As stated by Winston Churchill, former British Prime Minister and statesman who served the United Kingdom from 1940 to 1945, during the Second World War, and again from 1951 to 1955, "for a nation to try to tax itself into prosperity, is like a man standing in a bucket and trying to lift himself up by the handle".

Summary of Taxes Introduced by the despotic Akufo Addo-Bawumia NPP Administration

The taxes introduced during the first term (2017-2020) of the Akufo-Addo-Bawumia Administration include 3% Vat Flat Rate; 5% increase in VAT by making the GETFUND levy and NHIL straight taxes; 5% National Fiscal Stabilization levy (extended beyond expiry date of 2017); and 2% Special import levy (extended beyond expiry date of 2017).

Also, taxes for the first term (2017-2020) that were imposed on Ghanaians, collected and later withdrawn include the Luxury vehicle tax (GHS1000 to GHS2,500 depending on engine capacity of vehicle); and 50% increase in Communication Service Tax (CST).

Taxes introduced at the turn of 2021 by this administration include the 1% COVID-19 health recovery levy on the 3% VAT flat rate, making it 4% now; 1% COVID-19 health recovery levy on the 2.5% National Health insurance levy, making it 3.5% now; and 5% financial sector clean-up recovery levy, among others.

Furthermore, in the year 2021, taxes imposed on fuel prices included the 20 pesewas Energy Sector Recovery Levy on every liter of diesel and petrol; 10 pesewas Sanitation levy (“Borla”) tax on every liter of diesel and petrol; and 18 pesewas energy sector recovery levy on every kilogram of LPG.

Again, increases in existing taxes/levies on fuel prices from 2017 to date include 30% increase in Energy Sector levies (ESLA), extended beyond its original duration of 5 years to now 15 years; 11% increase in Special Petroleum Tax (from 41 pesewas to 46 pesewas) on every liter of diesel and petrol; 200% increase in BOST MARGIN from 3% to 9%; 67% increase in Fuel Marking Margin (from 3 pesewas to 5 pesewas) per liter of petrol and diesel; 40% increase in Price Stabilization and Recovery Levy on fuel products (from 10 pesewas & 12 pesewas on petrol and diesel respectively, to 14 pesewas and 16 pesewas on diesel and petrol respectively); 25% increase in Primary Distribution margin from 8 pesewas to 10 pesewas; 36% increase in Unified Petroleum Price Fund (UPPF) from 22 pesewas to 30 pesewas; and increase in Road Fund Levy from 46 pesewas to 48 pesewas on every liter of diesel and petrol.

The new set of killer taxes presented during the reading of the 2022 budget before Parliament include the (Bawumia Digital) Electronic transaction Tax of 1.75% on all electronic transactions involves the 1.75% Momo Tax; 1.75% Bank Transfer Tax; 1.75% Inward remittance (“Borga”) Tax; and 15% increase in fees and charges of government – which affects all fees paid for government services including Company Registration at Registrar General’s Department; Passport fees at the Passport office; Food and Drugs Authority certificate fees; Government Hospitals Fees; Energy Commission fees; Public University fees; DVLA fees (road worthy fees, drivers license fees etc.); Immigration fees (work permits, residential permit fees); NCA fees; EPA fees; NPA fees; Birth and Death Registry fees; and Airport fees, among others.

Effect of Tax Impositions Reflects Failure of Economic Management Team

The effect of the above taxes means that prices of commodities will see a twenty (20) to thirty (30) percent increase in the coming weeks once the 2022 budget is approved – this would worsen the standard and cost of living of Ghanaians, particularly as Christmas nears and as we enter into the New Year.

It is no wonder Dr. Priscilla Twumasi Baffuor, Senior Lecturer at the Department of Economics, University of Ghana, describes state actors under this Administration as being sorely out of touch with reality.

The economically dire state of the country is further reiterated by Most Reverend Naameh, President of the Catholic Bishops Conference, who highlights that state actors were seemingly oblivious to the level of poverty in the country. According to the President of the Catholic Bishops Conference, corruption is having a toll on the national economy thereby increasing Ghana’s poverty situation which is further compounded by the corruption of political leaders.

Most Reverend Naameh further reiterated that “Poverty is grinding down millions of people all over the country, prices of essentials are rising daily, and people are struggling to keep families alive together. Though poverty stares us in the face, it appears lost to those with power”.

The call by the Catholic Bishops Conference is reiterated by the Dean of Students at the University of Ghana, Professor Godfred Bokpin, who has noted that the introduction of a nuisance tax in the name of Electronic Transaction Levy (E-Levy) will worsen the sufferings of the poor and the marginalised in society. According to him, the introduction of the levy shows that government has adopted a lazy approach in collecting revenue.

