A Nation Reliant on Imports: Dissecting Ghana's Energy Mix

Ghana's energy consumption has increased steadily over the past two decades, nearly doubling according to the Energy Commission of Ghana. This rapid growth has taken the country away from its historical reliance on biomass, though it remains a significant contributor to the energy mix, and second only to fossil fuels. However, Ghana's dependence on fossil fuels, particularly import- ed oil, exposes the economy to the impact of mild to severe external shocks. This vulnerability highlights the need for a more diversified energy mix to ensure long-term stability.

Ghana is the 8th largest producer of oil in Africa. According to Trading Economics, the country produces an estimated 175,000 barrels per day. Despite being a net crude oil exporter, the nation remains vulnerable to systematic shocks as it is heavily reliant on imported refined petroleum products. This dependence has exposed the country’s economy to the whims of global oil price fluctuations, as starkly demonstrated by the recent Russia-Ukraine war, and the collective price control activities by the Organisation of the Petroleum Exporting Countries (OPEC).

Ghana’s stake in the production of oil fields, held through the Ghana National Petroleum Commission (GNPC) as of the end of 2023 was just under 20%, according to a report by Fitch Solutions. This has been aggravated by the slow pace of investments in upstream exploration, and Ghana’s consistently declining oil production output. Hopefully, the recent presence of the Sentuo Oil Refinery which is said to have an initial processing capacity of 40,000 barrels per day and a 100,000-barrel capacity. When in full operation is expected to reduce the country’s reliance on imported refined petroleum products. This article seeks to exam- ine the implications of global energy shocks on the oil and gas sector in Ghana as experienced from the Russia-Ukraine war.

The Domino Effect of Global Oil Price Volatility Resulting from Global Developments

Global oil prices have gone through historic volatilities over the past half-decade, amidst global shock waves including the COVID-19 pandemic and the Russia-Ukraine conflicts. Crude oil (Brent) prices spiraled downward in April 2020 (around $18 per barrel) due to collapsing demand as economies shut down. Prices started to recover in latter part of 2021 as the pandemic eased. However, this stability was short-lived when Russia invaded Ukraine on 24 February 2022. The development sent prices soaring above $100 a barrel for the first time in seven years emanating from the sanctions imposed by the western world leaders. The Russia-Ukraine war triggered a period of immense oil price volatility, sending shockwaves through the global energy market and directly impacting Ghana.

In the year 2022, the country’s energy situation was worsened by the depreciation of the local currency to 53.8% by the end of the year. Ghana’s dependence on imported refined petroleum products translates directly into higher inflationary impacts across multiple sectors. The transportation and household sectors, the largest energy consumers in Ghana, bore the brunt of the price hikes with developments. This domino effect cascaded throughout the economy, driving up food prices, utility bills, and other expenses, squeezing household budgets and hindering business operations. The high oil price spikes are prompting many coun- tries, to focus on renewable energy sources for a more stable and sustainable energy future.

