This evening, Evans Mensah, News Editor and Head of the Political Desk at JoyFM, a subsidiary of the Ghanaian media giant, The Multimedia Group, reached out to discuss the topic he was planning for his PM Express show tonight. He wanted to look at the Ghanaian government’s aggressive response to a decision by rating agency Moody’s to downgrade its bonds deeper into junk status (Caa1).

This is something of a wonkish subject, and quite challenging to format right for television. I was nevertheless intrigued by the challenge because of the government’s over the top reaction. It added spice.

One Deputy Minister of Finance has called the Moody’s rating action propaganda. The same Minister also insisted that the rating action was the result of a grand conspiracy to force the country into an IMF program.

Even the official Ministry of Finance response to the downgrade takes the unusual step of singling out Moody’s Primary Analyst for technical incompetence, calling into question the overall professionalism of the agency’s operation. As follows:

We are very concerned that Ms. Villa may not properly understand and evaluate Ghana’s deepening credit story since obtaining our first credit rating back in 2003. She also has not visited the country since assuming the role and as such this downgrade at this critical time was based entirely on a desktop exercise, virtual discussions and what we believe to be the omission of critical data provided.

Extract from Ghanaian Ministry of Finance’s response to Moody’s Rating Report

I decided to join Evans, a government’s spokesperson, and the main Opposition Party’s parliamentary lead on finance to dig into this contentious affair. Our discussion revolved around two main questions:

- Was the rating action based on an accurate assessment of the Ghanaian economic situation?

- Was the rating action indeed biased against Ghana as asserted by the Ministry of Finance?

It is instructive to note that whilst Fitch and Moody’s have both downgraded Ghana in their recent actions, S&P chose to leave their rating unchanged for now. For that reason, the government has been full of praise for S& P. The inference we are being invited to draw is that whilst Fitch and, particularly, Moody’s are biased and inaccurate assessors, S&P gets it.

Before delving into the details of the bias and accuracy claims, a sentence or two can be spared on whether this is all a fuss over nothing.

In richer countries, some are already suggesting that downgrades (yes, rich, northern, countries get downgraded too) don’t matter all that much anymore. In fact, they have been saying this for quite a while now.

In less wealthy countries, on the other hand, such nonchalance is not affordable. Positive sovereign credit ratings have been linked with everything from helping boost domestic financial systems to tackling the ever so pernicious perception risk premia Africa continues to grapple with. Because most investors cannot develop specialised knowledge about the dozens of small economies around the world whose high-yielding investment opportunities (such as debt packaged as bonds) they are increasingly learning to like, they rely on credit ratings agencies, like the Big 3 (Moody’s, S&P, and Fitch), to give them the condensed version. Many investment committees would normally use sovereign ratings as a quick filter of which frontier market’s debt to include in their portfolio.

Whilst the Financial Stability Board of the G20 (the group of the world’s 19 largest economies plus the European Union) has warned against such “mechanistic” or unsophisticated reliance on ratings, and though many of the top investment houses use ratings only as part of a composite measure when deciding to invest, sovereign ratings still have an outsized, strangely linearised, role in determining if a small, frontier, economy can borrow in the highly liquid international capital markets or not.

This is despite most ratings reports being littered with disclaimers like:

"Moody’s publications may also include quantitative model-based estimates of credit risk and related opinions or commentary published by moody’s analytics, inc. Credit ratings and moody’s publications do not constitute or provide investment or financial advice, and credit ratings and moody’s publications are not and do not provide recommendations to purchase, sell, or hold particular securities. Neither credit ratings nor moody’s publications comment on the suitability of an investment for any particular investor. Moody’s issues its credit ratings and publishes moody’s publications with the expectation and understanding that each investor will, with due care, make its own study and evaluation of each security that is under consideration for purchase, holding, or sale."

And

"Moody’s credit ratings and moody’s publications are not intended for use by retail investors and it would be reckless and inappropriate for retail investors to use moody’s credit ratings or moody’s publications when making an investment decision. If in doubt you should contact your financial or other professional adviser."

Yet, it is widely accepted that many investors lazily use ratings for more than they should and that sometimes poor regulatory design end up even giving ratings an oppressive force of law. Sovereign Credit Ratings are also firmly recognized as part of the triumvirate including sovereign bond spreads and nonresident holdings of general government debt. Said triumvirate dictates whether a country can retain access to international capital markets.

With these general background matters out of the way, let us now look at the central matters of accuracy and bias.

Accuracy

The Ministry of Finance’s press release takes issue with Moody’s calculations of the country’s prospective Debt to GDP, forthcoming balance of payments liabilities, and the impact of announced fiscal consolidation measures.

S&P, by contrast, seemingly aligned with the government’s perception of these matters leading to conclusions such as the following:

"We project that government revenue including grants will increase to 17.2% of GDP by year-end 2022 versus 14% pre-pandemic, reflecting the introduction of new taxes, including this year’s pending electronic transactions levy."

