- Introduction

Africa stands at a critical crossroads, rich in natural resources and cultural heritage, yet grappling with severe economic instability. The past two decades have seen the continent's currencies, such as the Ghanaian Cedi and Nigerian Naira, suffer dramatic devaluations, eroding the purchasing power of millions and stifling economic growth. This persistent volatility has not only inflated the cost of living but also burdened African nations with unsustainable foreign debt and deterred much-needed foreign investment.

Amidst these challenges, the AKL Lumi emerges as a beacon of hope—offering a unique opportunity to stabilize African economies and reclaim economic sovereignty. This article delves into the tumultuous history of African currencies, examining the forces that have shaped their decline and exploring how the AKL Lumi could transform Africa’s economic landscape by fostering stability, growth, and a unified regional identity.

- Historical Analysis of African Currencies

2.1 Examination of the Dollar and Ghana Cedi over the Past Two Decades

2.1.1 Exchange Rate Trends

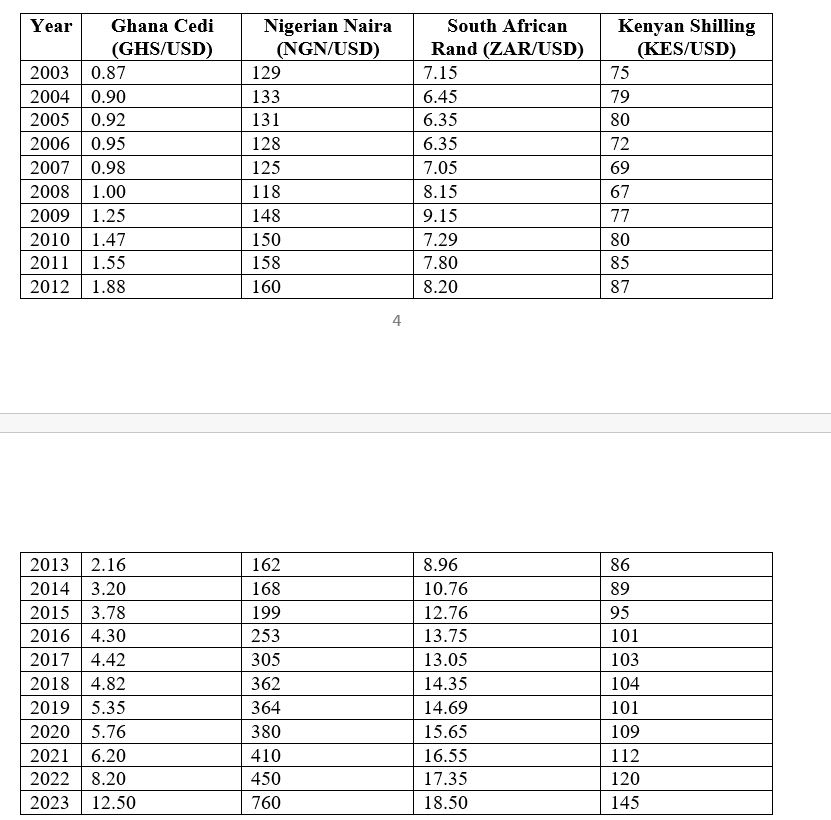

Africa, a continent rich in natural resources and cultural diversity, has faced significant economic challenges over the past two decades. One of the critical issues undermining its economic stability is currency volatility. For instance, the Ghanaian Cedi depreciated from an average of GHS 0.87 to USD 1 in 2003 to about GHS 12.50 to USD 1 by 2023, representing a devaluation of approximately 1,334% over two decades (Bank of Ghana, 2023). Similarly, the Nigerian Naira fell from NGN 129 to USD 1 in 2003 to around NGN 760 to USD 1 in 2023, marking a depreciation of over 490% (Central Bank of Nigeria, 2023). These fluctuations have profoundly impacted inflation rates, foreign debt, and overall economic growth. Currency stability is essential for fostering a conducive environment for investment, trade, and sustainable economic development.

