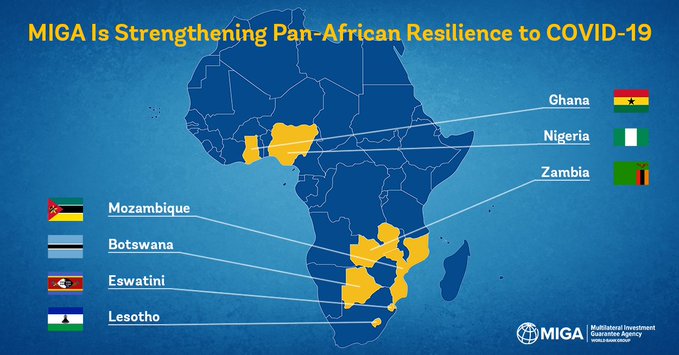

Ghana, together with six other African economies severely impacted by Covid-19 have been named beneficiaries of a World Bank Group capital relief project.

A member of the World Bank Group, Multilateral Investments Guarantee Agency (MIGA), issued the guarantees of up to $235 million to a wholly-owned subsidiary of South Africa’s FirstRand Group, for a period of up to 15 years.

It is the second capital relief project by MIGA meant to help strengthen the economies of beneficiary countries severely impacted by the coronavirus crisis.

MIGA is known for providing risk insurance and credit enhancement.

The guarantee covers the subsidiaries’ mandatory reserves held as per regulatory requirements in Ghana, Botswana, Eswatini, Lesotho, Mozambique, Nigeria, and Zambia.

This will help unlock funding and liquidity, and support the economies of the host countries, which are being severely impacted by the COVID-19 pandemic, particularly in the commodities markets.

Nearly 60 percent of the support provided by the MIGA guarantees will be directed to low-income IDA countries, and twelve percent will go to Mozambique, a country recently affected by conflict.

The global outlook remains weak due to the COVID-19 crisis.

Excluding Ghana and Mozambique, economic growth of the remaining five beneficiary economies are entering negative growth in 2020, though economic growth is projected to contract in all these countries.

Banks are facing increased pressure to optimize capital allocation and reduce risk exposures.

“Our support for a key regional bank that is helping weather the fallout from the global pandemic across seven countries in Sub-Saharan Africa is timely and essential,” said MIGA Executive Vice President, Hiroshi Matano.

He continued, “MIGA guarantees will help build resilience within the countries through the continued supply of credit. For the longer term, our support will help lay the foundations for credit growth and employment.”

MIGA’s capital optimisation product reduces the risk-weighting of the subsidiaries’ mandatory minimum reserves on FirstRand’s balance sheet.

FirstRand will use the freed-up capital to sustain the lending activities of its subsidiaries.

“MIGA’s capital optimisation product is particularly important now, given the stresses in many of the economies in which we operate on the African continent. In particular, it enables the availability of capital to support these economies through continued lending,” said Andries du Toit, FirstRand Group Treasurer.

MIGA’s support also entails providing assistance to the subsidiaries through the implementation of FirstRand’s updated Environmental and Social Management Systems (ESMS) and other policies related to MIGA’s Performance Standards.

This will improve the subsidiaries’ current environmental and social risk management practices.

Latest Stories

-

Indian Prime Minister Modi commits to stronger ties with Ghana

7 minutes -

NSMQ 2025: Berekum Presby pulls off last-gasp comeback to stun Techiman, reaches zonal finals for first time in 7-years

21 minutes -

Anglogold Ashanti Obuasi mine outlines a 5-year ‘Make Obuasi Great Again’ vision

23 minutes -

Useless Column: I’m Suspecting My Wife

29 minutes -

Amelley Djosu: Edem’s ‘Toto’, parliament and the politics of misunderstood art

57 minutes -

Sam George vows to secure DSTV price reduction

1 hour -

Government sets final deadline for NGIC 5G rollout amid delays

1 hour -

WAFCON 2024: Four Black Queens players to watch at continental showpiece

2 hours -

Kuami Eugene names favourite Ghanaian actors, bemoans absence of Ghanaian films on streaming platforms

2 hours -

Asante Kotoko pay tribute to deceased Liverpool star Diogo Jota

2 hours -

NPP rejects Ablekuma North re-run; vows to challenge case in court

2 hours -

Once upon a time in Ghana

2 hours -

TEWU declares strike over union representation in public universities

2 hours -

Ghana to host 2025 Global Entrepreneurship Festival – Samuel George

2 hours -

Ghanaian teenager Emmanuel Boansi wins Georgian Super Cup

2 hours