And:

"If the planned fiscal measures bear fruit, we project that net general government debt will stabilize at 77% of GDP this year, before gradually declining to 75% in 2025."

whilst Moody’s, on the other hand, doubled down on the view that:

"Moody’s estimates that government debt ended 2021 at 80% of GDP while interest payments alone consumed half of government revenue that year (positioning Ghana with the second largest ratio among Moody’s rated sovereigns)"

And

"The government has announced a 20% cut in primary spending, equivalent to a 4% cut on a year-on-year basis or 16% in real terms, to compensate for any shortcoming in the government’s revenue measures package. Such an unprecedented fiscal tightening will be socially, economically, and politically challenging to implement."

Also:

"Ultimately, Moody’s expects that a higher interest bill in 2022 and 2023 will offset the improvement in the government’s primary balance, thereby maintaining double-digit fiscal deficits (in cash terms) with a concomitant increase in the government’s debt burden."

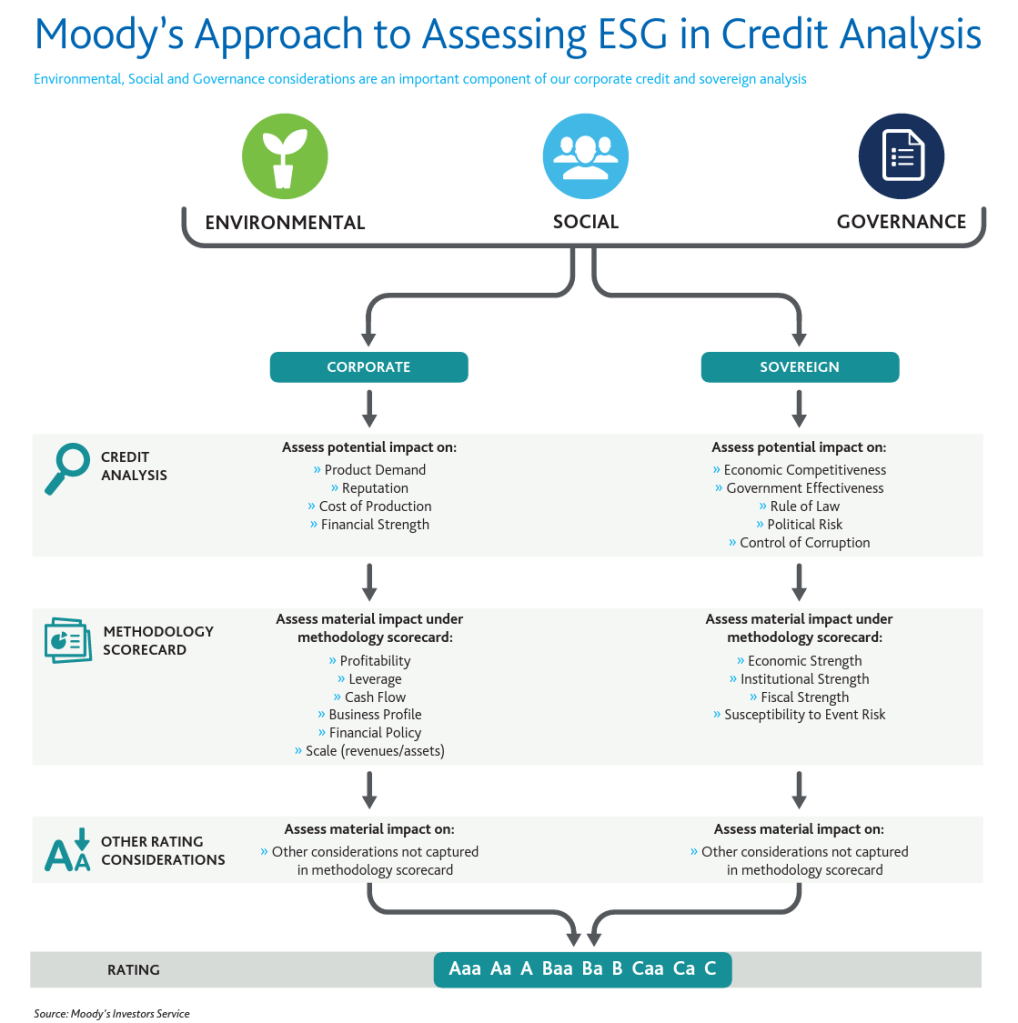

On the ESG (Environmental, Social & Governance) front, where the government protests loudly about the lack of quantitative data in the Moody’s report, the rating agency asserts as follows:

"Moody’s has lowered the governance issuer profile score to reflect domestic revenue mobilisation challenges and significant constraints on fiscal policy effectiveness reflected by very weak debt affordability. The authorities have undertaken some institutional reforms on the revenue and competitiveness front, which will take some time to produce results."

