Introduction

“While directly serving their customers, companies should indirectly serve the interests of society by taking responsibility for the holistic impact of their activities. It’s simply a broader view of value creation. This is what ESG is all about.” ― Hendrith Vanlon Smith Jr, CEO of Mayflower-Plymouth

Ghana is committed to sustainable finance through ESG (Environmental, Social, and Governance) financing, aligning with international standards. By actively promoting and facilitating the issuance of green, social, and sustainability-linked financial instruments, Ghana channels capital towards a greener future.

We investigate how companies in Ghana can tap in to access international funding to tackle ESG concerns. Previously, we examined the opportunities for ESG financing in Ghana, shedding light on the most recent advancements in ESG regulations, policies, and initiatives in the country and highlighted the types of ESG financing available for ESG driven projects.

How can companies attract ESG Financing in Ghana

Investors now consider the impact of a company’s activities on the environment and society in addition to financial returns, thus leading to a rise in environmentally and socially responsible investing. This trend involves considering a company’s ESG impact before making investment decisions. Businesses that implement ESG policies are more attractive to investors compared to those that do not.

Both greenfield and brownfield (include a footnote/ explanation for the 2 terms) companies in Ghana need to develop new strategies that will enable them to reduce the weighted average cost of funding of their business by exploring relatively cheaper and alternate sources of funding that ESG financing rewards.

The highlighted considerations below will go a long way to help with tapping into potential financiers of ESG.

- Developing ESG strategy in new business designs

- ESG reporting and transparency

- Strong environmental practices and social impact highlights

- Good governance

Types of Projects and Activities that attract ESG Financing

It is imperative for institutions, start-ups, small to medium-sized enterprises (SMEs) to conceive developmental projects that have positive sustainable impacts and benefits to the environment, society, and the economy at large. Investors aim to invest in companies that demonstrate willingness to improve company performance in line with the Sustainable Development Goals (SDGs).

The questions businesses should be pondering over are, what are the types of projects and initiatives that should be undertaken to attract ESG Financing in Ghana?

Environmentally Driven Projects

Green financing has emerged as a significant development in Ghana's commitment to attaining its SDGs. The following types of projects can play a crucial role in supporting a sustainable and eco-friendly environment in Ghana.

- Innovation in Green Technologies: Companies should make a conscious effort to develop and invest in innovative green technologies and solutions that will position them as leaders in sustainability, thereby attracting capital from investors interested in supporting eco-friendly innovations. A typical example is Solar Desalination where solar energy is used to desalinate salt water to curb water shortages.

- Climate Change Mitigation and Adaptation Projects: Companies should invest in renewable energy projects, energy efficiency, and other initiatives to reduce external carbon emissions and internal carbon footprints. By doing this, these projects attract funding from investors focused on addressing climate change. Electric vehicles, solar and wind-powered farms are examples.

Resource Efficiency and Conservation: Companies should implement sustainable practices that reduce resource consumption, waste, and environmental impact. Such practices can be attractive to investors seeking resource-efficient businesses. For example, a project that introduces environmentally friendly packaging materials such as plant-based packaging instead of petroleum-based plastic. These plant-based packages are recyclable and degradable and such projects would attract ESG funding from foreign investors.

Socially Driven Projects

Investors are attracted to the following social commitments.

- Social Impact and Community Engagement: Businesses that make deep commitments to improve society through community engagement, diversity and inclusion, and fair labor practices appeal to socially conscious investors and impact-focused funds.

- Supply Chain Sustainability: Building a sustainable and transparent supply chain by ensuring responsible sourcing, ethical labor practices, and reduced environmental impact should be the goal of businesses as this can attract financing from investors interested in supply chain sustainability.

- Stakeholder Interactions: To attract socially responsible investors, businesses should actively engage with stakeholders, including employees, customers, and local communities to build trust and enhance a company's reputation.

Governance Practices

Studies have shown that good corporate governance practices contribute significantly and favorably to sustainable performance.

- Governance and Ethical Business Practices: Maintaining strong governance structures, transparent business practices, and ethical behavior can enhance a company's reputation and make it more appealing to ethical investors and funds. For example, it is important to have a dedicated team or unit that advocates for ESG best practices in a business. Investors are attracted to governance practices that champion sustainability.

- Regulatory Compliance: Businesses should comply with ESG-related regulations and standards. Compliance does not only reduce regulatory risks but also signals to investors that the company is committed to sustainability. Businesses that adopt ESG frameworks such as the International Organization for Standardization (ISO), Global Reporting Initiative (GRI) and the Sustainable Development Goals (SDG) attract ESG financing.

- ESG Integration in Corporate Strategy: In developing corporate strategies, businesses should integrate ESG considerations into the core of their strategies and decision-making. This demonstrates a long-term commitment to sustainability, which can appeal to investors with a focus on sustainable and responsible investments. Companies that set ESG goals that prioritise Greenhouse Gas (GHG) emissions, waste recycling, renewable energy, etc. attract ESG financing.

How ESG financing can create value for Businesses in Ghana?

By adopting ESG initiatives and strategies, businesses can raise cheaper funds and become more resilient and better prepared to navigate potential disruptions to create value in this fast-changing world. ESG financing can add significant value to business performance. For example.

- Business Innovation

The shift in consumer behavior, requires businesses to be innovative to incorporate sustainability in product designs to meet changing customer needs. The demand for sustainable products and services is on the rise. Today, consumers prioritize sustainability in their purchasing decisions and are very well informed about environmental impacts of products consumed.