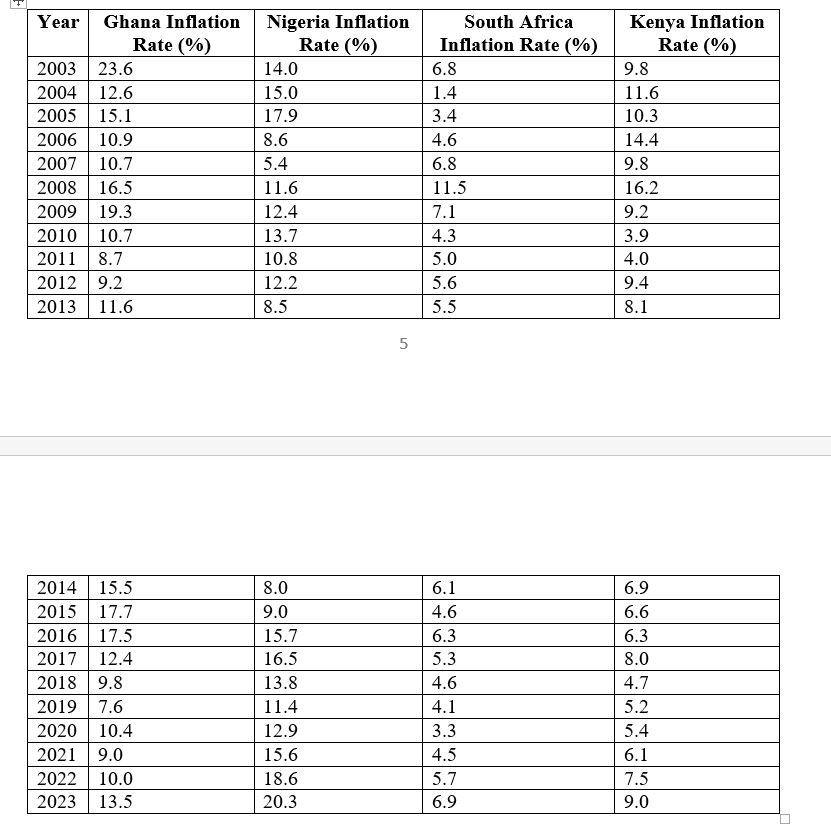

Persistent devaluation of African currencies has led to inflationary pressures, increased cost of imports, and reduced purchasing power for the general populace. For instance, Ghana experienced an inflation rate averaging around 14.72% from 2003 to 2023 (Statista, 2024), while Nigeria saw an average inflation rate of 12.9% over the same period (Statista, 2024). These economic instabilities have exacerbated poverty, unemployment, and economic inequality across the continent.

In this context, the AKL Lumi emerges as a potential solution to unify and stabilize African economies. The AKL Lumi, introduced by the African Diaspora Central Bank, aims to reduce reliance on foreign currencies, promote intra-African trade, and enhance economic sovereignty. By introducing a common currency, Africa could potentially mitigate the adverse effects of currency volatility and create a more stable economic environment conducive to growth and development. This article provides a comprehensive analysis of the Dollar and Ghana Cedi, along with other significant African currencies over the past two decades.

Using empirical data, we examine the trends and impacts of these currencies and explore how the AKL Lumi could potentially salvage the economic situation in Africa. We delve into historical trends, challenges faced by African economies, and the potential of the AKL Lumi to bring about a much-needed economic revolution. Through a detailed analysis, this article aims to provide empirical evidence of the performance of some selected countries’ currencies in Africa and the urgent need for African leaders to consider adopting the AKL Lumi as a viable solution to the continent's economic, cultural, and social issues, ultimately providing Africa with a unified identity and a brighter economic future.

2.2 Analysis of Currency Volatility and Economic Impact

2.2.1 Ghana Inflation Rates

The inflation rate in Ghana has fluctuated considerably over the past two decades, averaging around 14.72% from 2003 to 2023 (Statista, 2024). This high inflation has eroded purchasing power and increased the cost of living, contributing significantly to economic instability. As the Ghanaian Cedi has depreciated, several adverse economic impacts have emerged. Firstly, the increased cost of imports has become a major concern. As the Cedi loses value, the cost of imported goods rises, which in turn contributes to higher inflation rates.

This inflationary pressure exacerbates the cost of living for the average Ghanaian, making everyday essentials more expensive and further straining household budgets. Secondly, debt servicing challenges have intensified. With a weaker currency, the cost of servicing foreign-denominated debt increases, placing a greater burden on public finances.

