Rewinding to 2009, when MTN launched Mobile Money, setting the tone for a digital revolution in Ghana that changed the Ghanaian way of handling money and financial services.

This revolution broadened, following similar ventures by other telecom service providers like Tigo (now AirtelTigo) in 2012, and Vodafone (now Telecel) in 2015, promising a hop into financial freedom, inclusion, convenient and economic growth.

But this intense swing towards digital financial services hit a snag following the government’s introduction of the Electronic Transfer Levy (E-Levy) in May 2022, which hit Ghanaian's wallet.

The Birth of Mobile Money

Mobile Money (MOMO) offered a glimpse of progress, providing an electronic way to send, receive, and keep money on one’s mobile device conveniently.

With 4 million subscribers across all networks in 2017, subscribers of mobile money stood at 73 million at the end of 2024, after a leap from 65.6 million in December 2023, enhancing financial inclusion dramatically among diverse levels of societies.

Per the Bank of Ghana's records, transaction volumes jumped from 5.07 billion in 2022 to 6.81 billion in 2023, affirming Ghana's move away from cash.

The Biting Teeth of E-Levy

In May 2022, implementation of the Electronic Transfer Levy (E-Levy) came into full force, through the Electronic Transfer Levy Act, 2022 (Act 1075) and the Electronic Transfer Levy (Amendment) Act 2022 (ACT 1089), imposing a levy of 1% on electronic transfers.

The E-Levy was charged by banks and mobile money providers like MTN Momo, Vodafone Cash, AirtelTigo Money, Zeepay, GCB G-Money, Yup Ghana and the likes.

Projected to reap revenue of GH¢2.24billion for the year, the tax regime aimed to broaden tax base and court public contribution for development.

However, within a year of mobilization, the E-levy generated GH¢246.9million in revenue, accounting for only 11 percent of projected revenue.

Government’s projected tax in-take was much lower than expected.

This was not just a short of revenue, but a signal of a dangerous shadow being cast over the mobile money revolution.

Josephine is a student at Kumasi Technical University. Her financial life revolved around mobile money, especially with her online shopping activities.

“E-levy is my challenge. There was a time I wanted to buy something online, checked my wallet, I actually had the exact money I needed to buy that item, with charges.

“But because I did not have extra money for E-levy, I was not able to send the money to get that item. So I was discouraged from using Momo,” she said while narrating her ordeal with a new normal that was introduced by the levy.

MoMo transaction charges increased as a result of the levy, and consumers found a hard hitting way to show their high sensitivity to this price change.

Persons who are economically vulnerable are in the majority of those pushing back to cash transactions to avoid the additional cost.

Margaret Agyei, a patron of mobile money, has reverted to her traditional means of financial transaction, using the cash systems, following the implementation of the E-Levy tax regime.

“The MoMo was helpful. I could keep money of any value on it. But since the implementation of e-levy, sending 1000gh has become problematic because I have to deposit more than 1000gh or send more than 1000gh to the person. So I stopped. I rather prefer they put it in an envelope and send it via a car or parcel office,” she said.

Margret’s U-turn, not only water down the gains in financial inclusion especially of the poorest and most vulnerable, but also threatens the digital financial services progress.

Financially strained individuals, like her case, forms part of a 25% drop in mobile money usage within the nine months of the implementation of the levy.

According to research by the GSMA, transactions below 100 Ghana cedis reduced by 19%, those between 100 and 200 Ghana cedis slimed by 28% and the reduction was 48% for transactions above 200 Ghana cedis.

In contrast, cash out transactions – which are exempted from the levy – have increased 61% in value and increased year-on-year by 25% in volumes, indicating that consumers are returning to cash-based transactions.

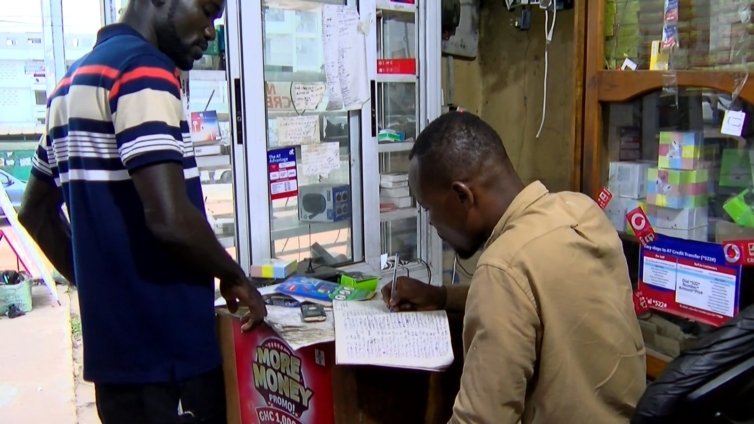

Mobile money vendors were also hard hit by the situation, losing their transaction numbers.

Sammy has been working as a MoMo vendor for over a decade and reports that E-levy impacted his work.

“At first, it affected me a lot. Because we are not used to new things. But later, people got to understand the reason why it was introduced. It is not any other transaction you do, you are deducted. But it was very bad. It impacted negatively on my business.

“I do a lot of transactions. I can do more than 100 transactions a day, it varies with time and occasion. Through the introduction of the E-levy, the transaction was reduced a lot. It reduced drastically, but people were beginning to understand the concept of mobile money,” Sammy said.

