On Sunday this week, the President of Ghana mounted the soapbox to calm nerves in his frazzled and bewildering country.

For months, soaring inflation (at near 40%) and a currency in free fall (50%+ depreciation against the US dollar this year) have been triggering controlled panic across the country. Yet, the President had studiously refused to comment substantively on the crisis in public.

To crown the confusion, he decided five weeks ago to embark on a tour of his political strongholds to “call on traditional authorities, commission a number of projects, and cut the sod for the commencement of new projects”. This bizarre decision to feign normality despite the escalating volumes of complaints and cries of anguish was widely used as further evidence of a presidency that has grown so aloof, so cocooned in a bubble of sycophancy, that reality simply can no longer penetrate. Surely, had the president any advisors left, whose counsel he respected, they would have cautioned him about how out of step the idea of a triumphant tour at this time was?

How the Bubble Burst

As anyone could have predicted, the tour was dogged by spectacles of booing crowds and unnecessary controversies sparked by some of the “traditional authorities” he visited. But the worst was yet to come. Incensed by the President’s claims that calls for him to sack some of his Ministers, whose performance he described as “excellent”, were induced by sheer ill-will, ruling party members of parliament (MPs) revolted. His own camp had finally had enough.

A group composed of more than 80 of the 138 ruling party MPs in the evenly split Parliament threatened to torpedo all government business unless the President sacked his Minister of Finance and the Minister’s right-hand man forthwith. Apparently, the MPs had been demanding this for weeks on the quiet but had been rebuffed at every turn. Finally, the thick cocoon encasing the president seemed to crack. His minders, scampering to regain some foothold, promised a big speech on the economic crisis.

So, on Sunday, he came on TV and did his thing as best as he could. Many Ghanaians were underwhelmed, though appropriate uses of humour at various points in the speech appear to have chimed with the Ghanaian style of not taking anything too seriously.

When I got my copy of the speech, ahead of an appearance on one of Accra’s main news networks, I leafed through with great anticipation, expecting a revelation. There was none of note. But three issues triggered me a bit and inspired the thoughts that I shared on TV the day after. I will reproduce them here for readers of this website.

“Ownership” is still a Problem

One way to sum up the management of the ongoing economic crisis in Ghana so far is that at every major crossroads in a maze of increasing chaos, the government has made the wrong call and chosen the worse turn.

First was a decision in mid-2021 after having raised $3 billion in March of that year, under tight global market conditions, to return to the markets a few months later for an additional $2 billion. The decision spooked investors who began to sense fiscal adventurism. A growing buzz of negative vibes started to ripple through the markets. In October, Ghana abandoned the plan as spreads on the country’s Eurobonds started to rise, suggesting increasing unease in the market. I started to observe a spike in Ghana-critical analyst reports around this time. Mind you, no negative ratings actions had occurred by this time.

With the spotlight suddenly turning on Ghana’s fiscal situation, the government chose to take a budget packed with some pretty contentious policies to the polarised hung Parliament. Even when the Opposition relaxed their objections to most of the items in the budget except the most controversial of them all, the ill-fated e-Levy, the government refused to make the necessary concessions. It clung on to the e-Levy throughout, despite consistent analyst feedback suggesting the tax was far from the silver bullet it was being made out to be, and almost universal opposition from civil society and citizen groups.

After burning precious goodwill and political capital, and generating even more market anxiety, the government managed eventually to pass the e-Levy. But at the price of a major ratings downgrade by Moody’s in February 2022, to CAA1, firmly in junk territory. Despite Moody’s action is wholly consistent with the timbre of market sentiment at that time, the government chose, rather bizarrely, to mount an attack on the individual rating analysts who had issued the opinion.

By this time, calls had begun to mount for Ghana to head for the IMF. With the country shut out of the international capital markets, investors continuing to dump the country’s bonds, severe fiscal pressures, and growing signs of a balance of payments crisis, the government’s posture of dismissing the IMF out of hand was startling in its incoherence. Some government ministers even went as far as to denigrate the IMF option as fit only for incompetent economic managers. Finally confronted with the stark reality of zero options, the government beat a retreat and scampered to the IMF.

The point of the above chronology is to emphasise the strong tendency of the government of Ghana to make the wrong bets and calls when faced with a strategic dilemma. Choices appear to be frequently motivated by grandstanding than by hard and cold calculation. At the root of this romantic approach to statecraft is the government’s inordinate sense of self, buoyed as it is by a culture of powerful political leaders rarely hearing the hard truth from those closest to them and inclined therefore to believe that all critical viewpoints emanate from implacable foes best ignored. Facts are heavily filtered to construct well-curated narratives for believers only, the rest be damned.

In the resulting version of reality, as constructed for the current ruling elite in Ghana, the country was sailing tranquilly on the waters of paradise until the pandemic struck in early 2020 and was on the verge of total and glorious recovery from even the pandemic until the tragic Ukraine episode erupted. In this narrative, Ghana is simply the pious innocent massacred by savage global currents from under which its blameless government continues to toil diligently to extricate its fate.

Mauling Facts to Suit a Narrative

Not surprisingly, the President of Ghana spent quite some time in his Sunday speech regurgitating the government’s mantra of the Ukraine crisis having created a world of total catastrophe in which Ghana’s plight is far more tolerable than that of its neighbours. For instance, in his account, whilst inflation, since 2019, in Togo has risen by 16 times and in Senegal by 11 times, Ghana has managed to get by with only a five-fold increase.

