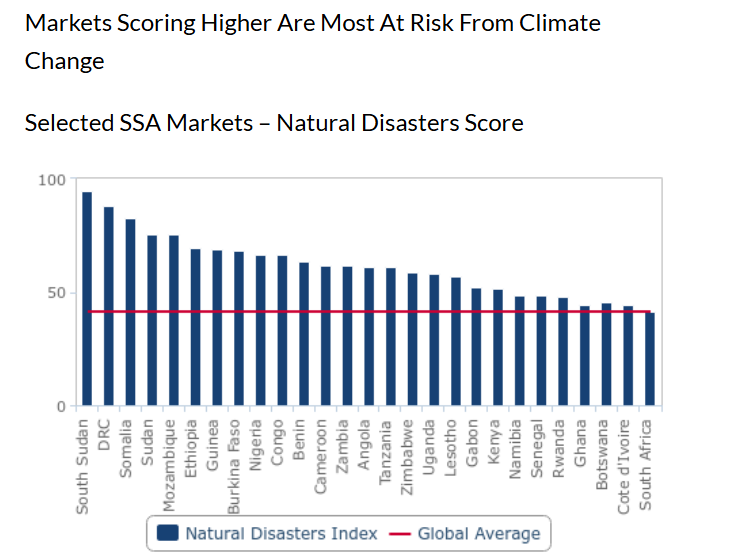

Banks in Ghana are ranked 4th in Sub-Saharan Africa (SSA) in terms of Natural Disasters Score.

According to Fitch Solutions Climate Change and Opportunities for SSA Banking Sectors report, banks in South Africa are the safest from natural disasters.

Coted’lvoire and Botswana placed 3rd and 4th respectively.

In the top 10 were Rwanda (5th), Senegal (6th), Namibia (7th), Kenya (8th), Gabon (9th) and Lesotho (10th).

Banks in South Sudan, Dr Congo and Somalia have the highest score for natural disaster.

According to Fitch Solutions, the banking sectors across Sub-Saharan Africa (SSA) face significant challenges due to climate change, which have been categorised into four main risk factors: physical risks, transition risks, financial market volatility and limited uptake of climate insurance.

First, banks face physical risks from climate change, which refers to the direct impact on assets from extreme weather events, rising temperatures and sea levels.

These risks, the UK-based firm said, are particularly pronounced in SSA due to the region's heavy reliance on agriculture and natural resources and low levels of resilience to climate change.

“A significant portion of SSA's economy is based on rain-fed agriculture, which is highly sensitive to climate variability. For example, nearly two-thirds of Africa’s economic output is dependent on the natural environment, making the region extremely vulnerable to droughts, floods, and other extreme weather events”.

“This dependency means that adverse weather conditions can lead to substantial economic losses, with estimated losses of US$7-15 billion per year due to climate change”, it added.

It continued that climate-related disruptions in these sectors can lead to significant job losses and reduced economic output, further straining the financial sector.

It added this affects the ability of borrowers to repay loans and increases the risk of defaults for banks.

It in turn weighs on banks’ capital and profits, threatening the overall stability of the financial sector.

Latest Stories

-

Fuel prices to fall from June 16 due to postponement of GH¢1.0 levy

39 minutes -

PassionAir assures passengers after Kumasi–Accra flight encounters turbulence

2 hours -

Fatherhood Beyond Finances: Two drivers inspire a rethink on presence, bonding and recognition

2 hours -

President Mahama urges protection of fuel price gains amid Middle East tensions

2 hours -

Republic of Rogues: Where Thieves Have Heads and the System Has None

3 hours -

Musah Mohammed donates jerseys and footballs to youth teams in Nkawkaw

4 hours -

Omane Boamah urges youth to persevere, recounts dramatic admission struggle at POJOSS

4 hours -

Minority unhappy over suspension of fuel levy, demands full repeal

4 hours -

Helicopter carrying Hindu pilgrims crashes in India, killing seven people

4 hours -

Council of State member urges Ghana to localise global solutions for youth employment

4 hours -

CAS overturns FIFA ruling and awards Right to Dream development fees from Ernest Nuamah’s transfer

5 hours -

Hitz Praise Zone: Nii Noi launches new gospel show on Hitz FM

5 hours -

BOAD reaffirms commitment to energy transition and sustainable agriculture in West Africa

6 hours -

10 kinds of women who have denied men the joy of fatherhood

7 hours -

A father’s hurdles caring for son with Sickle Cell disease – John Dzido shares a fraction

7 hours