Economic Consequences

An economist and financial analyst, Dr. Evans Nunoo, discusses the long-term economic implications for Ghana if the trend of reverting to cash persists due to tax policies like the E-levy.

The reduced demand resulted in lower taxes collected on mobile money revenues, as according to the GMSA, net tax revenue for the government would be negative – by almost 1.4 billion GHS per year.

Financial exclusion, security threats and inefficiency of the digital economy are conferred implication of the persisting taxation aimed at mobile electronic transactions.

“We reduce financial inclusion for the population we are targeting. And efforts to formalize the informal sector are jeopardized, slowing progress of financial inclusion, especially in rural areas where financial infrastructure is limited.

“The trend of reverting to cash will also undermine the digital economy and digitalization, as it will reduce investment in fintech, thus, people will be discouraged to develop financial technology. And along that, limit opportunities for digital entrepreneurs.

“Generally, tax revenue will decrease. Same phenomenon will arouse security risks and inefficiencies of the economy because people will run back to the cash system, increasing fraud, theft and other security risks.

“Another impact is the negative impact on monetary policy. It would be a little difficult to track the economy and for the government to have proper data for the proper economy,” Dr Evans said.

Potentials of the Promise of Reversal

It is expected that the Electronic Transfer Levy (E-Levy) and other nuisance taxes will be abolished during the government’s budget reading in March 2025.

According to the Minister for Finance, Dr. Cassiel Ato Forson, ongoing discussions aim to ensure that scrapping these taxes will not negatively impact Ghana's program with the International Monetary Fund for financial aid.

The Minister assured that the levy would be cancelled in 120 days.

For users of mobile money, the assurance presents a glimpse of hope.

“The E-levy is not helping. People come here and they withdraw without even knowing what it is. It’s good that there is a preposition to cancel it. I am hoping such is effective right now. It will help us, I believe those who have made the U-turn to revert back to using MoMo. I will be glad,” Isaac, a regular MoMo user said, expecting the government to expedite intentions to cancel the levy.

The government's plan to cancel the levy opens a discourse on balancing fiscal responsibility with digital growth.

With lessons from the e-levy roll out, Dr. Evans Nunoo is admonishing a strong need of balance for revenue collection with the promotion of digital financial services, possibly, exploring alternative taxations.

“But any good transfer system should have equity and balance, be fair and equitable. There are some people who can do thousands of cedis of transactions, which means, they are in a higher income bracket. Some also do less, so categorize such persons in a lower income bracket. The taxes can be progressive to reflect income levels.

“We can improve public awareness and transparency, educate people and create proper acceptance of tax regimes. The transparency regards where the tax revenues are going into, that can motivate some people. Government should explore broadening the tax base. There was no need to abolish a tax regime to create a new one and depend on it. Like in the case of road tolls and e-levy,” he said.

The Way Forward

The E-levy, as demanded by many users, does not demand just cancellation.

The challenge lies in reigniting mobile money's appeal, particularly among the economically vulnerable populations.

Concerted efforts are vital to whip up abandoned users, who avoided mobile money to avoid the tax regime.

Economist and financial analyst Dr. Evans Nunoo, discussed measures to be implemented to ensure that mobile money usage regains its positive standing.

“Post the levy's cancellation, we ought to be guarded by the existing charges. For the rural folk we can eliminate transaction fees until we are sure they are back and breasted. Government should subsidize momo transactions for certain groups, like students, market women etc.

“We can also run a public education campaign of the changes and the trend to attract users back. Stakeholders can expand mobile money services, like integrating momo into other services, like saving accounts and the links. It will encourage more people to come back or start using momo services,” he said.

E-levy phenomena is a deterrent tale of the impact of policies on innovations, particularly one that cares for the vulnerable populations in the country. Beyond that, there should be a strategic guideline that balances the quest for digital and financial inclusion and revenue mobilization

Latest Stories

-

Radio station closures not politically motivated – Communications Minister

11 minutes -

Mahama bids farewell to UK envoy, calls for deeper economic and security ties

16 minutes -

National Integrity Awards: Ghana has an opportunity to rewrite new chapter of national life -Justice Atuguba

19 minutes -

No radio station is above the law – Communications Minister

20 minutes -

If the power of the Speaker is fully invoked, it could be a danger to career progression of MPs – Bagbin

30 minutes -

Over 100 SOEs comply with Mahama’s audited accounts directive- SIGA

39 minutes -

Government to undertake massive retooling of Police Service – Mahama

41 minutes -

Over GH¢80m mobilised by MMDAs in first quarter of 2025

44 minutes -

Urgently resolve the nurses and midwives strike to save lives – CSOs to gov’t

59 minutes -

Let your conduct reflect high esteem of Parliament -Speaker Bagbin urges MPs

1 hour -

Police intercept trucks carrying 150 bags of Indian hemp

1 hour -

GNAT leadership pays courtesy visit to Mahama

1 hour -

Education Minister seeks Qatar’s support for Islamic Medical School in Northern Ghana

1 hour -

Global oil prices soar after Israel attacks Iran

2 hours -

More than 130m children were engaged in child labour in 2024 – ILO, UNICEF

2 hours