This scenario often leads to a vicious cycle where governments must allocate more resources to debt repayment, leaving less available for crucial investments in infrastructure, education, and healthcare. Lastly, currency instability serves as a significant deterrent to investment. Foreign investors are typically cautious about investing in environments where currency values are unpredictable and volatile. The instability of the Cedi can thus deter potential investors who seek more stable economic conditions. This lack of foreign investment hinders economic growth and limits job creation, further compounding the economic difficulties faced by the country.

2.2.2 Overview of Other Significant African Currencies

Nigerian Naira

The Nigerian Naira has faced significant depreciation over the past two decades, reflecting broader economic challenges. In 2003, the exchange rate was NGN 129 to USD 1. By 2023, it had fallen to NGN 760 to USD 1, representing a depreciation of over 490% (Statista, 2024). This sharp decline has been accompanied by an average inflation rate of 12.9% during this period. The persistent depreciation of the Naira has exacerbated economic hardship and social unrest in Nigeria. The high inflation rates have eroded purchasing power, increased the cost of living, and heightened economic uncertainty. Moreover, the volatility of the Naira has deterred foreign investment, as investors seek more stable economic environments. This currency instability has also impacted Nigeria’s ability to service its foreign-denominated debt, further straining public finances and limiting the government’s capacity to invest in critical infrastructure and social services

South African Rand

The South African Rand has experienced similar volatility, contributing to the country's economic challenges. In 2003, the exchange rate was ZAR 7.15 to USD 1. By 2023, it had depreciated to approximately ZAR 18.50 to USD 1, a devaluation of about 158% (Statista, 2024). The instability of the Rand has been influenced by various factors, including political uncertainty, economic mismanagement, and external economic shocks. South Africa has faced slow economic growth, high unemployment rates, and significant income inequality, which have been exacerbated by currency instability. The depreciation of the Rand has increased the cost of imports, contributing to inflation and reducing the purchasing power of South African consumers. Additionally, currency volatility has deterred foreign investment, limiting economic growth and job creation opportunities.

Kenyan Shilling

The Kenyan Shilling has experienced a more moderate depreciation compared to some other African currencies. In 2003, the exchange rate was KES 75 to USD 1, and by 2023, it had depreciated to around KES 145 to USD 1, a devaluation of approximately 93% (Statista, 2024). Kenya’s inflation rate averaged around 7.8% during this period, reflecting relatively better economic management. Despite this, the depreciation of the Shilling has still posed challenges for the Kenyan economy. The increased cost of imports has contributed to inflationary pressures, although to a lesser extent than in countries with more volatile currencies. Kenya’s relatively stable economic management has helped mitigate some of the adverse effects of currency depreciation, maintaining more stable inflation rates and economic growth compared to its regional counterparts.