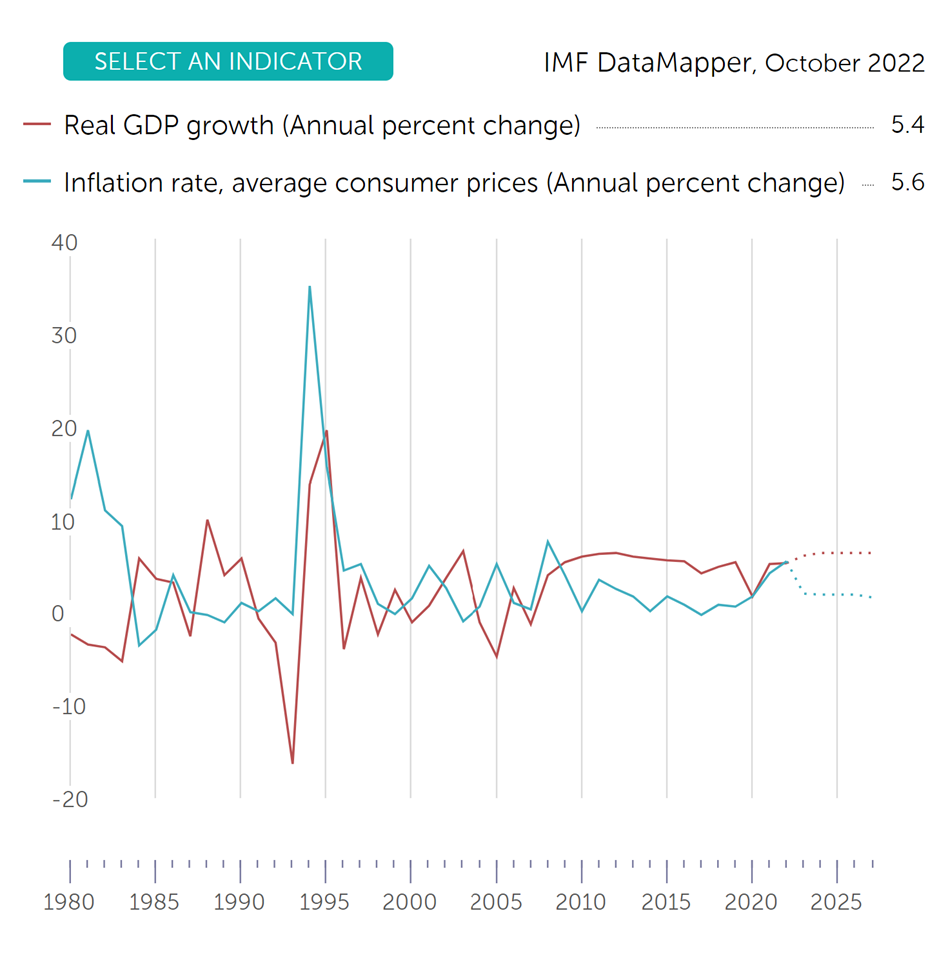

This is of course untrue. Inflation numbers are some of the most widely reported worldwide and the IMF, in its official global macroeconomic surveillance function, studiously monitors trends. Below I have provided the latest IMF data.

Togo

From a 2019 average rate of 0.7% to a 2022 average rate of 5.6%

From a 2019 average rate of 1.8% to a 2022 average rate of 7.5%

Beyond the factual negligence, which of course does not speak well of a major presidential speech screened by the government’s leading lights, there is a serious lack of analytical rigour. Inflation in Togo (5.6%) and Senegal (7.5%) bouncing up and down within the single-digit zone, and just 2.6% and 4.5% above the target of Francophone West Africa’s Central Bank (BCEAO), can certainly not be compared to Ghana’s situation. Not when inflation in Ghana is at more than 37%, and thus hovering nearly 30% above the Central Bank’s target. And certainly not when “cost of living impact” is the primary reason for the comparisons in the first place.

At any rate, why select CFA-area countries where inflation is usually so low, to begin with that per cent-on-per cent changes in inflation are likely to exaggerate the real effect on incomes, expenses and price changes?

Why not any of the many countries in Africa where the baseline inflation rate tends to be closer to Ghana so that per cent-on-per cent changes could translate to similar price effects and thus impact on expenditure and income?

For example:

Nigeria, where inflation has moved from 11.9% in 2019 to 17.4% today, using the President’s speechwriters’ preferred methodology?

Kenya, where inflation has moved from 5.4% to 7.7%?

Uganda, where inflation has moved from 2.85% to 10%?

Zambia, where inflation has moved from 9.15% to 9.9% (and in fact has dropped from 22% in 2021)?

Isn’t the fact that Ghana, with its inflation figure of 37% (annual average of 32%) and climbing, is today only behind Zimbabwe and Sudan in terms of absolute inflation numbers a more salient, and dare I say important, a fact to chew on?

Global vs Local

But this is not just about quibbling over some wonkish numbers. It goes to the heart of credibility in different ways. In one respect, it reinforces concerns about the lack of ownership of the crisis. The government’s continued spinning around the fact that its missteps and miscalculations have contributed significantly to the crisis makes it difficult to trust it to reverse course on those tendencies exacerbating the crisis. It puts to doubt the quality of any fiscal adjustment program, including the planned IMF one. In another respect, such relenting spinning backs perceptions that the government will always favour convenient scapegoating and rhetorical gymnastics over building trust.

