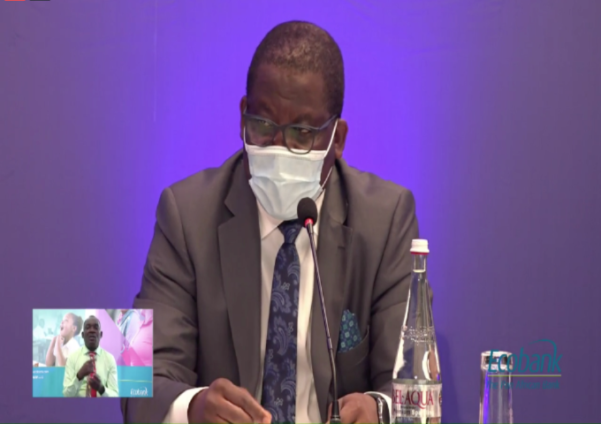

Managing Director of Ecobank Ghana, Daniel Sackey has disclosed that the bank leveraged on its scale and technology to make banking easier for its clients.

He told the Board and shareholders at this year's AGM that this enabled their customers to "bank seamlessly with us, using their preferred digital channels."

“In 2019, we demonstrated our ability to navigate the difficulties associated with an increasingly complex environment, after a challenging period in the banking sector," he said.

Mr Sackey said Ecobank Ghana drove growth by deepening relationships with its existing customers, whilst attracting new ones.

"We also utilised our growing partnership propositions with key actors in the retail sector to launch our first consumer digital lending scheme called Express Loans. This enabled our customers to borrow from the Bank using their mobile phones.

"In the seven months of the product launch, we have advanced loans to over one million customers. This is a significant step in our digital drive and our efforts towards providing our clients with convenience and meeting their financing needs within affordable price points. We do this to promote financial inclusion and to positively impact their lives”.

Mr Sackey also stated that during the year under review, Ecobank carried out several upgrades on its digital platforms in response to customer feedback.

This includes the enhancement of the Bank’s award-winning Ecobank Mobile, which in addition to an improved “look and feel”, now offers greater security and more features.

The Bank also upgraded its core banking application through the enhanced Omniplus and Omnilite product solutions, thereby providing a versatile and robust suite of digital solutions for business customers.

All these upgrades, he said, have significantly improved the Bank’s operations and allowed it to champion its self-onboarding agenda.

He said now, Ecobank provides self-onboarding capabilities to both individuals and businesses. These strategies have contributed immensely to the Bank’s customers benefiting from more affordable, convenient and safer banking services.

He further threw light on the support that the Bank is providing to both customers and the communities within which the Bank operates, especially during the COVID-19 pandemic.

Some of the measures he touched on included payment holidays and the provision of financial advisory services. Ecobank, under the auspices of the Ecobank Foundation, is also supporting government’s effort in the fight against the pandemic thus, contributing generously to the Ghana Private Sector Fund and other groups in cash and in kind.

He concluded by thanking shareholders and customers for the confidence they have reposed in the management of the Bank and the employees for their hard work and unwavering commitment to customers.

Latest Stories

-

Agradaa jailed 15-years

22 minutes -

Indian Prime Minister Modi commits to stronger ties with Ghana

43 minutes -

NSMQ 2025: Berekum Presby pulls off last-gasp comeback to stun Techiman, reaches zonal finals for first time in 7-years

58 minutes -

Anglogold Ashanti Obuasi mine outlines a 5-year ‘Make Obuasi Great Again’ vision

59 minutes -

Useless Column: I’m Suspecting My Wife

1 hour -

Amelley Djosu: Edem’s ‘Toto’, parliament and the politics of misunderstood art

2 hours -

Sam George vows to secure DSTV price reduction

2 hours -

Government sets final deadline for NGIC 5G rollout amid delays

2 hours -

WAFCON 2024: Four Black Queens players to watch at continental showpiece

2 hours -

Kuami Eugene names favourite Ghanaian actors, bemoans absence of Ghanaian films on streaming platforms

2 hours -

Asante Kotoko pay tribute to deceased Liverpool star Diogo Jota

2 hours -

NPP rejects Ablekuma North re-run; vows to challenge case in court

3 hours -

Once upon a time in Ghana

3 hours -

TEWU declares strike over union representation in public universities

3 hours -

Ghana to host 2025 Global Entrepreneurship Festival – Samuel George

3 hours