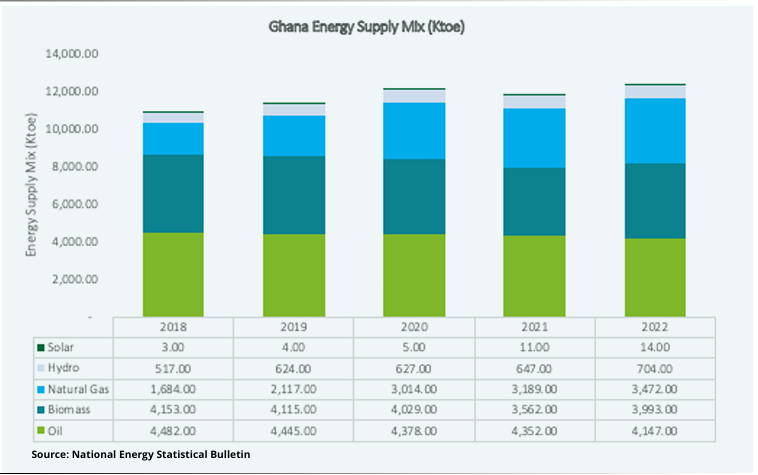

Structure of Ghana’s Energy Supply Demonstrating Oil Dependence

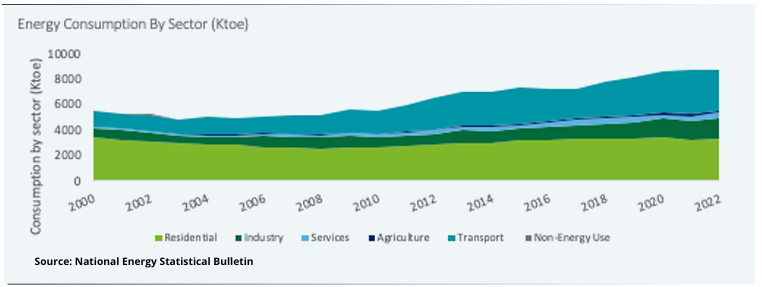

According to the Energy Commission, Ghana’s total energy consumption has grown at an annual average of 2.2% over the past two decades, from 5,470 kilo tonnes of oil equivalent (ktoe) in 2000 to 8,537 ktoe in 2022. The country has transitioned gradually from the over dependence on biomass to non-renewable petroleum sources, largely due to the rapidly increasing energy demands. Although total biomass supply decreased at an annual average growth rate of 2.9% over the two last decades, it holds the position of 2nd place in the country’s energy supply mix with total supply of 3,993 ktoe (32.4% of national energy supply), closely lagging that of oil sources. As of 2022, energy supplied from oil sources made up the largest proportion of energy supply with a contribution of about 33.4%, while that of natural gas and hydro stood at 28.2% and 5.7% respectively.

Ghana’s heavy dependence on oil and biomass exposes the country to external shocks. The economy has had a fair share of shocks from the Russia-Ukraine war given the over dependence on petroleum energy. The impact of this dependence translates directly to impact on energy consuming sectors. As of 2022, the transport and residential sectors were the largest consumers of energy, both contributing about 37.9% respectively to the country’s total energy consumption in 2022 . Other consuming sectors include industry, agriculture, and services.

The Impact of Oil Prices on Transportation

The Impact of Oil Prices on Transportation

The most visible impact of recent global and national economic developments on the oil and gas industry is the rising prices of fuel and cost of transportation due to heavy importation of petroleum products from the international market. Despite being a net exporter of crude oil that benefits from the spikes in oil prices, Ghana is highly

vulnerable to oil price shocks because the country imports a significant portion of refined petroleum product. The underproduction of the Tema Oil Refinery (TOR), the local refinery, had forced Ghana to import approximately 90% of finished petroleum products, prior to the establishment of the Sentuo refinery. This made it difficult to maintain price stability at the pumps.

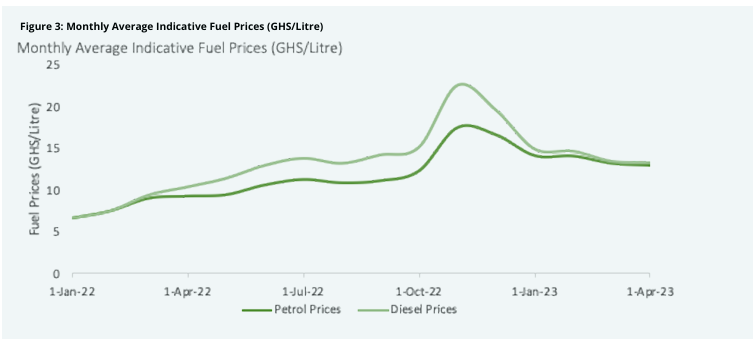

Historic data provided by the Bank of Ghana shows that the prices of diesel and petrol have generally been on an upward trend since January 2022, with fluctuations between May and October. This closely followed the spike in petroleum prices stemming from the currency’s depreciation. Prices moderated after the fall in global prices of refined petroleum. Overall, the prices were affected largely due to the country’s dependency on the international markets to supply refined fuel to meet local consumption impacted by a rising exchange rate over the period.

With the uncertainties in global oil prices amidst rising geopolitical tensions and expected volatilities in exchange rate during elections this year, consumers can expect fuel prices at the pump to remain high into the short-to-medium term. The recent event of Iran’s evasion by Israel is likely to have similar impacts as the Russia- Ukraine conflict, given that the dynamics which existed in the past have largely remained unchanged.