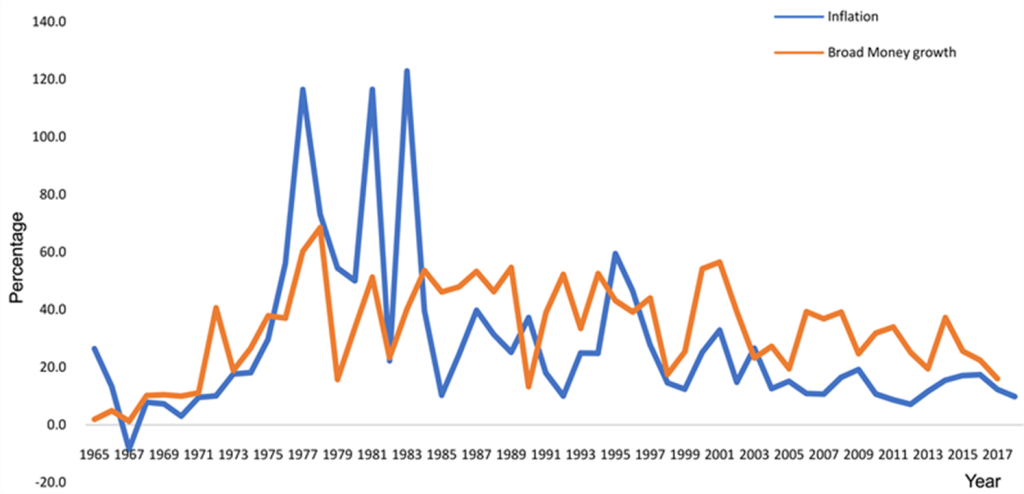

For example, researchers at home and abroad have long established a strong correlation between money supply and inflation in Ghana. The finding is robust under standard cointegration and unit root controls, simply meaning that it is not spurious but rather reliable.

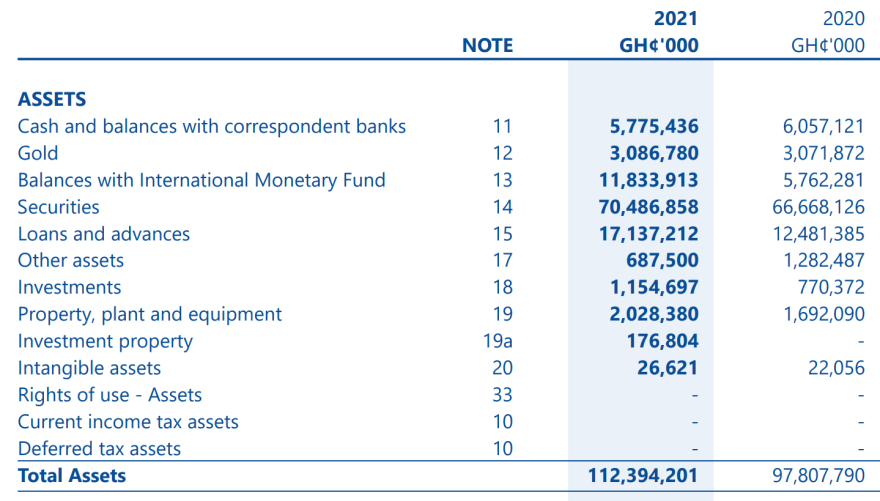

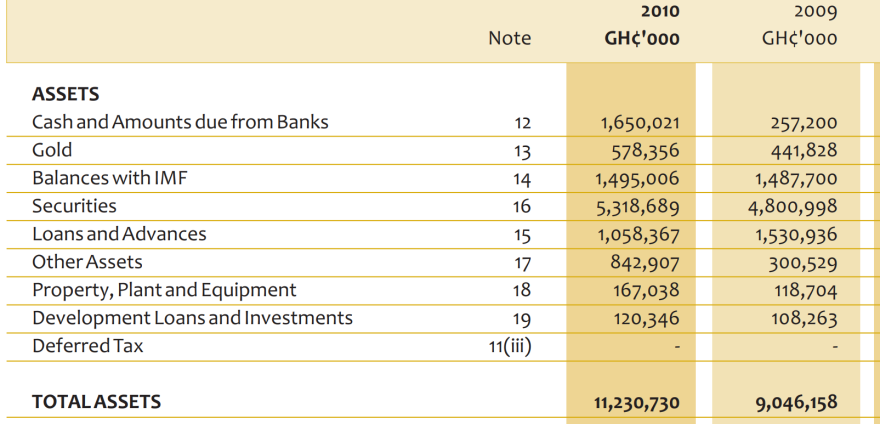

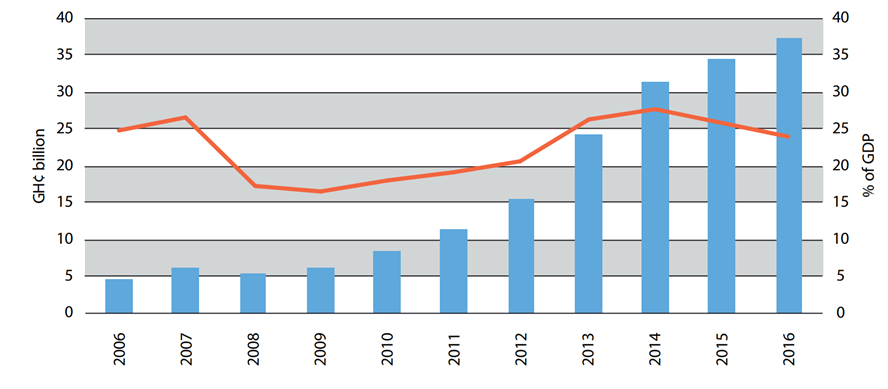

The Bank of Ghana’s increasingly accommodative stance towards unprecedented fiscal looseness on the government’s part is easily seen by the massive expansion of its balance sheet from 10% of GDP to nearly 20% of GDP over the last decade. By binge-buying government securities, especially in recent months, and advancing large loans to the government, it condones considerable fiscal recklessness. It is important to bear in mind that unlike households, firms, and even banks (fractional reserve banking notwithstanding) the Bank of Ghana undertakes virtually no productive activities and thus an expansion of its balance sheet is tantamount to creating money out of thin air.

The celebrated growth of the domestic debt securities market (Ghana Fixed Income Market – GFIM), reputedly the fastest growing in Africa, merely rides on the back of a government debt binge facilitated by the central bank.

