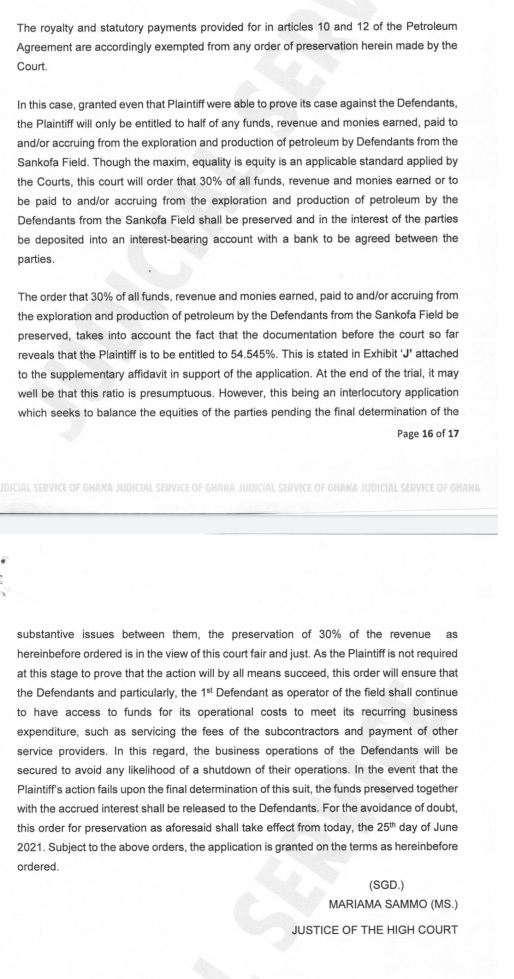

With respect to the ruling of a Ghanaian High Court this afternoon that 30% of all “funds, revenue, and money earned, paid to, and accruing from the exploration and production of petroleum from the [ENI-Vitol owned Sankofa field] be preserved” in an interest-bearing escrow account held at a bank chosen jointly by Springfield, ENI and Vitol, here is the state of play:

A. ENI’s global operating margin according to MarketWatch is about 3.31%.

B. Its Gulf of Guinea numbers (i.e. its macros most relevant to the Ghanaian context) are probably similar.

C. Were the court, per its order, to detain 30% of gross revenues minus statutory payments (taxes, royalties etc due to Government and similar entities), ENI (and Vitol) will simply not be able to continue producimg any oil from the Sankofa field.

One would suppose that this would be encouragement for ENI (and its minority partners in Sankofa, Vitol) to sit down with Springfield and try to resolve the dispute over Springfield’s insistence that their adjoining fields be unitised immediately in compliance with a directive by the Ghanaian Energy Minister backed by a GNPC finding that:

I. The petroleum finds in the Springfield owned Afina field and the ENI-Vitol owned Sankofa fields are connected; and

II. That Springfield’s side of the conjoined pool holds more than half of the combined “accumulation” (simply, the volume of hydrocarbons).

ENI and Vitol dispute the findings based on:

I. Their separate analysis of the same data relied upon by GNPC to come to its conclusions and

II. The fact that this data is based on only one discovery well dug by Springfield and virtually no appraisal campaign.

ENI’s counter-argument based on the same data analysed by GNPC turns on their belief that there isn’t even enough oil on the Springfield side of the straddling fields to be worth developing and perhaps this is why Springfield has all this while not even bothered with an appraisal campaign or commenced production.

They also contend that because they have been producing oil on their side of the “border” for quite sometime now, there would have been some “pressure effects” on the Springfield side, detectable in the GNPC analysed data, were the two fields to be truly connected.

To ENI, only the drilling of more appraisal wells on Springfield’s side will address the issue.

Given that in the last 20 years, the worldwide average cost of drilling and completing an offshore well exceeds $90 million, the issue of further appraisal of the Afina field is one of both risk mitigation and financial commitment. Hence, either Springfield lacks commitment or risk appetite.

GNPC and Springfield argue back that Ghanaian policy is founded on the principle that when adjoining fields are connected, they must be developed together in order to “maximise recovery” of the resource. Talk about further appraisal is premature when what is needed is immediate merger of the fields so that ENI does not continue to drain the common reservoirs.

Hence, the deadlock has evolved into a hopeless stalemate of technical analysis-paralysis.

With this context in mind it is not surprising that some analysts I have spoken to believe that the High Court ruling could break the stalemate. Until now, ENI had no real incentive to speed up resolution as its production was unaffected. Detaining 30% of revenues from the field is sure to get the attention of ENI’s bosses in the Piazza Ezio Vanoni.

D. Entering into discussions about unitisation does not however address the fundamental issues at play since increased pressure on ENI by itself does little to bring clarity to the contentions outlined above in such a manner as could propel the disputing parties towards an out of court settlement with a view to getting the order vacated to relieve the pressure on ENI’s finances imposed by the order.

E. ENI may evaluate the development as offering it no other option but to get an interpretation of the order from the Court that restricts the detention of “funds, revenues and money” to profits rather than gross revenues per se.