Instructively, both S&P and Moody’s disagree with certain data points and numerical projections preferred by the government. S&P believes the country’s cash deficit for 2022 shall be 9.4% instead of the government’s predicted 7.9%. It also insists that the cost of servicing the debt is 47% of all state revenue and not the government’s claimed 38%. It furthermore pegs GDP growth for 2022 at 4.2% instead of the government’s estimated 5.8% (2022 budget).

The issue here clearly is thus hardly one of S&P deciding to credit statistics and projections issued by the government whereas Moody’s refuses to follow suit. It is more about differing stresses and emphases, leading ultimately to different interpretations of contentious estimates, a very legitimate outcome of this type of analytical judgement exercised by different teams. In addition, Moody’s decided to be more cautious than S&P about whether the government can cut expenditure and raise as much revenue as it says it can but that caution arises from pessimism, or even scepticism, about projections that S&P also shares (as indicated above).

At any rate, rating agencies can have substantial methodological differences. Take for instance the all-important issue of “defaults”, the issue at the heart of all credit rating, sovereign included. Whilst Moody’s focuses on both the probability and severity of defaults, S&P, according to NYU Stern professor, Aswath Damodaran, focuses primarily on probability alone.

In such a context, it is hard to understand the government’s position that Moody’s did not consider critical data submitted or that it inaccurately analysed said submitted data.

To buttress its claim, the government goes hard on the competence of the Moody’s primary analyst. They question her familiarity with Ghana and dismisses her work as “desktop”. By so doing, the impression is created as if the Moody’s rating outcome is entirely the doing of one busybody through whom a set of arbitrary decisions has crystallised out of near-ignorance.

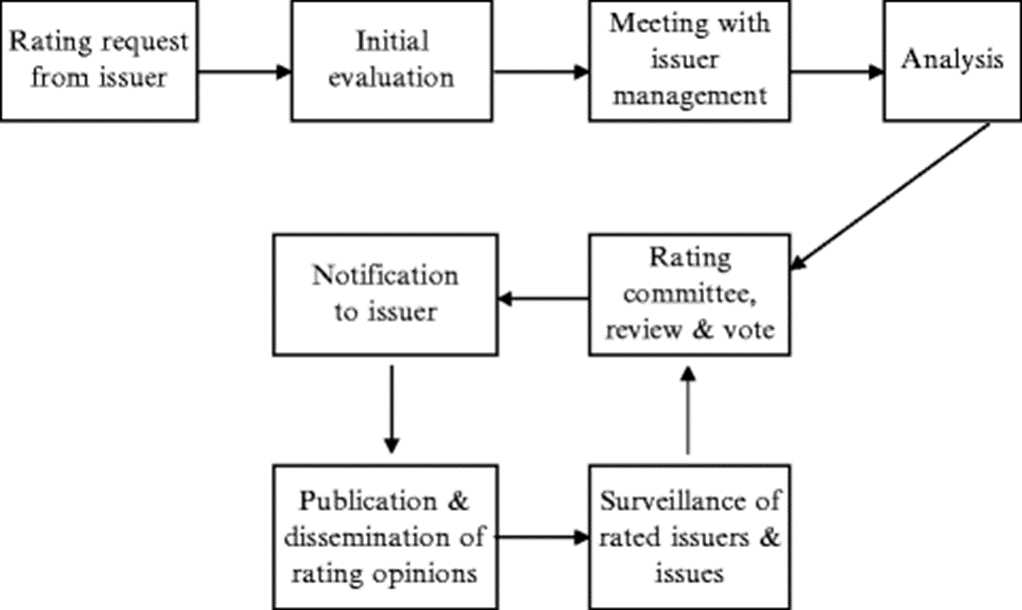

But every generic account of the rating process uses a chart like this that I picked up from a publication:

Like many of its ilk, the latest, now controversial, rating by Moody’s of Ghana’s credit status was solicited and paid for by Ghana. It went through a series of quality checks, including a full vote by a rating committee constituted by multiple individuals, some of whom are very familiar with Ghana. Ghana’s appeal was not assessed by the primary analyst but by the appeals subcommittee. Many of these steps are controls implemented since accusations very similar to what Ghana is now making were brought against the agencies by regulators in Europe nearly a decade ago.

On the charge of conclusions reached without quantitative analysis, Ghana assumes that the rating report finally issued to the ratee/issuer is the full dossier that backs the primary analyst’s recommendation. But this is not correct. The Moody’s ESG analysis is nowadays, contrary to Ghana’s claims, backed by quantitative models.