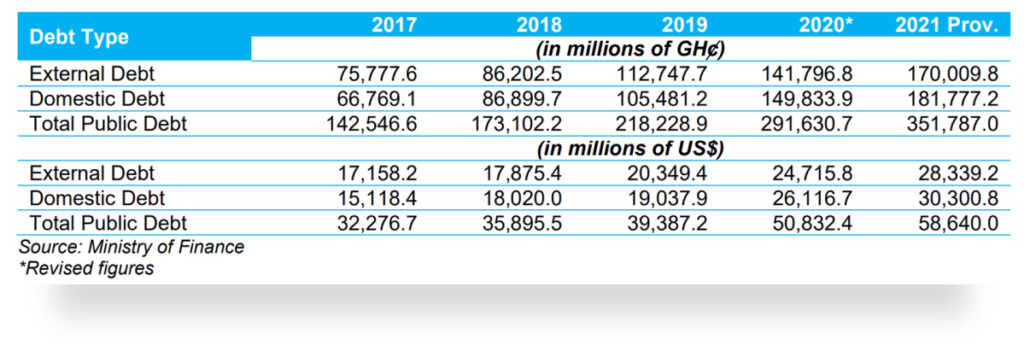

It bears remarking that for a decade, the domestic proportion of domestic debt stayed in the 25% range until exploding in 4 years to almost 40% of the total. Whilst foreign debt expansion was also massive in absolute terms, it is evident that large portions of the dollars borrowed externally propped up a massive growth in Cedi borrowing without the effects being felt in the exchange rate and inflation. Now that those anchors have been removed, the real extent of fiscal looseness in the last 5 years is plain for all to see.

No one disputes the contributory role of the global energy crisis and supply chain reconfigurations linked to the tragic Ukraine – Russia conflict in the inflationary spiral in Ghana. However, these effects have been relatively uniform around the world. So, where it is clear that Ghana’s situation is significantly worse than peer countries, it is only basic logic for serious leaders to look critically at the idiosyncratic domestic factors at play.

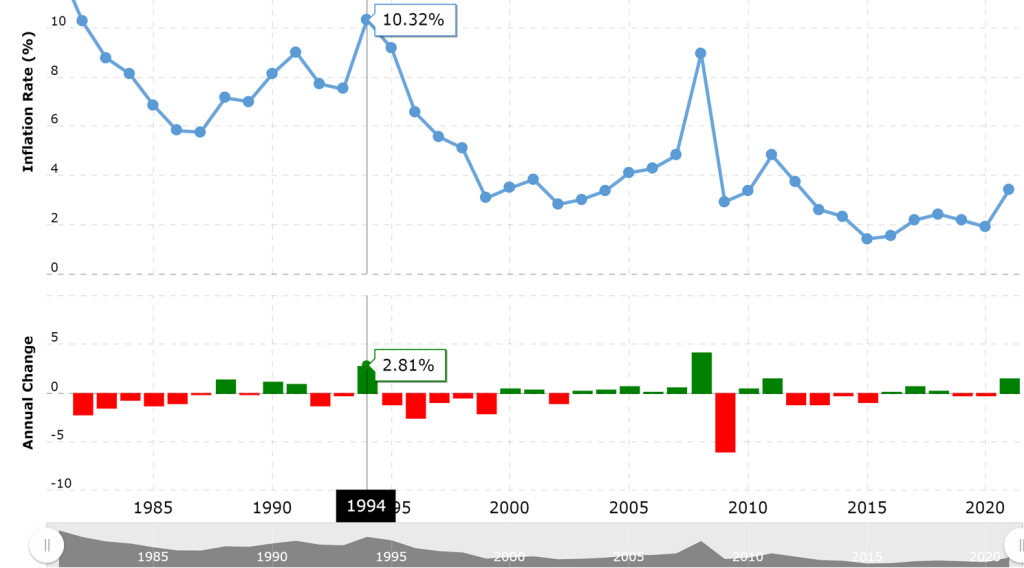

In fact, every major inflationary spiral Ghana has seen in the last 30 years had significant global inputs as easily discerned in the growth below.

The famous 1994 spike was the backdrop to the 1995 kumepreko demonstrations in Ghana. The 2008/2009 spike (triggered by the deepest global financial crisis in the last 30 years) coincided with the domestic power crisis and other downturns that led to the country’s return to the IMF. And, of course, the resurgence of external pressures in 2012-2013 had a role in the country’s 2014 request for another IMF program. But in every one of those episodes, domestic actors and commentators were right to also point to the important contributory role of national policy. Except, apparently, if government spokespersons are to be believed, in the present.

The IMF Salvation Hymn

As regular readers of this site must now be well aware, Ghana’s debt is likely to be declared as unsustainable by the IMF.

Per IMF policies, a country with unsustainable debt must propose a credible strategy to bring the debt back onto a sustainable trajectory. Because Ghana, already the largest IMF borrower in the IMF Africa region (which excludes North Africa) is requesting a whopping $3 billion of IMF money which will take its utilisation of IMF resources from the current 200% to 500% of its quota, its request should normally attract what the IMF calls, “heightened scrutiny”.

On the plus side, Ghana has maintained excellent relations with the IMF for a long time. The balance of these pros and cons is that whilst the IMF will do what it can to speed up the process, it is entirely up to Ghana to provide a credible plan to bring its debt back onto a sustainable trajectory.

As a matter of IMF policy, a plan for dealing with debt unsustainability must also be fiscally sustainable.

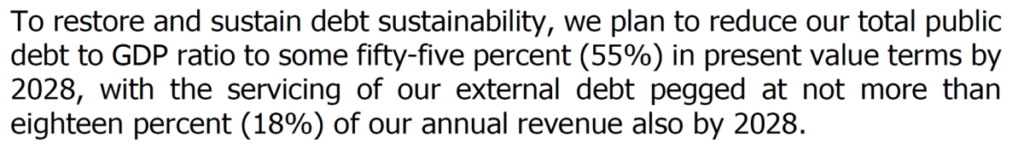

In the light of the above, the President provided the highlights of the plan submitted to the IMF in his Sunday speech. Two themes are the most important.

