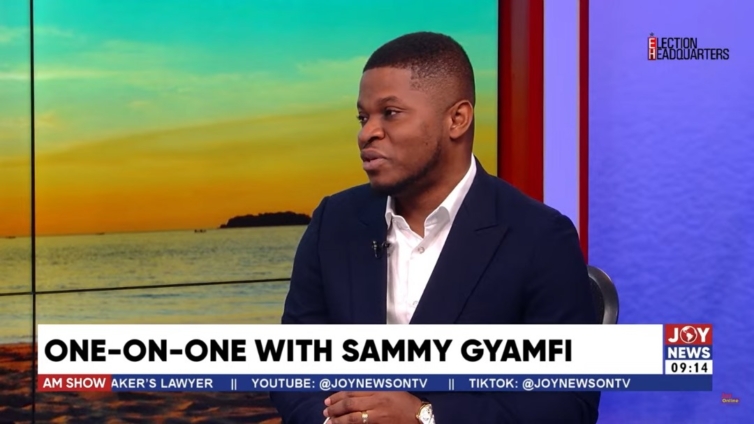

Sammy Gyamfi, the National Communications Officer of the opposition National Democratic Congress (NDC), has blamed the frequent depreciation of the Ghanaian currency, the cedi, partly on the shortage of US dollars on the Ghanaian market.

The cedi has experienced varied depreciation levels under the current regime and recently traded at GH¢17.00 to a dollar.

According to Mr Gyamfi, "One of the major factors for the constant depreciation of the Ghana cedi is the shortage of dollars in Ghana," he stated.

He attributed the dollar shortage to the country's financial struggles, which he linked to excessive loans taken by the government over the years.

"What has caused this? Number one, our bankruptcy. The government has engaged in a reckless borrowing spree since it took office in 2017. I am talking about the NPP and the Bawumia-led economic management team," he said.

The NDC National Communications Officer further criticized the NPP administration for not listening to advice when making decisions about borrowing. "They borrowed recklessly, despite sound counsel from the NDC and other neutral sources," he said.

He also criticized the NPP government for not using the loans to fund projects that could generate revenue to repay the debt. "The worst part is that the borrowed funds were not invested in the productive sectors of the economy. They were not invested in revenue-generating projects and programmes that could pay for these loans. As a result, we reached a point in November 2022 when we could no longer meet our debt obligations, and for the first time in the history of Ghana, we became a bankrupt nation," he claimed.

Mr Gyamfi lamented that this situation led to the country being excluded from the capital markets "because of bad leadership that borrowed recklessly and squandered those borrowed funds on consumption and corruption."

Touching on investment, he said the current state of the nation has "destroyed investor confidence in our economy."

He added that the only way to get the system back on track is to "restore that lost investor confidence through prudent fiscal and monetary policies.", which the NDC and Mr John Mahama is promising.

According to the Ministry of Finance, as of June 2024, Ghana's total central government debt stood at GH¢742.0 billion, which is 70.6% of the country's GDP.

This represents a 22% increase from the end of 2023, due to the depreciation of the cedi and payments to creditors. The debt comprises GH¢452.0 billion in external debt and GH¢290.0 billion in domestic debt.

Latest Stories

-

WHO Africa incoming director dies aged 55

2 mins -

Deputy Minister labels tourism as ‘Octopus Unit,’ advocates independent growth in creative art

12 mins -

NPP’s 2020 budget confirms ‘Nkokɔ Nketenkete’ is a good policy – Eric Opoku

16 mins -

Go to school so that you don’t ‘suffer’ like me – Kyeiwaa

22 mins -

Ghana ranked amongst Top 5 Visa Open Destinations

26 mins -

AratheJay announces debut concert ‘Nimo Live’ slated for December 19

49 mins -

Malik Jabir replaces Kwasi Appiah as Kotoko’s Technical Director

51 mins -

COCOBOD CEO assures completion of all projects in Western North region

60 mins -

Bawumia has served Ghana well, let’s give him another chance – Ahiagbah

1 hour -

Special voting ballots won’t be counted until December 7 – EC

1 hour -

The Ark Foundation makes recommendations to government on gender-based violence

1 hour -

Let’s retire Mahama; he’s an example of the biblical wicked and lazy servant – Ahiagbah

1 hour -

WAICA Education Conference 2024 addresses AI and the future of insurance

1 hour -

New Force Movement campaign team reportedly attacked by angry youth in Sowutuom

2 hours -

Harness media power to boost tourism – Deputy Tourism Minister to Ghanaians

2 hours