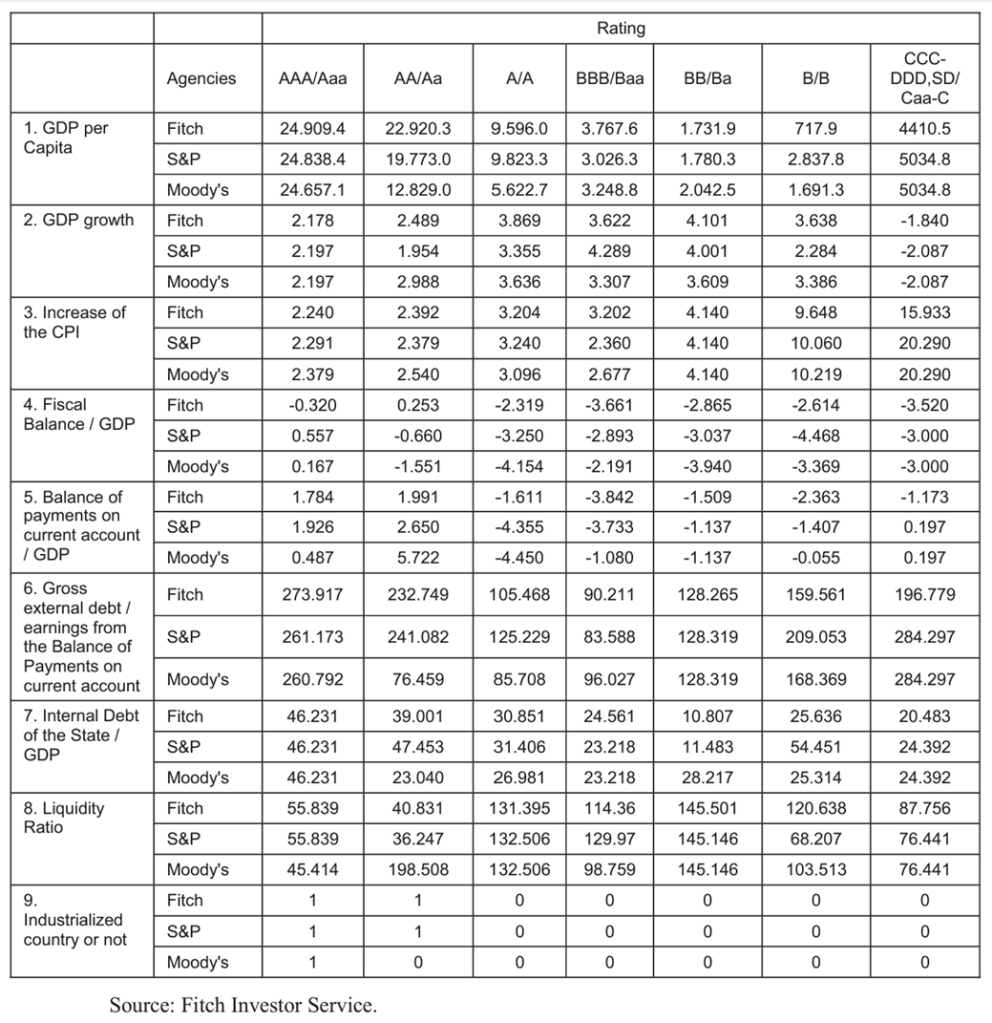

Below is a generic overview of key parameters and variables that go into a rating decision.

And regarding the specific claim by the government that Moody’s ESG analytics contain no quantitative data, the below summary suggests otherwise.

But something being “quantitative” does not mean that it will not reflect varying “analytical judgement” or span a range of materiality. At the core of the ratings exercise is the stochastic attempt to affix hard numbers to fudgy predictions about the likelihood that when a debt comes due the borrower may/can or may not/cannot pay.

Thus, Ghana’s B- rating by S&P reflects a belief, very crudely put, that in the course of the next 3 to 5 years, a default rate of between ~10 and ~16 percent is likely. That “10%” or “16%” is not anymore “solid” than the gut instinct of a shrewd investor, if one really decides to stretch the ontology of these exercises to breaking point. And, yet, by assigning numbers to certain measures and gauges, the work of many others in the chain of finance becomes easier as they now have manipulable inputs to use in many different permutations in many complex models.

But even a default is not the end of the chain. Other models, also linked to these same rating numbers, exist to tell the analyst the likely proportion of the debt at stake is likely to be recovered during a default,

Over time, these models are refined by empirical experience. Because defaults do happen, and when they do, everyone is afforded the opportunity to trace back and judge for themselves the degree to which these attempts at prophesy can be depended upon.

It bears emphasising, as related in the introductory discussion, that no serious investor is expected to use Sovereign Credit Ratings alone in their decision making. The existence of other measures of creditworthiness for state borrowers serves the additional role of providing proxies to check the accuracy of the analyses of rating analysts. One of these proxies operate by looking at how investors themselves are gauging the credit of a sovereign borrower on the open markets.

