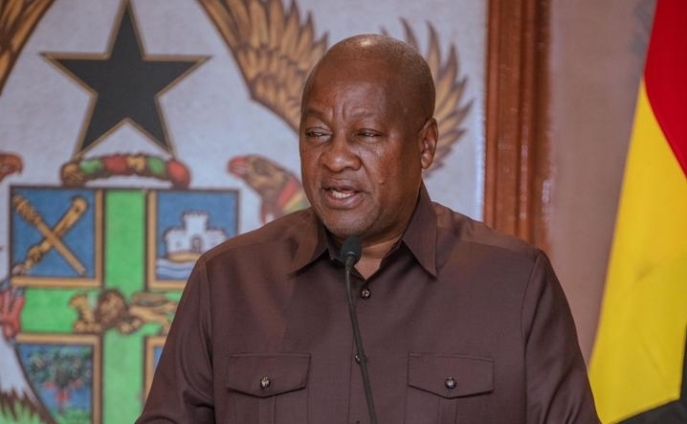

President John Mahama has directed the Ministry of Finance to settle outstanding Domestic Debt Exchange Programme (DDEP) coupons and build a financial buffer through the Sinking Fund.

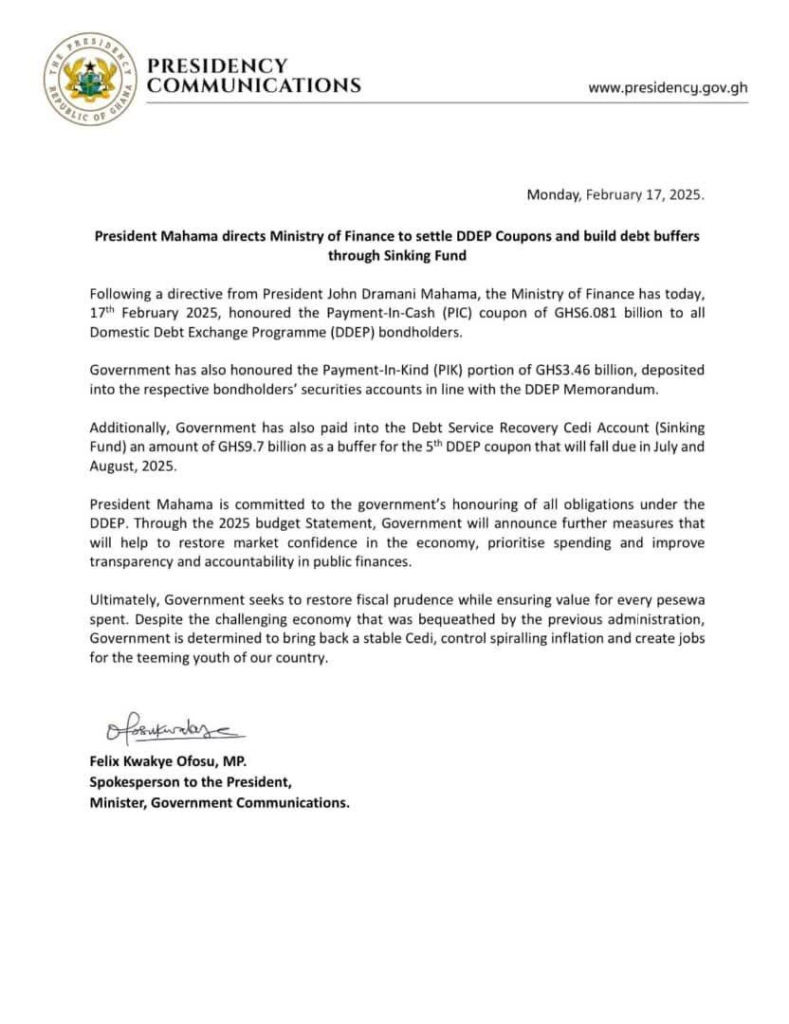

In line with this directive, the Ministry of Finance has on Monday, February 17, disbursed a Payment-In-Cash (PIC) coupon of GH₵6.081 billion to all DDEP bondholders. Additionally, a Payment-In-Kind (PIK) portion of GH₵3.46 billion has been credited to bondholders’ securities accounts, in accordance with the terms outlined in the DDEP Memorandum.

To further strengthen the country’s debt management strategy, the government has also deposited GH₵9.7 billion into the Debt Service Recovery Cedi Account (Sinking Fund). This move is intended to serve as a buffer for the next five DDEP coupon payments due in July and August 2025.

President Mahama reaffirmed his administration’s commitment to fulfilling all obligations under the DDEP while working to restore confidence in the economy.

He indicated that the upcoming 2025 Budget Statement will outline additional measures aimed at ensuring fiscal discipline, prioritising spending, and enhancing transparency in public financial management.

The government is focused on stabilising the cedi, controlling inflation, and creating jobs, despite the economic challenges inherited from the previous administration. By implementing prudent fiscal policies, the Mahama-led administration aims to restore macroeconomic stability and ensure value for every pesewa spent.

Latest Stories

-

Trump’s call with Putin exposes shifting ground on Ukraine peace talks

2 hours -

If not for Gold-for-Oil, our economy would have collapsed – Bawumia

2 hours -

‘NDC has no policy behind cedi gains’ – Bawumia dismisses opposition credit for currency stability

2 hours -

US Supreme Court lets Trump end deportation protections for 350,000 Venezuelans

3 hours -

IGP orders raid on illegal mining hub at Wassa Gyapa after JoyNews reports

3 hours -

Russia and Ukraine to ‘immediately’ start ceasefire talks, says Trump

3 hours -

France to open high-security prison in Amazon jungle

3 hours -

Gary Lineker: A sorry end to a BBC career

4 hours -

Lineker to leave BBC sooner than planned after antisemitism row

4 hours -

Nigerian judges endorse Ikot Ekpene Declaration to strengthen digital rights protection

4 hours -

Call for load shedding timetable misplaced; power generation meets peak demand – Energy Ministry

4 hours -

Cedi records 17.17% appreciation to dollar; one dollar going for GH¢13.50

4 hours -

Interplast named among Financial Times’ fastest-growing companies in Africa

5 hours -

GPRTU to reduce transport fares by 15% effective May 25

5 hours -

Ghana Alphas, Tau Alpha Lambda donate to Abeadze State College

5 hours