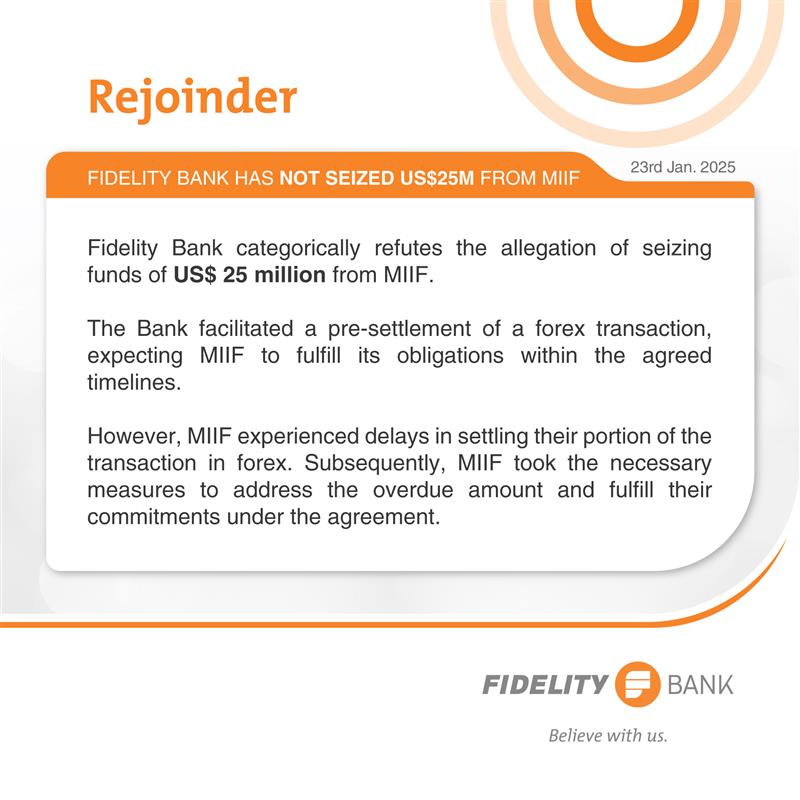

Fidelity Bank has refuted allegation of seizing funds amounting to US$25 million from the Minerals Income Investment Fund (MIIF).

A statement issued by the bank on its social media page explained that “the bank facilitated a pre-settlement of a forex transaction expecting the MIIF to fulfill its obligations within the agreed timelines".

“However, MIIF experienced delays in settling their portion of the transaction in forex. Subsequently, MIIF took the necessary measures to address the overdue amount and fulfill their commitments under the agreement”, the statement said.

Background

Earlier reports suggested that in 2024, the MIIF operating under the Ministry of Finance, underwrote an overdraft facility for a company, Goldridge Limited, through Fidelity Bank.

However, the company defaulted on repayment, leading to the seizure of the $25 million belonging to MIIF in November 2024.

Latest Stories

-

Black Stars could miss key players for 2025 Unity Cup – Dr Randy Abbey

6 hours -

Pyramids grab late equaliser in African Champions League final

7 hours -

EU calls for ‘respect’ after Trump threatens 50% tariffs

7 hours -

Ronaldo ‘could play’ in Club World Cup – Infantino

7 hours -

Amorim tells Garnacho he can leave Man Utd

7 hours -

Djokovic makes more history with 100th singles title

7 hours -

Ten Hag set to replace Alonso as Leverkusen manager

7 hours -

Salis’ Sunderland secure Premier League return

7 hours -

Assin Fosu chiefs and elders bless TGMA Unsung Artiste of The Year, Yaw Darling

8 hours -

Middle-aged, 2 children trapped in their home after a fig tree sealed their frontage doors

8 hours -

Roots of resistance: The climate cost of cutting Accra’s trees

9 hours -

Reimagining Informality: Harnessing the Urban potential of street vending in Ghana

9 hours -

Former Yendi MP Dr Farouk Mahama donates towards funeral of late Mion chief

9 hours -

Ghana Gas board pledges accountability and staff support during operational tour

10 hours -

Burkina Faso’s uprising is a rebirth, not rebellion – Ras Mubarak

10 hours