Audio By Carbonatix

Government has defrayed approximately 2.5 billion cedis of its GH₵5 billion debts owed to the Social Security and National Insurance Trust (SSNIT) in the form of bonds.

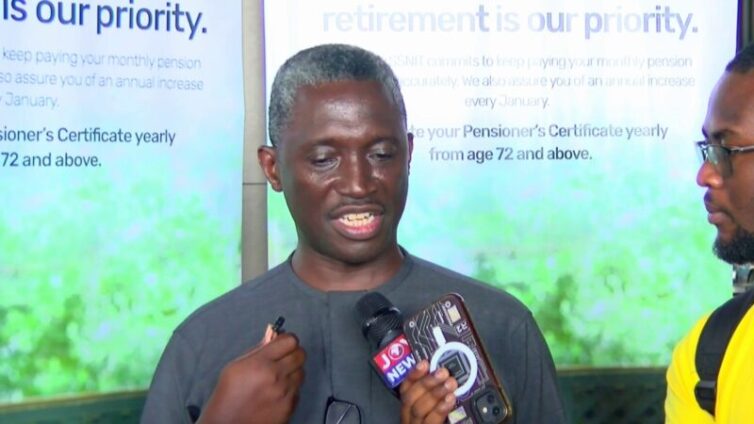

This was revealed by the Director-General of the Trust, Kofi Osafo-Maafo who says the payment followed a series of negotiations with government in a bid to thrust the scheme into a strong financial position.

Independent actuarial valuation of SSNIT’s viability suggested that delays by the government in settling its debts contributed to a decrease in investments.

As of December 31, 2021, SSNIT's records showed a total debt of GH₵9.3 billion, with a substantial GH₵6.9 billion owed by government.

The staggering figure represents about 75% of SSNIT's overall indebtedness, including overdue contributions and accrued interest charges.

The significant debt owed by the government places Ghana's pension fund in a delicate position, resulting in an annual decrease of 1.3% in SSNIT's investment returns.

But speaking at a stakeholder meeting with pensioners in Kumasi, Director-General of SSNIT said the government has defrayed about 2.5 billion of the debts.

“The government owes SSNIT and this is not a new thing. It’s probably span way over 10 years. Overtime and continuously we need to engage government and negotiate with them. And what we have had recently is that we’ve made some successes with that. The government most recently defrayed approximately 2.5 million cedis of the arrears in the form of bonds,” he said.

The trust is on a positive trajectory after making a net surplus of GH¢864million in 2023 from an initial deficit in 2021.

Mr. Osafo-Maafo explains the Trust anticipates similar results by the end of year, influenced by improvements in contributions collection, investment income and cost control.

“We are striving very hard to improve the net contributions, we are working hard to improve the net investment income and as well managing the business better,” he said.

Chief Actuary, Joseph Poku says the trust is working to ensure more contributions are generated to run the scheme in perpetuity.

“We are doing everything that we are suppose to do to ensure that we bring in new funds, have excess funds after paying the benefits put them in investments and make sure we manage those investments prudently to get more returns and add to the funds that are coming in,” he said.

Ashanti regional chair of the Pensioners’ Association, Adarkwa Tuffour emphasized on strengthening, safeguarding and improving it.

“SSNIT has been and continue to be the lifeline of thousands of Ghanaians, therefore we must safeguard, strengthen and improve the scheme. We must recognize and appreciate its value,” he said.

Latest Stories

-

Ghana is rising again – Mahama declares

4 hours -

Firefighters subdue blaze at Accra’s Tudu, officials warn of busy fire season ahead

5 hours -

New Year’s Luv FM Family Party in the park ends in grand style at Rattray park

5 hours -

Mahama targets digital schools, universal healthcare, and food self-sufficiency in 2026

5 hours -

Ghana’s global image boosted by our world-acclaimed reset agenda – Mahama

5 hours -

Full text: Mahama’s New Year message to the nation

5 hours -

The foundation is laid; now we accelerate and expand in 2026 – Mahama

6 hours -

There is no NPP, CPP nor NDC Ghana, only one Ghana – Mahama

6 hours -

Eduwatch praises education financing gains but warns delays, teacher gaps could derail reforms

6 hours -

Kusaal Wikimedians take local language online in 14-day digital campaign

7 hours -

Stop interfering in each other’s roles – Bole-Bamboi MP appeals to traditional rulers for peace

7 hours -

Playback: President Mahama addresses the nation in New Year message

8 hours -

Industrial and Commercial Workers’ Union call for strong work ethics, economic participation in 2026 new year message

9 hours -

Crossover Joy: Churches in Ghana welcome 2026 with fire and faith

10 hours -

Traffic chaos on Accra–Kumasi Highway leaves hundreds stranded as diversions gridlock

10 hours