As an expert in the financial industry, I have received numerous inquiries regarding the Ghana Gold Coin (GGC), reflecting a growing interest among Ghanaians in this innovative investment opportunity.

The GGC, launched by the Bank of Ghana under the leadership of Dr. Ernest Addison, offers a unique avenue for individuals to invest in gold, a historically stable asset that serves as a hedge against inflation and currency devaluation.

Investment details and availability

The GGC is available for purchase through commercial banks, with a minimum investment requirement of ¢10,000. This accessibility democratizes investment in gold, allowing individuals to own pure gold coins refined to 99.99% purity. Each coin is not only a store of value but also an inheritance asset that can be passed down through generations.

How it works

The GGC is priced in US dollars, with its value determined by the previous day's London Bullion Market Association (LBMA) Auction PM Price. To purchase, investors place an order at their bank, specifying the desired weight and quantity of coins. Transactions are conducted in Ghana cedis based on the prevailing exchange rate, ensuring that individuals can invest without direct exposure to foreign currency fluctuations.

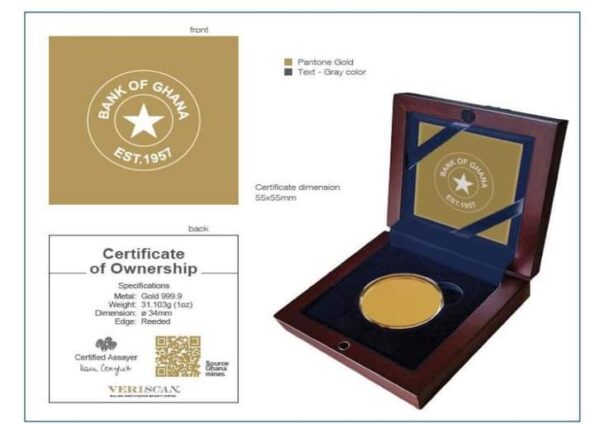

The coins come packaged with a wooden storage box, a transparent holder, and a certificate of ownership. For storage, investors can keep their coins at home or opt for bank vault services. When selling, investors can check current market prices and place a sale order with their bank, which guarantees buyback if needed.

Economic impact and currency stability

The introduction of the GGC is strategically aligned with the government's efforts to stabilize the Ghanaian economy amid rising inflation and currency fluctuations. By providing an alternative to holding foreign currencies like the dollar, the GGC helps reduce the pressure on the local currency, thereby promoting stability. The Bank of Ghana aims to mop up excess liquidity in the banking sector through this initiative, which can mitigate forex hikes and enhance overall economic resilience.

Future prospects

Investors should be aware that while gold has shown remarkable resilience as an asset, it is not without risks. Price volatility can occur, influenced by global market dynamics. However, projections indicate that gold prices may rise significantly in the coming years, making this an attractive investment option for those willing to navigate its inherent risks.

Conclusion

The Ghana Gold Coin initiative represents a pivotal moment for Ghana's financial landscape. It not only empowers citizens to invest locally but also supports broader economic goals such as reducing dollarization and stabilizing the cedi against inflationary pressures.

Under the guidance of Dr. Mahamudu Bawumia and the New Patriotic Party (NPP: Development in Freedom), this initiative exemplifies a forward-thinking approach to economic development and financial inclusion, paving the way for a more resilient and diversified economy.

Written by: Dr. Evans Duah

Latest Stories

-

Nottingham Forest go second with win over Everton

39 minutes -

GPL 2024/25: Samartex and Nations FC share spoils in Samreboi

45 minutes -

Some Elmina residents protest salt mining lease

47 minutes -

Berekum Chelsea held at home against Dreams FC

54 minutes -

Man City beats Leicester to end four games winless run

2 hours -

Savinho scores as Man City beat Leicester City

2 hours -

Obuasi Bitters supports widows in Obuasi with Christmas donations

2 hours -

Police in Wenchi gun down suspected armed robber after exchange of bullets

3 hours -

Groom dies at wedding ceremony in Akyem Anamase

3 hours -

KLM 737 slides off runway in Norway

4 hours -

Playback: The Law discussed transition law 101

4 hours -

ADB Board denies claims of irregular contract renewals, assures stakeholders of professionalism

4 hours -

Fiery plane crash kills 179 in worst airline disaster in South Korea

4 hours -

Re: Ablakwa blows whistle on ADB’s $750K ‘Midnight Contract’ amid transition tensions

5 hours -

Three migrants die attempting to cross Channel

6 hours