Both statements left analysts perplexed.

The Minister of Information, on a whirlwind tour of media houses, attempted to suggest that these plans have already been informally accepted by the IMF (“low-level agreements” as he called them).

The basis of analysts’ perplexity is that whilst a medium-term debt trajectory computation is always part of any Debt Sustainability Analysis (DSA) conducted in expectation of an IMF program, where it is clear that debt restructuring is the only fiscally sustainable path to restoring balance, the restructuring event itself must bring immediate relief in the short-term else a subsequent one will inevitably follow.

It would be completely ridiculous if the government’s plan is to undertake a restructuring process that spans 6 years. The point of a debt restructuring is an upfront adjustment that resets the trajectory towards medium-term sustainability (meaning that the downward slide in total debt stock and how much is spent servicing it does not reverse after a short term but persists until a stable lower equilibrium is reached and maintained in the medium term).

The Information Minister’s explication of the 6-year plan appears to suggest a different strategy in which the debt is tackled slowly year after year. Unfortunately, a debt restructuring is indeed an event as well as a process. There must be point in time when the default (change in the original terms of the debt) happens and if that initial default is sizable enough, then the ripple effects reset debt to a stable path not easily reversible to unsustainability in the short-term.

Since the Information Minister mentioned the Jamaica case, it is worth looking briefly at it.

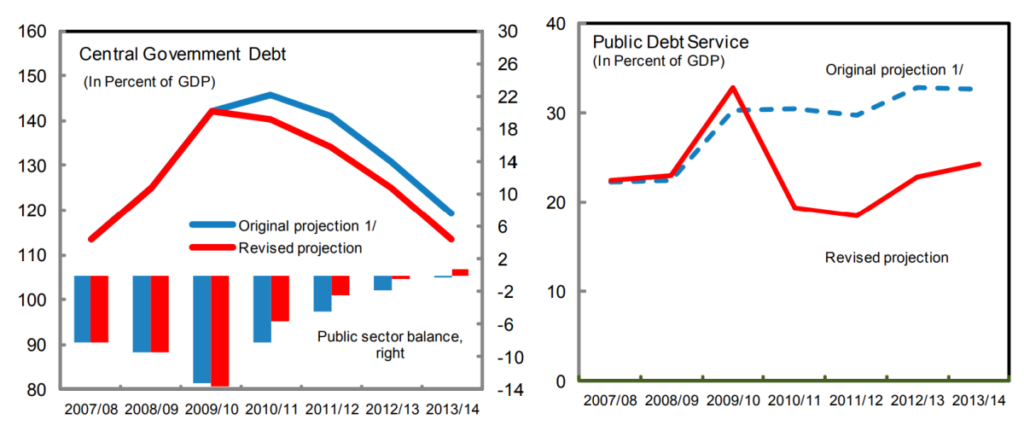

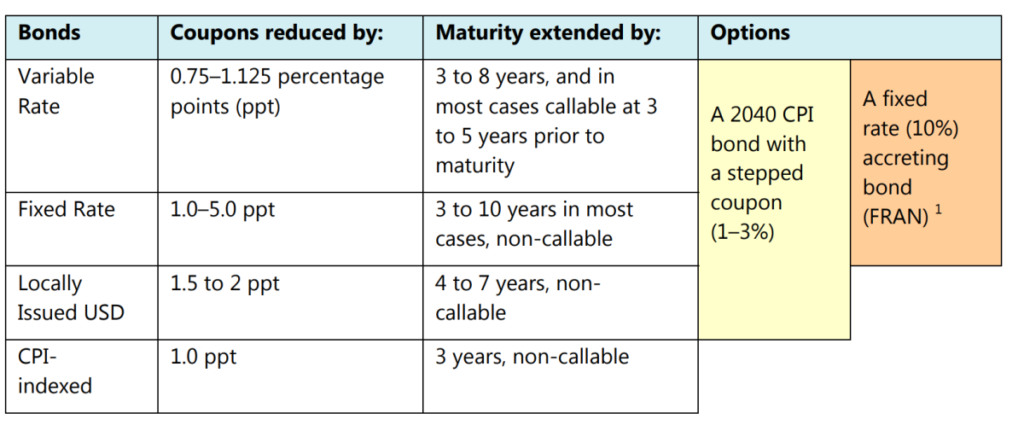

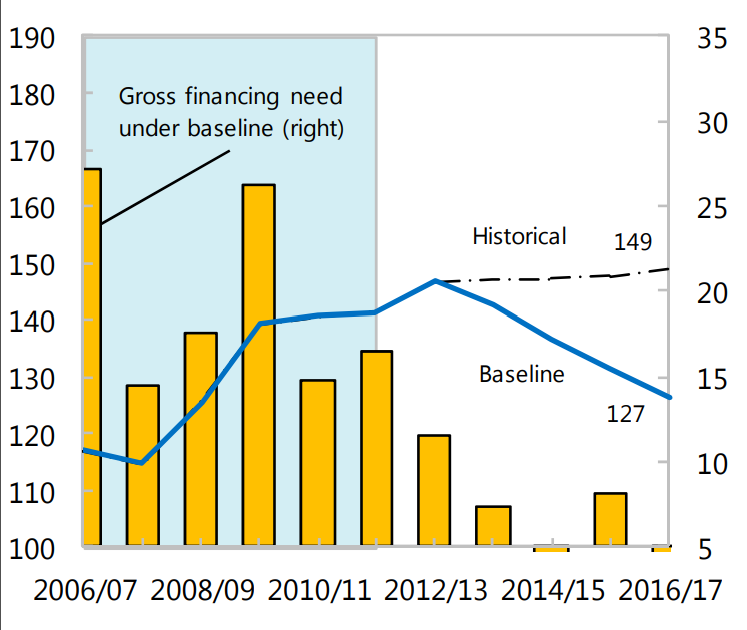

Jamaica attempted restructuring in 2010, with the results displayed in the charts below.

