The government of Ghana resisted going to the IMF for months until its economic crisis degenerated to the point of imminent catastrophe. But once it did, one fine day in July 2022, it pursued the program with the enthusiasm and zeal of a Pentecostal convert. And been well rewarded for it. In its latest assessment of the program which commenced in May 2023, the IMF was fulsome in praise, at least in IMF-speak.

As Ghana’s Finance Ministry gets ready to present its first post-review budget this week, many observers have been frustrated by IMF legalese, diplomatese and double-speak. They want it straight: is Ghana’s IMF program producing the economic wonders suggested by the government with the seeming endorsement of the IMF? This essay attempts to grapple with that question.

There is no doubting the fact that Ghana’s IMF ECF program has stanched the acute blood-flow seen at the height of the economic crisis. Inflation has fallen from 54% at the height of the crisis to 38% today. Currency depreciation has slowed from an annualised rate of more than 55% as at October 2022 to about 22% today. No one can dispute the sheer tenacity and relative skill with which the government, and in particular the Finance Minister, has managed to ram the IMF program through without the barest glint of a national consensus. Despite the absolute disregard for the opinions of civil society organisations, the political opposition, and even numerous dissenters within the ruling party, the government has successfully concluded a staff review of the first phase of the IMF program.

The IMF thus, definitely, has a point when it said in its press release at the end of the review that things have improved. The only question is whether the prospects are as bright and the improvements as solid as they and the government have sought to portray. The simple answer is “no”. The much-touted recovery is sluggish at best, and by some measures even illusory.

For example, a major indicator in any import-dependent economy is the inbound trade level. Central bank data for the first four months of 2023 suggests that imports of goods are lagging 2016 figures, with a possible fall in value by more than 6% relative to the 2016 figures. (Exports do not illuminate macroeconomic trends well in Ghana’s case because they are dominated by commodities whose pricing align with global, rather than local, cycles.) Correspondingly, the country’s main trading port, Tema Harbour, has seen a drop in container volumes exceeding 20% measured against the 2021 level. All the principal interest rates in the economy are at levels last seen two and half decades ago.

Compared to 2022, when the central bank’s Real Composite Index of Economic Activity (CIEA) showed positive growth every month until the last few months of the year, the CIEA in 2023 has recorded, albeit with a tapering trend, persistent negative growth since January of this year. Non-performing loans have risen from an average of ~14% in the last quarter of 2022, when the IMF program was essentially finalised, to roughly 21% today, putting ~$1.1 billion of banking assets at risk.

Some of the worst performing borrowers in the economy remain state-owned enterprises, which have exposed the government to $1.4 billion of potential liabilities not accounted for in the country’s ongoing debt salvage operation. A raft of so-called “public-private partnerships” (PPPs) sold as “commercially self-sustainable”, because the private sector was meant to underwrite commercial risk, have become a quasi-fiscal albatross around the neck of the state. The vaunted Ghana Card scheme (a civil identification project) is one such mess, with unbudgeted state liabilities since 2019 hitting $70 million by close of 2022.

The shakiness of the recovery owes much to the laxity in certain aspects of the ongoing ECF program. Much has been made of the success of the fiscal consolidation plan. But the praise is hardly critical. A great fiscal consolidation strategy must be closely complemented by tightening monetary conditions, at least in the medium-term. Yet, compared to 2022, over the period for which data is available, broad money supply in Ghana has increased by roughly 50%.

As empirical studies on dollarized economies, like Ghana’s, have shown, effective broad money supply expansion is one of the trends best correlated with persistent inflationary pressures. Not surprisingly, the pace of disinflation has been lacklustre with price falls in the producer segment reflecting more a collapse in B2B demand rather than any structural relief. Consumer-level prices thus remain stubbornly high.

Last year, this author wrote the following about the IMF program:

16. IMF will not fix systemic governance deficits

Repeating any treatment for the 17th time cannot be an occasion for celebration. An IMF program is merely an opportunity to attempt a reset of specific fiscal dials. It does not transform national governance culture wholesale on any level. The eventual transformation of Ghana’s economy to one of sustainable growth and widespread prosperity cannot be delegated to technical interventions by international organisations.