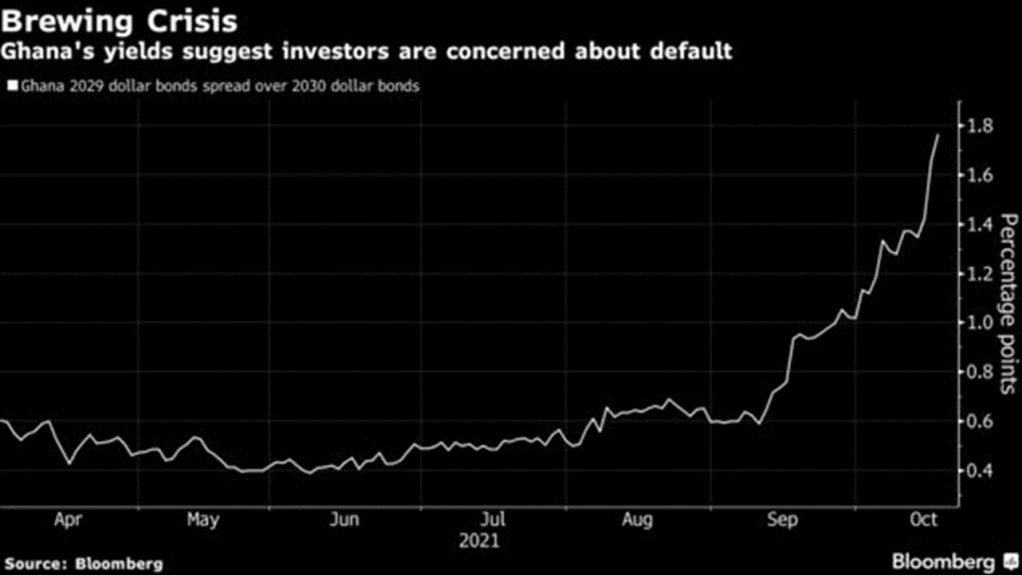

Prior to the latest downgrades by Fitch and Moody’s, there had been a steady stream of gloomy news suggesting clearly that investors were already pricing in higher repayment and default risks.

The appropriate response from the government, noting how Ghana had been catapulted into the global leagues of default prospects, would have been to address investor sentiment clearly with a budget focused on freeing up fiscal space, and with super realistic targets.

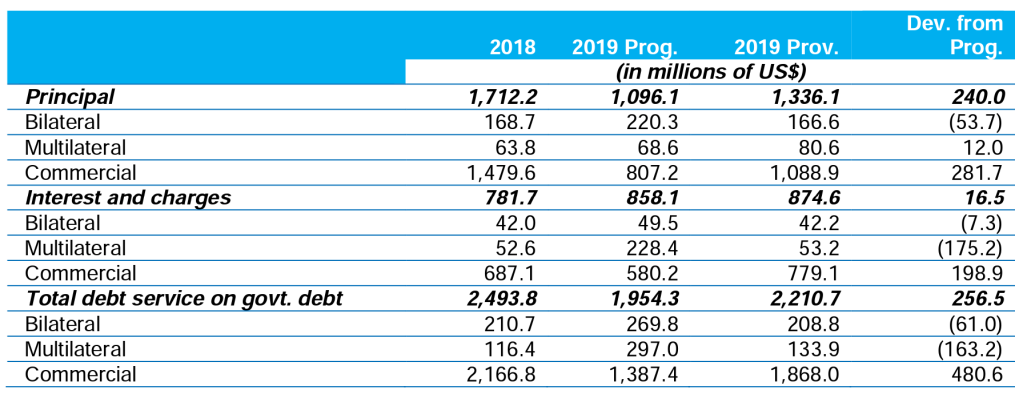

Instead, the government presented this:

A budget promising wild revenue expansion and even wilder expenditure growth. To sustain the credibility of the proposed ~43% primary revenue expansion (in one year), the government introduced a highly unpopular tax on all digital financial transactions without any plan for consensus in a hung parliament.

The markets went agog. Investors started deserting government of Ghana bonds as if they bore the plague.

It is hard to imagine what rational observers would have made of it if all this frenzy had attracted no action at all from any of the rating agencies, recalling how often they are berated for rating sovereigns too infrequently. Would that have helped the integrity of the rating process if investors, at whom ratings are targeted, are themselves giving strong hints that they fear a default yet rating agencies remain aloof?