The Impact of Oil Prices on Food

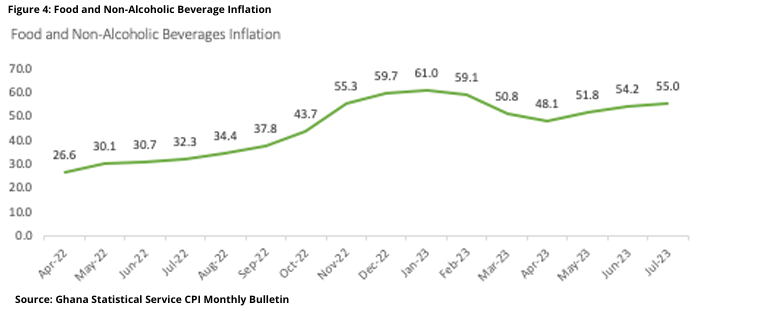

Figure 4 reveals a steady rise in food and non-alcoholic beverage inflation rates in Ghana from April 2022 to July 2023. While inflation was stable before this period, the situation appears to have worsened, demonstrating an upward trajecto- ry in food and non-alcoholic beverage. This follows the outbreak of the war in Ukraine in February 2022. In April 2022, the inflation rate was already high, at around 26.6%. However, a noticeable surge occurred in July 2022, pushing inflation to a concerning 32.3%. This coincides with the first few months of the war, suggesting a potential cause-and-effect relationship.

The food and non-alcoholic beverages inflation was largely attributed to energy related- inflation, which resulted from escalating fuel prices caused by exchange rate volatility and import inflation. The inflation rate for food and non-alcoholic beverages reached a peak of about 61.0% in January 2023, highlighting the significant price increases Ghanaians faced.

While there has been a slight decrease in recent months, the overall trend remains daunting.

Higher oil prices have implications on agriculture input for Ghanaian farmers, who rely on fuel for machinery and transportation. Normally, food items cost more in hinter lands, near areas of cultivation, than in the urban centers and cities, primarily due to the cost of transportation. Because food and transport sector are largely linked to the oil sector, the former is affected by shocks in the latter sector.

The Impact of Oil Prices on Utility Cost

According to the Energy Commission of Ghana, the bulk of Ghana’s dependable electricity generation capacity comes from thermal power plants, which is projected to generate 69.5% of total electricity by the end of 2024.

Thermal generation, fuelled by crude oil, natural gas, and diesel, continues to be the main source of Ghana’s power supply, leaving power generators at the mercy of soaring fuel prices. Energy is so crucial to the functioning of the economy that the high cost of generating power translates to high utility tariffs incurred by businesses, especially manufacturing companies and industries.

The Public Utilities Regulatory Commission (PURC), in consultation with power-generating companies, the Association of Ghana Industries (AGI), and the Trades Union Congress (TUC) in Ghana, approved an 18.36% increase in electricity tariffs in May 2023. Residential and non-residential consumers of electricity in Ghana were severely impacted by the hike in utility tariffs. The rising cost of housing, water, electricity, gas, and other fuels were significant contributors to Ghana’s record-high inflation in 2022. The spike in gas, oil, and diesel prices saddled businesses in every sector with higher costs, forcing them to pull back on new investments and pass these costs onto their customers in the form of higher prices.

For the 2024 second-quarter tariff review, PURC increased electricity tariffs by 3.45% for lifeline customers using 0-30kwh, 5.84% for residential customers using 31kWh and above and 4.92% for the industrial category of electricity consumers. Earlier this year, the Trade Union Congress (TUC) rejected the government’s proposal to implement a 15% Value Added Tax (VAT) on electricity consumption, citing the current economic challenges faced by Ghanaians as a major reason for this stance. If the government eventually implements VAT on electricity consumption or global oil prices begin to rise or the Ghana Cedi depreciates further against the US Dollar, electricity consumers are likely to experience a further increase in electricity tariff in the near future.

The unpredictable nature of electricity tariffs year-on-year, coupled with the unstable supply of electricity, could hinder Ghana’s industrialisation agenda and production by oil and gas fed industries in Ghana.

Impact Of Oil Prices On Other Economic Sectors

In 2022, brent crude prices rose above US$100 per barrel for the first time in more than seven years and this sent the Ghanaian economy into a tailspin. While some sectors might have seen a temporary advantage, the overall impact was a squeeze on businesses and consumers alike. The initial pain was felt at the pumps with price hikes at fuel stations. Public transportation, delivery services, and freight transportation also rose rapidly.

The manufacturing sector was no exception to the impact of rising fuel prices translating to an increase in transportation cost of raw materials and energy used in production processes. This led to higher prices for manufactured goods.

Construction also felt the pinch, the cost of transporting building materials increased the price of construction projects leading to higher housing costs. Hospitals and medical facilities faced a similar challenge - higher costs on their supplies and transportation, leading to increased healthcare costs. The effect of the conflict contributed to higher inflation, which put pressure on wages as the cost-of-living increase. Most employ- ers increased the wages of their employees. However, the wage increment did not fully compensate for the inflation, and this led to a decrease in purchasing power for workers.

