The fiscal and monetary measures to cushion impact of COVID 19 has so far been guided by sector-based considerations.

The justification for this approach is not without cause given that consumer demand, particularly in the services sector, have proven more elastic than others.

Take for instance, travel and tourism – it has been hardest hit due to the low traffic volumes caused by onslaught of COVID 19.

The impact has been revenue decline and unemployment. Notwithstanding, it is important to also draw attention to other exposed sectors which employ majority of persons considered vulnerable or poor, in this case, those who get by on less than GH4.8 worth of meals per day.

According to Ghana Living Standards Survey (Round 7), 23.4 percent of Ghana’s population fall within this bracket.

The urgent policy discussion now is twofold (1) how do we locate these persons, and (2) what kind of intervention would enable them generate decent levels of income to cover their basic needs – food, water and shelter?

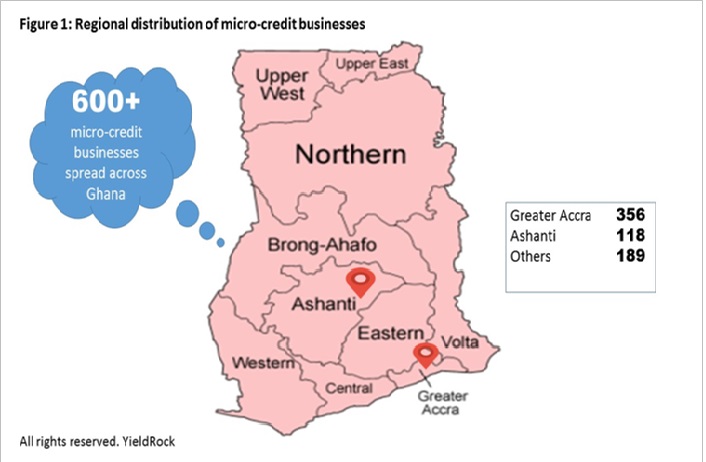

Micro-credit may be the answer - not only as a channel to reach the vulnerable but a mechanism to promote productive inclusion. Figure 1 shows that regional distribution of micro-credit businesses in Ghana.

Productive inclusion, unlike social protection, ensures that capital deployed for purposes of assisting the poor is channeled into productive economic activities that have measurable outcomes.

By close of FY 2019, an estimated amount of GH¢370 million had been disbursed to over 84,800 beneficiaries by some 600+ micro-creditors spread across all districts in Ghana. All districts – that’s an important point to note.

Note only does micro-credit have reach, but it also possess the risk management capabilities to ensure funds are repaid back into government chest.

Another point of interest to note, is that, at the bottom of the pyramid, female borrowers outnumber their male counterparts by a factor of two.

This is good news for policy makers, considering the emerging trail of evidence in development literature which suggests that female economic empowerment is one of the key covariates of poverty.

To put it simply, when mummy earns income, the family is taken care of. This essentially summarizes the business case for a micro-credit fund to support the millions of traders, chop bar operators, mechanics and shoemakers, who may also feel the adverse impact of COVID 19.

The situation is even more urgent considering the slowdown in funds flow from the top tiers of the financial sector to those at the base.

Market intelligence shows that banks and other NBFIs in tier 1 that hitherto supported micro-credit operators through on-lending facilities, have now adopted more stringent credit policies which limit their exposure to the sector. As a result, the demand for liquidity at the base of the pyramid cannot be overemphasized.

Obviously, there may be genuine concerns about weak corporate governance systems, poor lending practices and managerial inefficiencies.

But it is exactly why I believe the current business environment presents a door of opportunity for the Ministry of Finance and Bank of Ghana to engage the Micro-credit Association in order to fashion out implementation mechanisms that sorts out the strong institutions from the weak ones, and to further create incentives for the weak ones to shape up or ship out. We can kill several birds with one stone. A fund for micro-credit sector is an urgent policy matter.

Latest Stories

-

Expansion Drive: Takoradi Technical University increases faculties

4 hours -

SHS heads demand payment of outstanding funds before reopening of schools

5 hours -

We thank God for the 2024 general elections – Akufo-Addo

5 hours -

Coconut Grove Beach Resort marks 30 years of excellence with memorable 9 lessons & carols service

5 hours -

WAFU B U-17 Girls’ Cup: Black Maidens beat Nigeria on penalties to win inaugral tournament

6 hours -

Real Madrid beat Sevilla to keep pressure on leaders Atletico

7 hours -

Liverpool put six past Spurs to go four points clear

7 hours -

Manchester United lose 3-0 at home to Bournemouth yet again

7 hours -

CHAN 2024Q: ‘It’s still an open game’ – Didi on Ghana’s draw with Nigeria

7 hours -

CHAN 2024Q: Ghana’s Black Galaxies held by Nigeria in first-leg tie

8 hours -

Dr Nduom hopeful defunct GN bank will be restored under Mahama administration

9 hours -

Bridget Bonnie celebrates NDC Victory, champions hope for women and youth

9 hours -

Shamima Muslim urges youth to lead Ghana’s renewal at 18Plus4NDC anniversary

10 hours -

Akufo-Addo condemns post-election violence, blames NDC

10 hours -

DAMC, Free Food Company, to distribute 10,000 packs of food to street kids

11 hours