay within appropriation and be even more efficient in mobilising resources and managing expenditure.

176. Mr. Speaker, we have indicated that we are focused on:

i. Structural reforms to address systemic weaknesses and strengthen resilience in key areas including revenue mobilisation, expenditure management, commitment control and arrears clearance, debt management, financial stability as well as energy and cocoa sector SOEs reformation.

ii. Rejuvenating the growth agenda with a prioritised Growth Strategy, which emphasises private sector-led investments in areas such as agriculture, local manufacturing, tourism, and digital transformation. The PfJ (Phase II), Aquaculture, YouStart, Economic Enclaves Project, 1D1F, and Tech Hubs will be integral to this Growth Strategy. We will strengthen the ecosystem of financial services to enhance the catalytic role of the DBG, CBG, GCX, GIRSAL, GhanaEXIM, GIIF and VCTF.

iii. Launching the Mutual Prosperity Dialogue framework to enhance the ease of doing business and crowd-in significant private sector (domestic and foreign) investment, first from existing companies and also a global search for new entrants. 35 iv. Safeguarding Social Protection for the vulnerable.

177. Mr. Speaker, intermediate results from our collective efforts and our resources, especially our people, indicate that we will succeed. Beyond these current challenges, our economic prospects remain bright. But we must adapt quickly and address unexpected challenges ahead in order to rebuild our resilience.

178. Mr. Speaker, as I conclude, I would like to bring our attention to several critical imperatives that require our immediate and collective action:

i. The energy sector, especially IPP power payments, remains a critical challenge. We must support the ECG to significantly improve its collection to reduce the burden the sector imposes on public finances. I am pleased, Mr. Speaker, to announce that we have an updated Energy Sector Recovery Plan, and we must all support its implementation to bring the sector towards a sustainable path;

ii. Expenditure control has become more important to ensure that revenue shocks are efficiently managed. Even as we address the systemic challenges through technology and capacity development, Government will work with state institutions to enforce the sanctions outlined in the PFM Act, especially regarding off-budget commitments by MDAs;

iii. Improving non-oil domestic revenue collection cannot be overemphasised. In this vein, it is important to support the GRA to enhance collection and operationalise measures to strengthen revenue administration effort. To achieve the ambitious non-oil revenue target in the PC-PEG of 20 percent revenue to GDP, enhanced commitment is required; and

iv. Completing the domestic debt operations is essential to restore debt sustainability and move forward our engagement with the external creditors.

179. Mr. Speaker, this Mid-Year Review offers us an even better opportunity to jointly work towards entrenching stability for our economy. We must seize it. We must claim now a successful First Review with the Fund in September.

180. Let us continue to believe in Ghana. Let us have the courage to be proud about what we can achieved. Let us be and think positively. Let us act patriotic and stand firm. With hard work, integrity, fraternity, and mutual respect, we will stabilise and transform our economy as well as build a Righteous Nation – one of Peace, Prosperity and Freedom, today and into the future.

181. As 1 Peter 1: 10 exhorts us, let us use whatever gift we have received to serve Ghana, as faithful stewards of God’s grace. Let us indeed be perfectly united in mind and thought and build this great Republic.

182. Mr. Speaker, we all, including myself, have been ‘battered, bruised, and broken’ in this past year but we held our Resolve as a Resilient nation. The Battle has indeed always been the Lord’s. As we sit today, let us use this moment to glorify Him for: He has Rescued us; He has Recovered and Restored what we lost; and He is Reviving our economy.

183. Mr. Speaker, we need to Rejoice in fervent gratitude to the Lord. Mr. Speaker, we must endeavour to build a Righteous Republic, united in our Resolve to transform our economy, for in speaking one language and nothing will be impossible for us to achieve our manifest destiny of greatness.

184. Mr. Speaker, let me once again express my profound appreciation to this House and to all fellow Ghanaians for the support and cooperation towards stabilising the economy. Let me assure you and the nation that under President Akufo-Addo, we have steady hands piloting this ship of state.

185. Right Honourable Speaker, thank you for the opportunity to present the Mid-Year Fiscal Policy Review to this August House. 186. May God continue to bless our homeland Ghana and make her great and strong. Nkunim yɛ

Latest Stories

-

Voice of America channels fall silent as Trump administration guts agency and cancels contracts

6 hours -

Cybersecurity awareness initiative equips students with essential digital skills

7 hours -