2.3 Comparative Analysis Using Tables and Graphs

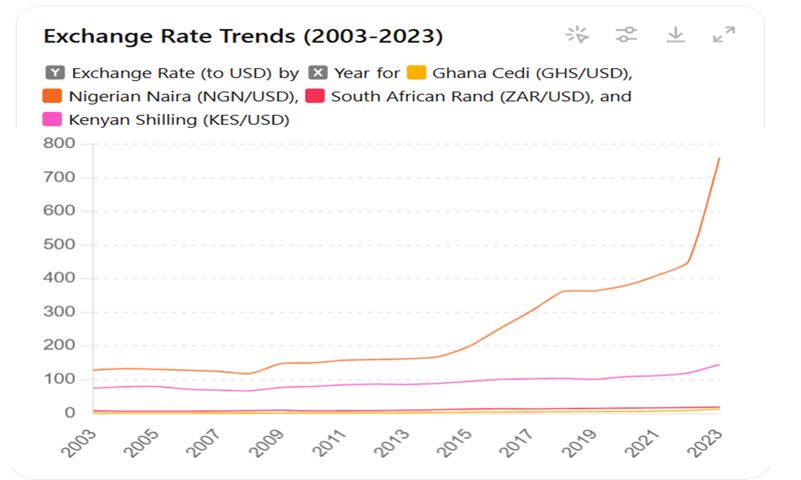

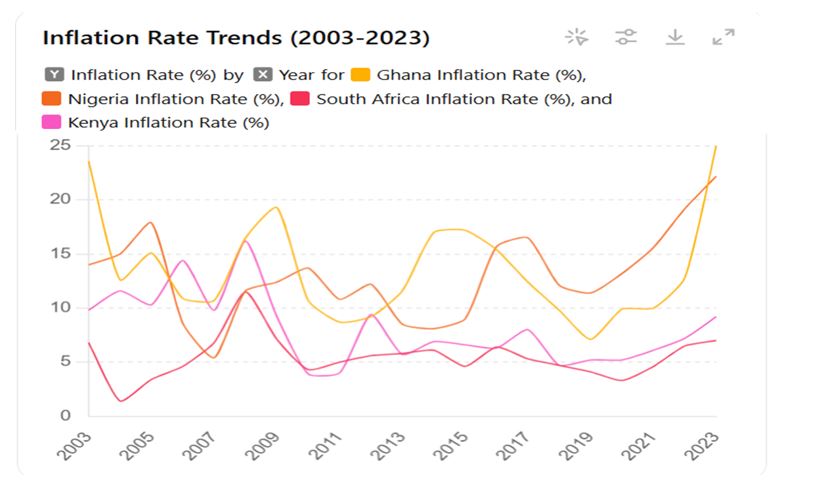

To illustrate these trends, the following tables and graphs provide a comparative analysis of the exchange rates and inflation rates of the Ghanaian Cedi, Nigerian Naira, South African Rand, and Kenyan Shilling over the past two decades.

Table 1: Exchange Rate Trends (2003-2023)

Figure 1: Exchange Rate Trends (2003-2023)

Table 2: Inflation Rates (2003-2023)

Figure 2: Inflation Rates (2003-2023)

- Challenges with the US Dollar and the Case for the AKL Lumi

The global economic landscape is experiencing a significant shift as the dominance of the US dollar faces increasing scrutiny and challenges. Financial educator Robert Kiyosaki has been vocal about the potential downfall of the US dollar, citing its excessive printing and rising inflation. Kiyosaki describes the dollar as "toilet paper" compared to stable assets like gold and silver, emphasizing that the over-reliance on the dollar is pushing the American empire towards its end (Kiyosaki, 2023).

Countries around the world are also taking steps to reduce their dependency on the US dollar. For instance, Saudi Arabia has announced plans to move away from using the dollar for international transactions, indicating a major shift in global financial practices (Geopolitical Economy Report, 2023). Similarly, the Gambia has imposed restrictions on using the US dollar to stabilize its economy. Egypt, too, has introduced measures to reduce dependency on the dollar, and recently, the Bank of Ghana (BoG) issued directives to close all dollar savings accounts, urging citizens to utilize the local currency instead (Central Bank of the Gambia, 2023; Bank of Ghana, 2023).

The BRICS alliance, consisting of Brazil, Russia, India, China, and South Africa, along with additional countries such as Saudi Arabia, UAE, and Egypt, has also taken steps to de-dollarize their economies. At a recent summit, BRICS countries decided to stop settling international trade using the US dollar and are considering creating a common currency among member nations (Watcher Guru, 2023). This move is part of a broader trend where developing countries seek to strengthen their local currencies and shield their economies from the influence of US sanctions and dollar hegemony. These global trends underscore the growing need for a stable and reliable alternative currency. The AKL Lumi, introduced by the African Diaspora Central Bank, offers a promising solution. Backed by assets such as renewable energy and gold, the AKL Lumi aims to reduce Africa’s reliance on volatile foreign currencies and foster economic sovereignty.

- Potential of AKL Lumi to Stabilize African Economies

The AKL Lumi, backed by renewable energy and gold, presents a unique opportunity to stabilize African economies through Diaspora Direct Investment (DDI). Given the volatility of African currencies and the growing challenges associated with the US dollar, the AKL Lumi stands out as a beacon of stability and economic growth for the continent. Unlike other currencies, the AKL Lumi is not introduced to compete but to provide economic stability and enhance financial sovereignty in Africa.

