Ecobank Ghana earned a record total revenue of ¢1.58 billion and profit before tax of ¢642.4 million in the 2019 financial year marking a growth of 21% and 27% respectively over the prior year figures.

Terence Darko, Board Chairman of Ecobank said the bank's operating expenses growth were well controlled within inflationary levels with a resultant reduction in cost-to-income ratio from 51.5% in 2018 to 45.8% in 2019.

"This remarkable performance is reflective of the Bank’s consistent strategy of building a diversified business model with a focus on growing revenue and managing costs and risks, even in the face of a highly competitive environment.

"Ecobank also posted strong performance on all key balance sheet items, providing its shareholders with a return on equity of 25%. The Bank continues to be well capitalised with total equity of ¢1.78 billion, one of the highest in the industry and a capital adequacy ratio of 18.58%, well above the regulatory requirement of 13%," he said.

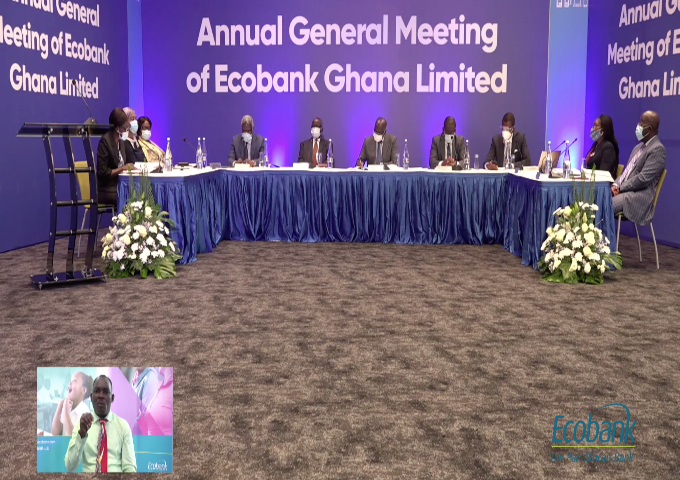

Speaking at Ecobank Ghana's 15th Annual General Meeting (AGM), he lauded the Directors for their hard work leading to the bank posting sterling financial results and maintaining its position as Ghana’s biggest bank.

This year’s AGM held virtually, highlighted strong growth in revenues and profits, strengthening of the Bank’s balance sheet as well as a dividend payout.

Speaking to shareholders at the AGM, Mr Darko said "the last two years have been marked by significant changes in the Ghanaian banking sector, largely underscored by the Central Bank’s clean-up activities across the industry.

"This has reduced the number of banks in Ghana from 34 to 23, and led to a stronger and more efficient banking system."

He gave a thorough overview of the global and domestic macroeconomic changes and how they have impacted businesses.

Ecobank Ghana ‘s credit rating has been affirmed by the Global Credit Rating Company at AA-(GH) and A1+(GH) in the long term and short term respectively with a stable outlook.

The current ratings reflect the Bank’s established domestic franchise value, resilient financial performance, risk appropriate capitalisation and adequate loan loss reserve.

Given the bank’s stellar performance, the Board proposed a dividend payout of 30 pesewas per share, which was unanimously approved by shareholders.

Latest Stories

-

West Ham confirm Graham Potter as new manager

27 minutes -

The nation’s greatest enemy is gone – Kumchacha says of Akufo-Addo

31 minutes -

Ghana is 2nd most indebted African country to IMF in terms of Concessional Lending

35 minutes -

Today’s Front pages :Thursday, January 9,2025

35 minutes -

Traders at Kumasi’s Race Course Market grapple with rising armed attacks

37 minutes -

NPP Electoral Area Coordinators call for suspension of Kpando Constituency Executives

43 minutes -

Kpando MP, Sebastian Deh calls for collective efforts toward developing the constituency

52 minutes -

Musah Superior writes: We will hold Mahama to his campaign promises

56 minutes -

Ghana’s First Female Vice President: A Trailblazer in Leadership and Inspiration

1 hour -

Mahama will appoint new MMDCEs in 14 days – Ashie Moore discloses

1 hour -

Joe Biden says he could have defeated Donald Trump

1 hour -

“This is Your Moment in History, My Dear Friend’s Wife” Part 3

1 hour -

The Days of My Years Here on Earth: Three Score and Ten (Naabe @ Seventy)

2 hours -

Over 30 heads of states, prime ministers graced Mahama’s inauguration

2 hours -

Armah-Kofi Buah lauds Mahama on historic ascension to presidency

2 hours