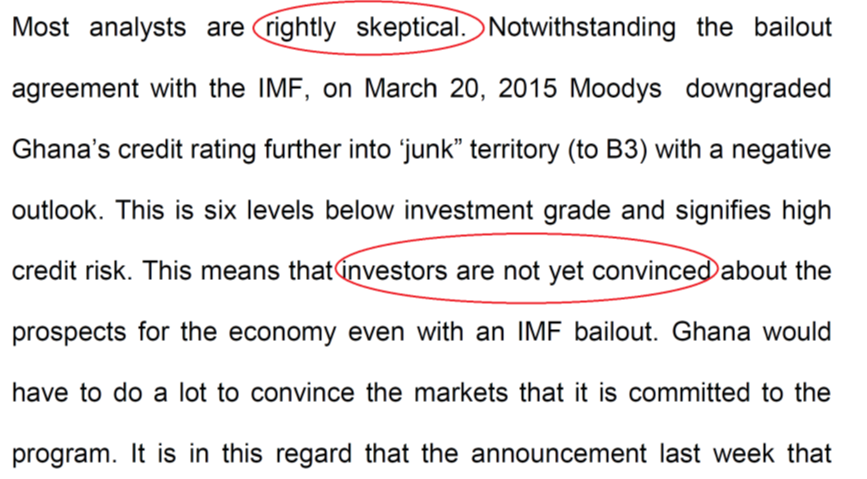

This question provokes much of the discussion in the second half of this essay. But before we get into it, the statement below made on 24th March 2015 by Ghana’s Vice President, then in opposition, at Central University, near Accra, on the occasion of an earlier Moody’s rating resonates with the discussion so far.

Bias

In its official response to the Moody’s downgrade, the government of Ghana alleges “institutional” and “anti-Africa” bias in the former’s conduct. In a separate communication, it praises S&P for being more progressive. The accusation here appears to be that some animus, unrelated to the mission of giving investors objective information about a borrower’s risk of default, is what is driving Moody’s behavior. There is a hint also that perhaps Moody’s has perverse incentives to downgrade rather than upgrade.

This is curious since S&P, despite having issued, proportionately, the fewest downgrades worldwide, compared to the other two major agencies, has been the most enthusiastic downgrade-issuer in Africa at the peak of the pandemic.

Clearly, then, the government’s chastisement of Moody’s and praise for S&P cannot be the result of its concern about “anti-Africa” bias per se. It must be confined strictly to the specific Moody’s downgrade related to Ghana.

Regarding the issue of “pro-cyclicality” (the tendency of rating agencies to issue downgrades during a crisis thus possibly prolonging the same crisis responsible for the downgrade in the first place), Ghana is certainly far from being the only complainant. The problem though is that rating agencies are damned if they do and damned if they don’t. The biggest complaint against them has been that they have been too enthusiastic in issuing upgrades, a phenomenon known as “rating inflation“! According to one specie of this charge, the agencies’ reckless overoptimism in dishing out top ratings (“investment grade”) was exactly what caused the subprime mortgage crisis.

Indeed, the best framing of the perverse incentives and conflict of interests in the rating industry is one where issuing downgrades actually loses the agencies money!

Whilst there is no denying the fact that African and Latin American countries have experienced more downgrades in this crisis, it is not clear how that could be the result of “systematic bias” when such bias is not aligned with the usual incentives of the agencies. Economist Hippolyte Fofack suggests that this could be due to an overactive sense of “reputational preservation”. Or, put another way, the agencies are overreacting in order not to miss a default and thus lose the confidence of investors. Perhaps, the sense is that in Africa it is safer to be wrong pessimistically rather than optimistically. Considering though that the rating agencies are super keen to grow their business in Africa and any country downgrade tends to result in automatic downgrades of existing and prospective corporate clients whose credit is tied to their host countries, such a logic is hard to fully unpack.