17. The fight is still on the homefront

It shall only come about as a product of the nation-building struggle. IMF will come and go. It is not a savior from poor economic leadership. But neither should it be treated as a convenient scapegoat for homebrewed failures. The fight for true economic liberation remains that of Ghanaian citizens alone.

In somewhat depressing fashion, the way the ECF program is being implemented appears to be vindicating the above sentiment much too readily. To fully appreciate this fact it helps to start at the beginning.

Despite Ghana’s initial aloof posture, the IMF was very keen to do a deal, having wooed the country relentlessly. So, in a somewhat expedited fashion, Ghana reached a staff-level agreement (an understanding to move forward, in principle) with the IMF in December 2022, having already begun to incorporate the key elements agreed with the IMF over the previous six months in informal and formal negotiations into the national budgeting framework and in its broader crisis-response strategy.

To get IMF Board approval of the in-principle agreement, Ghana had to undergo debt restructuring, during which the government did everything to pass on all the pain to the private sector whilst preserving most of its political flexibility.

Whilst the entire process was more chaotic and rockier than it should have been, the government did manage to do just enough to secure the coveted approval by May 2023 (after which it returned to the unfinished business of extracting more relief from beleaguered private creditors).

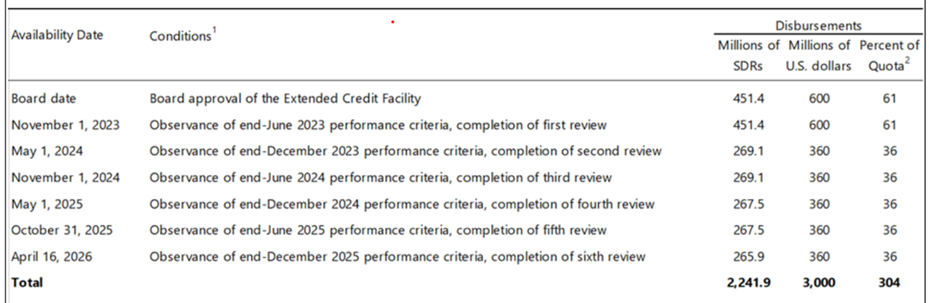

Along with the approval came a disbursement schedule for the $3 billion bailout package in the form presented below.

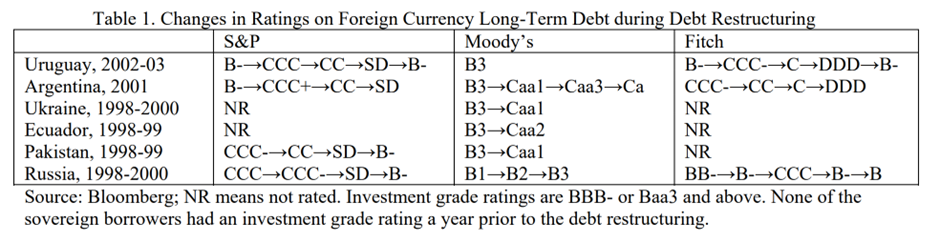

The government’s strategy of shifting most of the pain in the ECF program to the private sector, instead of more frontally grappling with the need to rein in its spending, dragged out the debt restructuring process well into October 2023. Fitch could thus only upgrade the country’s local debt ratings to one notch above restricted default in November 2023. The restricted default rating on foreign debt remains as the government is driving a very hard bargain with foreign creditors.

As shown in the table below, abstracted from an IMF working paper on the subject, Ghana’s path to international creditworthiness is bound to be more protracted than many other countries that have gone through a debt crisis over the years because of the tactical choices made by the government.

Government data, furthermore, shows that, notwithstanding the supposed fiscal consolidation effort, public sector wage growth continues, with the government on course to spend ~12% more than budgeted for 2023. Government operations costs have also seen no cuts whatsoever. The President continues to retain and pay over 100 Ministers and the Presidency’s personnel roster, long bloated by secondments from across the public sector, has not been revised throughout the crisis. It is useful to bear in mind that a committee of eminent experts tasked to look into constitutional matters has advised that the country will work fine with just 25 Ministers and can easily do away with a whole panoply of sinecures and redundant offices. Even more bizarrely, the government refuses to terminate white elephant projects like a so-called “National Cathedral”.

