Hanypay, a licensed fintech platform by the African Diaspora Central Bank (ADCB), is pleased to announce that the Central Bank of Zambia has extended an invitation for ADCB to engage in AKL Lumi transactions within Zambia through authorized dealers and willing local counterparties.

The Central Bank of Zambia highlighted, "There are no exchange controls in Zambia. In this regard, foreign investors are free to trade in convertible currencies with willing local counterparties as long as transactions are conducted through authorized dealers"

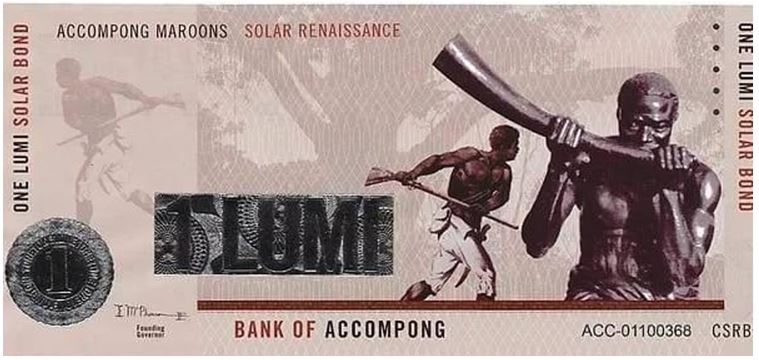

The ADCB, serving as the central bank of Eco-6—the Sixth Region of Africa—plays an instrumental role in fostering economic integration between Africa and its diaspora. As the official issuer and regulator of the AKL Lumi, ADCB champions the currency’s role in driving economic growth, enhancing financial sovereignty, and facilitating trade across Africa and the diaspora communities.

This collaboration with Zambia is a significant milestone, presenting unique opportunities for Zambian banks, businesses, and financial institutions to engage with Eco-6 and leverage the benefits of the AKL Lumi.

For Zambian businesses and financial institutions, this partnership offers several strategic advantages:

- Expanding Financial Services: Local banks and financial institutions can enhance their service portfolios by integrating AKL Lumi transactions, attracting new customers, and promoting accessibility.

- Supporting Cross-Border Trade: The AKL Lumi streamlines cross-border transactions, empowering businesses to expand into regional and international markets more efficiently.

- Boosting Financial Inclusion: Through Hanypay’s accessible platform, small businesses and individuals can engage in digital financial services, supporting broader financial inclusion across Zambia.

Hanypay says it is excited to collaborate with Zambian banks and financial institutions to facilitate AKL Lumi transactions through The Hanypay platform. In the coming weeks, Hanypay will launch an educational campaign to help the public access these opportunities and understand the advantages of using the AKL Lumi.

This initiative reflects ADCB's commitment to promoting economic empowerment across Zambia, aligned with the Southern African Development Community's (SADC) vision of regional economic integration and growth. Individuals and businesses eager to benefit from these opportunities can sign up for free at https://hanypay.co.

Hanypay's platform offers easy registration and access to a range of AKL Lumi services. Hanypay remains dedicated to supporting Zambia’s financial sector, fostering growth and prosperity through this strategic partnership.

Hanypay Onboarding Initiative for businesses, financial institutions, and Individuals Hanypay is thrilled to announce a strategic onboarding campaign aimed at businesses, financial institutions, and individuals across multiple regions. This initiative is designed to create a seamless and inclusive experience for all participants, enabling them to harness the full potential of Hanypay's advanced platform and access unique financial opportunities.

Engaging Businesses and Financial Institutions

Partnerships and Financial Access: Hanypay will be engaging with businesses and financial institutions to onboard them onto its comprehensive platform. This will enable these entities to leverage the robust functionalities of Hanypay for streamlined transactions, enhanced security, and diverse financial services.

Access to ADCB Funding

Through the African Diaspora Central Bank (ADCB), participating businesses and financial institutions will also have exclusive access to funding opportunities. This provides an exceptional advantage for growth and sustainability, especially for those with a strong commitment to economic development in their communities.

Special Benefits for Fintechs in Zambia and ADCB

Fintechs in Zambia, along with the ADCB, are positioned to benefit significantly from Hanypay’s infrastructure. By onboarding, they gain not only a pathway for secure transactions but also new avenues for funding, collaboration, and growth within the Hanypay ecosystem.

Benefits for Individuals

Inclusive Financial Participation: Individuals can also join Hanypay, benefiting from secure transactions, easy access to funds, and engagement with a growing community of users within the ADCB framework.

Empowerment through Access

Hanypay offers individuals the opportunity to participate in a dynamic financial ecosystem, expanding their financial independence and options for transactions across borders.

Key Features of the Hanypay Platform

Secure and Seamless Transactions: Hanypay is built on secure technology, enabling P2P, B2B, C2C, and G2G transactions.

Access to Multiple Currencies: The platform supports 170 fiat currencies globally, ensuring flexibility and accessibility.

Integrated Growth Support

Hanypay provides financial institutions and fintech tools to scale and reach wider markets, making it a vital ally for economic empowerment and development.

By uniting businesses, financial institutions, and individuals under one advanced platform, Hanypay reinforces its commitment to creating a transformative impact in Zambia, the SADC region, across Africa, and beyond. The onboarding initiative marks a significant step towards expanding financial accessibility, building stronger partnerships, and driving economic growth within the ADCB’s vision for a prosperous and interconnected future.

Email info@hanypay.co

Latest Stories

-

GBC accuses Deputy Information Minister Sylvester Tetteh of demolishing its bungalow illegally

11 mins -

Boost for education as government commissions 80 projects

22 mins -

NAPO commissions library to honour Atta-Mills’ memory

33 mins -

OmniBSIC Bank champions health and wellness with thriving community walk

35 mins -

Kora Wearables unveils Neo: The Ultimate Smartwatch for Ghana’s tech-savvy and health-conscious users

39 mins -

NDC supports Dampare’s ‘no guns at polling stations’ directive

42 mins -

Police officer interdicted after video of assault goes viral

59 mins -

KNUST’s Prof. Reginald Annan named first African recipient of World Cancer Research Fund

1 hour -

George Twum-Barimah-Adu pledges inclusive cabinet with Minority and Majority leaders

2 hours -

Labourer jailed 5 years for inflicting cutlass wounds on businessman

2 hours -

Parliament urged to fast-track passage of Road Traffic Amendment Bill

2 hours -

Mr Daniel Kofi Asante aka Electrician

2 hours -

Minerals Commission, Solidaridad unveils forum to tackle child labour in mining sector

2 hours -

Election 2024: Engagement with security services productive – NDC

2 hours -

Retain NPP for the good of Ghana – Rebecca Akufo-Addo

2 hours