Vice President of IMANI Ghana, Bright Simons, has revealed that three groups representing individual bondholders have commenced mobilisation to file legal suits against the government for including individual bondholders in the Debt Exchange Programme.

According to him, one of such groups is led by a former boss of the Securities and Exchange Commission (SEC).

The Finance Ministry had earlier cautioned individual holders of eligible bonds who refuse to take the Amended and Restated Exchange Memorandum under the Debt Exchange Programme provided by the State that they will find it difficult to obtain a judgement against the Government of Ghana.

Under a caption labelled “Enforcement of Civil Liabilities” in the 58 page Amended and Restated Exchange Memorandum to individual bondholders, Finance Minister, Ken Ofori-Atta emphasised that since Ghana is a sovereign state, any legal action taken by bondholders against the country would be difficult to materialise.

“The Republic of Ghana is a sovereign state. Consequently, it may be difficult for Eligible Holders of Eligible Bonds to obtain or realise awards against the Republic”.

“The Republic has submitted to the jurisdiction of the courts of Ghana and waived any immunity from the jurisdiction (including sovereign immunity) of such courts in connection with any action arising out of or based upon the Invitation to Exchange or any securities issued under the Invitation to Exchange brought by any holder of such securities,” it added.

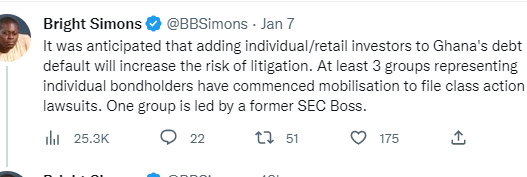

But in a tweet, Mr. Simons said “it was anticipated that adding individual/retail investors to Ghana’s debt default will increase the risk of litigation. At least 3 groups representing individual bondholders have commenced mobilisation to file class action lawsuits. One group is led by a former SEC boss.”

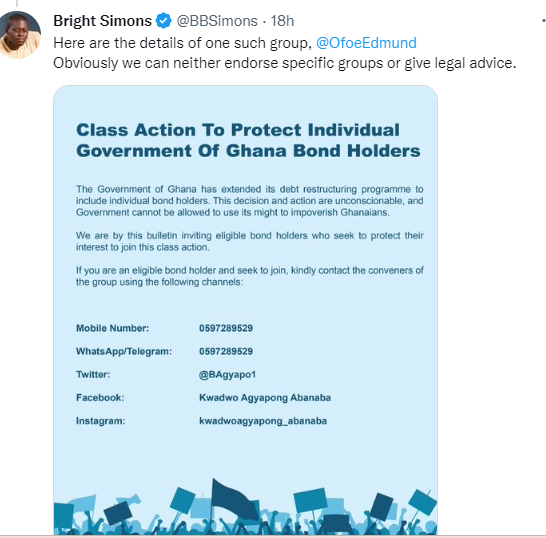

“Here are the details of one such group, @OfoeEdmund. Obviously we can neither endorse specific groups or give legal advice”, he added.

The Finance Minister on December 5, 2022 announced a Domestic Debt Exchange programme to restructure the country's debt which had reached unsustainable levels.

It initially excluded individual bondholders, but after stiff opposition from labour which led to their exclusion, government included retail bondholders.

Latest Stories

-

Police exhume multiple human remains in Central Tongu shrine

2 hours -

Ramaphosa opposes Trump’s 30% tariff on South Africa

3 hours -

First malaria treatment for babies approved for use

3 hours -

Alcaraz masterclass ends Norrie’s Wimbledon hopes

3 hours -

TOR throws light on premix composition amid sector reforms at stakeholder engagement

3 hours -

TOR dismisses claims of unchecked fuel dispatches, highlights strict multi-agency verification process

4 hours -

MPs vote to establish independent regulator for men’s football in England

4 hours -

Ghana abstains from UN vote on LGBTQ+ rights amid push for criminalisation

4 hours -

Jota’s car was probably speeding before fatal crash, Spanish police say

4 hours -

CJ’s powers too excessive, prone to political abuse – Prof. Prempeh calls for urgent reforms

4 hours -

Mahama inaugurates committee to oversee handover of UGMC to UG

4 hours -

Joao Pedro double sends Chelsea into Club World Cup finals

4 hours -

Former Arsenal sporting director Edu joins Nottingham Forest

5 hours -

KNUST Animal Science Dept trains experts to enhance poultry productionin Ghana

5 hours -

Newmont Ahafo South mine allocates $34m for road construction between 2025 and 2028

6 hours