The Past

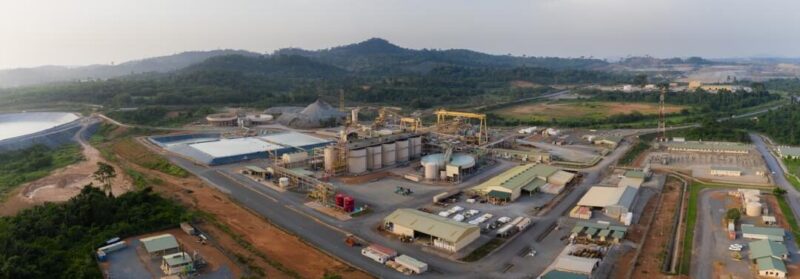

The Akyem Mine, located in the Birim North district of the Eastern region of Ghana, was conceived through exploration activities by Normandy Mining in the mid-1990s. With Newmont acquiring Normandy in 2002, exploration was intensified to confirm and define the gold resource in the years that followed. Backed by the necessary regulatory approvals and social agreements, Newmont committed over $900 million in capital investment, and more than $600 million in sustaining capital, to give birth to the Akyem Mine.

Construction of the mine’s infrastructure began in 2011 and was completed ahead of schedule and budget, paving the way for commercial production to begin in 2013. In February this year, the Akyem mine achieved five million ounces (5Moz) of gold production since commencing commercial production. This operational milestone also made it possible for Newmont to deliver on its pledge to its employees, local communities, and the government of Ghana while honouring its commitment to environmental stewardship and sound corporate governance.

Within the Birim North district and beyond, Newmont’s Akyem mine remains an exemplary corporate citizen and a major contributor to the local and national economy, paying more than $1 billion in statutory payments to the government over the past decade. The mine’s positive impact is, however, felt even more directly by the communities that host the operations.

Social Impact – Direct Initiatives

The Akyem mine employs about 2,000 Ghanaians, either directly or through its contractors, with about half of the workforce being from the 10 host communities. The revenue generated through this employment goes to support the economic well-being of families, with positive multiplier impacts down the line. To ensure a reliable talent pipeline for local communities, Newmont has put in place skills enhancement programmes – the Leadership and Apprenticeship Training Programmes.

The Apprenticeship Programme was introduced in 2011 to develop technical skills in welding, mechanical, electrical, and fabrication, with 90 local youth having been enrolled in the programme to date, and 77 graduated. Of the 77 graduates of the programme, 75 are employed directly with Newmont or by Newmont’s business partners. Upon graduation the beneficiaries are awarded diplomas in mechanical and electrical engineering, as well as proficiency certificates in Original Equipment Manufacturer (EOM) maintenance from the University of Mines and Technology (UMaT).

Like the Apprenticeship Programme, the Leadership Programme is also designed to set beneficiaries up for success, equipping them with solutions-driven skills to be competitive in the job market. The majority of the 112 trainees who have graduated from the programme either work for Newmont or a contractor on the mine.

Newmont recognizes the importance of local procurement, and its potential to stimulate local economic growth. The company has, therefore, put in place a deliberate initiative (Enhance Local Procurement Programme or ELPP) to build the capacities of local entrepreneurs and make them eligible and competitive for supply opportunities. Over 100 local businesses are enrolled on this programme, and specific supplies (goods and services) are ring-fenced for local businesses.

Newmont’s $15 million investment in road infrastructure in 2022 contributed to the reconstruction of 27kilometres of the 41-kilometre New Abirem to Nkawkaw road, which is a critical route for the transportation of goods and people across this prolific farming enclave, known for the production of cocoa and timber.

Social Impact – Development Foundation

Newmont has sought to improve livelihoods through its development foundations, in this case, the Newmont Akyem Development Foundation, which the company exclusively funds with a donation of 1 dollar per ounce of gold sold, and 1% of profit before tax. Established in 2010 after the adoption of a Social Responsibility between Newmont and the mine’s 10 host communities, the company’s donations to the community-led foundation have yielded $33.7 million, which is being spent on a variety of interventions and initiatives meant to promote economic diversification, self-sufficiency, and enhance social infrastructure.

Environmental, Social and Governance

The Akyem mine's efforts towards reforestation, biodiversity conservation, and decarbonization are well documented, showcasing the mine's commitment to environmental sustainability. In the Mamang and Kweikaro forest reserves, where the mine is undertaking a reforestation offset programme, the company has exceeded the reforestation target that was agreed with the regulators and is cited as an industry benchmark for reforestation offsets.

In the Atewa Range forest reserve, which is one of the highest priority ecosystems in West Africa and a globally significant biodiversity area, Newmont is undertaking a similar programme in biodiversity, working with regulators and other international partners. Under the programme, the company aims to restore native vegetation cover and encourage the return of local fauna, in fulfilment of its commitment to “No Net Loss” for key biodiversity values. Newmont’s efforts in this area were presented at the Climate Change Conference (COP 28) held in Dubai last year.