It is evident that in each parameter (total debt as well as share of national income used in servicing the debt) there is a sudden cliff which represents the debt restructuring event after which post-default management sets in to stabilise the outcome to some desired medium-term equilibrium. The debt service (how much the country pays in interest and principal repayments per year) is particularly noteworthy. The reader will note an attempt to bring down the 35% debt service to GDP number to something below 20% in the immediate aftermath and curtail further growth in the medium term.

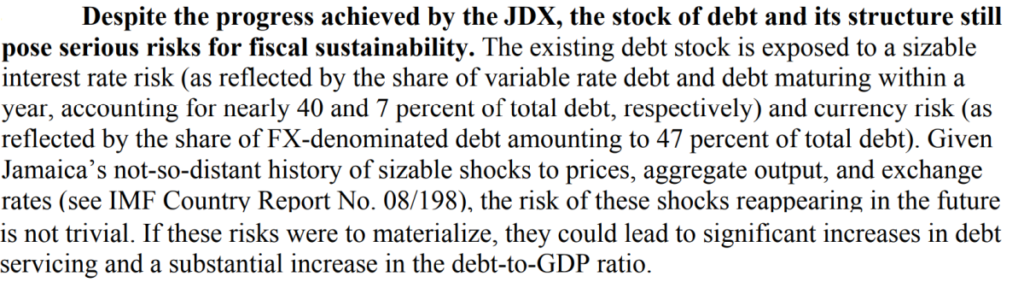

Equally revealing is the maturity profile of the country’s debts before the debt restructuring event (pre-JDX) and immediately afterwards (post-JDX).

The reader will also notice that some reversals of gains were evident in both the debt trajectory and the maturity profile of debt. Not surprisingly, Jamaica had to do a second restructuring because the relief offered in the first instance was simply insufficient. Crucial to understanding this point is the knowledge that Jamaica chose to avoid principal haircuts, as Ghana plans to do. It opted to extend the maturity of debt securities and reduce coupon payments where possible but simply did not go deep enough.

As the IMF, which had provided resources to assist Jamaica navigate these difficult times, noted, Jamaica’s shallow restructuring strategy was not fiscally sustainable.

On February 12th, 2013, the Caribbean country launched a second restructuring program with heftier coupon haircuts and maturity extensions as below.

Useful to note that the entire process took 9 days to cover 97% of creditors. And the effect was felt in the immediate aftermath. The government’s borrowing needs declined by almost 30 percentage points.

In view of the above, if the government’s chief spokesperson says the government wants to use the Jamaican playbook then the following inferences are reasonable.

- The government plans to launch an initial program that it is fully aware will not provide the needed relief but which it hopes will be sufficient to secure an IMF deal and hopefully give it enough breathing room until the next elections.

- The government must know that the 6-year timeline for debt restructuring is meaningless. At some definite point in the near future, it will have to propose a specific day on which the program will be launched and the entire process will take months not years.

- As far as creditors are concerned, the pain will hit immediately.

- It is the fiscal adjustment part of the process, aimed at preventing debt from rising back again to unsustainable levels that could take six years, not the debt restructuring event.

- The decision to set the 55% target at the end of 2028 reflects only the fact that there will be no principal haircut but the debt stock will remain and apparently reduced steadily through GDP growth, possible fiscal surpluses, principal retirements and perhaps even debt buybacks.

- Investors will still feel the pain of not being able to redeem their principal when due because of the maturity extension/tenure elongation, which will have liquidity implications across the economy.

There are some important facts to bear in mind. In the Jamaica case, the IMF’s preferred solution after the botched initial attempt was a 25% haircut on principal plus other impairments across the board. It took months and persistent negotiations for the IMF to agree to accept the government’s self-initiated approach of deeper coupon cuts and maturity extensions. In Ghana, the government has not even been bold to suggest what exactly it has in mind much less galvanise the society behind it.

Jamaica recognised the legal constraints under which it was operating and thus built massive social consensus across the society, something the Ghanaian government has refused to do. Ghana’s planned “market-led” approach, entirely dependent on voluntary participation, is fraught with the risk of litigation. The only way to mitigate that risk is legislative backing for the debt restructuring program, which will require opposition backing. To date, the government has refused to meaningfully engage in this.

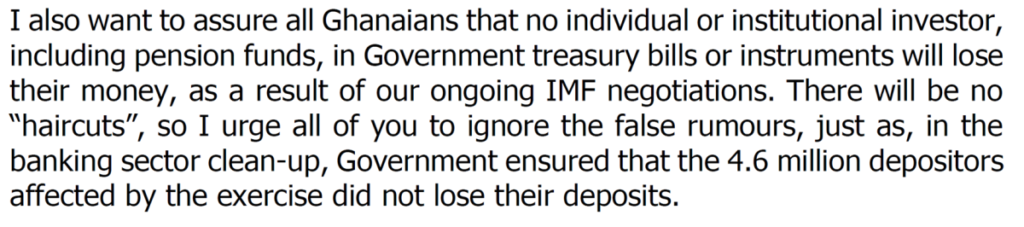

Treasury Bills

The President also mentioned a decision to exempt treasury bills, which per my estimation may currently hover around 28 billion Ghana Cedis or 14% of total debt. Given that treasury bills tend to pay no coupons and are short-term, this may well be a natural consequence of the strategy to undertake a shallow restructuring in the initial stage for political convenience reasons.

How Feasible is the Government’s Debt Treatment Plans?

