Over two million cedis is being paid to shareholders of Amenfiman Rural Bank as dividends for the 2021 financial year.

This represents a 30% return on investment, with each share attracting 6 pesewas.

The development comes after the expiration of a directive by the Bank of Ghana for deposit-taking institutions to halt payment of dividends in two financial years due to the impact of COVID 19 pandemic.

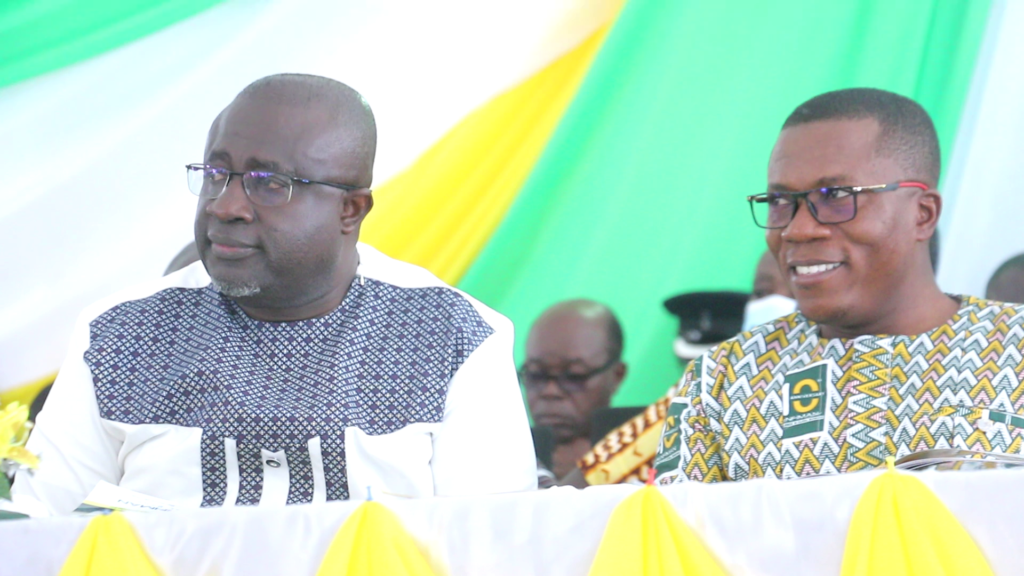

At the Annual General Meeting of the Bank in Wassa Akropong, Chief Executive Officer, Alexander Asmah said more will be done to ensure profitability.

“Having been able to overcome the challenges of COVID-19 and having to come this far with all the restrictions relaxed, we can assure you we will work so hard to protect your investment”, he said.

Financial Performance

Amenfiman Rural Bank’s total income increased from GH¢62.2 million to GH¢78.2 million, representing 25.7 percent increase over that of 2020.

The Bank recorded profit before tax of GH¢10.1 million compared to GH¢11.5 million posted in 2020, a slight dip from the previous year’s. The profit after tax was GH¢7.586 million after paying corporate tax of GH¢3.566 million

Due to consistent implementation of a diversified business model, growth in interest income was GH¢85.4 million from GH¢67 million in the year 2020, up by 26.8 percent. Commission and fees also increased by 21.7 percent to GH¢ 8.4 million from GH¢ 6.9 million.

Deposits of customers grew by 10.4 percent from GH¢363.6 million in 2020 to GH¢ 401.7 million.

In closing the 2021 financial year, total assets of the bank grew by 12.6 percent, driven mainly by a 43.9 percent increase in loans and advances to support the agriculture and SME sectors of the economy.

With stated capital of GH¢ 6.7 million, managers of the bank assured they are sufficiently capitalized to make profit.

Management of the Bank says prudent strategies had to be adopted to keep the bank afloat despite economic challenges.

Board Chair, Dr. Toni Aubynn explains, “the difference between the rural bank and the other banks is that we are very close to our customers so we know their challenges so if you come to us for credit, we will follow you and know what you are doing. We are a very friendly bank and we think ahead, this has reflected in the many awards we have won”.

Support for SMEs

In helping drive the government’s agenda to create jobs through entrepreneurship, the bank is helping build capacities of customers to start and maintain businesses.

Dr. Alexander Asmah said the necessary funding will be granted to businesses to be established through the training.

“We are empowering the people, our customers and people in our communities to create multiple streams of income. They should not rely only on their salaries, they should be able to take money from the Bank and invest in another project to make some money”.

“Together with such attitude we will build the economy, so we are carefully empowering people who will be able to help us build the economy”, he added.

Latest Stories

-

Sinner beats Djokovic to set up Alcaraz final

12 minutes -

Why ‘the game is about glory’ has a hollow ring at Spurs

15 minutes -

Italy in ‘difficult moment’ after Norway defeat

19 minutes -

Global EarthTribe applauds Ghana’s ban on Styrofoam, offer support for sustainable alternatives

20 minutes -

Ancelotti’s first game as Brazil boss ‘special’ despite Ecuador draw

25 minutes -

Makers and Partners leads planting exercise at GAF Critical Care and Emergency Hospital

30 minutes -

OSP lied about Ofori-Atta’s medical report – Frank Davies claims

39 minutes -

Defence Minister welcomes Northern chiefs in Central Region, praises their support

46 minutes -

Ghana’s most potent weapon against corruption is OSP – Kissi Agyebeng

56 minutes -

World Environment Day 2025: A call to eliminate plastic pollution in Africa

60 minutes -

Eid al-Adha celebration: Mahama prays for global peace

1 hour -

Environment Minister calls for attitudinal change to end plastic pollution

1 hour -

NAPO urges politicians, public office holders to embrace accountability

1 hour -

Finance Minister hails outcome of National Economic Dialogue

1 hour -

Ishmael Yamson appeals to Mahama to institutionalise National Economic Dialogue

1 hour