The Finance Minister, Dr Cassiel Ato Forson on Thursday, March 13, presented eight bills to Parliament aimed at abolishing several taxes, including the Electronic Transaction Levy (E-Levy), the betting tax, amongst others.

The bills also seek to uncap statutory funds such as the National Health Insurance Levy (NHIL) and the GETFund levy.

These proposed tax repeals and amendments align with the National Democratic Congress’s (NDC) manifesto pledge to ease the financial burden on Ghanaians.

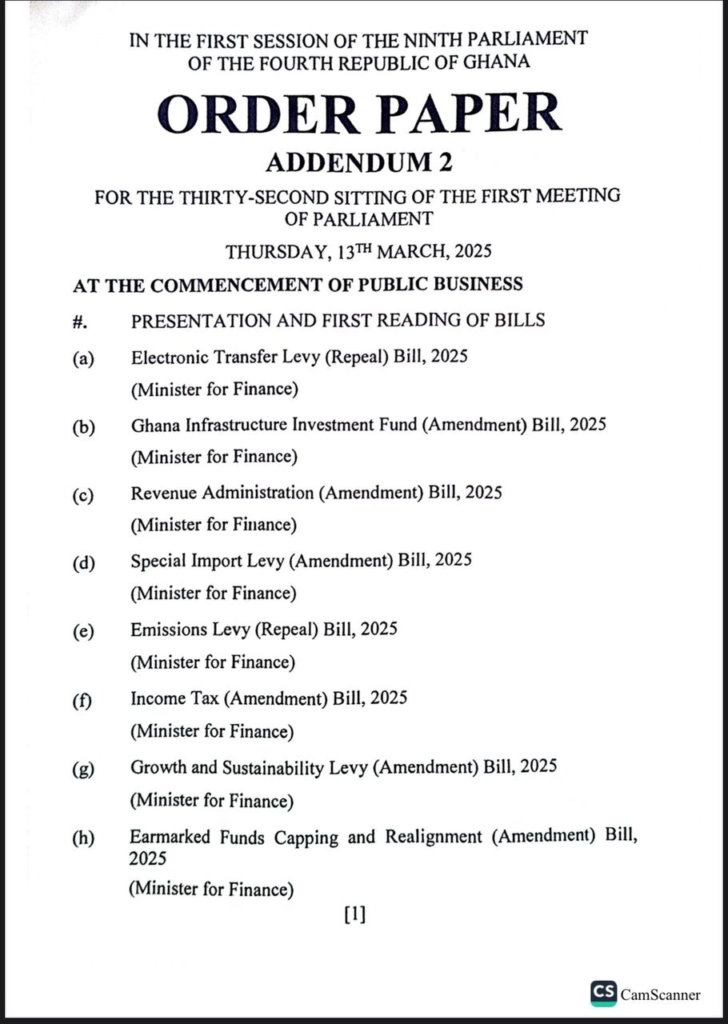

The proposed bills include Electronic Transfer Levy (Repeal) Bill, 2025, Ghana Infrastructure Investment Fund (Amendment) Bill, 2025, Revenue Administration (Amendment) Bill, 2025, Special Import Levy (Amendment) Bill, 2025, Emissions Levy (Repeal) Bill, 2025, Income Tax (Amendment) Bill, 2025, Growth and Sustainability Levy (Amendment) Bill, 2025, and Earmarked Funds Capping and Realignment (Amendment) Bill, 2025.

This move follows the Finance Minister's announcement during the presentation of the government’s first budget statement on March 11, 2025.

In addition to scrapping the E-Levy and betting tax, the government has also proposed abolishing the Emissions Tax and making amendments to other levies that have been deemed excessive.

Speaking on JoyNews PM Express on Tuesday, March 11, Dr Forson stated that he expects Parliament to consider the bills under a certificate of urgency to ensure their swift passage.

He expressed confidence that the process would be smooth due to the simplicity of the repeals, adding that each of the taxes to be scrapped only requires a single clause in the legislative process.

“Repealing these taxes will be straightforward. Each repeal is just a single clause. Removing the betting tax, the E-Levy, and others will be a simple process,” he assured.

He further stated that as revenue-related bills, they qualify to be presented under a certificate of urgency, which allows for expedited consideration.

Dr Forson also assured that once Parliament passes the bills, President John Dramani Mahama will sign them into law immediately, marking a significant step in fulfilling the government’s promise to alleviate the tax burden on citizens.

Latest Stories

-

EOCO urges public patience, cites complex nature of financial crime investigations

2 minutes -

Toyoto Cup against Kaizer Chiefs a big opportunity for Asante Kotoko – Nana Apinkra

9 minutes -

Ghana risks U.S. visa sanctions over high student overstay rate – Ablakwa confirms

14 minutes -

Ghana Swimming Association inaugurates LOC for Africa Aquatics Zone 2 Championships

46 minutes -

Bank of Ghana reverses dismissal of nearly 100 employees

49 minutes -

A Highway of Tears: Ghana’s road safety crisis demands action now

1 hour -

Ras Mubarak: Open letter to Ghana’s Minister of Transport

1 hour -

UniMAC hosts Dr Bryan Acheampong for landmark AI and future of work lecture

2 hours -

The future of work belongs to humans who know how to work with machines – Dr Bryan Acheampong

2 hours -

Atwima Nwabiagya MP calls for developing Barekese and Owabi dams into tourist sites

2 hours -

Ghana–China ties deepen as Chief of Staff hosts high-level Chinese investor delegation

2 hours -

Minority demands PURC justify 2.45% tariff hike amid declining economic indicators

2 hours -

New book “The Essence of Ghana” to launch July 1, celebrating national identity through commemorative days

2 hours -

Goosie Tanoh presents 24-hour economy document to Speaker, policy kicks off on July 2

2 hours -

Prof Ali-Nakyea narrates how 2016 Range Rovers were falsely declared as 2003 Peugeots at Takoradi Port

2 hours