Furthermore, in presenting the 2022 budget statement and economic policy to Ghanaians in Parliament on Wednesday, November 17, 2021, Ken Ofori-Atta stated that "the provisional nominal debt stock including financial sector bailout costs and energy sector IPPs payments, stood at GH¢341.76 billion, equivalent to 77.5% of GDP as at end-September 2021, up slightly from GH¢291.63 billion, equivalent to 76.1 percent in December 2020."

As a result of the current debt stock, it is not surprising that Ghana has been named by the World Bank and International Monetary Fund (IMF) among the African-dominated heavily indebted countries.

Reversal of discount on Benchmark Values indication of Broke Government

As highlighted by the Vice President in charge of SMEs, Association of Ghana Industries (AGI), Humphrey Anim-Dake, local manufacturing industries risks possible collapse if government does not review the 50% Benchmark Policy on imported products. The reversal of the 50% and 30% benchmark value discounts on 42 categories of imported goods and vehicles respectively only goes to indicate that Government has over the years engaged in wasteful expenditure and is simply broke.

Projections

According to the 2022 Budget, 35.66% of Expected Revenue will go into Compensation of Employees, 37.25% into Interest Payment, 16.31% into CAPEX, and 9.1% into Goods and Services.

As a result, Compensation of Employees, Interest Payment, and Goods and Services constitute 82% of Expected Revenue. This means less than 20% of the Expected Revenue (approximately 16.31%) will go into Capital Expenditure (CAPEX). This implies that not much will be done in terms of critical physical infrastructure needed to facilitate our development.

Non-Oil Tax Revenue constitutes about 77.5 percent and amounts to GH¢77,136 million (15.4 percent of GDP), representing an increase of 46.2 percent from the 2021 projected outturn. This is not encouraging.

Conclusion

Clearly the Akufo Addo administration is bereft of ideas to raise enough revenue to develop this country and save the economy from the burden of the wanton borrowings. I urge Ghanaians to rise up and demand that government sits up by checking its expenditure, cutting down the wastage and instead invest in productive areas of the economy. Anything short of that will lead to devastating effect on the citizens and an eventual collapse of the economy.

*******

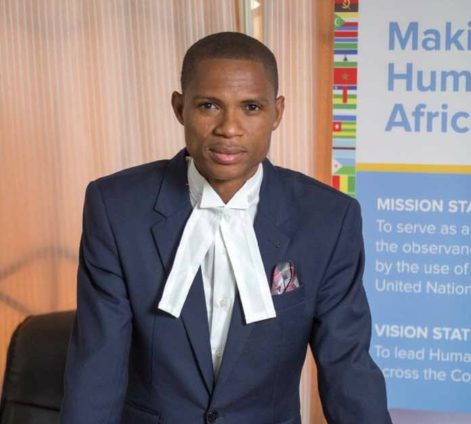

The writer, Hon. Francis-Xavier Sosu is an economic policy analyst, private legal practitioner, human rights activist, Member of Parliament for Madina, member of the Appointments Committee of Parliament and Deputy Ranking Member of the Constitutional, Legal and Parliamentary Affairs Committee of Parliament. The writer can be contacted via: francisxavier.sosu@gmail.com www.madinamp.com www.fxsosu.com

Latest Stories

-

EPA CEO Prof. Klutse’s 69 groundbreaking scientific research findings driving bold climate policies and decisive action

14 minutes -

Finance Minister announces sweeping cost-cutting measures to rein in government expenditure

23 minutes -

Resource GNFS instead of ordering their dismissal – Ntim-Fordjour to Ashanti Regional Minister

28 minutes -

GOC President Ben Nunoo Mensah ‘will not contest’ in April’s Elective Congress

35 minutes -

IGP Yohuno makes sweeping police transfers, including 2 officers in leaked tape saga

54 minutes -

Electricity is no more free – Energy Minister warns SOEs

57 minutes -

Elmina Sharks to play behind closed doors for rest of season, fined GHS 20,000 for misconduct

1 hour -

Labour Minister pushes for stronger HR policies and job creation

1 hour -

Jordan Ayew names Christian Atsu as the best player he has ever played with

1 hour -

Elmina Sharks’ Asamoah banned for a year, five officials suspended for rest of season

2 hours -

GPL: Hearts of Oak fined GHS 20,000 for allowing fans into ‘security zone’

2 hours -

GFA bans Elmina Sharks President Papa Kwesi Nduom for three months

2 hours -

Today’s Front pages: Wednesday, March 26, 2025

2 hours -

Kenyan police officer goes missing in Haiti gang ambush

2 hours -

One collapses, properties destroyed in Tuesday’s rainstorm in Damongo

2 hours