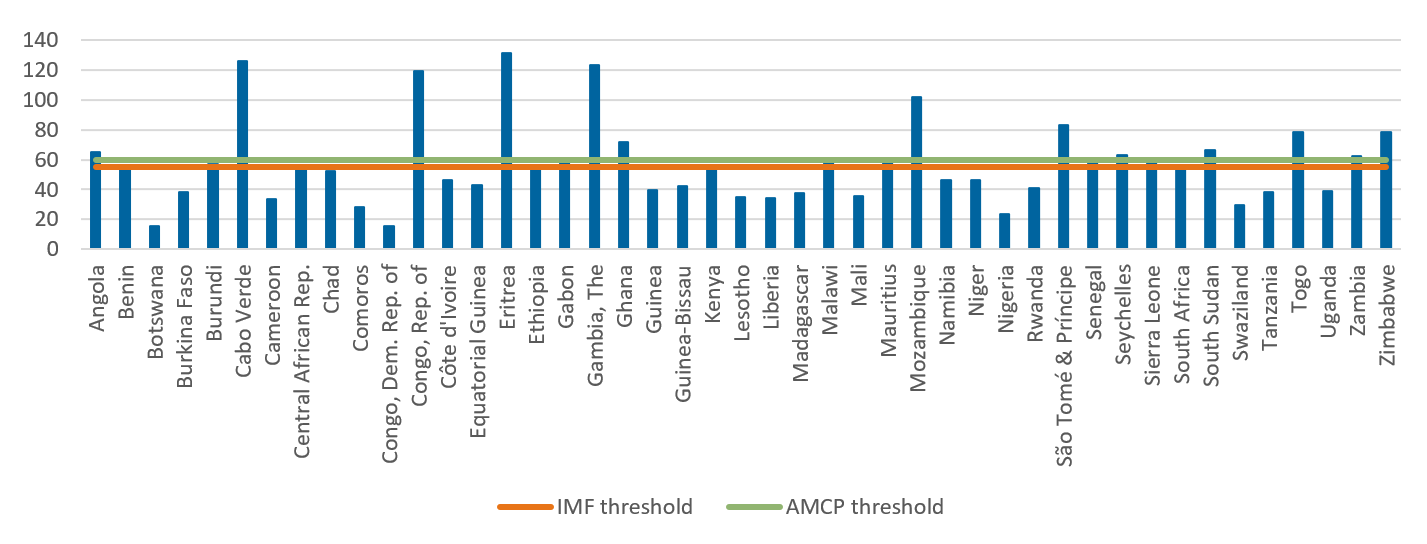

Even if we accept these arguments by Fofack and the Africa Peer Review Mechanism (APRM), which a few years ago set up a program to monitor the effect of credit rating actions on African countries, they should merely establish a uniform hurdle for the whole of Africa. What then are we to make of Ghana’s specific deteriorating circumstances?

The above factoid highlights the scale of the Ghana “special case” and makes a compelling pitch for the Fitch downgrade, for instance.

Below is a list of countries, including four from Africa, that inhabited Moody’s B3 band alongside Ghana until the latter’s downgrade.

•Belarus

•Bosnia

•Cape Verde

•Moldova

•Mongolia

•Nicaragua

•Niger

•Pakistan

•St. Vincent & the Grenadines

•Ukraine

•Togo

•Swaziland

•Tajikistan

A quick check at the World Bank’s data store immediately underlines the revenue crisis that Moody’s so overwhelmingly emphasised:

Surely, with such a wide gap, can an argument not be made that whatever anti-Africa residual bias may be at play, Ghana’s situation deserves its own separate analysis?

Even Ghana’s current neighbourhood, the Caa1 peer group, does not offer a reassuring contrast.

All of these countries have severe crisis-induced challenges. COVID-19 has been less damaging in Africa, as Ghana itself stridently points out, so the pandemic has limited explanatory power in accounting for this strange divergence from peers, whereby Ghana pays so much more for paying interest and principal on its debt.

Even those countries in rating bands below Caa1 on the Moody’s scale do not have the same degree of debt service burden as Ghana’s.

Could something other than bias account for Ghana’s fiscal congestion? There is a good candidate.