The rise in oil prices had a cascading effect across the entire economy. Understanding these diverse impacts is crucial for businesses and policymakers to navigate the economic challenges associated with rising oil prices.

Looking Beyond the Immediate Crisis to Build Long-Term Energy Security

To mitigate the damaging impact of the global energy crisis on Ghana’s economy and impact on the subsistence of millions of Ghanaians, it is imperative to develop our oil and gas industry to insulate it from external shocks as much as possible. Some immediate action items that can be taken include the following:

Transitioning To Renewable Energy Sources

The ultimate and most sustainable solution to the threat of energy security is the transition to renewable energy. This is crucial to drive industrialization and promote economic growth in the long term. Adequate invest- ments by government into renewable energy resources can reduce electricity costs to millions of Ghanaians.

Renewable technologies also require less maintenance cost and will save power producers the high cost required to maintain continuous and stable energy supply in the country. This will allow the increasing population demand for stable electricity supply and fuel to be met as it will reduce the country’s dependence on refined fuels from foreign governments.

Incentivising Oil Exploration

While exploring alternative sources of funds to finance alternative renewable energy projects, there is the need to expand Ghana’s exploration of oil to bridge the energy gap. The recent global energy crisis serves as a stark reminder of the need for a more secure and diversified energy landscape in Ghana. Government should explore options to incentivise oil exploration to boost production capacity, especially in the challenging global oil and gas landscape today. Significant investments into Ghana’s upstream and downstream sectors will not only improve the country’s foreign reserves but will also curtail structural trade imbalances arising from Ghana’s overreliance and dependence on imported refined petroleum products and reduce fiscal and monetary shocks to the economy.

Promoting Private Sector Participation

The government can also play a crucial role in encouraging private sector involvement in energy development through targeted policy incentives. This could include revising upward the target for 10% renewable energy by 2030, engaging stakeholders in the financial sectors to incentivize private participation at attractive interest rates to businesses and promote foreign direct investments to contribute to the development of renewable energy generation plants. This will allow the increasing population demand for stable electricity supply and fuel to be met as it will reduce the country’s dependence on refined fuels from foreign governments.

Expanding Refinery Capacities

Ghana can take advantage of the limited refining capacity in West Africa to make major investments and harness opportunities in the region. The country’s landmark oil refinery, the Tema Oil Refinery, possess the potential to deliver the much-needed petroleum require- ments for the country.

The global energy crisis serves as a wake-up call for Ghana. By implementing a multi-pronged approach that prioritizes domestic exploration, refining, and renewable energy development, Ghana can build a more secure and resilient energy sector. This will not only safeguard the nation's economy from future oil price shocks but also contribute to environmental sustainability and foster long-term economic growth. The time for action is now.

About Deloitte

Deloitte is the world’s largest and most diversified professional services organisation by turnover, providing audit and risk advisory, consulting, financial advisory and tax services in over 150 countries across the globe.

Deloitte provides confidence and value to clients through high-caliber staff, robust project management, effective working methods, innovation, security, and strong working relationships. Our global network allows us to bring the full spectrum of competencies, experience, and market knowledge to our clients. With our experience, knowledge, and tools, we deliver insights and advice that help clients avoid the many pitfalls of complex deals and benefit from a service that can meet stakeholder targets and expectations.

Latest Stories

-

Cedi appreciation due to strengthened economic fundamentals – BoG Governor

50 seconds -

Use data from BoG to make cedi projections, not predictions from Zamraman – Governor Asiama

4 minutes -

Retract and apologise for disrespecting our MP – Essikado-Ketan NDC to Afenyo-Markin

14 minutes -

APL claims vindication following IMF’s revelation of BoG’s $1.4bn forex support

20 minutes -

Inexperienced Scholarship Boss has ruined Ghana’s goodwill with foreign schools – Kofi Ofosu

22 minutes -

Essikado MP cautions: Environments that silence dissent kill growth

28 minutes -

REM youth conference expands to Ghana, strengthens Ghana-Korea ties

45 minutes -

Can the Elephant dance again?

48 minutes -

Ekumfi MP leads road inspection to boost local development

51 minutes -

NPP Delegates Conference to proceed despite petition – Osei-Owusu

54 minutes -

Krobo youth group to stage protest over abandoned Somanya–Kpong road project

56 minutes -

Mahama demands reparation for slave trade

59 minutes -

Forex market intervention for 2025 Q1 has not depleted our reserves – BoG

1 hour -

NPP bigwigs revolt over top-down flagbearer election plan

1 hour -

NDC yet to decide on contesting Akwatia by-election – Mustapha Gbande

1 hour