The picture emerging of the government’s strategy for dealing with Ghana’s unsustainable debt leaves much to be desired.

The plan as can be deciphered is fraught with political risks as described above. But the fiscal issues are more daunting.

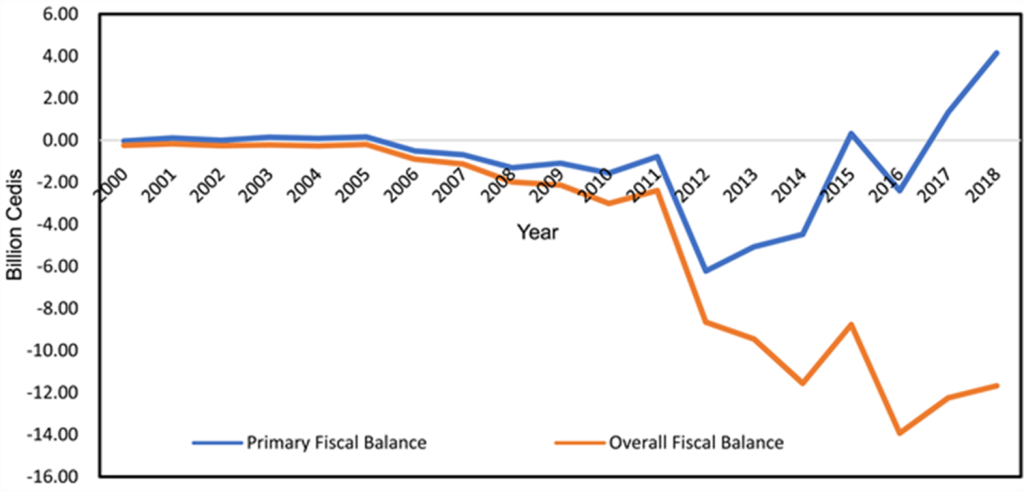

Under current circumstances, the government is faced with the onerous task of not just reducing the crushing burden of current debt but to halt the escalating growth of that debt as well. In this case, the government is promising to actually cut the debt by about 6.5% of GDP every year. This is supposed to be done in a context where the government has lost an average of $4 billion per year in overseas financing to which over the last 3 years it has come to feel highly entitled. Regardless what form restructuring takes, the effect would be to lower the government’s capacity to borrow from domestic markets anyway. Only consistent fiscal surpluses over the next 5 years can achieve these crazily ambitious goals. And yet below is the record of the government’s fiscal balance situation historically: consistent deficits.

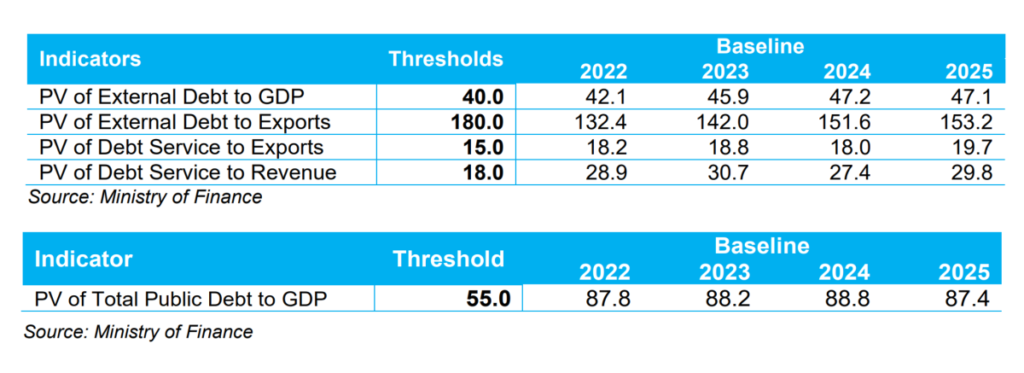

The government’s own medium-term analysis in 2021 shows no sign of a reduction in debt numbers as seen below.

Readers will note that the 55% threshold is thus not a new aspiration. The analysts in the Ministry of Finance simply know, as indicated in the table above, that under current fiscal conditions, a reduction in numbers is highly fanciful.

The Long and Short of it

The only question remaining then is whether the current fiscal conditions can be significantly altered by the proposed shallow restructuring.

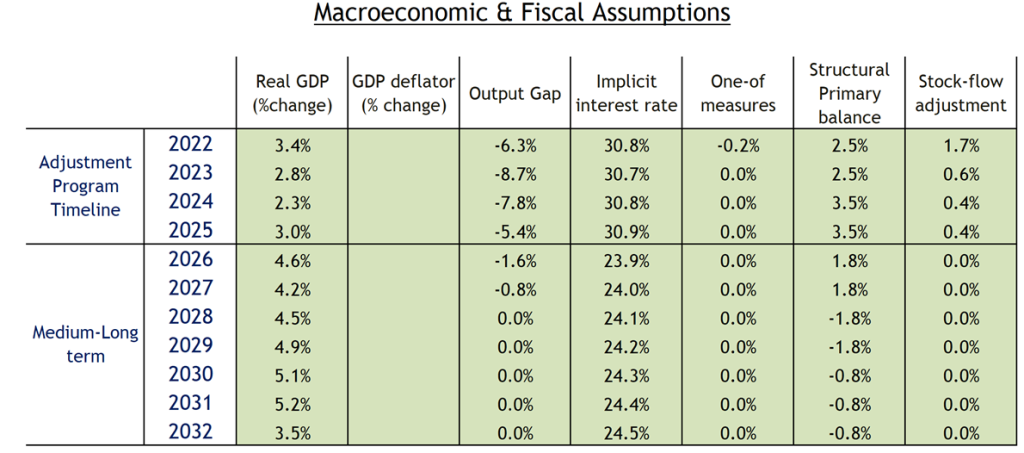

Below is a standard set of debt sustainability assumptions used around the world.

