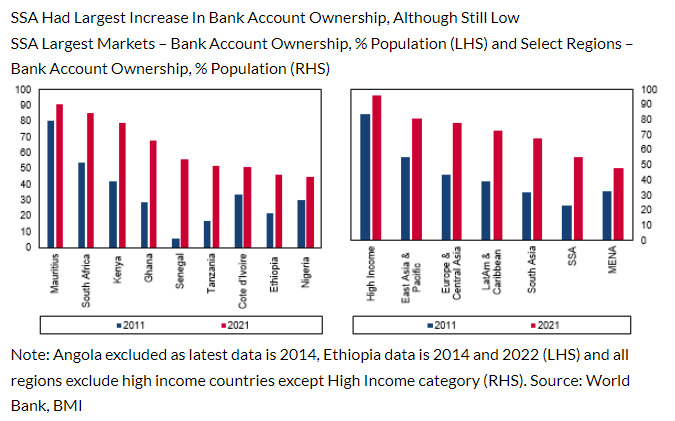

Ghana placed 4th in Sub-Saharan Africa with the largest growth in digital bank account ownership, Fitch Solutions, has revealed.

However, it described the increase as still low, compared to peers globally.

The country saw a growth of more than 40% in the digital bank account (including mobile money) between 2011 and 2022 to a little over 60%.

Mauritius placed 1st with more than 90% growth, followed by South Africa (82%) and Kenya (74%).

In 5th to 9th were Senegal (54%), Tanzania (50%), Ivory Coast (49%), Ethiopia (47%) and Nigeria (44%).

In the article “Navigating The Digital Banking Landscape In Sub-Saharan Africa”, the UK-based firm said Sub-Saharan Africa (SSA) has lagged behind other regions in banking sector development but leads in digital banking progress.

“We estimate that SSA banking assets will represent 53.0% of Gross Domestic Product in 2024, compared to the emerging markets average of 84.8%. Limited access to traditional banking has hindered broader economic participation and growth”.

Digital banking offers unprecedented opportunities for financial inclusion, fostering economic development and accelerating technology adoption. The proliferation of mobile phones, improved internet connectivity, and increasing regulatory support are key drivers of this shift.

Fitch Solutions added “We anticipate that SSA will continue to develop its digital banking capabilities, benefiting households, businesses, traditional and challenger banks, and the broader economy. This article investigates key themes and challenges associated with digital banking in SSA, a topic we previously highlighted as influential in the region’s banking development”.

It pointed out that Nigeria and Kenya stand out as the main hubs for digital banking in SSA, each showcasing unique ecosystems driven by traditional banks and innovative fintech companies. In Nigeria, key players like Kuda Bank and GTBank leverage robust mobile platforms to offer a range of financial services, targeting the unbanked and underbanked populations.

Other notable countries, it said, include South Africa with its advanced financial infrastructure, Ghana with surging mobile money usage, and Tanzania experiencing rapid mobile banking growth.

Latest Stories

-

How does the new Club World Cup work, and why is it so controversial?

16 mins -

Nana Kwame Bediako proposes construction of more state-owned football academies

23 mins -

Watching football frequently is a waste of time – Nana Kwame Bediako

55 mins -

‘We have wasted taxpayers money’ – Herbert Mensah on Ghana’s sporting decline

1 hour -

No African-based quality; achieve international healthcare standards with local solutions – SafeCare Founder

2 hours -

UHC alone insufficient without quality healthcare – PharmAccess CEO warns

3 hours -

CHAG to receive GH¢2.2bn boost; GH¢110m earmarked for 2025 recruitment – MoH

3 hours -

Ghana Industry CEO Awards: Bright Ladzekpo is Most Respected Advertising CEO

3 hours -

Video: Fatawu Issahaku joins Leicester dressing room celebrations after win over West Ham

3 hours -

Kempinski lights up the festive season in grand style

3 hours -

‘We’ll seal every ballot box’ – NDC’s Tanko-Computer slams Ashanti Regional EC boss for blocking party seals

3 hours -

39 CHAG facilities achieve SafeCare Level 4 – Executive Director

3 hours -

Election 2024: NDC elders asks polling agents to uphold their duties and safeguard Ghana’s future

4 hours -

Bank boss takes pay cut after employee ‘tried to kill clients’

4 hours -

Man jailed four years for threatening to shoot, kill citizens during Dec. 7 elections

5 hours