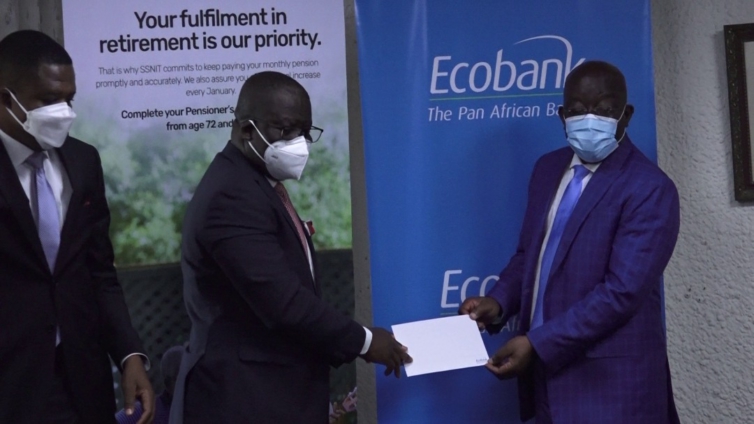

Ecobank Ghana has paid a dividend worth ¢28.8 million to the Social Security and National Insurance Trust (SSNIT), representing the Trust’s 16% stake in the bank.

This is in respect of the 2020 financial year, and the amount is almost double what it paid for the 2019 financial year.

Shareholders of the bank approved a dividend of 55 pesewas per share, amounting to a total of GH¢177 million for the 2020 financial year.

It represented a 100% increase over that of the 2019 final dividend payment.

Managing Director of Ecobank Ghana, Dan Sackey, in making the payment, told Joy Business, the dividend payment, reflects the buoyant performance of the bank, amid the scourge of the Coronavirus Pandemic on the financial sector.

“Last year, we paid a dividend of around ¢15.7 million, so this reflects on the improved performance and also improved capitalization with the bank, thus allowing the Central Bank to approve the payment of a higher dividend payment, compared to what was approved last year.”

“SSNIT is the second largest shareholder in the Ecobank Group, so it is a significant shareholder in excess of 16% shareholding, so the dividend payment reflects that significant stake in the bank,” he stated.

Director General of SSNIT, Dr. John Ofori-Tenkorang, commended Ecobank for honoring its obligation.

According to him, the payment comes in handy to support SSNIT’s ¢250 million monthly pension payment.

“SSNIT rely on investments to supplement the pensions that we pay. We collect contributions from existing members and add investment returns and pay pensioners and plough back what’s left of the investments. Dividends are an easier form of recouping investments and we commend ECOBANK for that,” Dr. Tenkorang told Joy Business.

Despite the adverse effect of Covid-19 on the economy, Ecobank Ghana registered an impressive 22% growth in profit for last year.

This is due to a significant increase in interest income during the period.

According to its 2020 Financial Statement, the bank’s Return on Equity- an important profitability indicator for shareholders, also grew by 26.0%.

Ecbank Ghana’s quarter one performance.

Ecobank Ghana registered a year-on-year profit of 33% in the first quarter of this year to ¢168.2 million, its unaudited first quarter financial statement revealed.

This was as a result of significant growth in interest income, largely investments in government securities, despite the impact of covid-19 pandemic on the Ghanaian economy.

Net interest income surged from ¢287.5 million in March 2020 to ¢364.8 million in March 2021, whilst net fees and commissions also went up to ¢58.5 million in the first three months of this year, from ¢54 million the same period a year ago.

Consequently, Return on Average Equity grew by 31%, while Return on Average Assets was estimated at 5%.

From the financial statement, the earnings could have been more if not for covid-19, which compel the bank to slowdown lending activities in the first three months of this year.

--

Latest Stories

-

I was suspended in SHS after making a dance video with my uniform – Lisa Quama

55 mins -

Unemployed man sentenced to 5 years for causing harm

57 mins -

GTA gears up for National Tourism Awards 2024

58 mins -

Police foil robbery attempt, arrest four suspects

1 hour -

Prof. Gyampo criticises vacating of MP seats due to cross-carpeting

4 hours -

A critical examination of Speaker Alban Bagbin’s ruling on potential breaches of Article 97(1)(G) and (H)

5 hours -

Trump calls 6 January ‘day of love’ when asked about Capitol riot

5 hours -

UTAG calls for immediate prosecution of persons arrested for engaging in galamsey

5 hours -

Prof Ransford Gyampo: And Speaker Bagbin declared 4 seats vacant…

6 hours -

Secret Service has ‘deep flaws’ and must overhaul leadership, report says

6 hours -

Kenya’s deputy president sacked while in hospital

6 hours -

One Direction ‘devastated’ at Liam Payne’s death

6 hours -

Ghana’s debt to ease to 70% of GDP in 2024; another debt default unlikely – Fitch

6 hours -

Meta fires staff for buying toothpaste, not lunch

6 hours -

U-20 AFCON 2025Q: Afriyie’s brace earns Ghana draw against Benin

6 hours