4.1 Short to Medium Term: Boosting Economic Activity and Investment

Diaspora Direct Investment refers to the investments made by Africans living abroad into their home countries. The African diaspora, estimated to be over 150 million strong, holds significant financial resources. In 2020 alone, remittances from the diaspora amounted to over $83 billion, underscoring the substantial economic potential of this group. The AKL Lumi’s asset backing by renewable energy and gold provides a stable and reliable currency for investment, significantly mitigating the risks associated with currency volatility. This inherent stability is crucial in attracting more diaspora investments, as investors are assured of the currency's intrinsic value. The primary rate of the AKL Lumi is pegged at four grains of gold (0.2592g), which has a parity value of $15.96. Although the current market rate of 4 grains of gold (0.2592g) is approximately $18, the African Diaspora Central Bank (ADCB) maintains its fixed rate at $15.96 to ensure stability and predictability (ADCB, 2023). By using the AKL Lumi, diaspora investors can avoid the high transaction costs typically associated with traditional cross-border remittances and currency conversions. This cost efficiency can encourage more frequent and larger investments, bolstering economic activities across the continent.

Moreover, the digital accessibility of the AKL Lumi through blockchain technology ensures that diaspora investors can seamlessly invest in African projects from anywhere in the world. Platforms like Swifin and HanePay facilitate this process, making investments more straightforward and transparent. Increased DDI facilitated by the AKL Lumi can fund critical infrastructure projects such as roads, bridges, and utilities, which in turn boost economic activity and create jobs. Additionally, diaspora investments can provide much-needed capital for small and medium enterprises (SMEs), which are the backbone of many African economies. This influx of capital can lead to increased business activities, innovation, and employment opportunities. Investment in renewable energy projects, supported by the AKL Lumi, can enhance energy security, reduce reliance on fossil fuels, and promote sustainable development.

4.1 Current Implementation and Funding

The AKL Lumi has already been implemented in several countries and regions, receiving funding through licensed fintech platforms HanyPay and Swifin. Notable projects include substantial investments in water sanitation in Africa, infrastructure in Hawaii, and development projects in South Africa and Uganda. Agreements have also been reached to implement the AKL Lumi in other regions, with substantial funds allocated for further development projects. A recent Public-Private Partnership (PPP) agreement involving the African Diaspora Central Bank (ADCB), the Republic of Vanuatu Trade Commission – Ghana, and STRATEMA AM GmbH of Germany underscores the commitment to leveraging Diaspora Direct Investments for sustainable economic growth.

The ECO-6 treasury within the ADCB has issued funds denominated in AKL Lumi 93,984,962.40, equivalent to US$1,500,000,000. These funds will be invested in regional local entities across various sectors, including banks, trade unions, government agencies, enterprises, start-ups, and R&D initiatives contributing to sustainable solutions. A portion of the funds will finance renewable energy reserves, aiming to deliver seven gigawatts (7GW) of solar energy over a 25-year term, aligning with Agenda 2063. The monetary value of LUMI is pegged to 100kWh of solar energy or four grains of gold (0.2592g), ensuring its role as a stable store of value (ADCB, 2023).

Over the long term, the widespread adoption of the AKL Lumi can enhance economic sovereignty by reducing dependency on volatile foreign currencies. This can stabilize national economies and protect them from external economic shocks. The AKL Lumi can facilitate increased trade among African countries by providing a common and stable currency, leading to greater economic integration, economies of scale, and stronger regional cooperation. The stability and sustainability of the AKL Lumi can attract not only diaspora investments but also global investments.

As the AKL Lumi gains acceptance, it can position Africa as a stable and attractive investment destination. Through providing a stable and accessible currency, the AKL Lumi can promote financial inclusion, bringing more people into the formal economy. This can increase savings, access to credit, and overall economic participation. The AKL Lumi’s link to renewable energy promotes sustainable development. Investments in solar energy and other renewable projects can create a sustainable economic foundation, reducing environmental impact and fostering green growth. Furthermore, investments in education and skills development funded through the AKL Lumi can build a knowledgeable and skilled workforce, essential for long-term economic growth and innovation. Countries that adopt the AKL Lumi can build economic resilience by stabilizing their currencies and reducing vulnerability to external shocks. This can lead to sustained economic growth and improved living standards. With stable investment facilitated by the AKL Lumi, African countries can develop technology and innovation hubs, driving the digital economy and creating high-tech jobs. By fostering intra-African trade and attracting global investments, the AKL Lumi can help transform Africa into a regional economic powerhouse, with increased influence and competitiveness on the global stage.