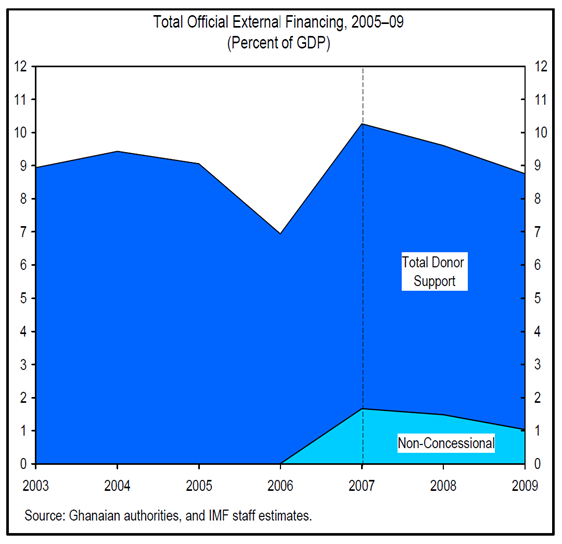

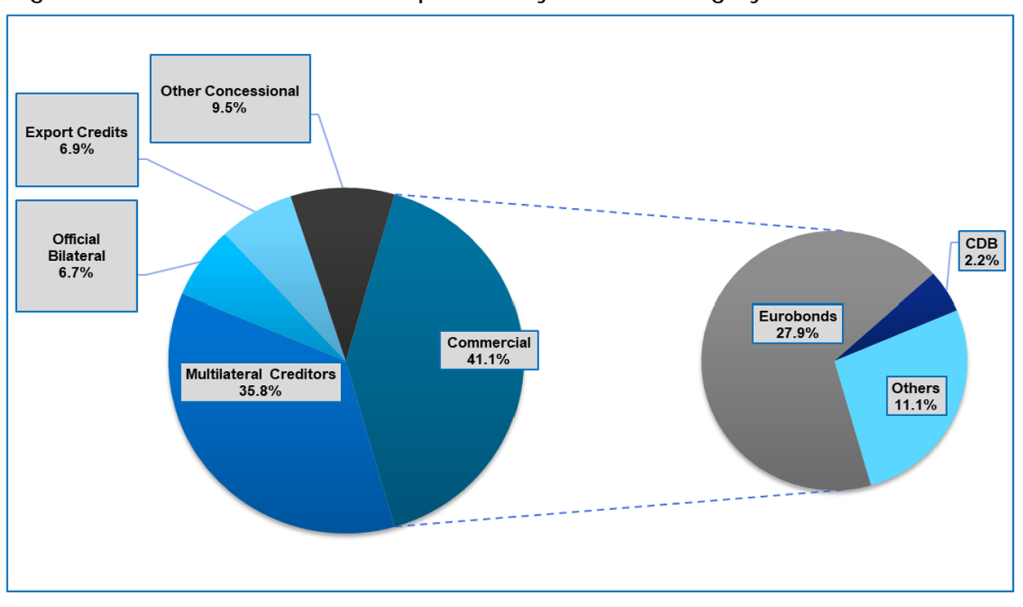

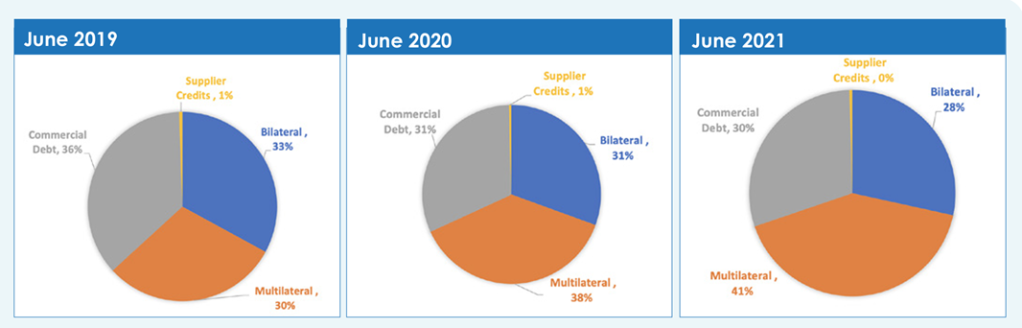

The pace at which the country’s debt portfolio transformed to “predominantly commercial” was much too fast for the pace of the country’s development. Ghana seems to have “graduated from aid” way faster than its institutions and other capacities could catch up, saddling it with expensive, non-concessional, debt that its sub-Saharan lower middle income peers have yet to grapple with to the same degree.

To probe this a bit further, consider the two graphs below.

Compare Cape Verde and Mozambique to Ghana, and it becomes crystal clear how the debt composition can have an outsized impact on debt service burden. Whilst the former two countries borrow considerably from multilateral and bilateral sources, Ghana is increasingly being locked into pure commercial debt (also referred to as “external private” below) as a consequence of foreign policy choices (not investing enough attention into economic relations) and sheer fiscal desperation.

As proof that this is not merely a feature of Ghana’s lower middle income and higher GDP situation, Kenya’s debt composition is reproduced below as well.

Clearly, whatever grievances Ghana may have against the rating agencies, the country is still best served looking at more fundamental issues like its growing addiction to expensive commercial debt, well above its economic capacity to service.

Even if the growing calls for “Africa based” continental rating agencies and local regulations on ratings (cf. along these lines) were to be heeded, investors would still choose which ratings agencies to believe, forcing the matter out of the hands of governments. One even wonders how much commitment African governments and corporations will show were such entities to emerge, considering that only 6 countries have met some of the key milestones on the APRM’s roadmap for improving Africa’s sovereign rating situation.

It is up to Ghana’s leaders to decide when to move beyond the sense of persecution to focus on the deep structural issues of efficient spending and realistic tax mobilisation from an increasingly overburdened population.

Latest Stories

-

Legislature remains the heartbeat of democracy, need that recognition –Speaker Bagbin

15 minutes -

TCDA highlights measures to reclaim 910 acres of encroached land at Wenchi Agricultural Station

19 minutes -

MTN promises to execute Ambition 2025 Strategy despite economic challenges; records GH¢5.028bn profit in 2024

27 minutes -

Coastal erosion in Volta Region: James Gunu declares ‘state of emergency’

1 hour -

Akpafu Todzi EP JHS housed in a weak structure

1 hour -

SONA was too brief on ‘galamsey’ but… – Ken Ashigbey

2 hours -

Minority boycotts orientation programme for MPs

2 hours -

Women of Valour demands swift investigation into KNUST murder

9 hours -

UCC lecturer applauds Mahama’s SONA

10 hours -

I’ll stand by your side – New Deputy GTA CEO Abeiku Santana to Maame Efua Houadjeto

11 hours -

Aba with the Sauce recruits Chley for wavy Amapiano single and video ‘Move’

11 hours -

Isco inspires Betis to comeback win over Real Madrid

12 hours -

‘End of era’ for Africa as Namibia buries founding father

12 hours -

Jeffrey Schlupp scores and sets up another as Celtic put five past St. Mirren

12 hours -

‘Trump and Vance were so rude’: Ukrainians react to disastrous White House meeting

12 hours