F. Or to quash the order entirely in a higher court.

G. Or to stop production altogether if it cannot achieve either of the two outcomes above. What is a fact is that it cannot comply with an order to sequester 30% of total revenue and maintain production at the same time. Judging by its operating margins, such a thing is a financial impossibility.

H. Regardless of how much ENI is boxed into a corner, and even if the ruling accelerates the commencement of discussions about the unitisation process, there is no guarantee of a quick resolution because as everyone who has looked at the matter closely knows: the devil is in the detail:

I. Who will be the unit operator of the joint field once Springfield’s Afina field and ENI-Vitol’s Sankofa field are unitised or merged?

II. Who will be the technical operator of the joint field?

III. Will the Plan of Development of the joint field entail any modifications of the design of ENI’s already producing field? For example, ENI’s 2019 Akoma discovery could be fast-tracked by using Sankofa-associated infrastructure. How will the precise unitisation configuration impact such plans?

IV. Will a joint Plan of Development impact existing ENI production?

V. How will Springfield fund its share of the joint appraisal of the field it used to own alone (Afina) should the unitisation configuration favour separate development?

VI. How will Springfield fund its share of the development of the joint field should the configuration chosen require redevelopment given its previous challenges with fundraising for its drilling campaign?

VII. Will the equity split among Springfield, ENI and Vitol be determined subsequent to appraisal of the Afina Field? If so, how is that different from the status quo? In short: is determining how much ENI, Springfield and Vitol should own in the joint field dependent on finding out how much oil is in Springfield’s field right now through additional appraisal? If so, then aren’t we back to square one? Because this is precisely what ENI has been pushing for and Springfield has been resisting. But if that is not done, then how will the percentage equity split be determined? If the split is not determined how can a joint plan of development be agreed upon?

Here is where GNPC has done the nation a great disservice. Its advice to the Minister so far lacks the depth and creative thinking needed to truly unlock the complexity of trying to merge an already producing field with one that has not yet been fully surveyed (technically, “appraised”).

As a minority stake owner in both Afina and Sankofa, and as an entity that can increase its leverage further in a merged field, GNPC has the strategic positioning to think more holistically about a path to resolution that can accelerate unitisation because it presents all the parties with a win-win unitisation configuration. There are a thousand and one ways in which a unitisation can be done, but most are impractical and few are pareto-efficient. GNPC’s technical insight would have been most useful if it had helped to break the strategic logjam through superior analysis of options, scenarios and trade-offs.

Instead, GNPC has failed to help the Minister think through the details and intricacies properly by making it look as if all that matters is to procure the bare minimum technical reasons to support unitisation. When in fact it is how unitisation is to be approached that has caused this unfortunate stalemate. Unfortunate, because the continued delay in the development of Springfield’s Afina implies lost opportunities of employment, revenue to the state and the potential development of indigenous capabilities in the oil and gas sector. Whilst any legal risks to ENI’s Sankofa’s continued production mean immediate adverse effects on jobs, spending in the local economy, gas supply for power, and government revenue (which in 2019 amounted to nearly $260 million).

Nothing in the analysis GNPC, in its capacity as the national oil company, and thus de facto principal technical advisor to the state, has produced to date offers any serious insight as to how unitisation can be creatively structured to overcome the very real uncertainties about volumes in the separate fields, equity splits of the joint field and need for redesign of existing production architecture to accommodate a greenfield operation. And we have read all their reports on the matter.

Without creative breakthroughs in thinking, the unitisation process, even when commenced, will become bogged down in a similar protracted analytical stalemate as we have witnessed over the last two years.

It is time for the Government to broaden its advisory arsenal well beyond the GNPC, an organisation that has become more and more lacklustre under its present leadership.

*****

Bright Simons is a Ghanaian social innovator, entrepreneur, writer, social and political commentator. He is the vice-president, in charge of research at IMANI Centre for Policy and Education. He is also the founder and president of mPedigree.

Latest Stories

-

Shamima Muslim urges youth to lead Ghana’s renewal at 18Plus4NDC anniversary

36 minutes -

Akufo-Addo condemns post-election violence, blames NDC

44 minutes -

DAMC, Free Food Company, to distribute 10,000 packs of food to street kids

2 hours -

Kwame Boafo Akuffo: Court ruling on re-collation flawed

2 hours -

Samuel Yaw Adusei: The strategist behind NDC’s electoral security in Ashanti region

2 hours -

I’m confident posterity will judge my performance well – Akufo-Addo

3 hours -

Syria’s minorities seek security as country charts new future

3 hours -

Prof. Nana Aba Appiah Amfo re-appointed as Vice-Chancellor of the University of Ghana

3 hours -

German police probe market attack security and warnings

3 hours -

Grief and anger in Magdeburg after Christmas market attack

3 hours -

Baltasar Coin becomes first Ghanaian meme coin to hit DEX Screener at $100K market cap

4 hours -

EC blames re-collation of disputed results on widespread lawlessness by party supporters

4 hours -

Top 20 Ghanaian songs released in 2024

5 hours -

Beating Messi’s Inter Miami to MLS Cup feels amazing – Joseph Paintsil

5 hours -

NDC administration will reverse all ‘last-minute’ gov’t employee promotions – Asiedu Nketiah

5 hours