Yet, in the first review of the ECF program, the IMF has been fulsome in praise of Ghana’s performance under the program. How to explain this paradox? Simple really: sleight of hand.

Frontloading the domestic debt restructuring and freezing payments on servicing overseas financial obligations, particularly Eurobond servicing, which also naturally led to a decline in foreign-financed CAPEX, allowed government spending to come down just enough to lower the fiscal deficit just enough to meet the IMF program’s expectations.

Furthermore, when a government no longer services its obligations, including to corporate holders of domestic debt, it ripples across the rest of the system, tampering economic levels, and conserving scarce foreign exchange, with a resultant effect on inflation and the exchange rate.

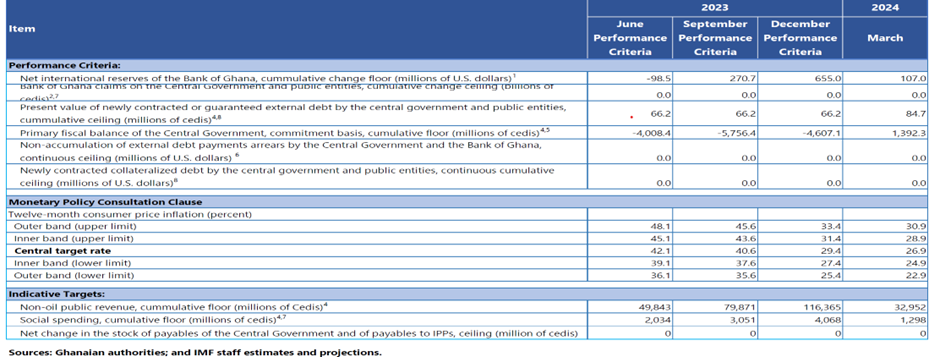

Complementing the above strategy is a clever decision by the IMF to narrow down the review criteria to those areas highly responsive to these short-term stabilisation measures. The table below lists the said criteria. A perfunctory examination would show that merely by freezing government obligations to the private sector, the majority of the first review hurdles were already bound to be crossed.

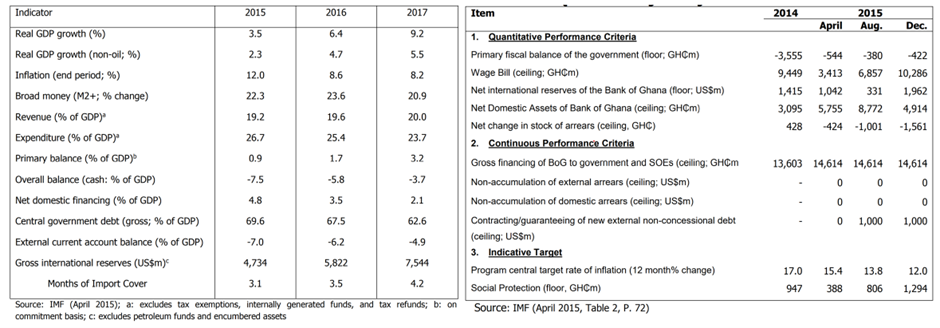

Drawing partly on work done by Accra-based IFS on Ghana’s previous IMF ECF program (2015 to 2019), we can contrast the 2023 scorecard aced by the current government with the review criteria of the 2015 program presented in the tables below.

Some of the key scoring indicators removed from the recent review include wage bill management, domestic arrears management, and broad money dynamics. The very areas the government is underperforming in.