- Driving long-term growth

Companies that integrate ESG principles can drive long term growth by easily getting access to funding, securing community and customer loyalty through sustainable products. A study by accounting firm Moore Global found that companies with strong ESG principles saw their profits grow 9.1% in the three years between 2019 and 2022i.

- Cost reductions

Companies that adopt ESG can enjoy substantial cost reductions as green activities minimize cost of operations and cost to the environment at large. The FedEx hybrid-electric vehicles have saved the company approximately 83,000 gallons of fuel and eliminated 950 tons of greenhouse gas emissions (FedEx Newsroom, 2008).

- Reduced regulatory interventions and government support.

Companies operating in an environmentally friendly spaces face few legal battles and regulatory interventions. Government also provides subsidies and support to businesses going the green way. It is therefore easier for such businesses to secure funding.

- Improved productivity

Productivity levels are high for companies that incorporate ESG. The improved productivity arising from the attraction of top talents and employee morale make such businesses a good fit for funding from investors. According to a study by Marsh and McLennan, organizations with the highest employee satisfaction had ESG scores 14% higher than the global average, likely due to their strong environmental performance ii.

- Optimization of investments and assets

With the growing interest in ESG by investors, fund providers and capital markets, businesses that are committed to ESG can attract investments with good returns. According to the Climate Bonds Initiative Green, social, and sustainability bonds designed to funnel investments into ESG projects reached a new global record of over $700 billion in issuances in 2021, almost double the 2019 total of $358 billion. Evidently such businesses that attract ESG financing stand a good chance of optimizing their assets and maximizing returns.

- Increases Brand Value and Reputation

Businesses that promote best ESG practices become noticeable by customers due to their brand and therefore enjoy a more positive reputation and increased brand value. This brand advantage can contribute to faster growth and market expansion. According to a study by Cone Communications, 87% of consumers said they would purchase a product from a company that advocates for an issue they care about iii.

Conclusion

Today’s financial markets are increasingly dominated by environmentally and socially conscious investors and financiers who are looking to allocate capital to businesses demonstrating a long-term commitment to sustainability and impact. The growing momentum of international investors to support ESG goals within the Ghanaian financial markets presents an opportunity for businesses to align with sustainable practices. By setting and implementing sustainable goals and projects, businesses can attract lenders, enhance performance, and contribute to the development of the Ghanaian economy.

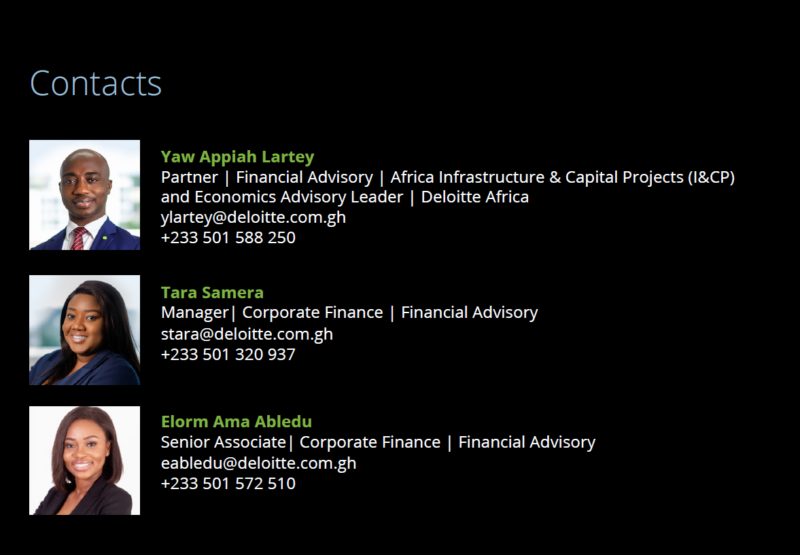

How Deloitte Can Help

- Deloitte provides corporate finance advisory services, and we help clients navigate the ever-changing financial markets to raise equity and debt funding for their businesses.

- Our financial advisory unit provides a wide range of services from feasibility studies to Transaction Advisory, Due Diligence, Reporting Accounting, Restructuring, Valuation and Financial Modelling services, Infrastructure & Capital Projects, Real Estate and Economic Advisory services, and Forensic services.

- Deloitte provides confidence and value to clients through high-caliber staff, robust project management, effective working methods, innovation, security, and strong working relationships.

Latest Stories

-

Inside the Bundesliga: German football’s heartbeat and its African ties

29 minutes -

Immigration judge says Columbia University student Mahmoud Khalil can be deported

5 hours -

Kenya: Opposition tells Prez Ruto- You are no Kibaki

5 hours -

Uganda and Zimbabwe open Rugby Africa Women’s Cup Division One with wins

5 hours -

Why Salah turned down ‘£500m Saudi move’ for Liverpool stay

6 hours -

I died, went to heaven but God sent me back – Actress Doris Ogala

6 hours -

‘I am not intimidated’ – Rev. Ntim Fordjour breaks silence after botched arrest attempt

6 hours -

NPP will be better if the ‘demons’ are evicted from the party – Prof Frimpong-Boateng

6 hours -

Maison Yusif Fragrance makes history with ‘The Apex’ – Africa’s best selling niche fragrance

8 hours -

Braye hits hat-trick as Medeama beats Dreams FC 4-0

9 hours -

Electricity tariffs up by 14.75%, water by 4.02% in latest review

9 hours -

Francophonie Festival 2025: A celebration of education and culture

9 hours -

Most Ghanaians are like single-phased wires -Prof. Akosa

10 hours -

GUBA leads historic Memphis-Ghana Trade Mission, paving the way for diaspora investment

10 hours -

KNUST declares 2 former students persona non grata over indiscipline, campus disturbances

10 hours