5. Conclusion

The analysis of the Dollar, Ghana Cedi, and other significant African currencies over the past two decades has highlighted the persistent economic challenges faced by African economies, including currency volatility, high inflation, and substantial foreign debt. These issues have undermined economic stability, exacerbated poverty, and hindered sustainable development across the continent. The introduction of the AKL Lumi presents a transformative solution to these challenges. Backed by renewable energy and gold, the AKL Lumi offers a stable and reliable currency that can reduce reliance on volatile foreign currencies and foster economic integration. The unique features of the AKL Lumi, including its non-fiat nature and digital accessibility, position it as a pioneering financial instrument capable of driving sustainable economic growth and financial inclusion. Through the strategic implementation of the AKL Lumi, supported by policy changes, technological infrastructure, and public awareness campaigns, African nations can unlock substantial economic benefits.

The AKL Lumi can facilitate increased Diaspora Direct Investment (DDI), attracting substantial financial resources from the African diaspora to fund critical infrastructure, SMEs, and renewable energy projects. This influx of investment can boost economic activity, create jobs, and enhance financial stability in the short to medium term. In the long term, the widespread adoption of the AKL Lumi can enhance economic sovereignty, promote sustainable development, and position Africa as a stable and attractive investment destination. By reducing dependency on external currencies and fostering intra-African trade, the AKL Lumi can drive economic integration and strengthen regional cooperation. The successful implementation of the AKL Lumi requires coordinated efforts from governments, regional bodies, and the private sector. By addressing potential challenges such as resistance to change, technological barriers, and security concerns, African nations can ensure the seamless adoption of the AKL Lumi and maximize its economic impact.

The AKL Lumi is not just a currency; it is a symbol of Africa's potential for economic transformation and empowerment. By leveraging the financial power of the African diaspora and promoting sustainable development, the AKL Lumi can help Africa achieve economic stability, growth, and self-reliance. African leaders are encouraged to embrace the AKL Lumi as a viable tool for addressing the continent's economic challenges and realizing its vision for a prosperous and unified Africa.

-

About The Authors

Albert Derrick Fiatui, is the Executive Director at the Centre for International Maritime Affairs, Ghana (CIMAG), an Advocacy, Research and Operational Policy Think-tank, with a focus on the Maritime Industry (Blue Economy) and general Ocean Governance. He is a Maritime Policy and Ocean Governance Expert.

Dr. David King Boison is the CEO of Knowledge Web Centre, a prominent research and consulting firm, Senior Research Fellow at CIMAG and Project Team Leader for the Vanuatu Trade Commission to Ghana on the AI Africa Project.

Latest Stories

-

MTN MoMo users face six-hour nationwide blackout for system upgrade

11 minutes -

Tinubu made cancer treatment possible in Nigeria – Minister

19 minutes -

Final preparations underway for state burial of helicopter crash victims

33 minutes -

World Bank cautions BoG on excessive FX Interventions, calls for banking sector reforms

41 minutes -

3 dead in tragic road accident on Bekwai-New Edubiase Road

44 minutes -

Helicopter crash: Sissala Council of Chiefs commiserates with bereaved families

48 minutes -

The Big Push: Ghana’s panacea towards joblessness and skills for the future

48 minutes -

MTN signs $2m deal to sponsor four Ghana national teams until 2027

51 minutes -

Sportswear brand On signs three new NIL athletes from Kenya

55 minutes -

Koforidua Catholic Bishop warns clergy against unfounded prophecies after helicopter crash

1 hour -

Melcom Group signs book of condolence in honour of 8 fallen patriots

1 hour -

Why I think Dr Bryan Acheampong is simply the best

1 hour -

Access Bank, others pay tribute to helicopter crash victims

1 hour -

I believe NPP will give me mandate to lead – Dr Adutwum

2 hours -

Observer missions push for EC appointment overhaul, lower presidential age limit

2 hours