It underlies a very simple model for plotting debt trajectory under the constraints of fiscal sustainability. The stock-flow adjustment term captures corrections for various discrepancies complicating the link between fiscal deficits and debt accumulation. The output gap term reflects the limitations of GDP to lift up to full national potential.

Taking into account the reduced growth that typically follows debt restructuring episodes and elevated cost of borrowing in the short run, a simple arithmetic computation shows that a shallow debt restructuring involving even a coupon cut of 30% off current rates on domestic debts (assuming the government follows through with plans to omit external debt in defiance of the Political Opposition) would mean a drop in average weighted cost of servicing debt to about 15%.

Failure to do a principal haircut, rigidities in the budget, higher cost of borrowing, and a shift of the debt profile to short-term maturities (already underway) all point to the cost of borrowing returning to 20% in just two years. If the only fiscal savings amount to the 7.5% percentage points drop in the average weighted cost of servicing the eligible debt (i.e. domestic debt stock minus treasury bills, ESLA, which is issued under English law, etc), then debt accumulation will drop by only so much from the current 25% annual average rate (in real terms) observed in recent years.

Judging from the contribution of the domestic cost of borrowing to the deficit, the estimated savings of about 10.5 billion Ghana Cedis in the first year and less thereafter following a shallow restructuring will initially lead to a drop of about 1.5% percentage points off the secular trend of the fiscal deficit. Even if we pad the figure to 2% percentage points, such a retreat will not generate enough fiscal surpluses in the ensuing years to be used in buying back debt or even halting any further increases in debt so that GDP growth and output lift can in time lead to a falling public debt-to-GDP ratio trajectory.

We have not even touched on the fact that though the government is said to be planning to omit external debt from treatment, it still intends to drop external debt servicing from over 35% of domestic revenue (growing every day due to exchange rate depreciation) to just 18%. Unless the plan is to issue no more Eurobonds, with considerable effect on government’s forex reserves capacity, and just continue to pay off the stock, it is hard to fathom how this can be achieved. Or, maybe, external debt will be included, after all, just not at the principal level, in which case the reservations above regarding “shallowness” apply.

In short, the planned shallow debt restructuring exercise would be wholly ineffectual without a major accompanying fiscal consolidation program. Unfortunately, the President did not mention any serious fiscal adjustment plans apart from the so-called “30% reduction in discretionary spending” trope, which so far has merely led to a massive piling up of arrears but left fiscal deficits stuck at an elevated level.

All the aforesaid leads to the conclusion that the plan the government has hinted at is not credible on fiscal sustainability, which raises serious questions about the “country ownership” of the proposed IMF program and the risk of IMF resources being used to pay usurious interest rates on new debt.

As is now public knowledge, the Information Minister insists that the Debt Sustainability Analysis (DSA). From his comment, it would appear that the government believes that whatever it discussed informally with the IMF during the annual meetings constitutes an agreement in principle. But the IMF has policies. A DSA is always embedded in an overall macroeconomic review. Each such review goes through at least three rounds of administrative scrutiny before the conclusion. There is no way on Earth that process can be completed by the mid-November budget timeline.

Seeing as, without the DSA sign-off, a formal letter of intent and memorandum cannot be submitted by the government, which in turn would also go through multiple rounds of administrative review, we believe that the government's end-of-year timeline for a staff agreement is super aggressive and smacks of desperation. But even if it pulls it off to the surprise of all of us, the government, as argued in our previous comment, will still have to conclude any prior actions five days before board approval. The IMF board meanwhile meets at quarterly intervals. All of this is subject to no objections being raised during any formal review. So the quality of the government's proposed strategy is critical to even getting a final deal in Q1 2023.

Because IMF’s policies are very clear about the need to mitigate such risks, it is inconceivable that the government indeed has an “advanced agreement in principle” with the IMF structured along the terms discussed above that can be incorporated into the 15th November (or soon thereafter) budget in a form acceptable to the Political Opposition (especially one that plans to impeach the Finance Minister, constitutional ambiguities notwithstanding, on 10th November).

Until the government gets serious and starts building massive social consensus around a transparent and truly credible combined debt and fiscal sustainability plan, the IMF deal that it has currently hinged everything on will itself start to lose credibility generating further market anxiety, negative investor sentiment and what the Bank of Ghana now prefers to call, “disorderly market conditions”. All these, sadly, with severe implications for living standards in Ghana.

Hopefully, the President won’t wait until he is backed into a corner again before taking decisive steps to respond.

Latest Stories

-

UPSA defends swearing-in of new Vice-Chancellor amid legal dispute

4 hours -

GPL 2024/25: Samartex eye end to losing streak against Nations FC

5 hours -

CHAN 2024Q: Ghana’s Black Galaxies kicked out after Nigeria defeat

8 hours -

CHAN 2025: Ghana misses out after defeat to Nigeria

8 hours -

Speaker Bagbin honoured with citation for exceptional leadership

8 hours -

Photos: They came, they bonded and had fun at Joy FM’s Party in the Park

9 hours -

No shipper using a port in Ghana should pay for delays – GSA

9 hours -

Bongo Naba appeals to Ya Na, Yagbonwura, others to intervene in Bawku crisis

9 hours -

I fell in love with Ghana during 2010 World Cup – Jeremie Frimpong

9 hours -

Appoint ‘brutal’ OPK as Whip – Carlos Ahenkorah urges NPP leadership

11 hours -

Ablakwa questions alleged GH₵60m transfer to presidency for ‘special operations’

12 hours -

Dame Judi reveals apple tribute to Maggie Smith

12 hours -

NDC rejects rerun in outstanding polling station in Dome Kwabenya

12 hours -

EC has the power to re-collate results – Ayikoi Otoo

12 hours -

Putin apologises for plane crash, without saying Russia at fault

12 hours