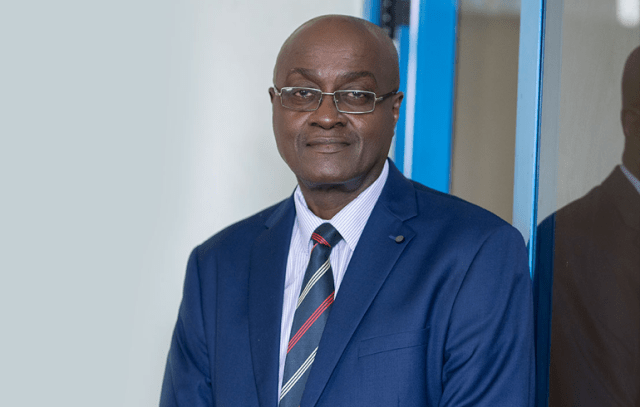

Banking Consult, Dr. Richmond Atuahene has adviced the Central Bank to put its best foot forward to eliminate the various increased pressures on the liquidity of banks and the threat to their solvency.

Dr. Atuahene said the situation if not managed properly will affect the ability of banks to lend to private sectors and small businesses and cause a depletion of regulatory capital.

“From where I sit and the calculations in front of me, Bank of Ghana would need to work hard because out of the 23 (banks), I do not know which one would stay if we go by the International best practices,” he said on Top Story, Monday.

His advice follows the Bank of Ghana’s stress test which revealed that some 23 banks would be heavily affected in terms of liquidity and capital after the debt exchange programme is rolled out.

The Governor of the Bank of Ghana, Dr. Ernest Addison during the bank’s Monetary Policy Committee meeting on Monday (January 30) said measures have been outlined to deal with the liquidity issues of these banks.

“Yes, the bank did the stress test on the ability of these 23 or so banks to withstand the impact of the debt exchange.

"We did see the numbers, the implications for liquidity and the implications for capital and on the basis of that exercise, the bank came up with a high regulatory release which we thought would help them deal with the impact on liquidity and capital. We agree to reduce the cash reserve ratio from 14% to 12% on domestic reserves,” he said.

The Central Bank also announced that profitability levels in the banking sector have declined.

This, the BoG said, is due to the mark-to-market losses on investments, higher impairments on loans, and rising operating costs.

“Profit-after-tax was GH¢3.9 billion at the end of December 2022, representing 18.9 percent contraction year-on-year, compared to 12.3 percent annual growth recorded in 2021,” the Central Bank indicated.

Latest Stories

-

REMAPSEN celebrates 5 years of championing health and environmental awareness across Africa

37 minutes -

I served with diligence and honesty; I am willing to defend my NSS tenure in court – Mustapha Ussif

53 minutes -

Afenyo-Markin challenges Ahiafor’s sub judice ruling, calls it ‘dangerous precedent’

3 hours -

Mahama instructs Armed Forces to escort all vehicles in Bawku area

3 hours -

African artists, global awards, and the fight for visibility

3 hours -

This Saturday on Newsfile: GRNMA strike, ORAL probe into NSA, shut down of 64 radio stations

4 hours -

19 arrested in raid on drug and robbery dens at Kasoa Dominase, Onion Market

4 hours -

Luv FM High Schools Debate heats up as top schools advance to Round of 16

4 hours -

Asantehene urges chiefs to offer lands as equity for farming

4 hours -

GhanaFest Alberta 2025 launch ignites diaspora business momentum

5 hours -

22-year-old hearing-impaired man allegedly dies by suicide after rape accusation

5 hours -

CAETE 2025: MDF seals 10k jobs deal with China’s Yixintai Group

5 hours -

Climate Change: AGN Chair emphasises importance of Africa’s unity in global negotiations

6 hours -

TV stations risk prosecution over pirated content – Copyright Office warns

6 hours -

Anointed Engineering donates ‘Borla Macho III’ tricycle to support sanitation drive in Accra

6 hours