Audio By Carbonatix

Ratings agency, Fitch has pointed out that Nigerian banks are making significant progress in raising core capital to meet new paid-in capital requirements and are meeting the first quarter 2026 deadline,

According to the UK-based firm, this is supporting a recovery in capitalisation from the impact of naira devaluation, providing fuel for business growth.

It again reduces the likelihood of significant banking sector consolidation.

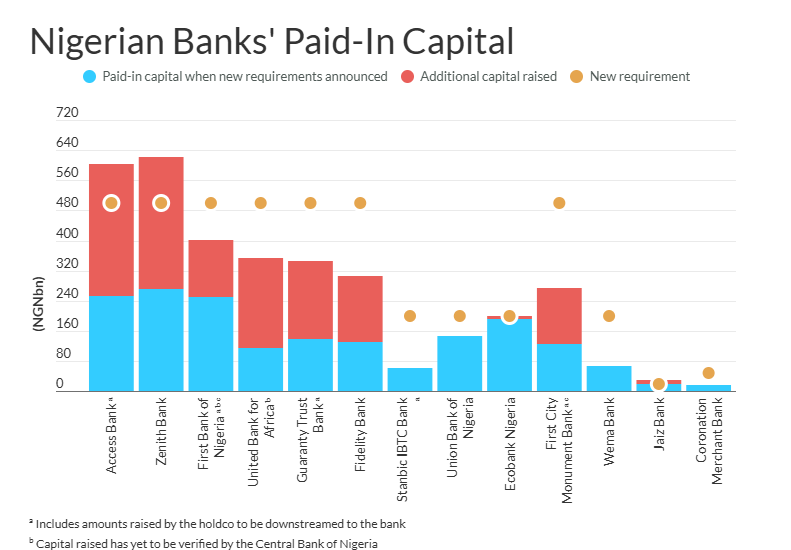

In a report, it said the two largest banks, Access Holdings and Zenith Bank, are the first to secure enough fresh capital to meet the Naira 500 billion requirement for an international licence.

First HoldCo, United Bank for Africa and Guaranty Trust Holding Company are also taking a phased approach. They have recently raised capital and have shareholder approval to begin raising more to meet the Naira 500 billion requirement. First HoldCo’s and United Bank for Africa’s recent rights issues are awaiting final regulatory approval.

Fidelity Bank and FCMB Group have completed initial capital raisings but Fitch said they will need to raise more to maintain their international licences. “As second-tier banks, they must raise significantly more capital relative to their balance sheets than larger banks. They have extraordinary general meeting approval for this, although they could consider downgrading to a national licence as they each have just one foreign subsidiary”.

Ecobank Nigeria Limited (ENG) and Jaiz Bank also needed only small capital injections to meet their requirements and have already achieved compliance.

“We estimate that ENG is still in breach of its total capital adequacy ratio (CAR) requirement of 10% but it has further capital-raising plans to restore compliance”.

Stanbic IBTC Holdings also has launched a rights issue to raise capital to maintain its national licence.

In March 2024, the Central Bank of Nigeria announced a significant increase in paid-in capital requirements (share capital plus share premium) for commercial, merchant and non-interest banks. Banks have three ways to comply – through equity injections, Mergers and Acquisitions and downgrading their licence authorisation.

Fitch-rated banks have also made notable progress towards compliance. Almost all have raised capital or formally launched the process to do so.

Latest Stories

-

Joy FM Party in the Park kicks off as patrons flock in amid growing excitement

22 minutes -

Ghana, 2 others to see strong absolute growth in electricity consumption – Fitch Solutions

38 minutes -

Return to bond market on gradual basis – IMF to government

1 hour -

Activist Felicity Nelson brings Christmas comfort to Accra Police cells

1 hour -

Obuasi Bitters Luv FM Nite with the Stars Thrills Kumasi on Christmas Eve

1 hour -

4 banks including one state bank remain severely undercapitalised – IMF

1 hour -

Police arrest 28-year-old with 98 parcels of suspected cannabis in Tamale

2 hours -

Does Goldbod owe BoG US$214m, or has BoG lost US$214m? A policy and financial risk analysis

4 hours -

US Congressman says airstrikes first step to ending killings in Nigeria

4 hours -

Afenyo-Markin urges NPP to move from talk to action after 2024 election loss

4 hours -

Ghana’s 69th Independence Day Concert in UK to be held on March 7 – Sleeky Promotions

5 hours -

BoG’s international reserves could cross $13bn by end of 2025

5 hours -

Afenyo-Markin urges discipline, unity as NPP prepares for 2026 flagbearer primary

5 hours -

Haruna Iddrisu demands tough sanctions for officials implicated in galamsey

6 hours -

‘Opoku-Agyemang is very capable of leading the country’ – Haruna Iddrisu

6 hours