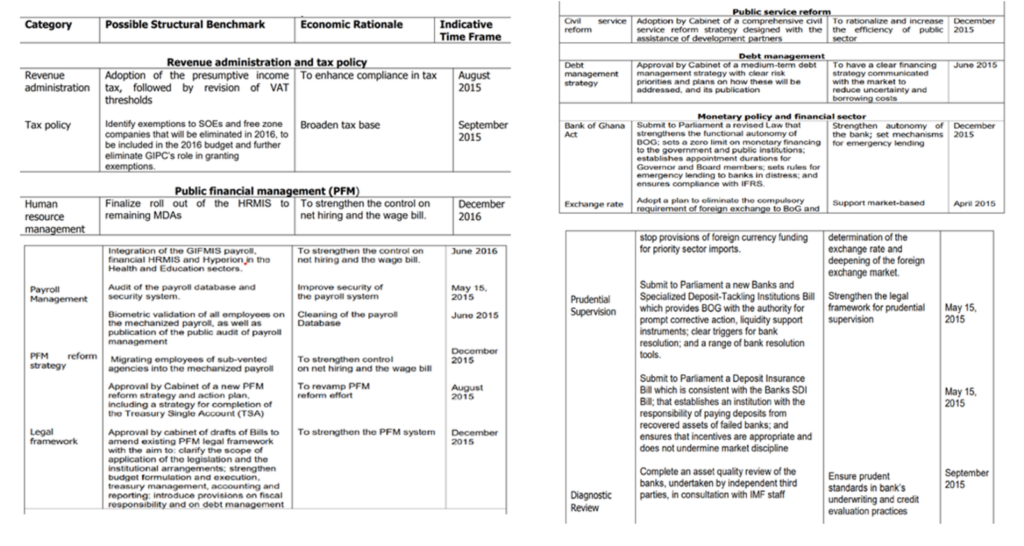

Even more fascinatingly, the IMF decided to scale down the ambition of the phase one review scope by not even touching on the structural reform agenda at all. In the 2015 program, on the other hand, structural targets, as listed in the table below, such as blocking waste in public spending, were important criteria in the review process and the source of some of the relatively harsher verdicts delivered by the IMF then. All this “marking scheme slimming down” stuff is very curious because Ghana’s economy is in a far worse shape today than was the case in 2015. The conventional wisdom, to use a simple analogy, is that the sicker the patient the greater the need for more monitoring indicators.

It is clear to even the casual observer that the IMF having learnt its lessons over the years and having thus become humble about how much its programs can actually engender lasting change has very shrewdly decided this time around to alter the marking scheme in order to prop up the government’s goal of manufacturing program momentum, at all cost. No more shall pesky civil society activists like this author find it easy showing how much the ECF program is falling short of its own reach.

In fact, unlike in 2015 when the first few months of the ECF program saw the government being subjected to diagnostic reviews, this time around, the plan is to complete the first governance diagnostic in 2024, nearly a year after formal commencement of the program.

That the marking scheme for the review was changed by the IMF to ensure that the Ghanaian government will pass with flying colours is but just one of the curious aspects of the ongoing ECF program. In some cases, critical evidence was simply ignored. For instance, in the area of social protection, Ghana’s LEAP program designed to support the most vulnerable in society came up for much praise by IMF reviewers. Yet, Ghana’s own Auditor General have been trenchant in their criticism, lamenting how, for instance, a cost threshold that should not have crossed 10% escalated past 22%.

Just as well that no structural reform issues were tackled. The two main sectors highlighted for special attention in this latest IMF bailout program – energy and cocoa – have degenerated considerably since the program started.

According to analysis by KPMG, the energy sector faces worse outcomes than initially assumed in the areas of distribution-level power sale collections, technical losses, OPEX failures, and generation-level losses. Combined, these problems could lead to cumulative accounting shortfalls of roughly $8.275 billion by the end of 2023 against a 2019 baseline.

According to Ghana’s Ministry of Energy, collection losses in energy sector sales for 2023 have worsened by a mindboggling 20 times compared to 2017 figures. The country’s state-owned gas producers continue to lose 80% of recoverable value on each unit of gas sold to a private generator called Genser. The main distribution utility, and the primary source of cash for the entire energy system, ECG, has wasted tens of millions of dollars on metering solutions that still leave more than a quarter of bills uncollected. Worse of all, none of these solutions were competitively procured. In fact, ECG is working assiduously to be exempted from all public sector procurement constraints so it can continue dishing out sweetheart contracts to favourite fuel and meter contractors.

