Audio By Carbonatix

Ghanaians who fail to disclose their sources of taxable income overseas risk being penalized by the Ghana Revenue Authority.

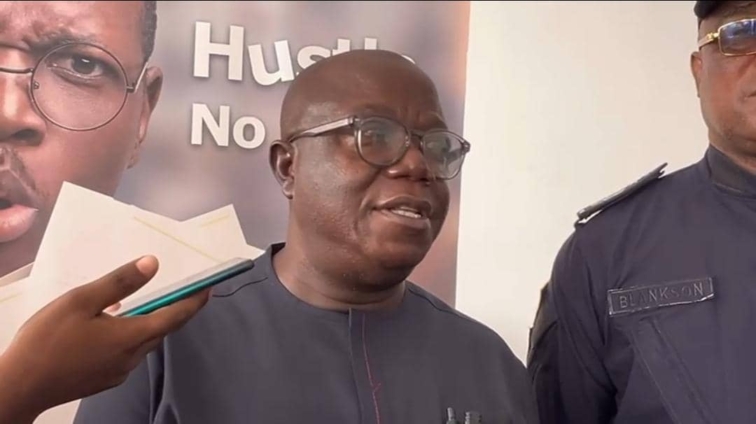

This was disclosed by the Commissioner of Domestic Tax Revenue Division, Edward Gyamerah, on the sidelines of a management retreat in Takoradi in the Western region.

The move which is part of the Authority’s strategy to increase revenue generation in the country is under the voluntary disclosure programme.

According to Mr. Gyamerah, the voluntary disclosure programme will allow residents with income abroad to disclose their earnings without payment of penalty.

He explained that in 2016 when the Income Tax Act 896 was amended, Ghana moved away from the source of jurisdiction to global.

“Over the years, this has been a big challenge where most people are not disclosing this. Now we’ve signed an arrangement with other jurisdictions. Currently, we have 145 countries that are providing us with information on resident Ghanaians having accounts elsewhere”.

“So we’ve gone through a process and come up with how individuals, persons, companies, entities, etc. have this income and have not disclosed to the Ghana Revenue Authority to use this opportunity to provide the source to GRA.

Sanctions

On sanctions to be applied to those found culpable, he said “We have the administrative sanction and we have the judicial sanctions. So for us, we first raise an assessment of you, expecting you to come [and pay up]. If you fail to pay, of course, we have the judicial aspect where we can go to court and let the judiciary help us enforce the collection of the tax”.

“We will use all enforcement procedures to ensure the collections of the tax”, he added.

The retreat was on the theme “Tax, Transparency, and Certainty, the GRA way”.

Latest Stories

-

Ghana is rising again – Mahama declares

5 hours -

Firefighters subdue blaze at Accra’s Tudu, officials warn of busy fire season ahead

5 hours -

New Year’s Luv FM Family Party in the park ends in grand style at Rattray park

5 hours -

Mahama targets digital schools, universal healthcare, and food self-sufficiency in 2026

5 hours -

Ghana’s global image boosted by our world-acclaimed reset agenda – Mahama

6 hours -

Full text: Mahama’s New Year message to the nation

6 hours -

The foundation is laid; now we accelerate and expand in 2026 – Mahama

6 hours -

There is no NPP, CPP nor NDC Ghana, only one Ghana – Mahama

6 hours -

Eduwatch praises education financing gains but warns delays, teacher gaps could derail reforms

6 hours -

Kusaal Wikimedians take local language online in 14-day digital campaign

7 hours -

Stop interfering in each other’s roles – Bole-Bamboi MP appeals to traditional rulers for peace

7 hours -

Playback: President Mahama addresses the nation in New Year message

8 hours -

Industrial and Commercial Workers’ Union call for strong work ethics, economic participation in 2026 new year message

10 hours -

Crossover Joy: Churches in Ghana welcome 2026 with fire and faith

10 hours -

Traffic chaos on Accra–Kumasi Highway leaves hundreds stranded as diversions gridlock

10 hours