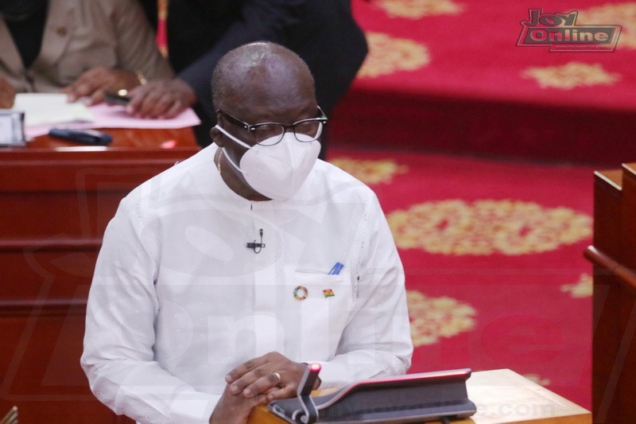

Finance Minister, Ken Ofori Atta has tasked the newly formed board of the Minerals Income Investment Fund, to appropriately address concerns raised by critics and stakeholders of the Agyapa Royalty Deal before it is submitted to Parliament.

This he said, is to make the deal operational and fit for purpose.

The Finance Minister made the call when he inaugurated the Board in Accra on Tuesday, October 12, 2021.

“…address and overcome all the concerns against the Agyapa transaction, so we can go to the market and create the first mineral royalty company in Ghana and in Africa because it is good for Ghana.”

He charged them to continue with the work that has been done in fulfillment of the theme of the 2021 budget, ‘Continuity, Consolidation and Completion’ in order to launch the Deal on the international market as soon as possible.

According to the Minister, “I’m unequivocal that it is the way to go in terms of monetizing our minerals and finding a way to leverage it to reduce the level of debt of the country and move it into equity. And with the concerns that were raised, we should be able to address them and move forward.”

The Agyapa Royalties deal, was approved by Parliament but was withdrawn by government following a Corruption Risk assessment by the former Special Prosecutor, Martin Amidu.

The Corruption Risk Assessment revealed that there was reasonable suspicion of bid-rigging and corruption activity in the selection process of the deal.

It was also discovered that the transaction was embroiled in infractions regarding relationships and conflict of interest.

Background

On August 14, 2020, Parliament approved the Agyapa Minerals Royalties Investment Agreement and four related documents to allow for the monetisation of Ghana’s future gold royalties.

Under the agreement, Agyapa Mineral Royalties Limited has been incorporated in Jersey near UK to receive and manage royalties from 16 gold mining leases over the next 15 years or so.

In exchange, the firm will list on the London and Ghana Stock Exchanges (GSE) and raise at least $500 million for government to invest in infrastructure, health and education.

The listing will allow private people to buy a 49 per cent stake in the firm.

However, some 22 civil society organisations called for a suspension of the deal, insisting it was not in the interest of Ghana.

Latest Stories

-

CHAN 2024Q: Ghana’s Black Galaxies held by Nigeria in first-leg tie

52 minutes -

Dr Nduom hopeful defunct GN bank will be restored under Mahama administration

1 hour -

Bridget Bonnie celebrates NDC Victory, champions hope for women and youth

2 hours -

Shamima Muslim urges youth to lead Ghana’s renewal at 18Plus4NDC anniversary

3 hours -

Akufo-Addo condemns post-election violence, blames NDC

3 hours -

DAMC, Free Food Company, to distribute 10,000 packs of food to street kids

4 hours -

Kwame Boafo Akuffo: Court ruling on re-collation flawed

4 hours -

Samuel Yaw Adusei: The strategist behind NDC’s electoral security in Ashanti region

4 hours -

I’m confident posterity will judge my performance well – Akufo-Addo

5 hours -

Syria’s minorities seek security as country charts new future

5 hours -

Prof. Nana Aba Appiah Amfo re-appointed as Vice-Chancellor of the University of Ghana

5 hours -

German police probe market attack security and warnings

5 hours -

Grief and anger in Magdeburg after Christmas market attack

5 hours -

Baltasar Coin becomes first Ghanaian meme coin to hit DEX Screener at $100K market cap

6 hours -

EC blames re-collation of disputed results on widespread lawlessness by party supporters

6 hours