Banks in Ghana remain in a solid position despite Ghana’s challenging economic environment and the ongoing efforts of the Domestic Debt Exchange Programme (DDEP), Fitch Solutions has stated in its new report dubbed “Ghana’s New CRRs To Have Muted Impact On Loan Growth And Weigh On Profits”.

According to the London-based firm, the banking sector has reported strong growth in balance sheet items despite unfavourable conditions.

It added that capital levels, which had fallen close to the minimum requirement, are beginning to improve again, and banks are recording robust profits.

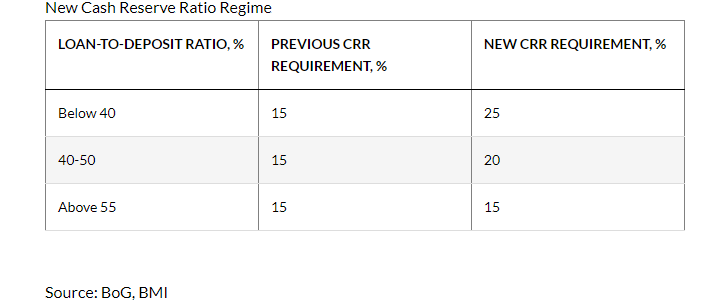

However, it explained that the recently introduced linking of banks’ cash reserve ratio (CRR) requirement to their loan-to-deposit ratio (LDR) will have several unfavourable consequences.

On March 25 2024, the Bank of Ghana (BoG) introduced a new regime aiming to boost lending and reduce excess local-currency liquidity to control inflation by linking the CRR to the LDR. “While we believe this will compel some banks to extend more credit, very poor loan quality will keep lending too risky for others, who will instead prefer to hold high cedi cash reserves at the central bank”, it stressed.

The table below shows the new requirements, which took effect at the end of April 204.

CRR to spur loan growth

Furthermore, Fitch Solutions said “We believe this new regime will support loan growth for some banks”.

Institutions with currently low ratios of non-performing loans (NPLs) to total loans, will have room to increase their lending and, therefore, their LDR, which will boost industry credit growth in 2024. For instance, Zenith Bank, Access Bank, and GTBank – the seventh, eighth, and ninth largest banks in Ghana, respectively – recorded NPL ratios between 2-4% in quarter one 2024.

It said, this will allow them to increase lending, with an average LDR of 20.2% for the same period.

The growth will be supported by an improving economic environment characterised by interest rate cuts, falling inflation, and strong economic growth, which will boost credit demand. Additionally, these diminishing headwinds will make it easier for households and businesses to repay their debts, improving banks' loan quality and incentivising further credit extension.

Latest Stories

-

Pakistan to nominate Trump for Nobel Peace Prize

1 hour -

Suicide bombing at Damascus church kills 22, Syrian authorities say

1 hour -

Bellingham scores as 10-man Real Madrid beat Pachuca

2 hours -

Three fans die in Algeria football stadium fall

2 hours -

South African engineers freed after two years in Equatorial Guinea jail

2 hours -

FedEx founder and former boss Fred Smith dies aged 80

2 hours -

Bride shot dead in attack on French wedding party

3 hours -

Legon Cities handed transfer ban over unpaid GHC 29,000 compensation to Francis Addo

3 hours -

Alonso says FIFA investigating racial abuse against Rudiger

3 hours -

Rashford would like to play at Barcelona with Yamal

3 hours -

Garnacho posts picture wearing Aston Villa shirt

3 hours -

Premier League contacts Chelsea over Boehly ticket website

3 hours -

Liverpool agree £40m deal to sign Kerkez from Bournemouth

4 hours -

Everton close on deal for Fulham right-back Tete

4 hours -

Why Alcaraz is ‘red-hot favourite’ for third Wimbledon title

4 hours