Audio By Carbonatix

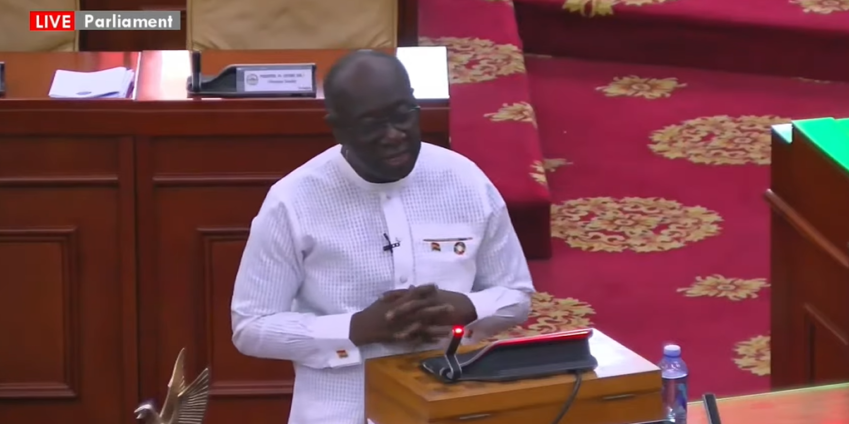

The Finance Minister, Ken Ofori-Atta has underscored the importance of the controversial Domestic Debt Restructuring Programme (DDEP).

The Minister says the programme has provided the government with an increased fiscal flexibility.

Delivering the 2023 Mid-Year Budget Review in Parliament on Monday, July 31, Ken Ofori-Atta also said the DDEP has also helped the government address its cash and other liquidity constraints.

He thus thanked all bondholders who participated in the programme.

“After three (3) months of negotiations with the different bondholder groups and amendments to the original terms, government successfully completed the DDEP on 14th February.”

“Total bonds outstanding at the settlement date amounted to GH¢126,978.5 million, of which GH¢29,286.2 million were held by Pension Funds, bringing the total eligible bonds to GH¢97,749.6 million. The Ministry received final participation of GH¢82,994.5 million, representing 84.9 percent of total eligible bonds.”

“The DDEP has provided the government with increased fiscal flexibility and addressed cash and other liquidity constraints. Once again, we are grateful to all investors who participated in this exchange,” he said.

Meanwhile, he also reiterated the government’s commitment to embarking on further engagements on another round of the DDEP.

“Mr. Speaker, to complete the domestic debt operations, government announced in April 2023 its intention to further pursue the discussions around the following domestic debt instruments which were excluded from the DDEP perimeter.

Following the government’s decision to seek a bailout from the IMF, the Bretton Woods Institution set conditions for the government to meet.

Key amongst these conditions was for the government to bring its skyrocketing debt level under control.

Due to this, the government embarked on a debt exchange programme with its foreign partners and local bondholders.

Even though it faced a stiff resistance from the local front, the government successfully secured over 85% participation.

Latest Stories

-

Two women granted bail over assault of 12-year-old; another remanded

2 hours -

Bellingham responds to partying claims with ‘joke’ drinking celebration

4 hours -

US opens priority visa appointment system for World Cup

4 hours -

Jellyfish-inspired outfit steals show in Osaka win

4 hours -

Victorious Sinner sees ‘room to improve’ on serve

4 hours -

Bournemouth sign midfielder Toth for £10.4m

4 hours -

Marseille in talks with Arsenal over Nwaneri loan

5 hours -

Bodo/Glimt stun Man City in Champions League

5 hours -

Slot hints Salah will start for Liverpool in Marseille

5 hours -

Mbappe punishes old club Monaco as Real Madrid hit six

5 hours -

Jesus stars as Arsenal beat Inter Milan in landmark win

5 hours -

Adabraka gold heist: Police arrest alleged gang leaders as arrests rise to seven

5 hours -

Taxi driver killed as cop’s gun goes off in Weija – Officer hospitalised, police launch probe

6 hours -

NDC opens nominations, sets February 7 for Ayawaso East parliamentary contest

6 hours -

Ex-president accused of murder plot expelled from Togo to Burkina Faso

6 hours