In the cocoa sector, debt restructuring has not been able to redeem the state-owned marketing monopoly, Cocobod. For the first time in 30 years, it has struggled to close the annual syndication loan well ahead of the main buying season. In spite of the obvious certainty of funding challenges, the government chose to increase the farmgate price of cocoa ahead of securing the necessary financing for the buying season.

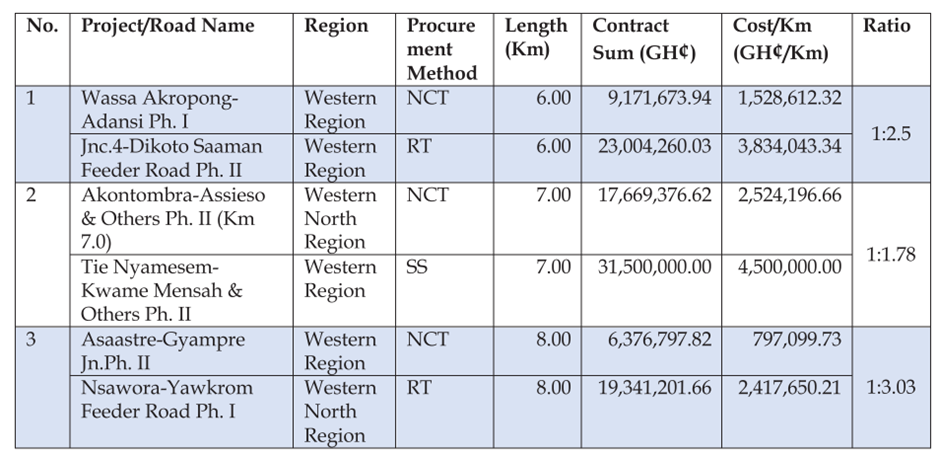

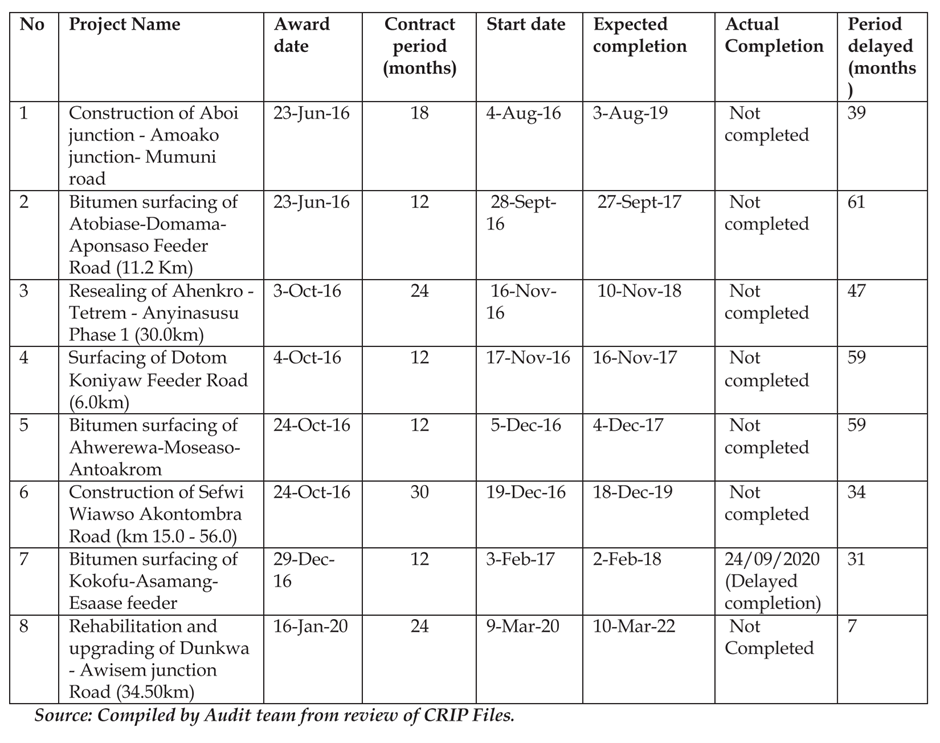

None of Cocobod’s worsening financial conditions are inexplicable. Massive waste and inefficiencies have in recent years become hallmarks of how it does business. As the data below from Ghana’s Auditor General shows, Cocobod can save ~65% of its CAPEX on large-scale infrastructure, like the vaunted cocoa roads, that is if a cocoa trader should even be investing in such projects, simply by using competitive procurement methods. It simply won’t.

