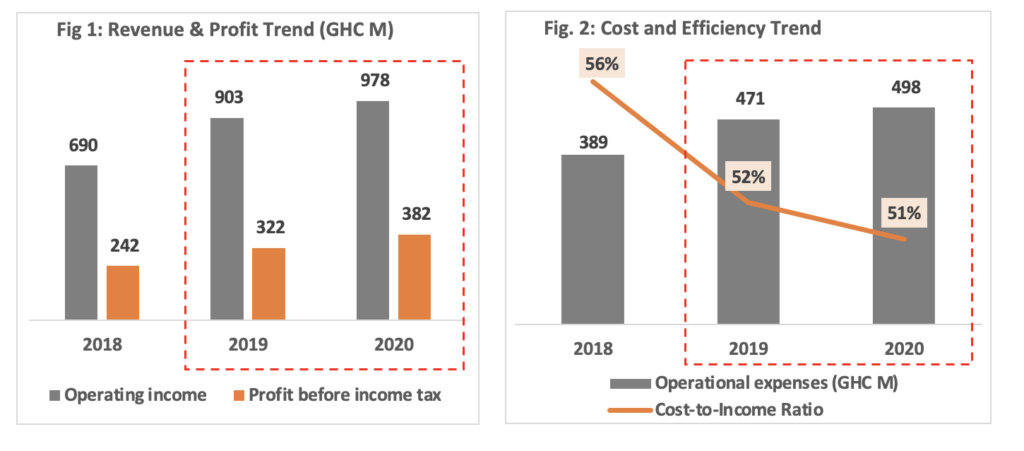

Fidelity Bank Ghana recorded a remarkable profit before tax of ¢382 million in 2020, representing a 19% increase from the ¢322 million recorded in 2019 despite the challenges posed by the Covid-19 pandemic.

The Bank also grew its operating income by 8% over the prior year to ¢978 million. (see Fig 1 below).

Operating expenses were well managed, growing at a relatively lower rate of 6% to GHS 498 million in line with the Bank’s efficiency drive, anchored on digitization, expenditure reprioritization and the adoption during the year of cost containment measures aimed at mitigating the impact of COVID-19 on the Bank’s business. The overall growth in revenues outpaced the increase in operating expenses, resulting in the Bank’s cost-to-income ratio declining further to 51% (see Fig. 2 above). The cost to income ratio measures a bank’s operating expenses as a percentage of its operating income. The low cost of operations as compared to the impressive increase in revenue shows the Bank’s efficiency and profitability in spite of the negative effects of COVID-19.

Several key balance sheet items posted strong performance with deposits increasing by 25% to GHC 6.51 billion and investment securities growing by 15% to GHC 4.93 billion, exceeding the industry average in both cases. The Bank’s gross loans and advances declined by 2% year-on-year to GHC2.4 billion, reflecting the impact of settlements during the year.

The Bank remains well capitalized closing the year with total equity of GHC1.0 billion and a capital adequacy ratio of 21.43% which is well above the regulatory minimum of 13% (reduced to 11.5% during the year by the Bank of Ghana as a policy response to the COVID-19 pandemic). The capital adequacy ratio is a measurement of a bank’s available capital expressed as a percentage of its risk-weighted credit exposures. Fidelity Bank’s capital remains adequate for its current risk profile and planned growth of its business.

Fidelity Bank’s market leading platforms and channels continue to attract customers, resulting in significant growth in digital and electronic transaction volumes during the year. In 2020 Fidelity Bank’s credit rating was affirmed by the Global Credit Rating Agency at A and A1 in the long- and short-term categories respectively, with a stable outlook. This reflects the bank’s strong capital base, liquidity position and financial performance over the review period.

Speaking on the Bank’s 2020 financial performance, Julian Opuni, Managing Director of Fidelity Bank Ghana, stated, “2020 was a challenging year for everyone. We are fortunate that our financial performance in 2020 revealed that we continue to make strong progress across all areas of our business. Moreover, we understand that our success is a function of the unwavering support that we receive from our loyal customers and we are grateful to them for their continued business.”

With respect to Q1 2021 financial performance, Fidelity Bank recently published its unaudited financial results for the quarter ended March 31, 2021, declaring a profit before tax of GHC 104.5 million, 16% in excess of the equivalent figure for the same period last year. Profit after tax recorded a growth of 30% over Q1 2020 to GHC 89.5 million.

Driven by this strong profitability, the Bank’s capital adequacy ratio rose to 21.73% in Q1 2021 (Q1 2020: 20.07%). Fidelity’s capital adequacy ratio is significantly above the regulatory minimum threshold of 13%. The Bank’s capital position remains robust and adequate for planned expansion and growth.

The Bank closed the quarter with a total deposit base of ¢6.9 billion, growing by 13% over the position recorded in Q1 2020. Although the Bank’s balance sheet declined by 8% against the position recorded in Q1 2020, it maintained its average loans and advances book at GHC 2.3 billion while increasing its investment in government securities by 38%. Consequently, despite a much lower interest rate environment, net interest income rose to GHC 197.4 million, a 7% growth over Q1 2020 while non-interest income increased by 29% to GHC 68.4 million.

By all accounts, Fidelity Bank has performed well and demonstrated its resilience in the face of the ongoing challenges of the COVID-19 pandemic. It is expected that the bank will continue to cement its leadership position in the Ghanaian banking sector if it continues along this trajectory.

Latest Stories

-

Joy Prime to premiere “PrimeTime” with George Quaye on June 18

6 minutes -

Israel carrying out ‘extensive strikes’ across Iran as Tehran warns ‘more severe’ response coming

29 minutes -

Government suspends GH₵1 fuel levy indefinitely, new date to be announced later

51 minutes -

Democratic state politician and husband shot dead in targeted attack

1 hour -

15 killed by Israeli fire near Gaza aid site, hospitals say

1 hour -

Ashaiman NDC in shock as chairman Shaddad Jallo dies

2 hours -

Mahama converts Daboya College into public Teacher Training Institution, revives Doli project

2 hours -

Prioritise prudence, not foreign debt – Deputy Ahafo Regional Imam implores African leaders

2 hours -

Mahama promises STEM School and TVET Centre for Savannah Region

2 hours -

Mahama announces new public university for Savannah Region

2 hours -

Ahiagbah demands Health Minister’s dismissal over handling of nurses’ strike

2 hours -

Mahama’s clemency for radio stations was pure gimmick – Egyapa Mercer

2 hours -

GRA postpones implementation of Energy Sector Levy

2 hours -

GES urges supervisors and invigilators to uphold integrity and honesty

5 hours -

Don’t let your parents down – Omane Boamah to Pope John SHS students

5 hours