With climate change being quite a topical issue, the Akyem mine has adopted energy-efficient technologies in its operations to reduce energy consumption and its carbon footprint. These include investment in renewable energy sources such as its lower-cost Solar Photovoltaic (PV) Energy System with an installed capacity of 110 kilowatt-peak (kWp), providing energy support for camp accommodation and related facilities. The mine's tyre retreading project, being implemented in partnership with Kaltire, promotes the reuse of tyres, and saves an average of 60 tons CO2eq annually.

Present

Newmont, in February this year, announced the company’s plan to divest six businesses that no longer fit the strategic direction of the company. The company’s Akyem operation was identified as one of the six sites held for divestment. The Akyem mine’s life of mine for surface or open pit operations ends in 2027, but the mine has significant underground potential that could extend the life of the mine beyond 2040. Studies on the underground operation have already begun but will require dedicated resources, significant investment and technical expertise to move it forward.

Following Newmont’s acquisition of Newmont and the subsequent definition of the company’s strategic focus on Tier 1 assets, the Akyem mine no longer fits the capital allocation priorities of Newmont’s going-forward assets. Tier 1 assets refer to assets that have scale, low-cost profile, long mine life, and are located in favourable mining jurisdictions. If Akyem were to stay in the Newmont portfolio, it would be starved of the immediate capital needed to advance the underground operation and would jeopardize the possible extension of mining operations beyond 2027.

Newmont, therefore, began the search for a suitable owner who would provide the required financial and technical resources to unlock Akyem’s underground potential. The bidding and selection process was transparent and thorough, and initially involved 30 bidders, both local and international. A subsequent shortlisting to 7 bidders and a further shortlisting to 4 bidders included two Ghanaian entities. Assessed against a set of established criteria, which included financial and technical capacity for the underground operation, as well as demonstrated ESG performance, Zijin Mining emerged as the preferred bidder and most suitable new owner for the Akyem mine.

Future

From the start of the process, Newmont was focused on finding a buyer who has the financial and technical capacity, will support local hiring, deliver value to all our stakeholders, and partner with us on a smooth transition. As one of the world’s largest mining companies, Zijin presented a compelling long-term vision and plan for the site, indicating thoughtful consideration of its future, as well as that of the workforce, community, and country. Zijin also demonstrated the technical expertise and resources required to operate Akyem to internationally recognized standards. The leadership of Zijin have started direct engagements with relevant stakeholders to provide additional assurance and outline specific plans towards achieving these.

The operation of the underground is of particular importance since it requires a substantial amount of capital injection and technical expertise. Zijin has a market capitalisation of over $60 Billion, a strong balance sheet and access to capital. It also has a proven track record of developing complex new mines, together with a focus on technology and innovation with world-class in-house research, design and construction capability. The underground operation will ensure that the mine continues to operate into the future; sustaining employment for Ghanaians, developing local communities, and contributing to the national economy. Zijin operates in over 15 countries with a diversified portfolio and is ranked No.5 in Copper reserves, No.6 in Gold reserves, and No.4 in Zinc reserves, globally, with a strong record of ESG performance.

Although Newmont is transitioning from Akyem, the company’s operations in Ghana continue, focused now on the Ahafo Mine. Following the thorough and transparent international bid process, under the eagle oversight of regulators, Newmont is confident that Zijin would be a worthy partner and entrant into the Akyem community and Ghanaian mining industry.

*****

The writer works with Akyem Mines and can be reached via email at akrasiMoses10@gmail.com

Latest Stories

-

Shippers’ Authority blocks arbitrary fee hikes with new regulatory powers

3 hours -

Cedi to remain broadly stable in coming months; gained 30% against dollar since January 1

3 hours -

Mahama declares galamsey a national emergency, orders arrest of rogue taskforces

3 hours -

Ghana champions youth skills with national dialogue and launch of TVET Week 2025

3 hours -

Ghana’s inflation to remain on a downward trajectory in second-half 2025 – Fitch Solutions

4 hours -

‘Deal with galamsey, the situation is urgent’ – National House of Chiefs president to Mahama

4 hours -

AG directs EOCO to investigate NDC executives cited in galamsey allegations

4 hours -

Mahama pledges 70% world market cocoa price to farmers

5 hours -

EOCO teams up with Nigerian agency to rescue trafficking victims

5 hours -

State funeral to be held for Joseph Kobina Ade Coker on August 1

5 hours -

Mahama orders arrest of fake anti-galamsey taskforce extorting miners

6 hours -

Joseph Kobina Ade Shino Coker

6 hours -

Royal Sweet Limited signs up for JoySports Invitational Tournament 2025

7 hours -

Ghanaian movie industry wasting talent – Gloria Sarfo

7 hours -

Ho West MP secures 100 international scholarships for constituents

7 hours