The flagbearer of the New Patriotic Party (NPP), Dr Mahamudu Bawumia, has firmly reiterated his commitment to abolish the controversial E-Levy and betting tax if elected President in the 2024 general elections.

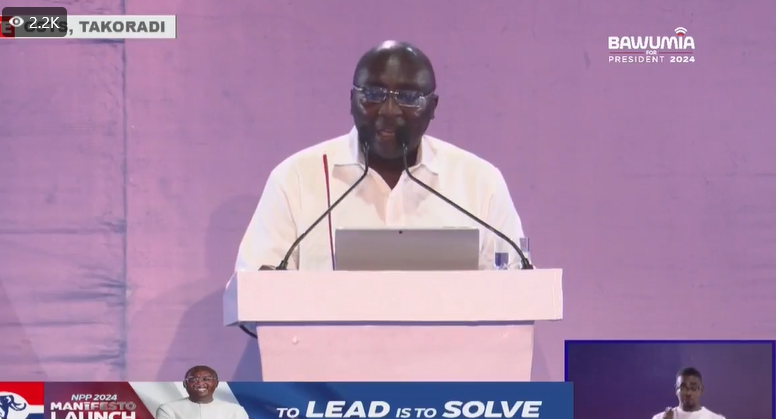

Speaking at the NPP’s manifesto launch in Takoradi on Sunday, August 18, he outlined his administration's vision for comprehensive tax reforms aimed at reducing the financial burden on Ghanaians.

This includes a tax amnesty for previous years’ unpaid taxes, as well as waivers on interest and penalties for unfiled taxes.

He also detailed strategies to position Ghana as a global digital leader, focusing on policies, competitive incentives, and strategic investments to transform the nation into a world-class digital economy.

“We will fast-track Ghana’s transformation into Africa’s digital hub through strategic policies, incentives, and investments. This includes investing in local talent and tech start-ups while abolishing the E-Levy.

“We’ll implement broad tax reforms, offering a one-time tax amnesty to all Ghanaians and corporate entities, wiping the slate clean from previous tax obligations. This will give everyone a fresh start in their tax journey.

“We will reform the Value Added Tax system by consolidating all levies into a single line item, which will be treated as part of input and output VAT, eliminating the cascading effect of the current regime.

"We’ll also reduce Withholding Tax for small-scale gold exports to 1% to curb smuggling, and abolish the Betting Tax,” Dr. Bawumia promised.

Business-friendly tax reforms

Dr Mahamudu Bawumia also pledged to establish a more business-friendly environment if elected in the upcoming 2024 elections.

Read also: 2024 NPP Manifesto: Bawumia pledges business-friendly tax reforms

He highlighted his unwavering commitment to boosting and expanding the private sector.

He outlined a comprehensive plan for a revamped tax regime under his administration, specifically tailored to accelerate business growth and spur economic development across the country.

Latest Stories

-

Trump’s call with Putin exposes shifting ground on Ukraine peace talks

2 hours -

If not for Gold-for-Oil, our economy would have collapsed – Bawumia

3 hours -

‘NDC has no policy behind cedi gains’ – Bawumia dismisses opposition credit for currency stability

3 hours -

US Supreme Court lets Trump end deportation protections for 350,000 Venezuelans

4 hours -

IGP orders raid on illegal mining hub at Wassa Gyapa after JoyNews reports

4 hours -

Russia and Ukraine to ‘immediately’ start ceasefire talks, says Trump

4 hours -

France to open high-security prison in Amazon jungle

4 hours -

Gary Lineker: A sorry end to a BBC career

5 hours -

Lineker to leave BBC sooner than planned after antisemitism row

5 hours -

Nigerian judges endorse Ikot Ekpene Declaration to strengthen digital rights protection

5 hours -

Call for load shedding timetable misplaced; power generation meets peak demand – Energy Ministry

5 hours -

Cedi records 17.17% appreciation to dollar; one dollar going for GH¢13.50

5 hours -

Interplast named among Financial Times’ fastest-growing companies in Africa

6 hours -

GPRTU to reduce transport fares by 15% effective May 25

6 hours -

Ghana Alphas, Tau Alpha Lambda donate to Abeadze State College

6 hours