None of these governance defects have been tackled with any seriousness so far as part of the IMF program because of the tactical decision to focus primarily on shifting the pain of adjustment to the private sector.

The shrewd way the IMF and the government are going about gaming the marking scheme for the government’s performance in the ECF program, notwithstanding, the strategy of deflecting all pain elsewhere may well backfire at some point.

Ghana is due for an inflow of a second tranche of $600 million from the ECF. However, per the agreement with the IMF, the release is conditional on the country’s Paris Club creditors and China issuing a letter of Intent or a draft MOU confirming that agreement has been reached in principle to restructure the country’s bilateral debts. However, some confusion has broken out among countries who want the coverage period of the debts eligible for restructuring to end in 2020, on one hand, and those who insist that it must stretch to end-2022, on the other.

Ghana and the IMF, of course, want the maximum coverage possible in order to extract the deepest possible debt-relief, all the better for allowing the government to postpone harder austerity decisions. They have enlisted the United States into their corner. The US is more than happy to deploy its immense geopolitical capital in support of these causes because it has quietly wrung out important concessions from Ghana over the course of this whole IMF bailout imbroglio, such as the installation of an Advisor in Accra with broad, unpublicised, influence over sovereign financial planning.

The end-2022 cut-off date for debt coverage would, however, also ensnare major export credit facilities advanced by some European countries. And it will impact regional development finance banks like Afreximbank, who advanced a large loan to Ghana within the proposed debt relief period under very opaque circumstances. Afreximbank must have been shaken by this development given its already somewhat precarious international credit rating (BBB, compared to, say, the Islamic Development Bank’s AAA).

The Ghanaian government, with the backing of the IMF, may pat itself on the back for its shrewd burden-shifting, but the export credit agencies and DFIs taking the hit are part of deep financial networks. The government may find that it gets much harder than securing new facilities in the near future. Even though freeing up fiscal capacity by restructuring old debts might appear, on first sight, as a clever way of saving borrowing room for vote-attracting projects ahead of next year’s ultracompetitive general elections, there is a massive downside: alienating prospective creditors. Already, Afreximbank has been stalling on arranging financing for planned railway investments.

If the point of the scorecard-gaming is to speed up Ghana’s return to international creditworthiness, then it is clearly in conflict with the burden-shifting, faux-austerity, strategy. And both strategies are, undoubtedly, in tension with Ghana’s true national interest of a durable, reform-backed, recovery.

Latest Stories

-

Galamsey: One dead, 3 injured as pit collapses at Nkonteng

32 minutes -

Man, 54, charged for beating wife to death with iron rod

37 minutes -

MedDropBox donates to UG Medical Centre

41 minutes -

Afenyo-Markin urges patience for incoming government

43 minutes -

Case challenging Anti-LGBTQ bill constitutionally was premature – Foh Amoaning

50 minutes -

Fifi Kwetey: An unstoppable political maestro of our time

52 minutes -

Volta Regional ECG Manager assures residents of a bright Christmas

59 minutes -

Taste and see fresh Ghanaian flavors on Delta’s JFK-ACC route

60 minutes -

ECG to pilot new pre-payment system in Volta Region in 2025

1 hour -

Hammer splits ‘Upper Echelons’ album into two EPs; addresses delay in release

1 hour -

NDC MPs back Supreme Court’s ruling on anti-LGBTQ bill petition

1 hour -

Dr. Rejoice Foli receives Visionary Business Leader Award

1 hour -

Economic missteps, corruption, unemployment and governance failures caused NPP’s crushing defeat – FDAG report reveals

1 hour -

Supreme Court, EC need complete overhaul to safeguard our democracy – Benjamin Quarshie

1 hour -

Dr. Elikplim Apetorgbor: Congratulatory message to Mahama

2 hours